A Global Bull Market - 1/18/2024

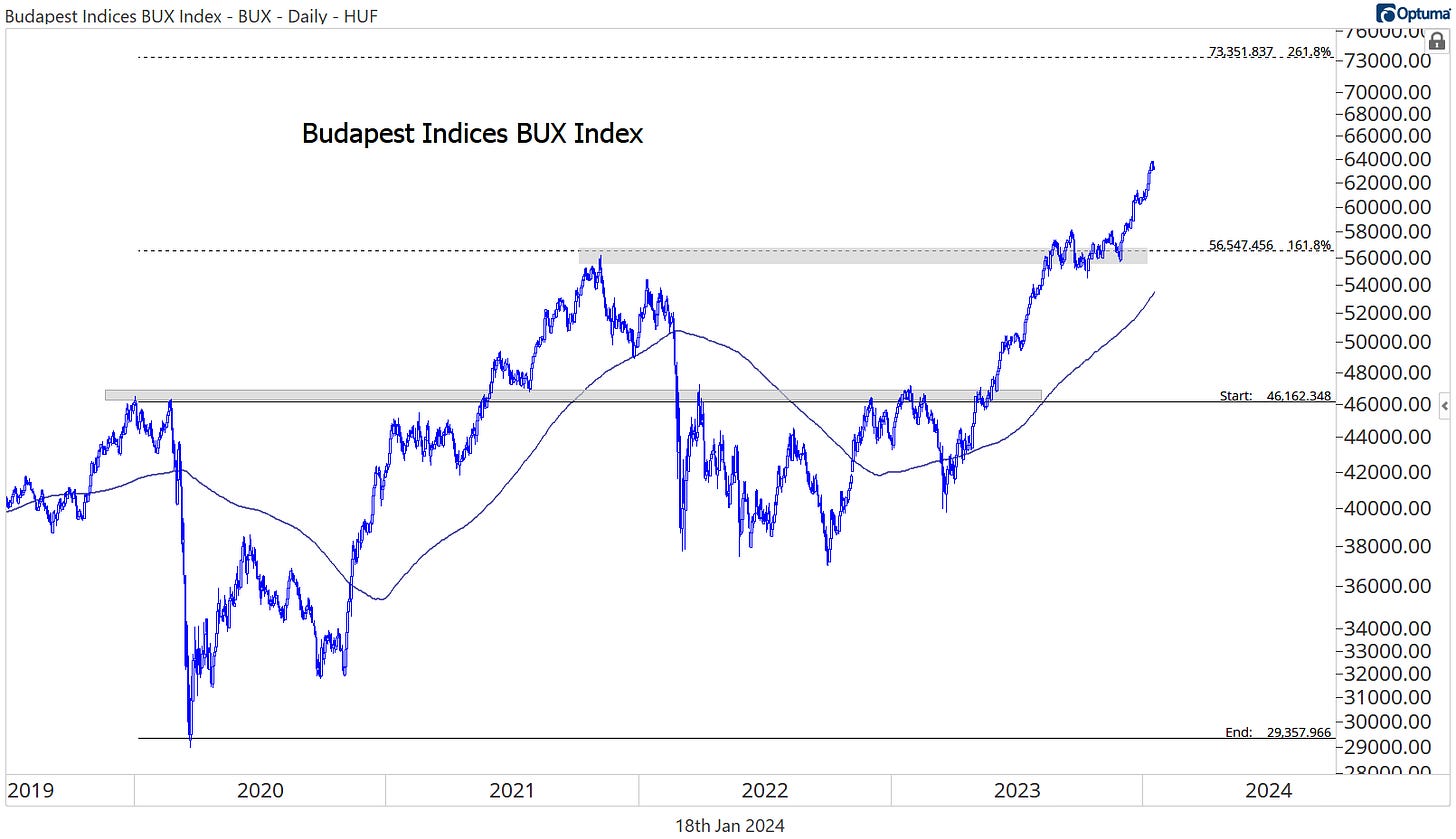

For most of the last year we’ve seen the narrative that just a handful of mega cap growth stocks are rising. True, mega cap growth has been an important leader over the last 12 months. And true, some parts of the market (we’re looking at you, small-caps) have failed to participate very much at all. But this bull market was never about just a few stocks. If it were, US stocks would stand alone atop the global leaderboard. But it’s a 45% gain for the BUX Index in Budapest that holds the banner. Stocks in Greece and Poland are rocking, too - both have outpaced the NASDAQ in USD terms.

