A Global Bull Market - 12/7/2023

It's not just a US story

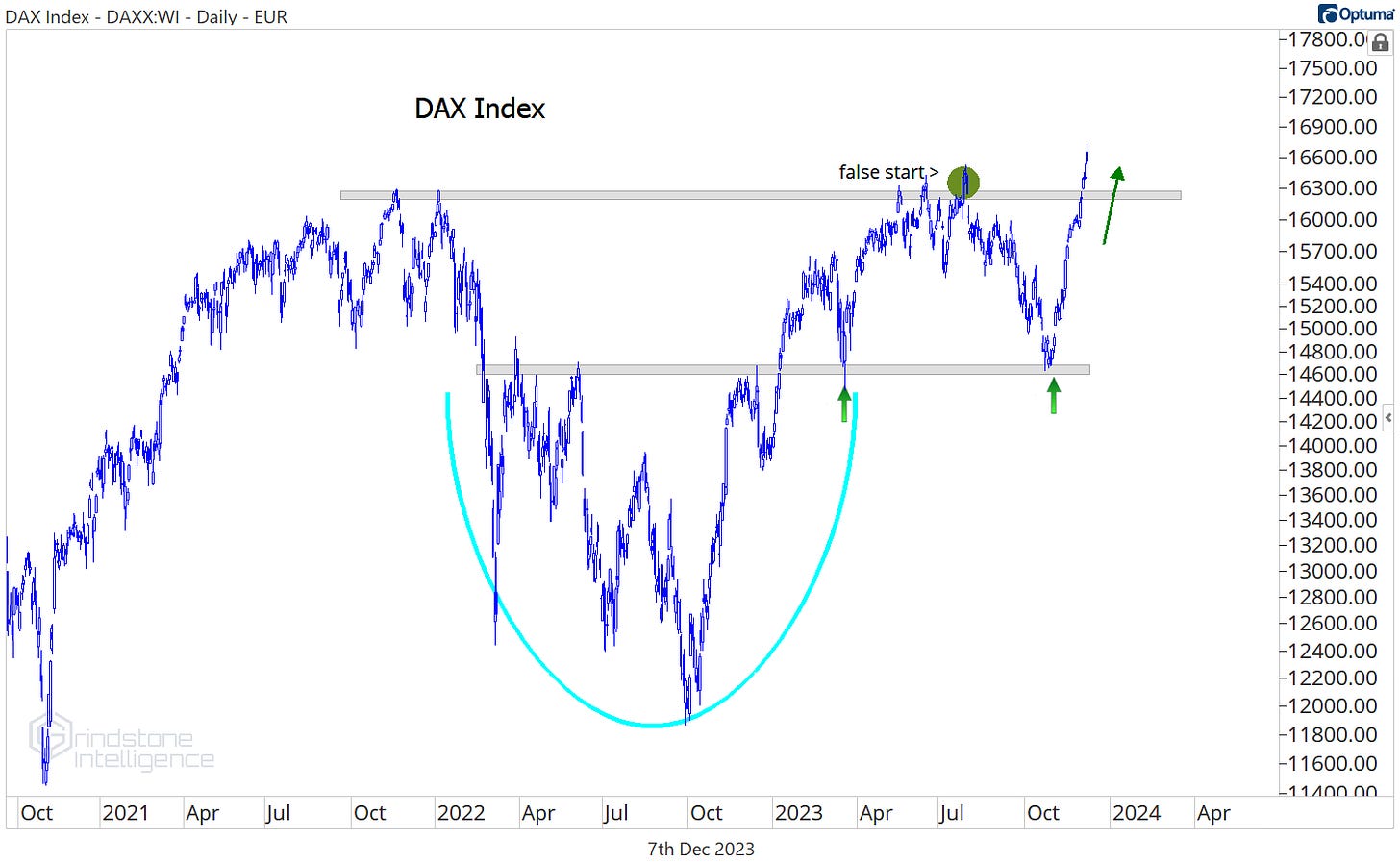

The German DAX just hit a new all-time high.

All year we’ve seen the narrative that just a handful of mega cap growth stocks are rising. True, mega cap growth has been in the pole position for most of the year. And true, some parts of the market (we’re looking at you, small-caps) have failed to participate at all. But this bull market was never about just a few stocks. If it were, would stocks in Italy be joining the DAX rally by breaking out to multi-year highs?

And would stocks in Japan be knocking on the door of new highs themselves?

