A Global Bull Market

It's not just a US story

It’s not just a handful of stocks. It’s not even just stocks in the United States. This is a global bull market.

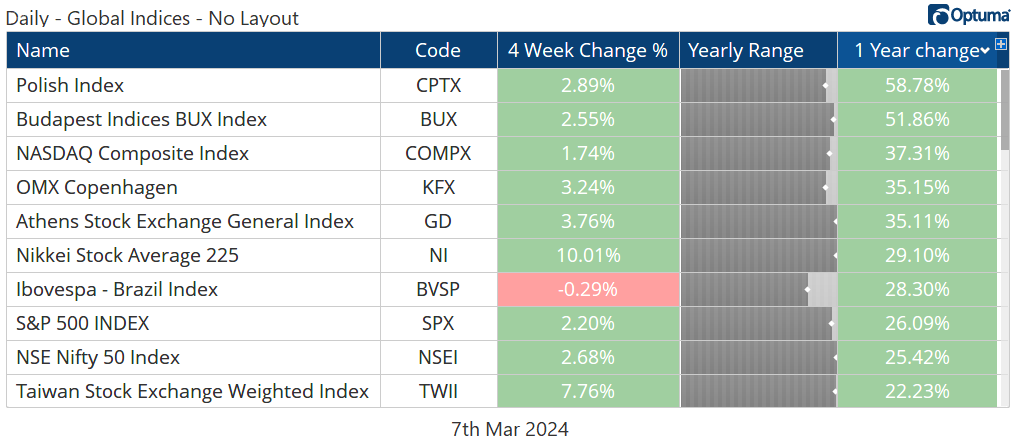

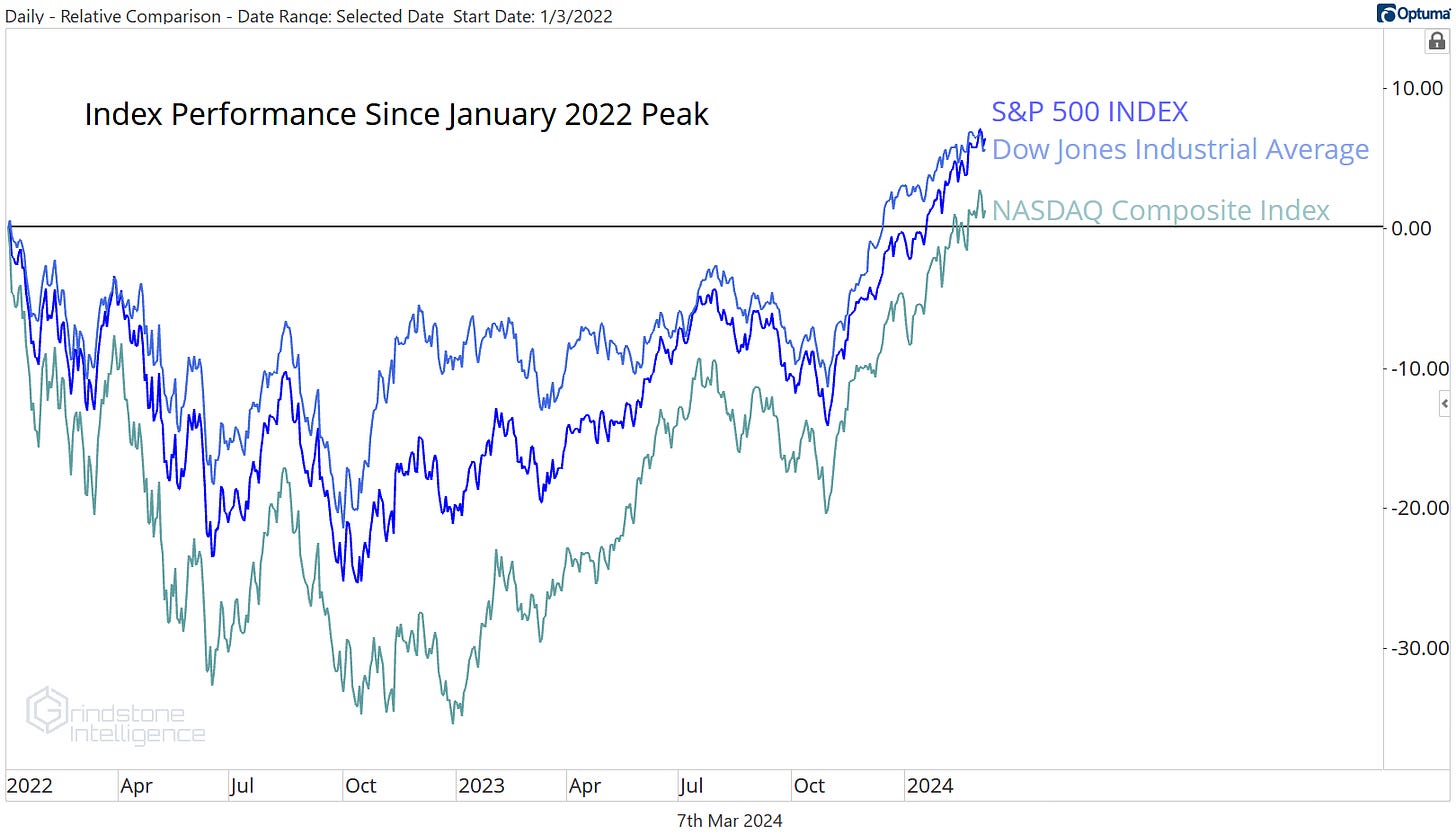

True, some parts of the market have failed to participate very much at all. But this bull market was never about just a few stocks. If it were, US growth stocks would stand alone atop the global leaderboard. Instead it’s a 58% gain for the CPTX Index in Poland that holds the banner. There’s no currency funny business driving that either. The returns below are all in USD terms.

We’re not trying to say returns in the US have been bad. The NASDAQ Composite is number 3 on this list and up 37% over the last 12 months. That’s nothing to sneeze at. What we trying to say is that this rally is broad. Stocks in Hungary, Denmark, Greece, Japan, Brazil, India, and Taiwan are all on par with the returns achieved by the US-based S&P 500.

It’s a global bull market.

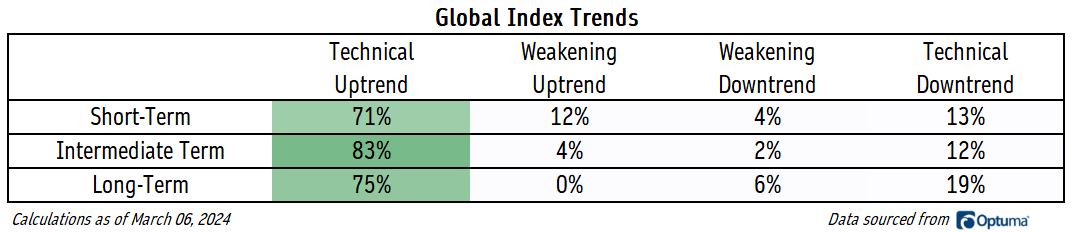

At least 70% of the global indexes that we track are above rising short, intermediate-term, and long-term moving averages. Less than 20% are below a falling moving average.

That’s not something you see in bear markets.

