2021 U.S. Equity Market Preview

A year ago, I laid out the consensus expectations for S&P 500 earnings in the years ahead and used them as a framework to develop reasonable expectations for equity performance in 2020. I think it’s safe to say the year turned out a little different than we all expected. At the time, the average analyst believed the index’s forward earnings per share would be $193 at year-end. They were less than $170 in late December. Similarly, the valuation multiplier was just above 18x last January, and I believed anything between 14x and 22x (a range wide enough to float a barge through) was reasonable to expect by year end. I should have opted for something larger than a barge. On December 31st, the S&P 500 closed at 3756.07, or 22.6x forward earnings.

In the words of the great Yogi Berra, “It’s tough to make predictions, especially about the future.” Two thousand and twenty reminds us all to take forward-looking statements with a grain of salt.

That said, I think it’s important to have a roadmap for what’s ahead. In any year, the ride is bound to get bumpy – but the map can tell you whether you’re truly off-course or just taking a detour. So let’s look at 2021.

If you’re like me, you’re still getting used to the idea of 2020 being in the past. But right now, 12-month forward EPS includes estimates for 2022 data. That means any discussion of year-end S&P 500 levels derived from a forward multiple is based on earnings reports that we won’t get for more than 2 years. Still, we have to start somewhere.

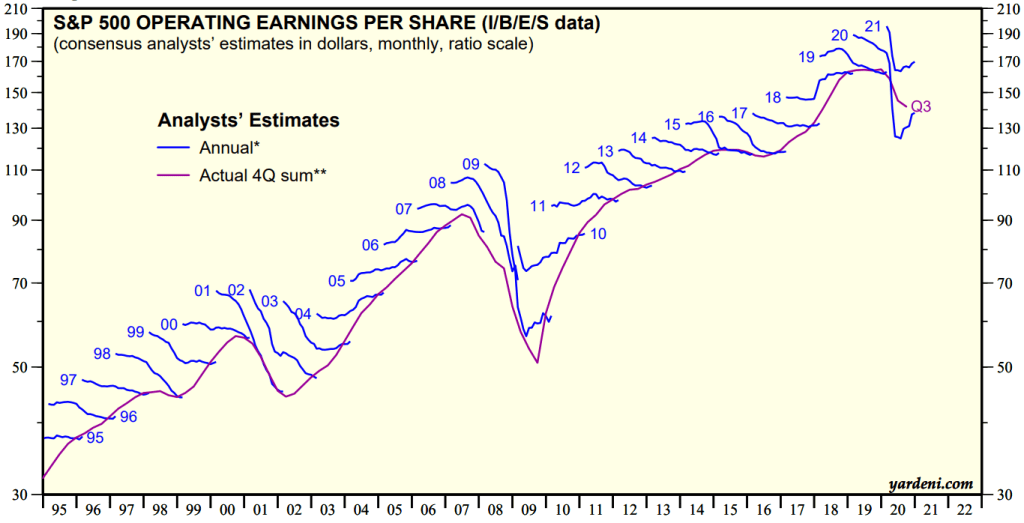

According to Bloomberg, the consensus estimate for 2022 EPS is currently $192, but consensus estimates are habitually too optimistic, as noted by macroeconomic strategist Ed Yardeni. He publishes this chart to illustrate:

The blue squiggles represent the consensus analysts’ earnings per share estimates for any given calendar year. With a few exceptions, initial projections are simply too high, and analysts are forced to revise their estimates lower as time passes. On average, that revision is between 5% and 10%. If estimates were to follow a normal trend, forward 12-month earnings at the end of this year would be about $177 per share.

Here’s what that all means for prices in 2021. If analysts have it right and we’re able to maintain the same multiple, stocks would return 16% this year. Alternatively, if earnings trends follow a traditional trajectory and multiples remain constant, stocks would have a slightly below-average year.

If valuations rose to their 1999-2000 highs, stocks would have a fantastic year in either earnings scenario. On the other hand, there would be disappointment on Wall Street if multiples fell back to 2019 levels.

Of course, that’s all based on current earnings projections, and 2020 reminded us how erratic those can be. The pace of vaccinations, extent of further lockdowns, appetite for spending, and magnitude of stimulus packages will all play key roles in the 2021 earnings recovery. Stay tuned.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post 2021 U.S. Equity Market Preview first appeared on Grindstone Intelligence.