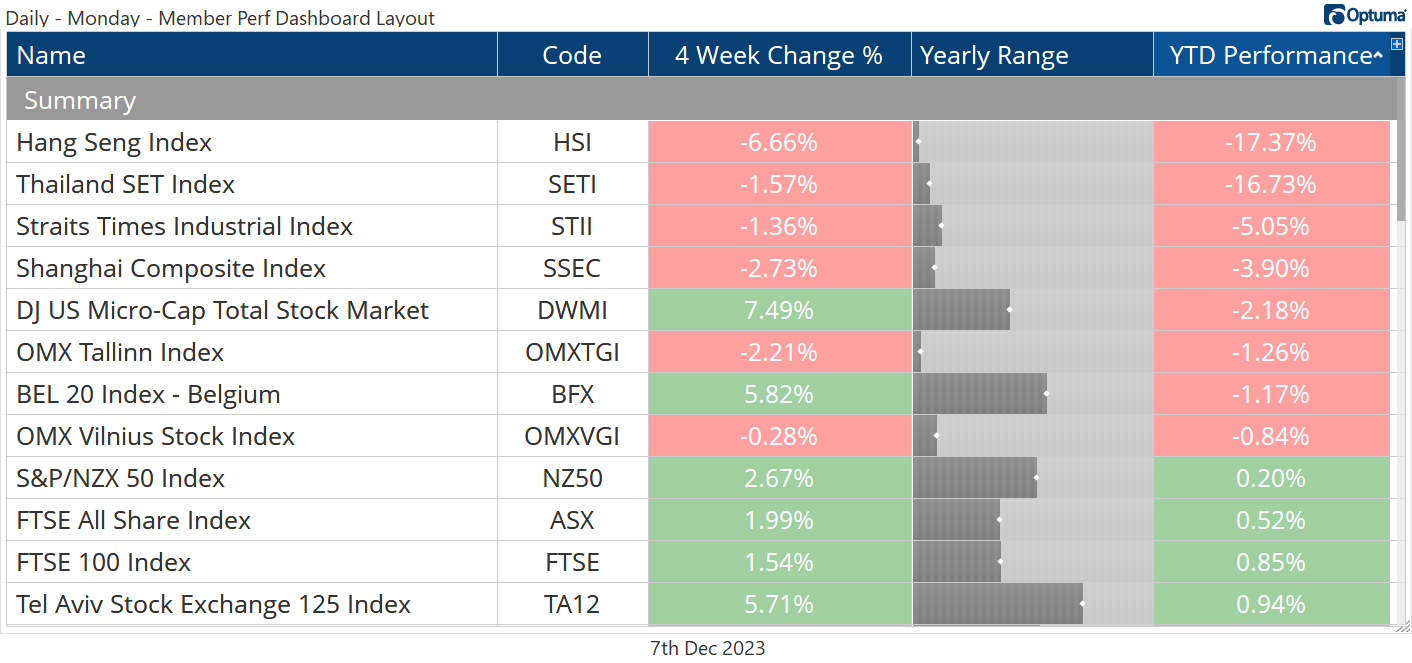

In fact, we track more than 50 of the most important stock market indexes in the world, and the majority of them are rising.

Sixty-two percent of members in our global index basket are above rising, long-term moving averages. And nearly 80% are in short-term technical uptrends.

Still not convinced that the story of the year is about more than just large cap Tech? Check out the global index leaderboard. Sure, the NASDAQ is near the top of the list, sporting a 35% YTD gain. But Polish stocks have done even better, rising 41% in 2023. Stocks in Greece, Hungary, Japan, Spain, Ireland, Taiwan, and Denmark have all gained more than 20% this year. And all are better the the S&P 500 for the year.

Poland has been outperforming the US since the end of 2022. Check out EPOL, the iShares MSCI Poland ETF, compared to the S&P 500. The ratio is well on its way to reversing a downtrend that’s been in place for nearly 15 years. We count three higher lows and a 2-year relative high.

Here’s the ETF on its own. EPOL just set a new 52-week high and is set to challenge the 2021 peak.

Indian stocks are also breaking out. Here’s the INDA coming out of a 2-year consolidation. Nothing bearish about that.

That’s not to say we want to be buying everything we see. We want to be focusing on the areas showing relative strength, and that means avoiding the stocks and indexes that aren’t keeping up with the broader trend. Like these YTD losers.

China can’t get anything going. The FXI just broke down to new 52-week lows - not something you see in an uptrend.

But China is the exception, not the rule. Emerging markets ex-China have managed to get back above their pre-COVID highs, a level that’s been trouble for the last 18 months.

So it’s not just mega cap Tech. It’s not just the US. It’s not just developed markets. We’re in the midst of a broad-based bull market. Stocks are innocent until proven guilty.

That’s all for today. Until next time.