Even though markets have faced some headwinds to start 2024, pullbacks haven’t resulted in significant damage to underlying trends. Two-thirds of the global indexes that we track are above rising short and intermediate-term moving averages. Three-quarters of them are above a rising long-term moving average. That’s not the type of thing you see in bear markets.

The BUX broke out to new highs in December, finally absorbing all the supply that came in near the 161.8% retracement from the 2020 decline. We’ve got our eye on the next key Fibonacci retracement level at 73000. That’s more than 15% higher from here.

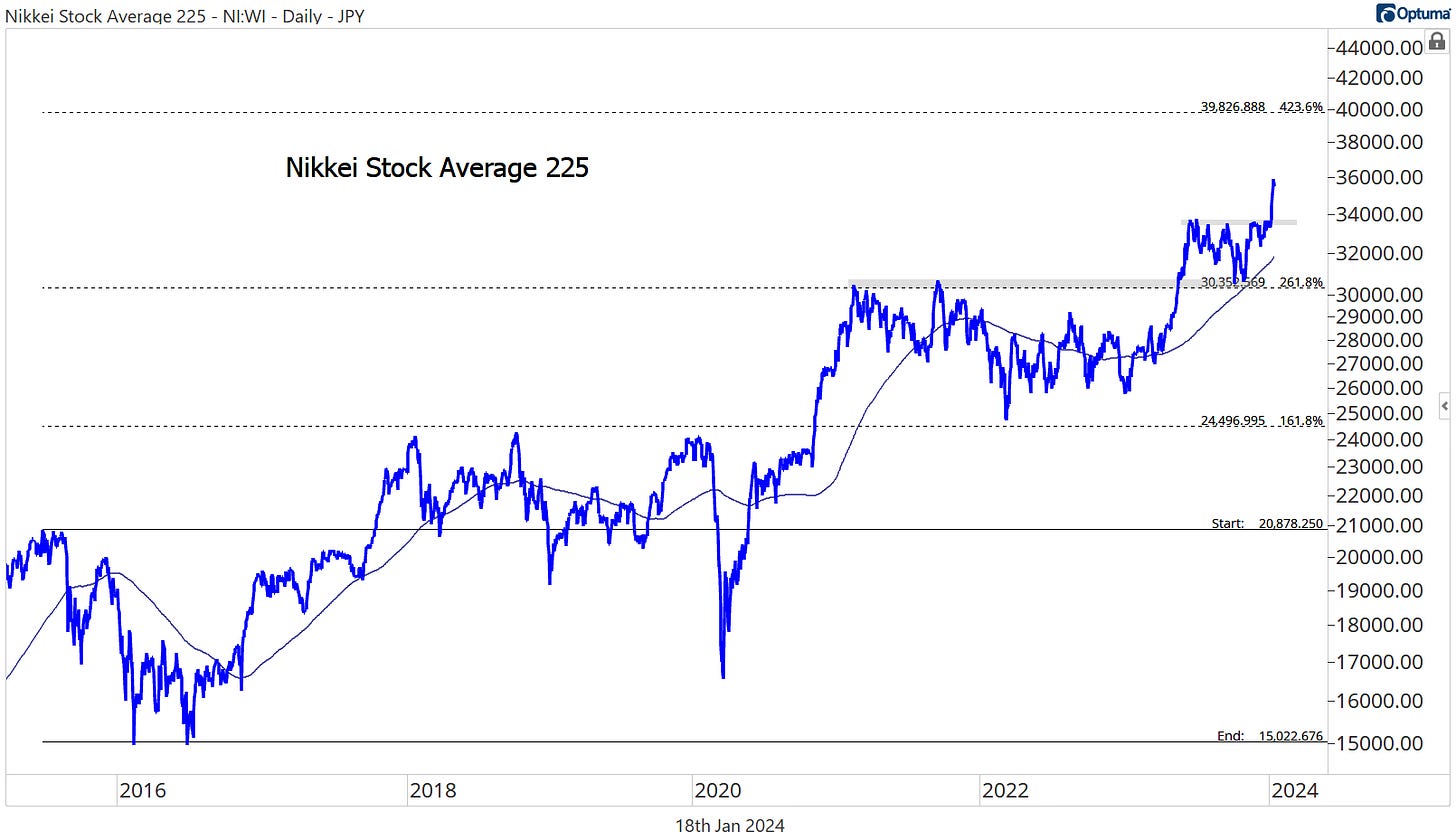

Trends in Japan are just as healthy. The Nikkei 225 resolved higher from a 6-month consolidation last week. That just continues the pattern of breakout-consolidation-breakout that’s been in place for years.

