A Changing of the Guard? Growth vs. Value

2022 was the year that Value made a comeback. For more than a decade, ‘Value Investor’ was synonymous with ‘Serial Underperformer’. From the lows in 2007 to the highs in 2021, the S&P 500 Growth Index outgained its Value counterpart by a whopping 170%. Last year, it gave up a third of those relative gains.

Now the S&P 500 Growth/Value ratio is nearing a pretty important level: the internet bubble highs. I’ve spoken at length on this blog about the significance of historical turning points, even ones from 20 years ago. Wouldn’t it make sense to see prices react as we approach those former peaks? If they do, that’ll pave the way for growth to outperform over the near and intermediate term.

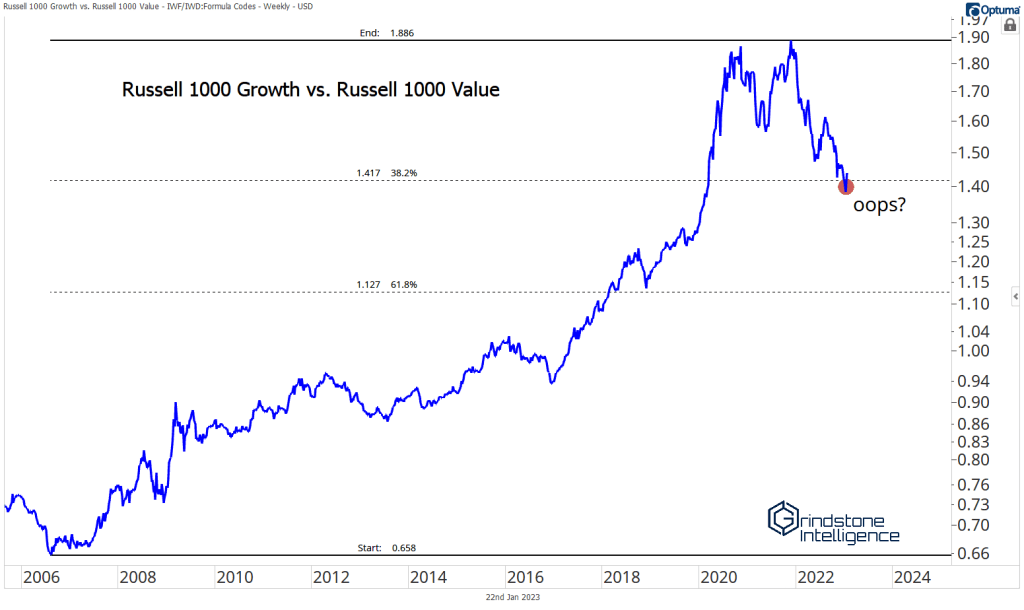

It’s not just the S&P 500 flavor of growth/value that’s at a key level.

The same ratio for the Russell 1000 is trying to find support at the 38.2% retracement from the entire 2006-2021 advance. In the first week of the year, the Russell 1000 Growth Index looked set to continue its downward trend, as it failed to acknowledge that area of interest. But it’s since rallied back above. Could that be a failed breakdown that starts a mean reversion rally?