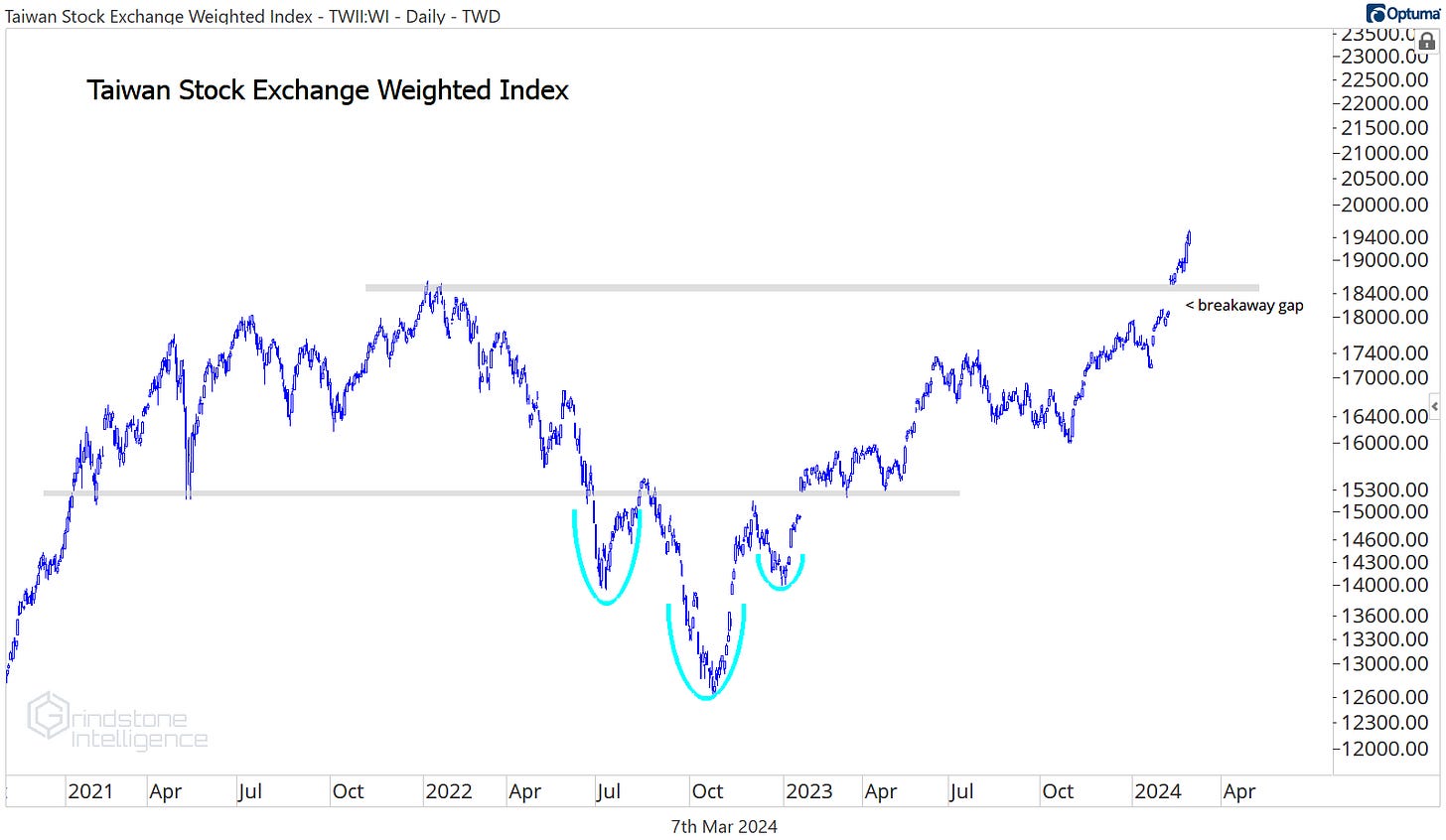

Neither are new highs. Check out this huge breakaway gap for the Taiwan Stock Exchange Index.