If you’re looking to get exposure to Japan, we only want to be long the EWJ if it’s above $66.50. That was the floor in 2021, and that former level of support is now acting as resistance.

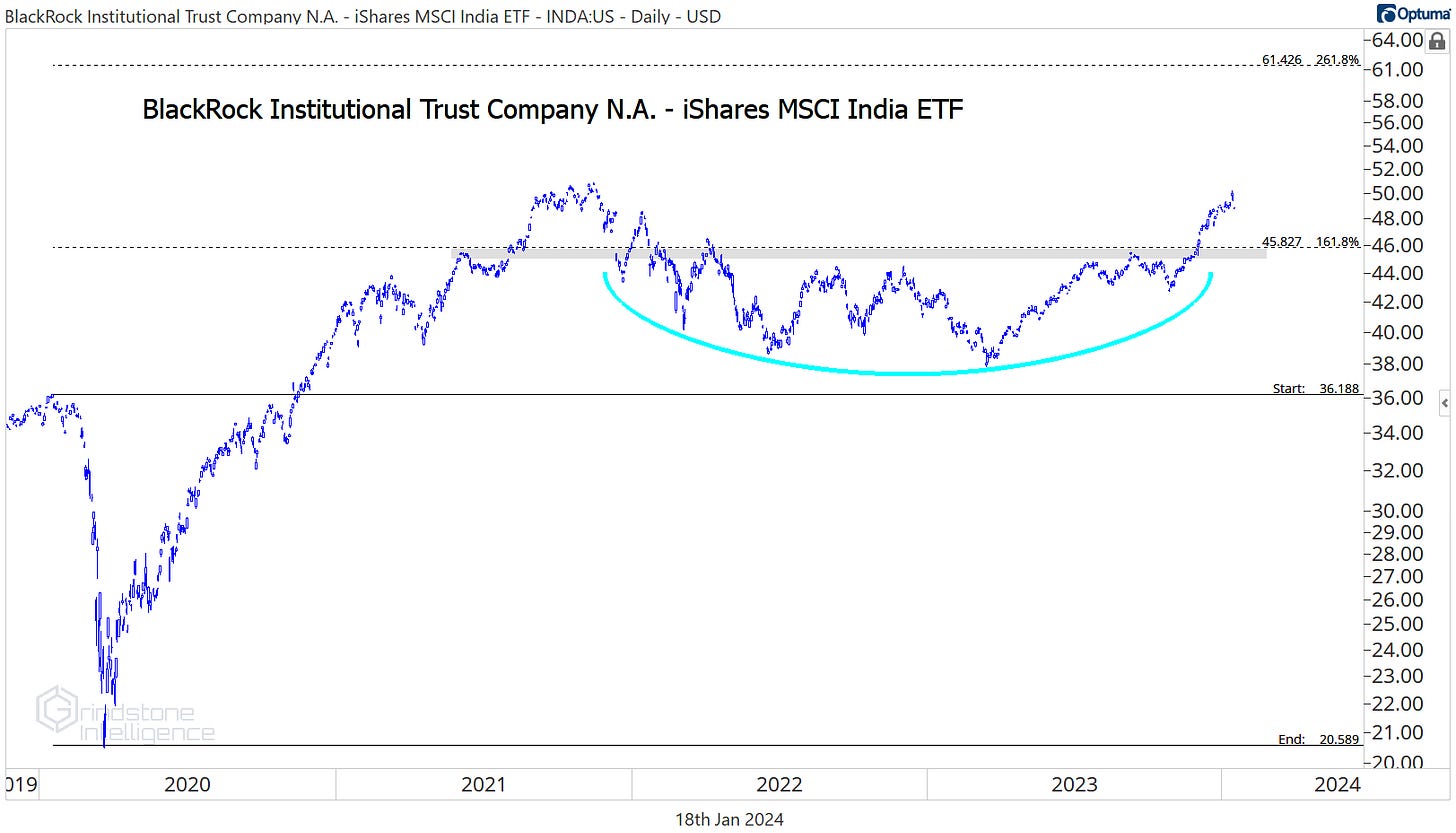

Elsewhere in APAC, Indian stocks are knocking on the door of their 2021 highs after breaking out above the 161.8% retracement from their 2020 decline. We like this INDA above $46 with a target above $60.

