A ‘Magical’ Scan for Stocks

Back in 2005, Joel Greenblatt introduced his ‘Magic Formula for Investing’ with The Little Book That Beats the Market. The book details a methodical approach that helps investors find some of the cheapest, most well-operated companies and buy them each month for a one-year holding period.

There is nothing “magical” about the formula (or our variations of it), and the use of the formula does not guarantee performance or investment success. Obviously. But Greenblatt’s own results have shown the value utilizing this simple approach.

We’ve adding some of our own flair to the Magic Formula with today’s scan. We combined Greenblatt’s approach with our penchant for following price action and came up with a handful of stocks from each sector that we think are well positioned to outperform. They all have market caps greater than $1B, and they’re all in technical uptrends. Here they are sorted by market cap:

Alphabet stands out at the top of the list as it consolidated above former resistance. This one’s been one of the top performers in 2023, and it hasn’t given much of anything back so far in August. That bodes well for the stock as we enter the final few months of the year.

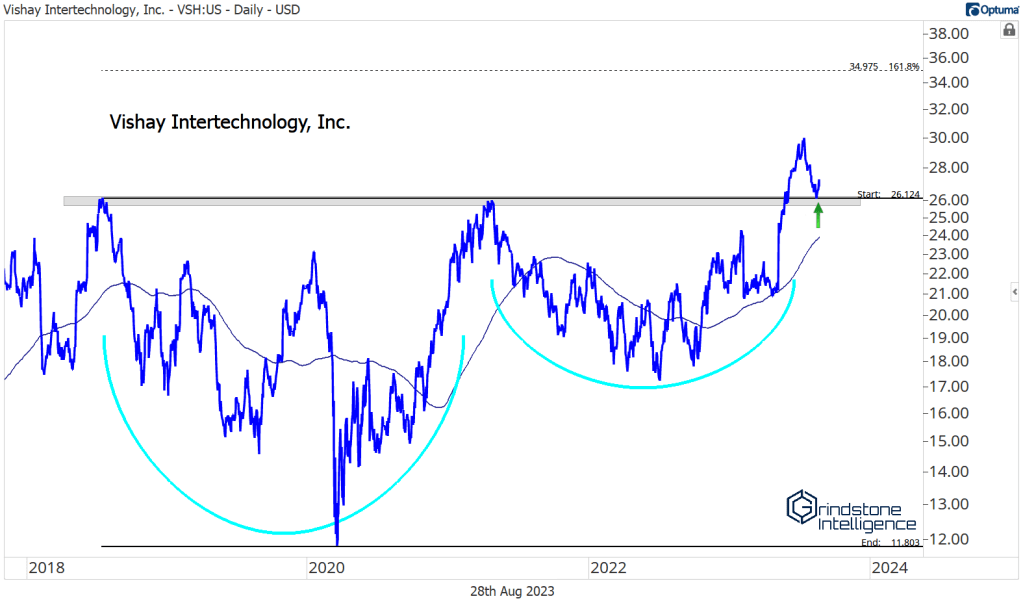

Vishay Intertechnology is a $3.7B company in the Electrical Components sub-industry. The stock broke out from a big, multi-year cup-and-handle pattern to start the summer, then pulled back sharply over the last month. Now, it’s finding support at the site of the initial breakout. We like the idea of buying VSH as long as it’s above $26, with a target up near $35, which is the 161.8% Fibonacci retracement from the 2018-2022 range.

Similarly, we like this pullback in the homebuilder, NVR. The homies have been one of the top-performing groups all year, in spite of all that talk about a ‘housing recession’. We want to be buying this backtest of $6000 with a target up near $7500.

The most fun chart in the list is Health Care company HCA. Call me crazy, but price action over the last 18-months looks a lot like the price action from a couple years ago. Check it out: an earnings rally into consolidation, a failed breakout followed by a huge selloff, then stair steps higher to challenge the former highs. Last time, HCA rose another 70% after the breakout. Does it do so again?

If it’s above $275, we like it with a target of $400.

The post A ‘Magical’ Scan for Stocks first appeared on Grindstone Intelligence.