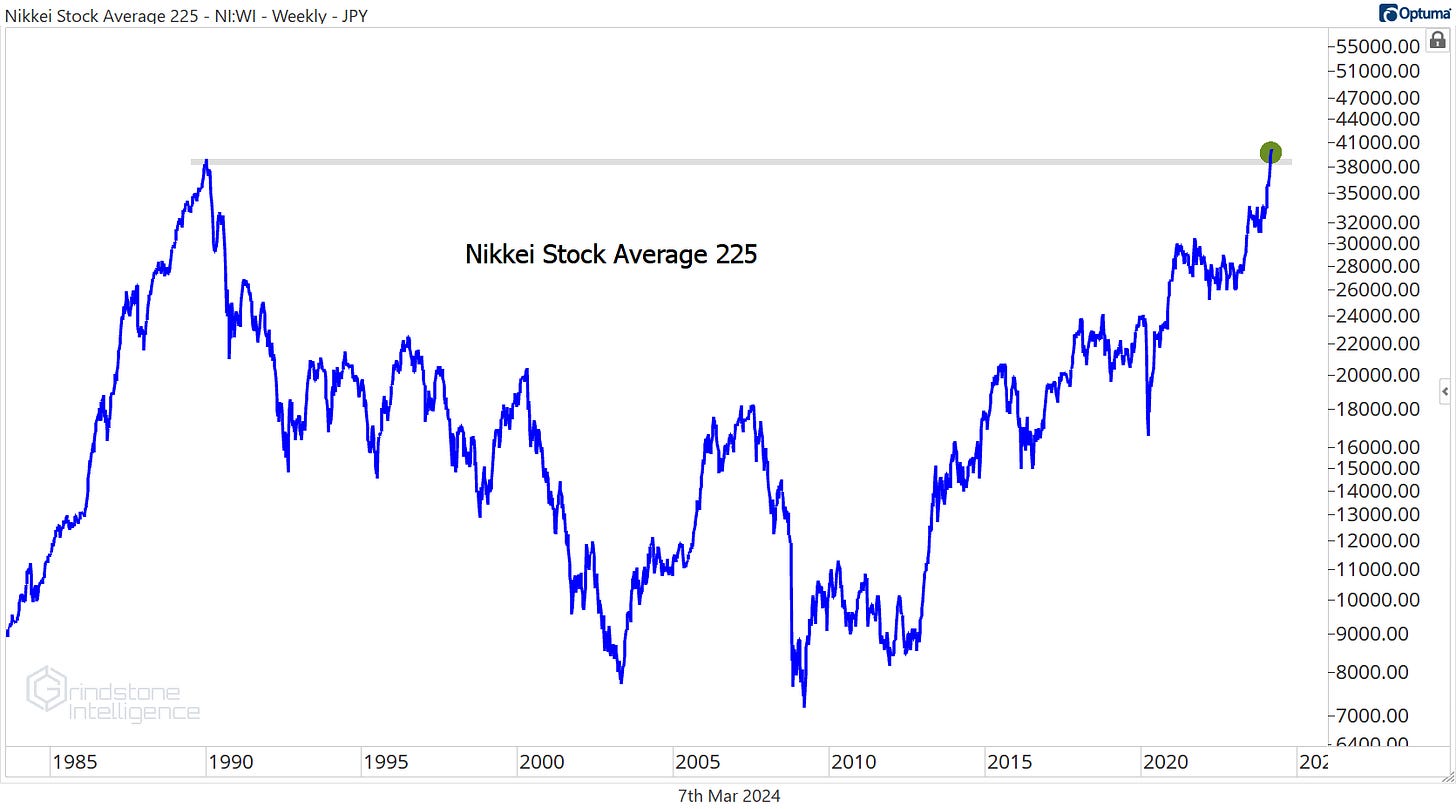

Japan just entered a recession according to most economists, but the stock market doesn’t seem to care. The Nikkei 225 just surpassed the all-time highs that were set more than 30 years ago! That’s not bearish.

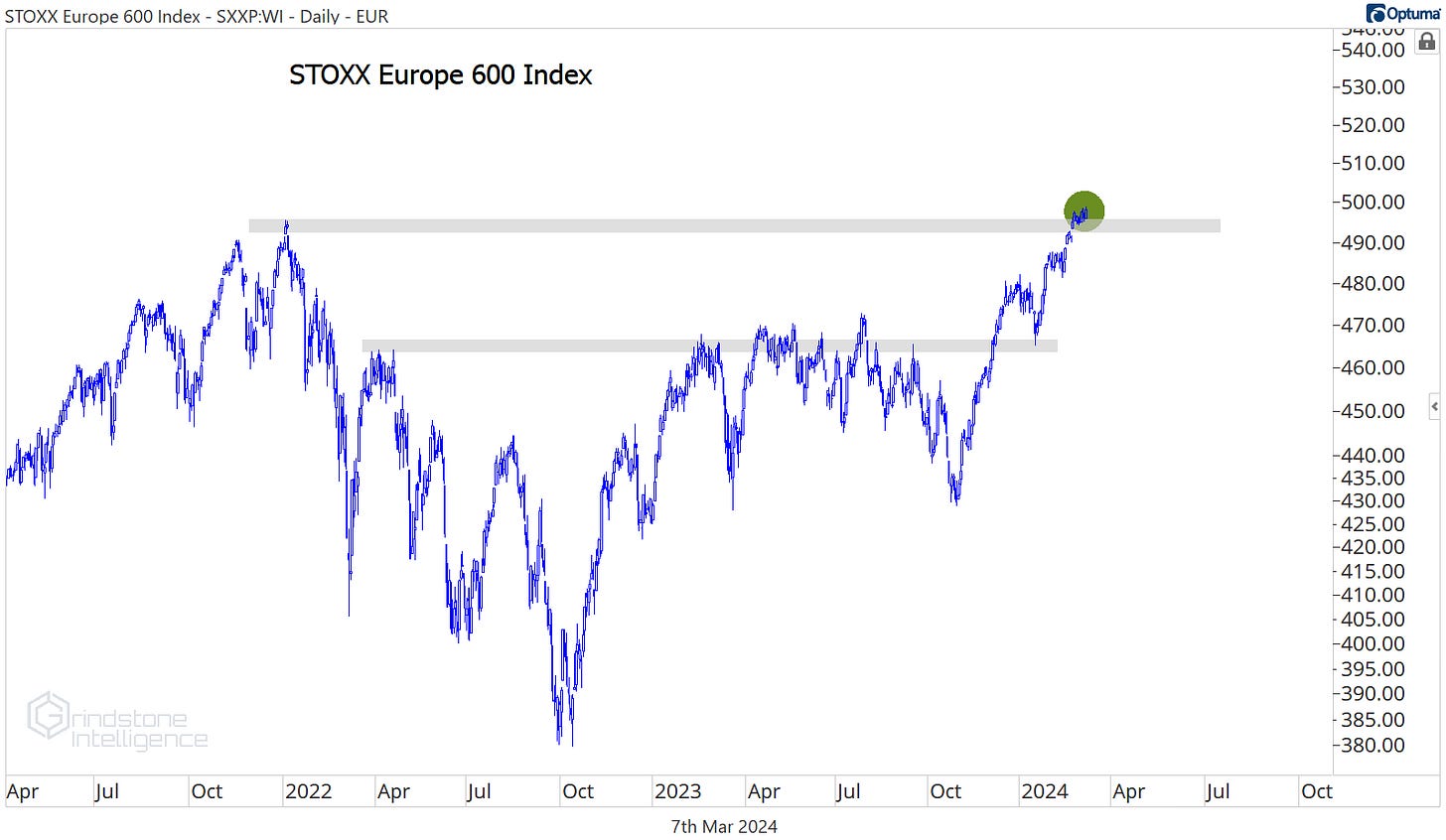

The STOXX Europe 600 just hit new all-time highs itself.

