A Growth Problem for US Stocks

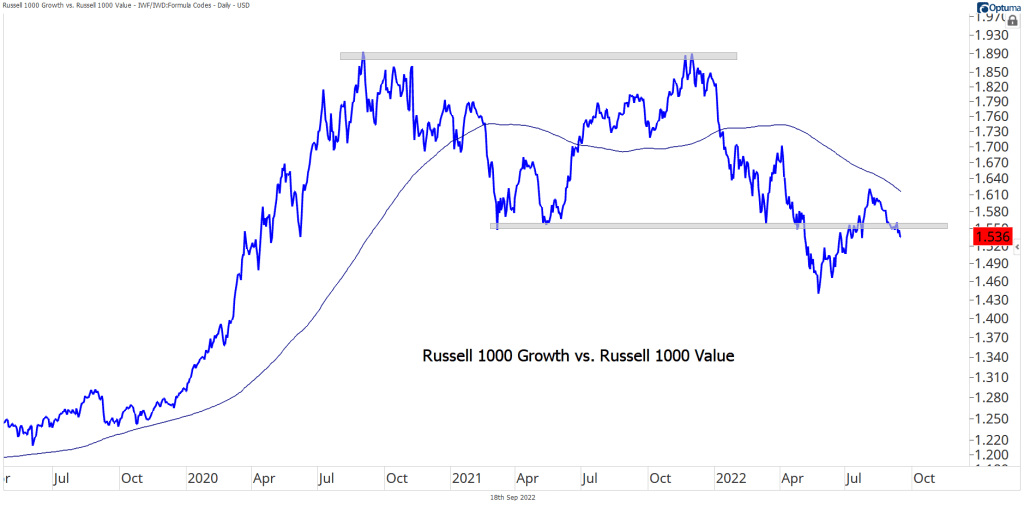

Just over two years ago, a paradigm shift began. In early September 2020, stocks took a beating, falling more than 3% in a single day. Volatility was nothing new in 2020. After all, we’d just witnessed one of the fastest 20% declines ever, followed by the fastest recovery on record. Yet something was different about that day. The selloff was led by Growth stocks, which had dominated their Value counterparts for that year and most of the last 20.

We couldn’t have known it then, but Growth’s tremendous run had officially come to an end. It tried once more last November to surpass those September 2 highs, but now Growth is in a clear downtrend relative to Value.

The biggest sector component of US Growth indexes is Information Technology, at more than 40%. And Tech’s recent peak couldn’t have occurred at a more important level: the 2000 highs. Both the monthly and weekly closing highs from the Internet bubble have marked key turning points in the consolidation over the last two years. That resistance has proven too much to overcome – Tech is now setting new 52-week lows on a relative basis.

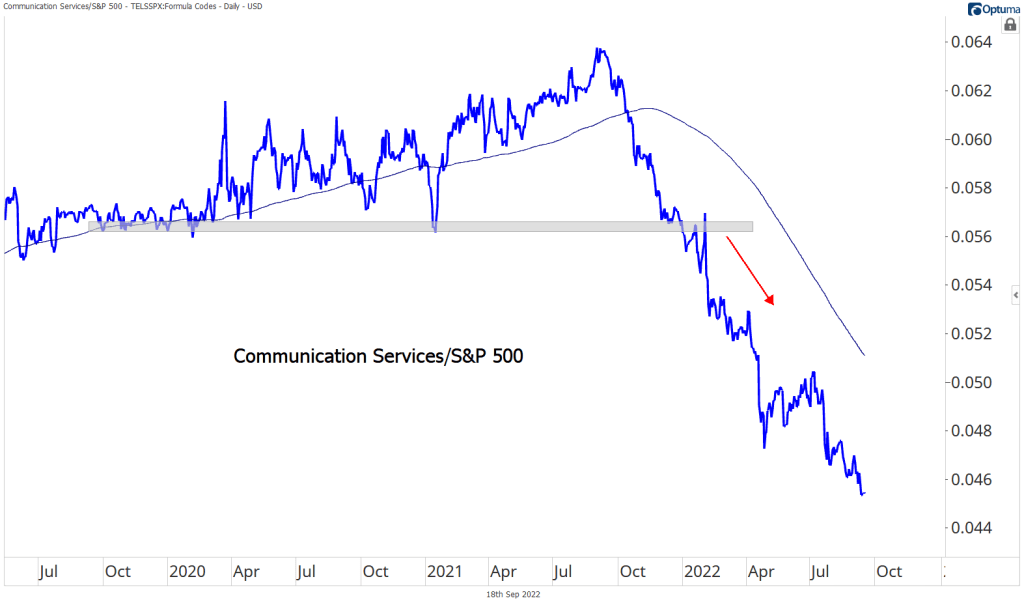

Communication Services has been even worse. The group has been in a relative downtrend since late 2021, and at no point has the sector made a serious rally attempt. It was setting new lows last week on both a relative and absolute basis.

The final piece of the Growth puzzle is Consumer Discretionary, and it’s the one that doesn’t quite seem to fit. Discretionary peaked two years ago along with the rest of Growth. But unlike Tech and Communications, this consumer-oriented sector set its relative bottom months ago. And now it’s setting 20-week highs.

Is this just the pause that refreshes before Discretionary rejoins Tech and Communications in their downward trends? Or is this a sign that Growth’s struggles are coming to an end? The answer could dictate the future of the current bear market in risk assets.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post A Growth Problem for US Stocks first appeared on Grindstone Intelligence.