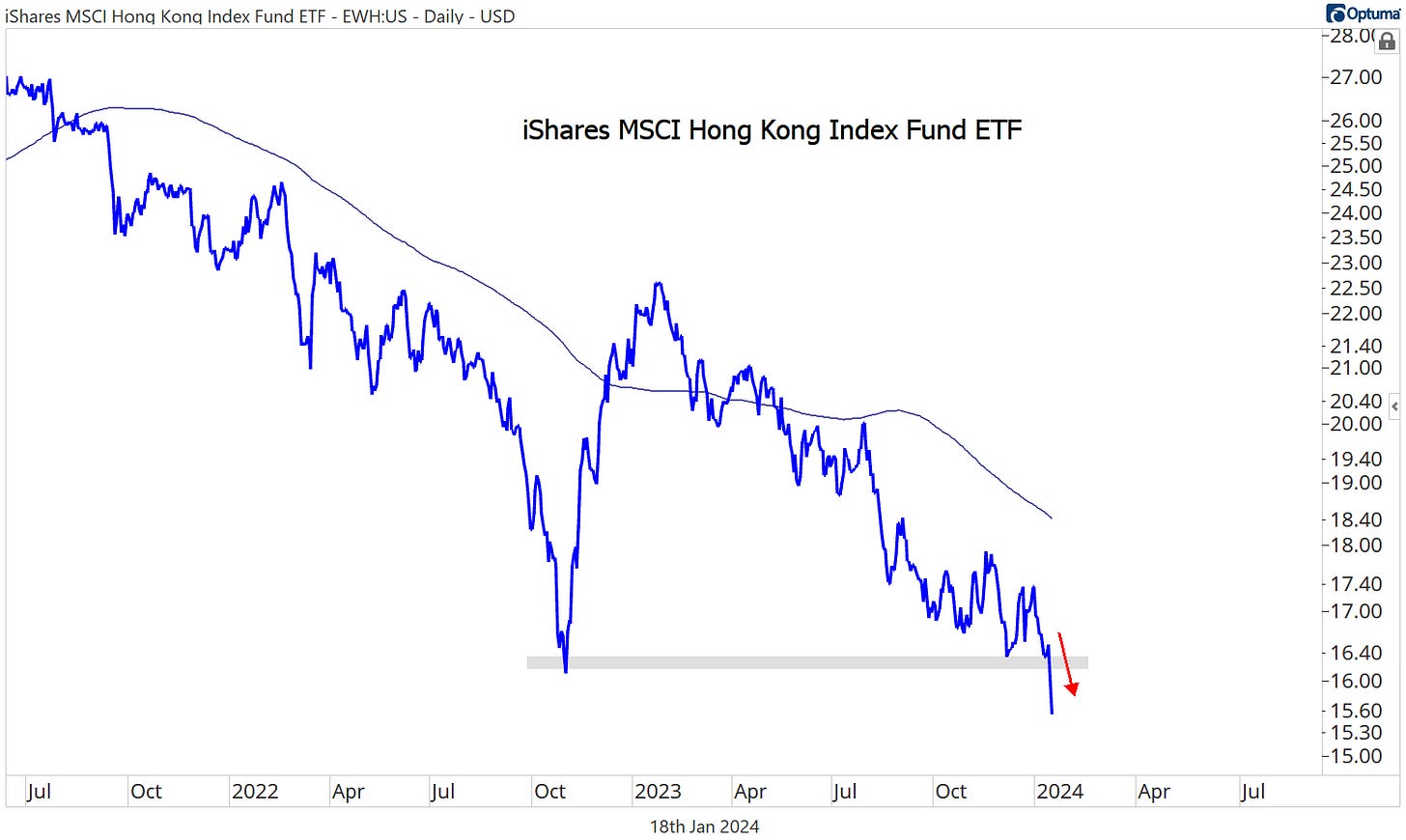

Now, just because there are broad pockets of stock market strength doesn’t mean every market is headed higher. We want to be focusing on the areas showing relative strength, and that means avoiding the stocks and indexes that aren’t keeping up with the broader trend. Like these losers:

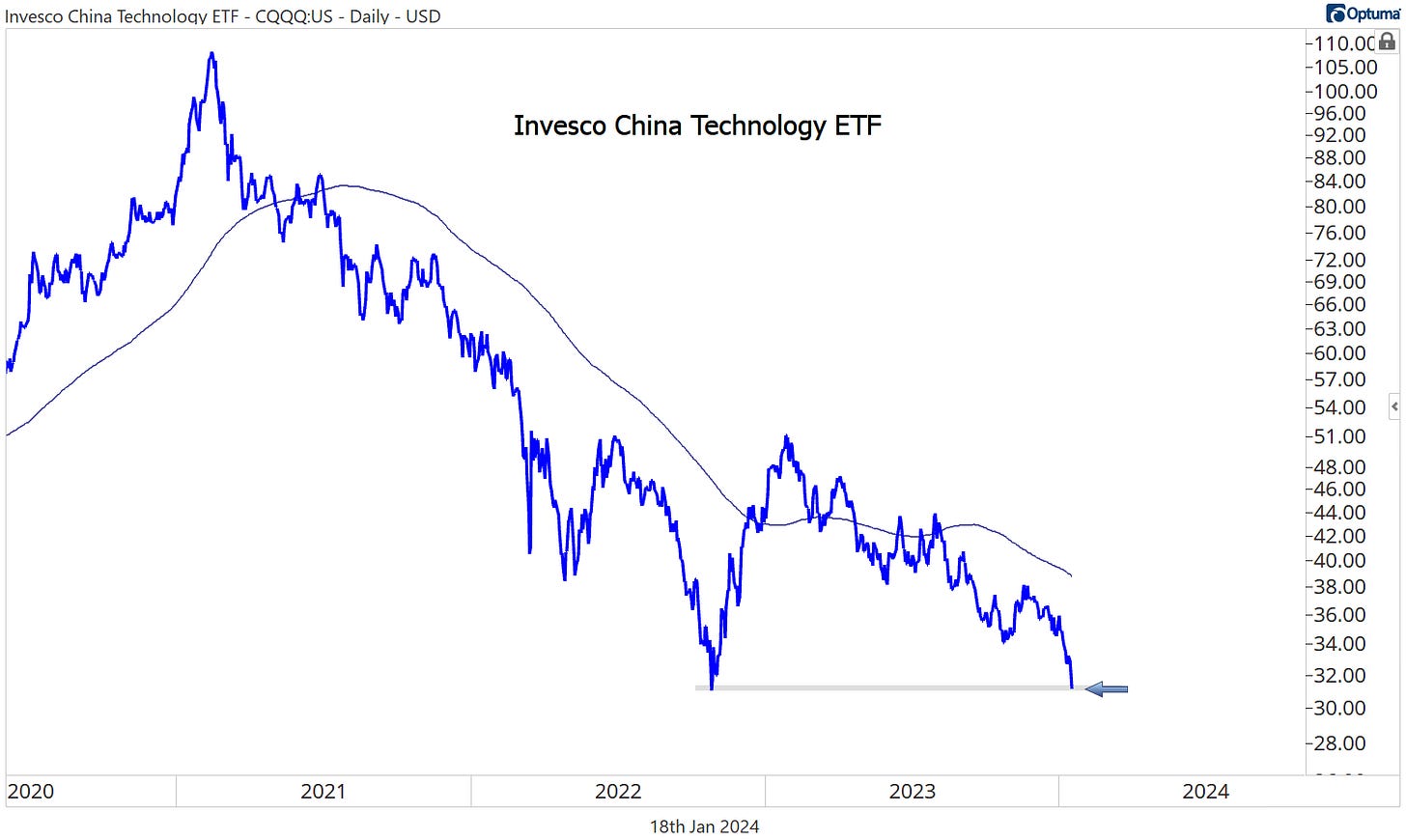

China can’t get anything going. Stocks in Hong Kong just broke down to new 52-week lows - not something you see in an uptrend.

What’s the bull case for China? A failed move

From failed moves come fast moves in the opposite direction.

If the EWH can reclaim that former support level of $16.40 the bulls will have the upper hand and we could easily see a mean reversion back towards $18. Just remember that if you’re buying Chinese stocks today, you’re doing from a position of weakness. And even though this could be the bottom, the higher likelihood is that the downtrend continues.