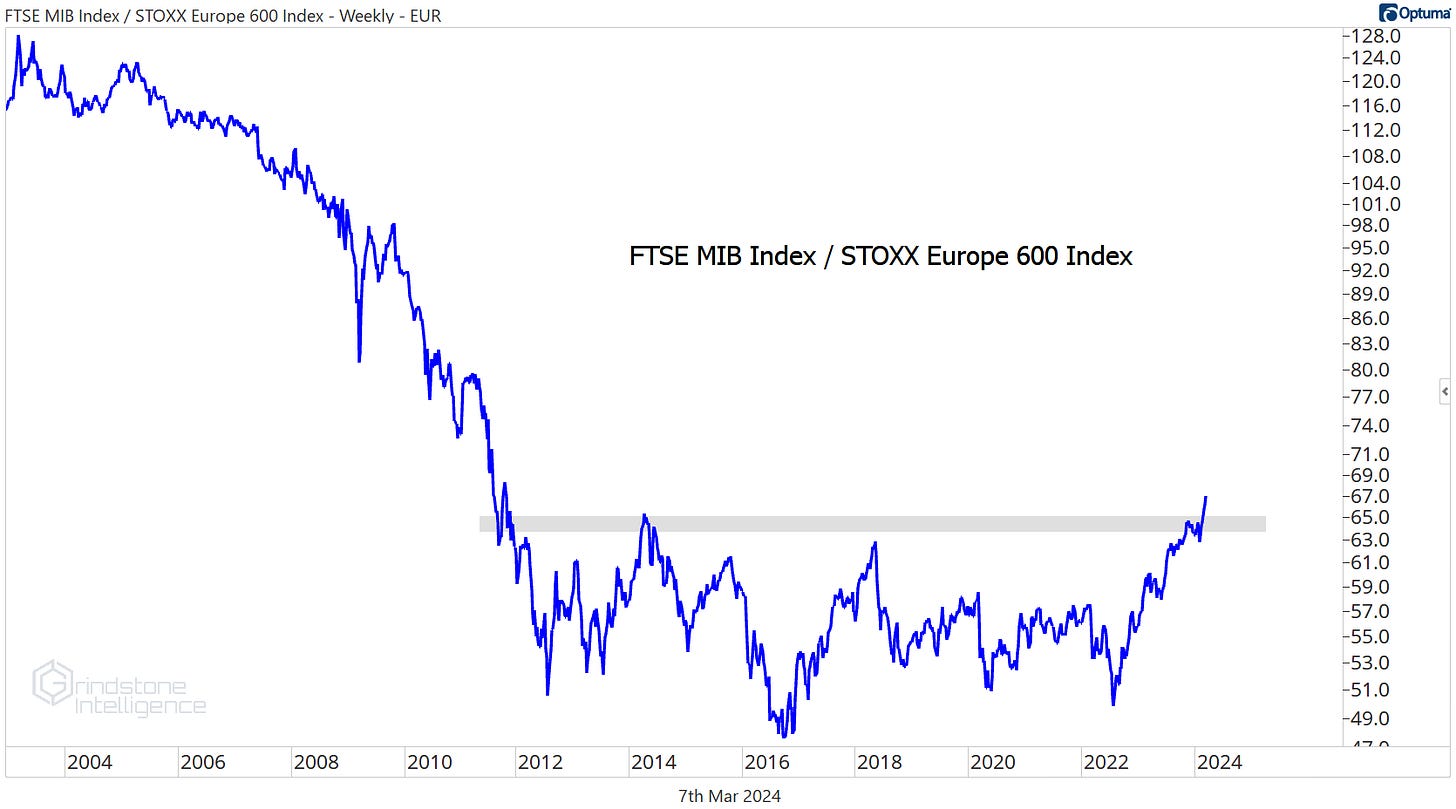

And it’s not exactly the stalwarts leading the way higher there, either. Just a few years ago it looked like Greece and Italy were going to be responsible for the death of the Euro. The Athens Stock Exchange Index is at 13-year highs. And Italy is breaking out of a 10-year base relative to the benchmark European index.

