A Classic Reversal Candle in Stocks and Some Thoughts on the GameStop Story

The GameStop saga dominated the financial news flow this week. It’s a thrilling story, likened to David vs. Goliath, in which a group of online amateurs teamed up in an effort to defeat the ‘villains’ of Wall Street. If you’re unfamiliar with the plot, there is no shortage of commentary (and opinions) detailing the various ‘squeezes’ and manipulation attempts that have driven the price of GameStop’s stock over the last several weeks. I won’t waste my evening writing about it too. Let me just say this: The drama feels unprecedented. In reality, though, this is a story markets have told time and again throughout history. Overconfidence, excessive leverage, poor risk management, and liquidity shortages tend to result in catastrophic problems for some, and opportunities for others. The market has a way of catching people off guard. If you think you know who all the winners and losers of this tale’s most recent iteration will ultimately be, you might want to think again. The story of GameStop is far from over.

But for most investors, GameStop is just that: a story. While its implications are certainly broader than the outcome of a single stock price, we have to be careful not to miss the forest for the trees. While a few heavily shorted stocks rallied, the S&P 500 Index tumbled from its Monday highs. The resulting weekly candle was, in the field of technical analysis, a classic reversal pattern.

A ‘bearish engulfing pattern’ consists of one up candle followed by a down candle. On the second candle, prices open above the prior close and close below the prior open, so that the body of the second candle ‘engulfs’ the body of the first. In the case of the S&P 500, last week’s candle engulfed the prior 3, increasing its potential significance.

The indicator is considered valid if it follows a recent uptrend in stocks, and, in theory, is likely to mark a turning point. Given last week’s candle immediately followed an all-time high, how confident should we be that a change in trend has actually occurred? I took a look at history for some clues.

As with any such backtest, assumptions are important. For this one, I analyzed weekly data for four major US stock indexes: the S&P 500, Dow Jones Industrial Average, Nasdaq 100, and Russell 2000. After finding each occurrence of a down candle that engulfed a prior up candle, I narrowed the list to those occurring within an uptrend – prices had to have risen over the previous 5 weeks.

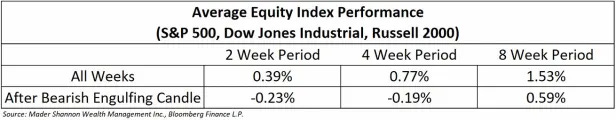

The result was 166 total bearish engulfing candles in just over 7,000 weeks of data, or roughly 1 occurrence per year. Here’s how indexes performed afterward:

At first glance, the data was far from groundbreaking. Sure, stocks have underperformed their averages in the 2 and 4 week periods following a bearish engulfing candle, but the margin is thin – only 14 basis points in the initial 2 weeks. And by the end of the eighth week, stocks were actually doing better.

A closer look yielded more interesting results. The Nasdaq 100 severely skews the data. In fact, a bearish engulfing candle has actually been quite bullish for the tech heavy index. Check it out:

The Nasdaq candle didn’t quite qualify this week, so this is some data to keep in mind for the future. I’ll be interested to see whether it can continue to buck conventional wisdom.

Alternatively, the other 3 indexes adhere more closely to the textbooks. With the Nasdaq excluded, equities on average demonstrably struggle after the reversal pattern:

For 4 weeks after the negative candle, stocks tended to still be down nearly 20 basis points. That’s nearly 1% worse than would be expected otherwise, and certainly material enough to bear watching.

Feel free to keep up with the GameStop story. It’s sure to be one we’ll remember as the years pass. But don’t let it distract you from the broader moves. After the S&P 500’s reversal in the final week of January, history warns us to approach February with some caution.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post A Classic Reversal Candle in Stocks and Some Thoughts on the GameStop Story first appeared on Grindstone Intelligence.