China bulls can hang on to the fact that Chinese Tech stocks haven’t broken their own 2022 lows (at least not yet), and based on the news flow out there, it’s hard to imagine China sentiment getting worse. What better place for buyers to step in and defend?

What’s the bear case for global stocks? A failed move.

The German DAX is arguably the most important developed market stock index outside of the US, and there’s nothing bearish about the DAX breaking out to new all-time highs in December.

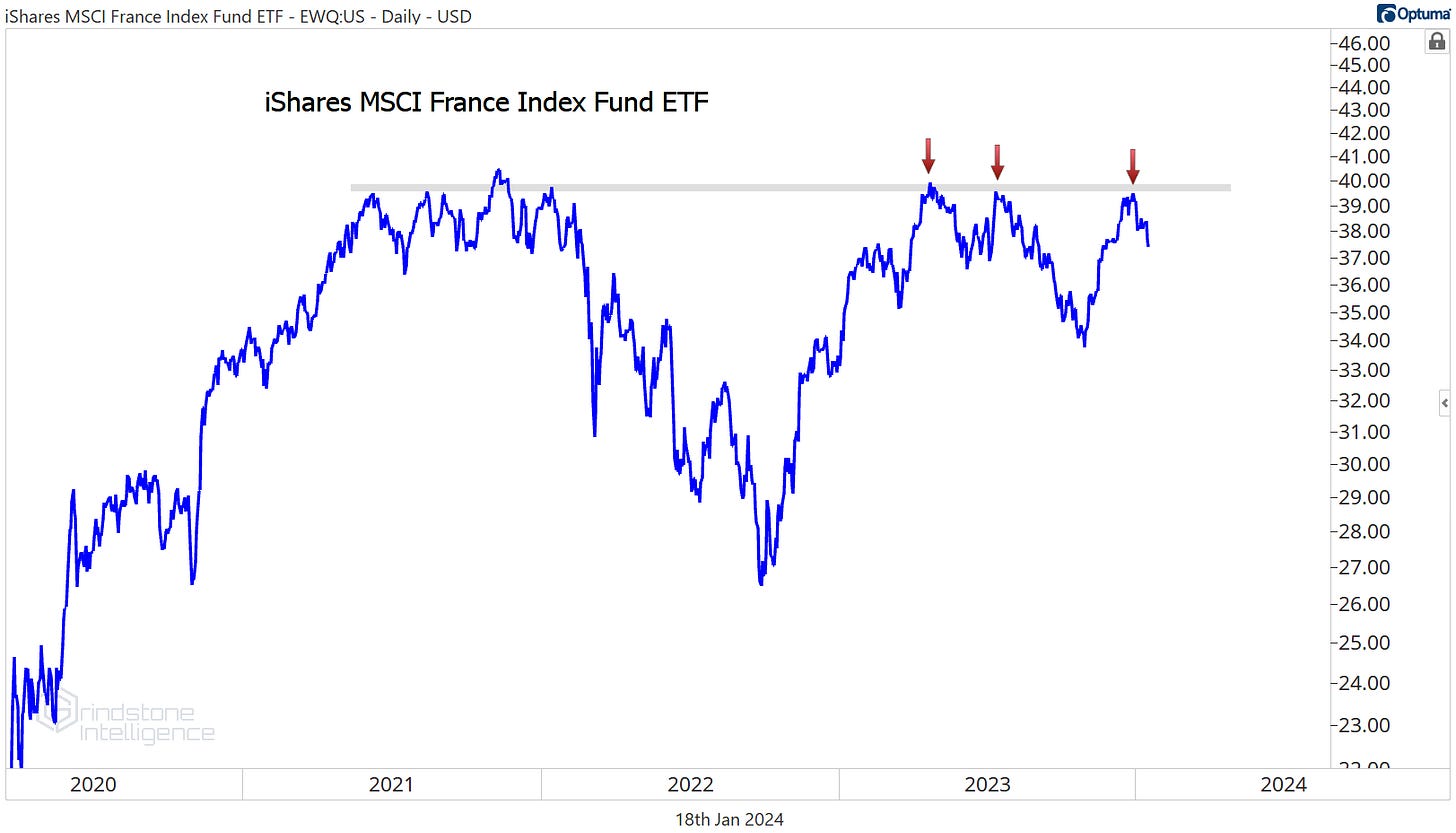

But bulls need to make sure they defend the breakout level on this backtest. Already, the iShares Germany ETF (EWG) is back below that former resistance level.