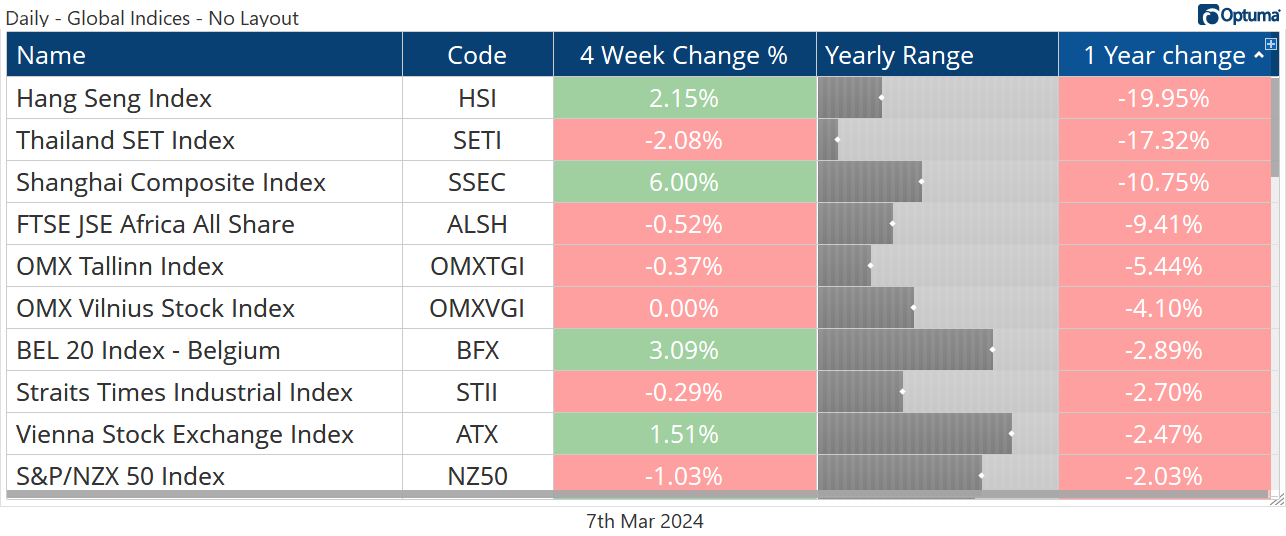

Now, just because there are broad pockets of stock market strength doesn’t mean every market has been off to the races. China has struggled to get anything going. The Hang Seng has dropped 20% over the last year, and the Shanghai Composite is down 10%.

Yet the bears can’t even keep those worst areas of the market down. The Shanghai Composite has rallied 15% from its February trough to get back above the 2022 lows.