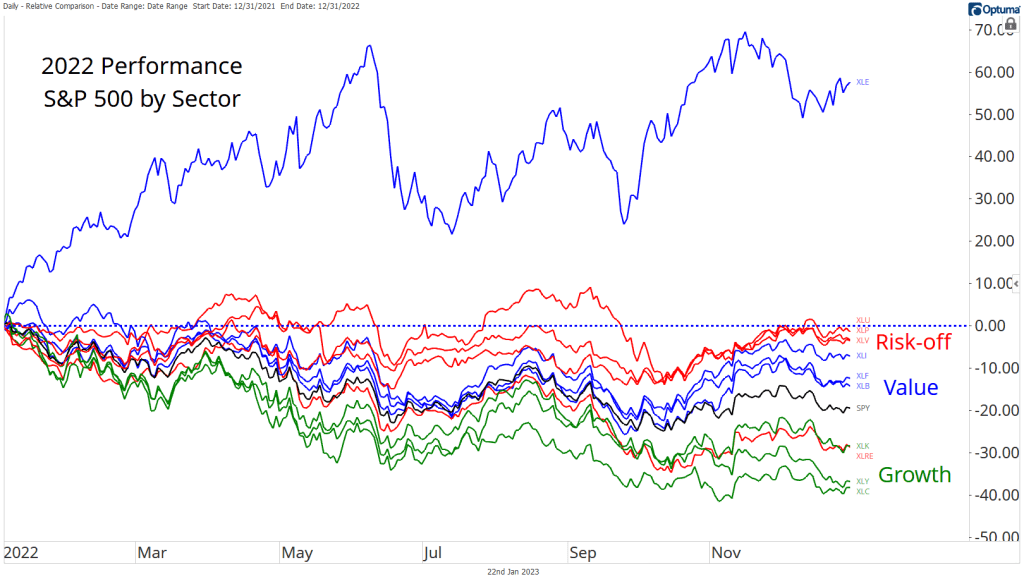

If it is, stock prices will need to be driven by a different leadership group than they were last year. In 2022, the Energy Sector (shown by XLE, the SPDR S&P 500 Energy Select ETF, in the chart below) was far and away the best place to invest. It rose nearly 60%, while every other group finished in the red. Energy stocks always dance to the beat of their own drum, but they tend to dance more closely with value-oriented sectors, like Financials (XLF), Industrials (XLI), and Materials (XLB). Each of those sectors (in blue below) handily outperformed the index last year. Risk off area (red) also outperformed, as Utilities (XLU), Consumer Staples (XLP), and Health Care (XLV) each fell 5% or less.

It’s a different story so far in 2023. Communication Services (XLC), Consumer Discretionary (XLY), and Information Technology (XLK) are all near the top of the year-to-date performance spectrum, while value stocks lag and risk-off sector decline.

One sector, as you might have noticed, is out of place: Real Estate (XLRE). Real Estate typically trades more like risk-off areas of the market, owing to its higher dividend yield and typically-lower volatility. But in 2022, the group traded lock-step with growth areas of the market. This year is more of the same. The ‘why’ of Real Estate’s action offers a clue to the future of growth/value.

It’s all about interest rates.

Check out Real Estate’s performance relative to the S&P 500 compared to the 10-Year Treasury Note. The two are nearly identical: rates drove the underperformance of real estate and growth stocks alike.

The underperformance of growth can traditionally be attributed to two factors: lower economic growth expectations and higher interest rates. A weaker economy reduces the likelihood of growth companies achieving lofty expectations, thus reducing the price investors should be willing to pay for those expectations. And higher interest rates mathematically reduce the value of future earnings, disproportionately impacting the worth of high-growth business. Real Estate is taking it on all sides – higher rates pressure these highly levered businesses, weak economic growth threatens occupancy rates, and lower-risk bonds now offer a competitive yield, decreasing the relative appeal of high dividend stocks.

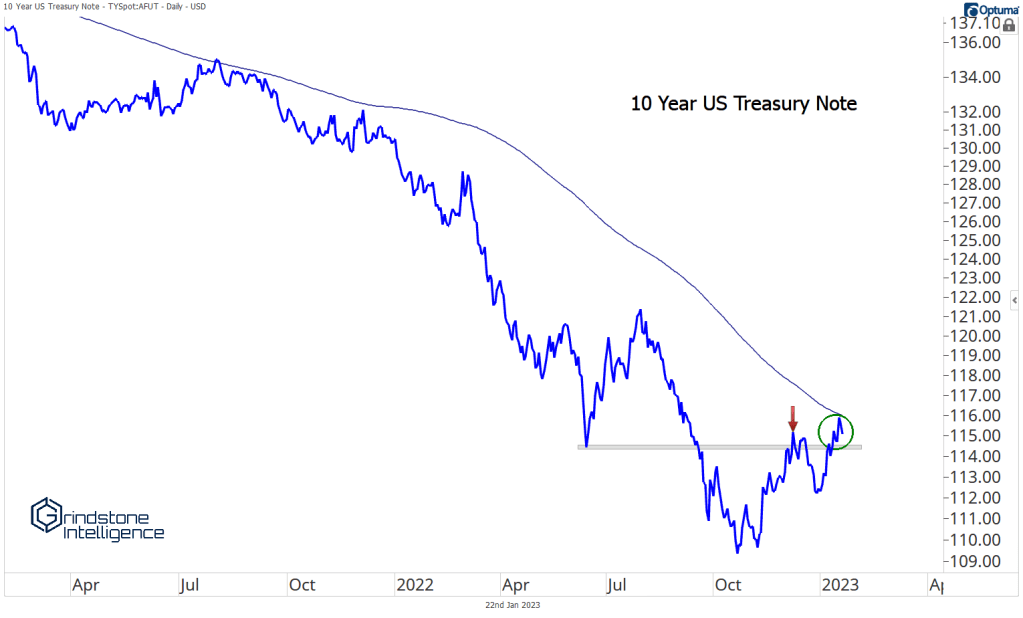

Of course, lower growth and higher rates are linked this time around. The consensus belief has been that Federal Reserve interest rate hikes will increase the cost of capital and lead to weakened economic activity. But with the slowing of inflation in recent months, interest rates have stabilized. In fact, rates are falling, driving bond prices to their highest level in months. Growth stocks and Real Estate have rallied in turn.

The question is, how long can it last? The 10-Year Treasury is coming up against a falling 200-day average. If it fails to surpass it, and instead drops back below the December highs, Value stocks could take the lead once again. If rates have peaked, though, keep a close eye on Growth.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts are meant for informational and entertainment purposes only. See Terms for more information.

The post A Changing of the Guard? Growth vs. Value first appeared on Grindstone Intelligence.