So is the EWP.

And the France ETF never even managed to set new highs. Europe needs to get its act together before a short-term mean reversion turns into a long-term trend reversal.

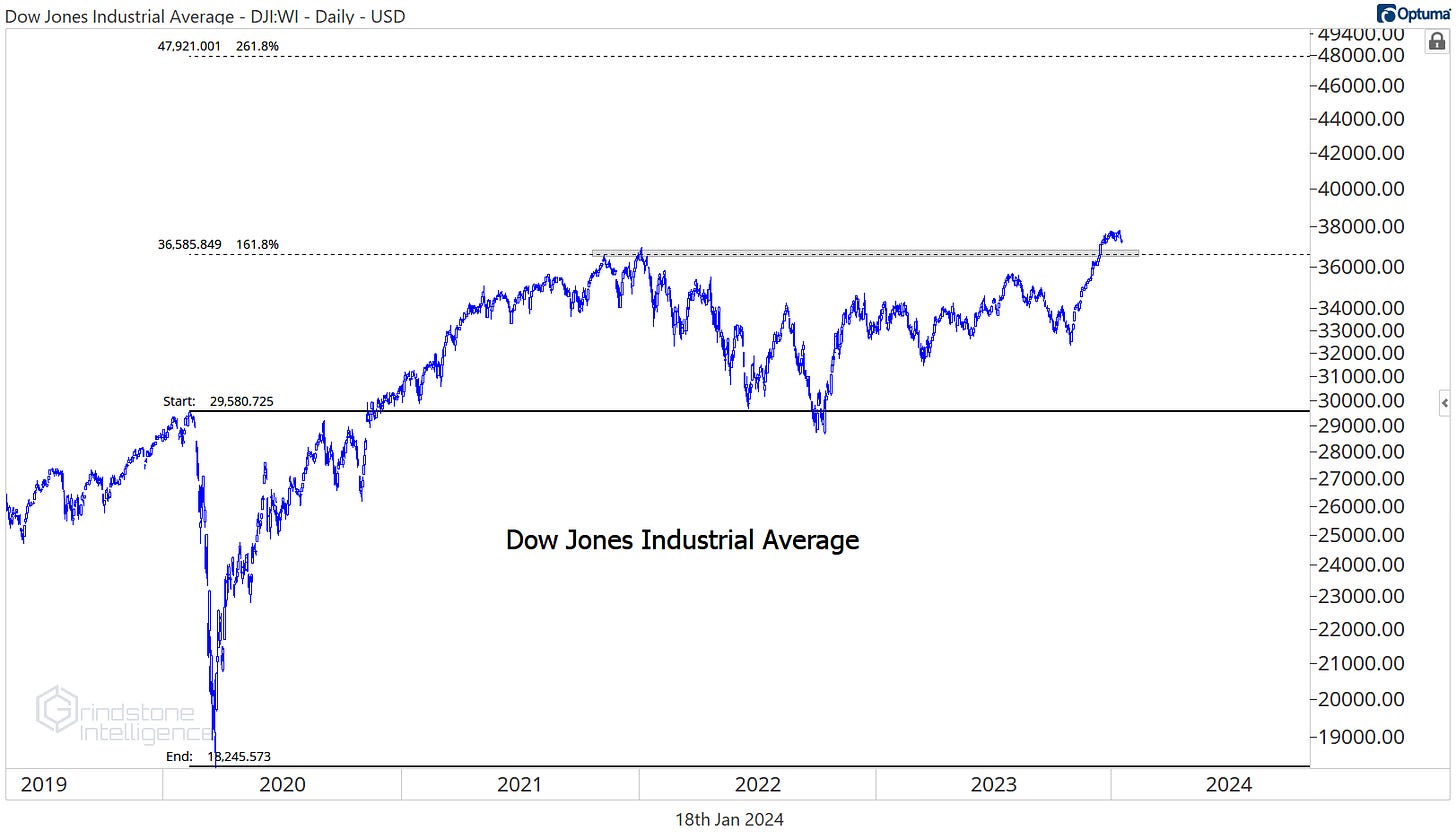

Back home, we’re watching the Dow Jones Industrial Average, which was the first of the major indexes to set new all-time highs. As long as the Dow is above 36500, the trend remains intact.

But if it’s not, we’ll need to reassess our opinion about this global bull market for stocks.

That’s all for today. Until next time.