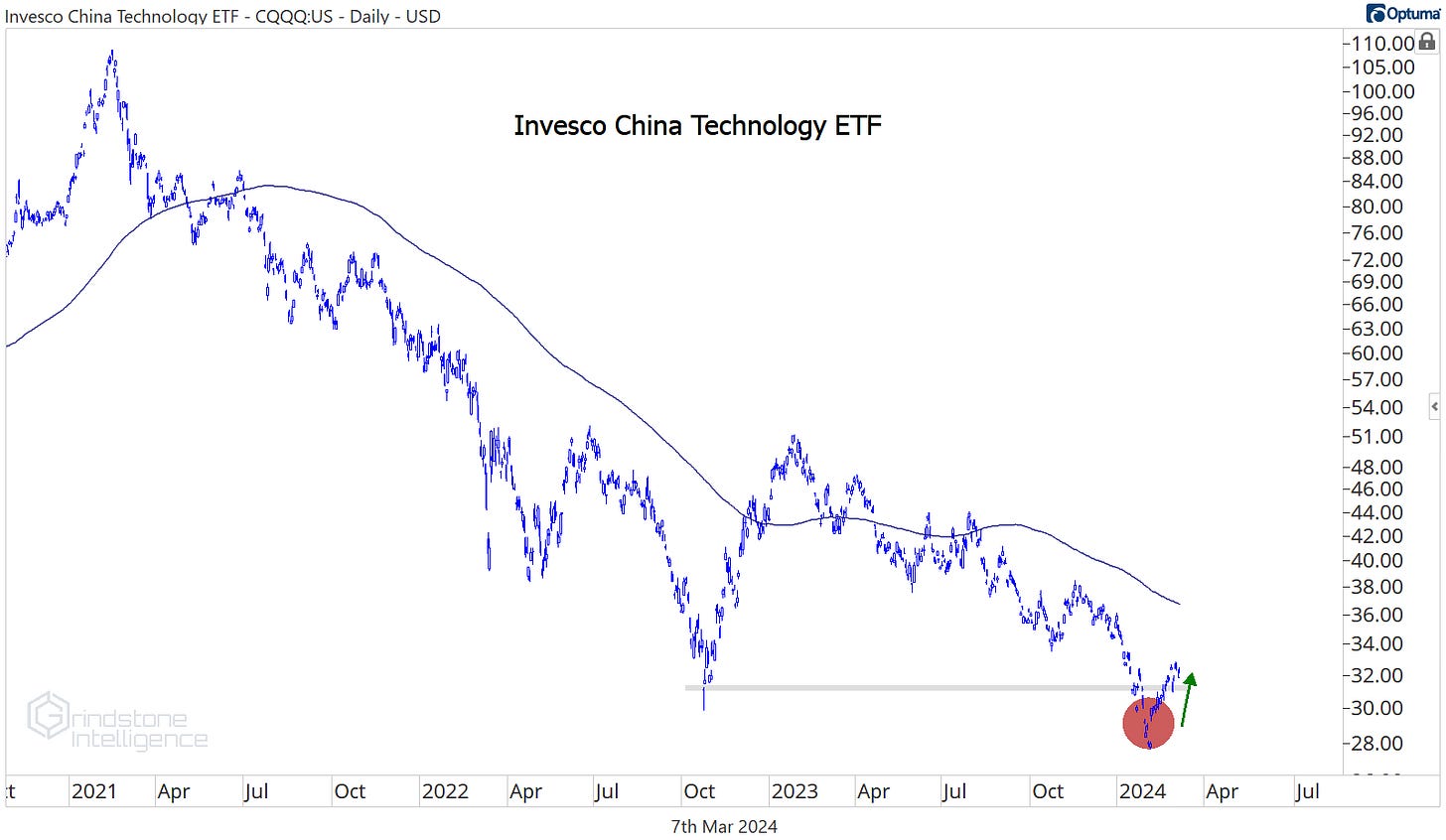

We’ve got a similar failed breakdown shaping up in CQQQ, the China Technology ETF. There’s plenty of work to do before saying a trend reversal is in place, like getting back above the 200-day, but things at least things aren’t getting worse.

And FXI never even broke its 2022 lows. What better place to find support?

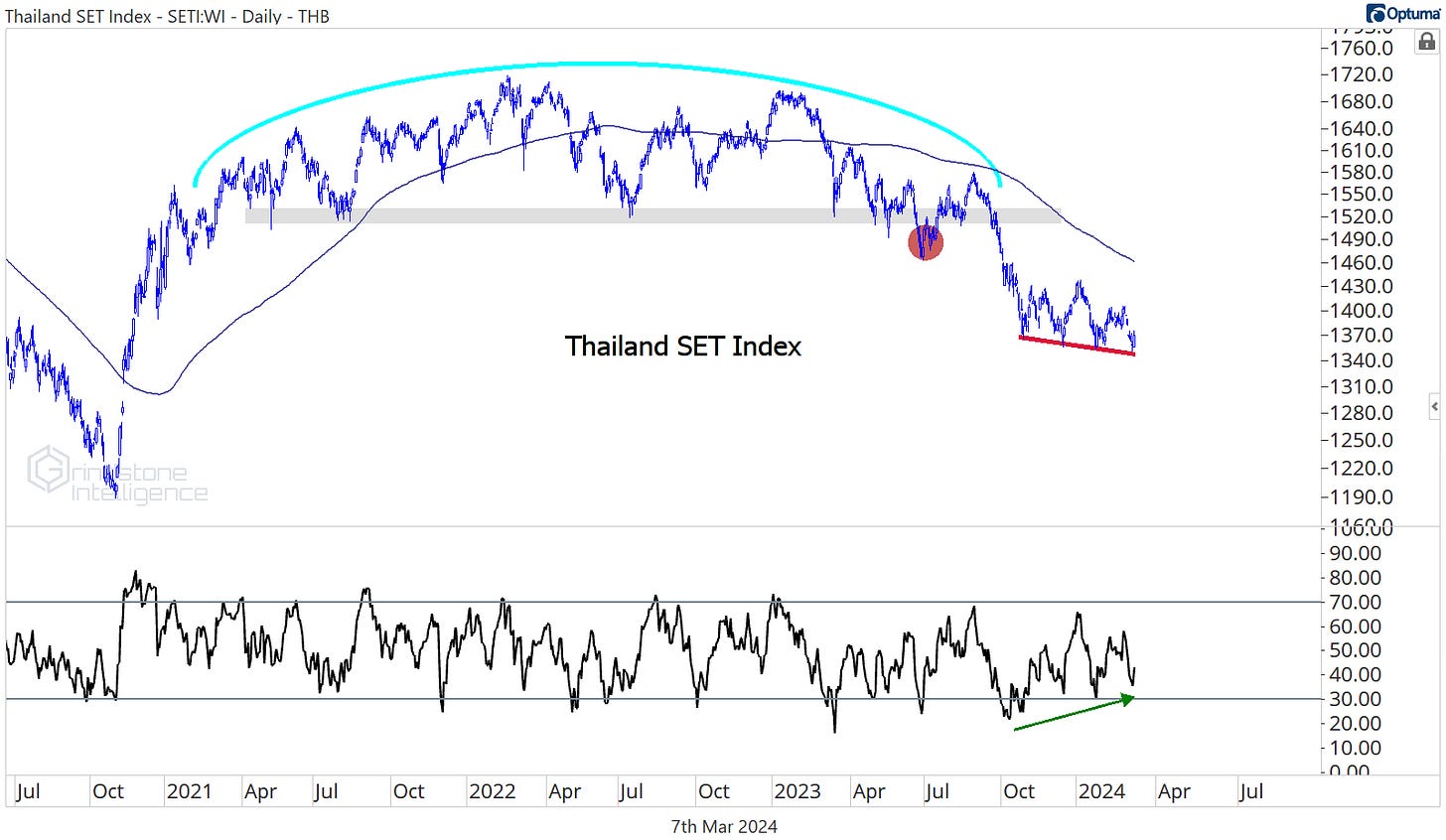

Thailand has been another stinker. After a multi-year topping pattern, it broke a major support level and has kept falling ever since. Since October, though, RSI momentum has been steadily improving.

If that bullish momentum divergence results in another big loser starting a new trend higher, what else can bears hang their hat on?

We think they’ve got to be rooting for a failed breakout.

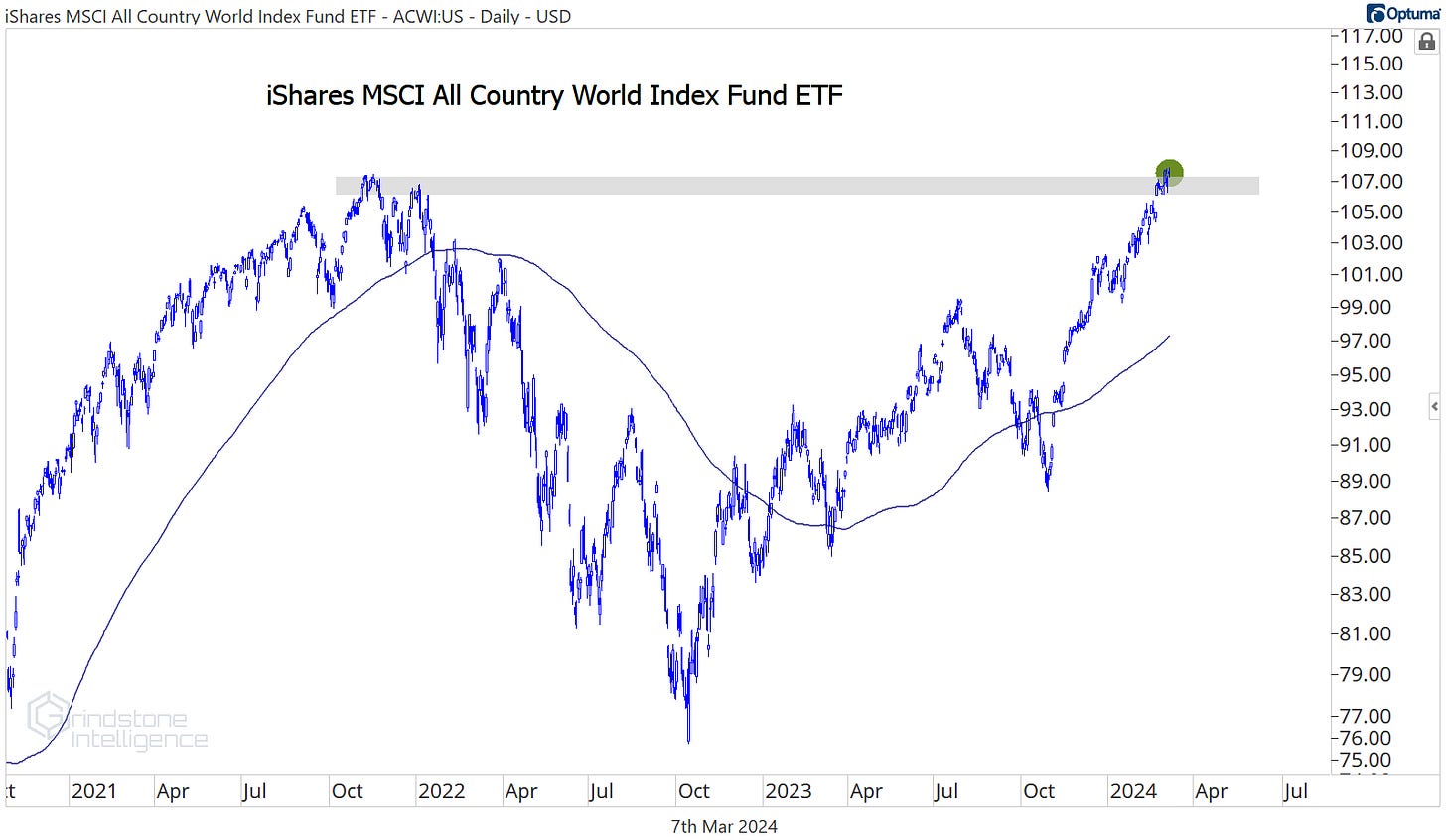

Here’s the MSCI All Country World Index Fund ETF, ACWI. It just broke out to new all-time highs.

A failed move doesn’t have to mean the end of the world is at hand. It could just mean a reversion to the mean - maybe last summer’s highs near $100 - while we build up steam for another push higher.

But if the weakness spreads and we start seeing failed breakouts here in the US, too, we’ll be forced to reassess our opinion about this global bull market for stocks.

That’s all for today. Until next time.