A Risk Appetite Assessment

Nobody is fleeing for the exits

If the value of a stock is the present value of all its future cash flows, then the stock of a company that will grow future cash flows at an above-average rate should be worth more. That’s the essence of investing’s growth factor – it focuses on stocks that are expected to rapidly grow earnings, but those stocks tend to be expensive.

If above-average growth rates fail to materialize, though, the higher price is no longer justified, presenting investors with considerable downside risk as valuation multiples correct.

During times of uncertainty, investors tend to pivot out of those growth-sensitive areas and focus instead on companies with stable earnings power. Being able to see those pivots give us insights into investors’ appetites for risk. And that’s important, because risk appetite is what drives market prices.

A great example of this dynamic is the relationship between the Consumer Discretionary sector and the Consumer Staples sector. Earnings trajectories for Discretionary companies are tied to economic strength, Staples less so – you’re probably not getting a new car during a recession, but you’re still going to the grocery store and buying toothpaste.

So when the Consumer Discretionary/Consumer Staples ratio troughed at the end of 2022, then rose steadily for the next 10 months, that was evidence of buyers showing preference for the riskier, growthier stocks in the market.

However, the Discretionary/Staples ratio peaked last fall after running into a key rotational level from the 2021 lows:

Is that a sign of investors fleeing for safety and a harbinger of bad things to come?

We don’t think so.

The relative weakness in Consumer Discretionary over the last few months is largely attributable to just one stock. Tesla alone represents about 13% of the entire sector, even though it’s lost 40% of its value since last summer. And if we strip away the outsized influence of market cap weightings, the Discretionary/Staples ratio hasn’t peaked. It set a higher high just last week.

We see the same thing in the small cap space. Consumer Discretionary stocks continue to outperform Consumer Staples.

The preference for risk shows up in the world of fixed income, too. Investment grade credit spreads have fallen off the table over the last few months, and they’re down near their lowest levels in 15 years.

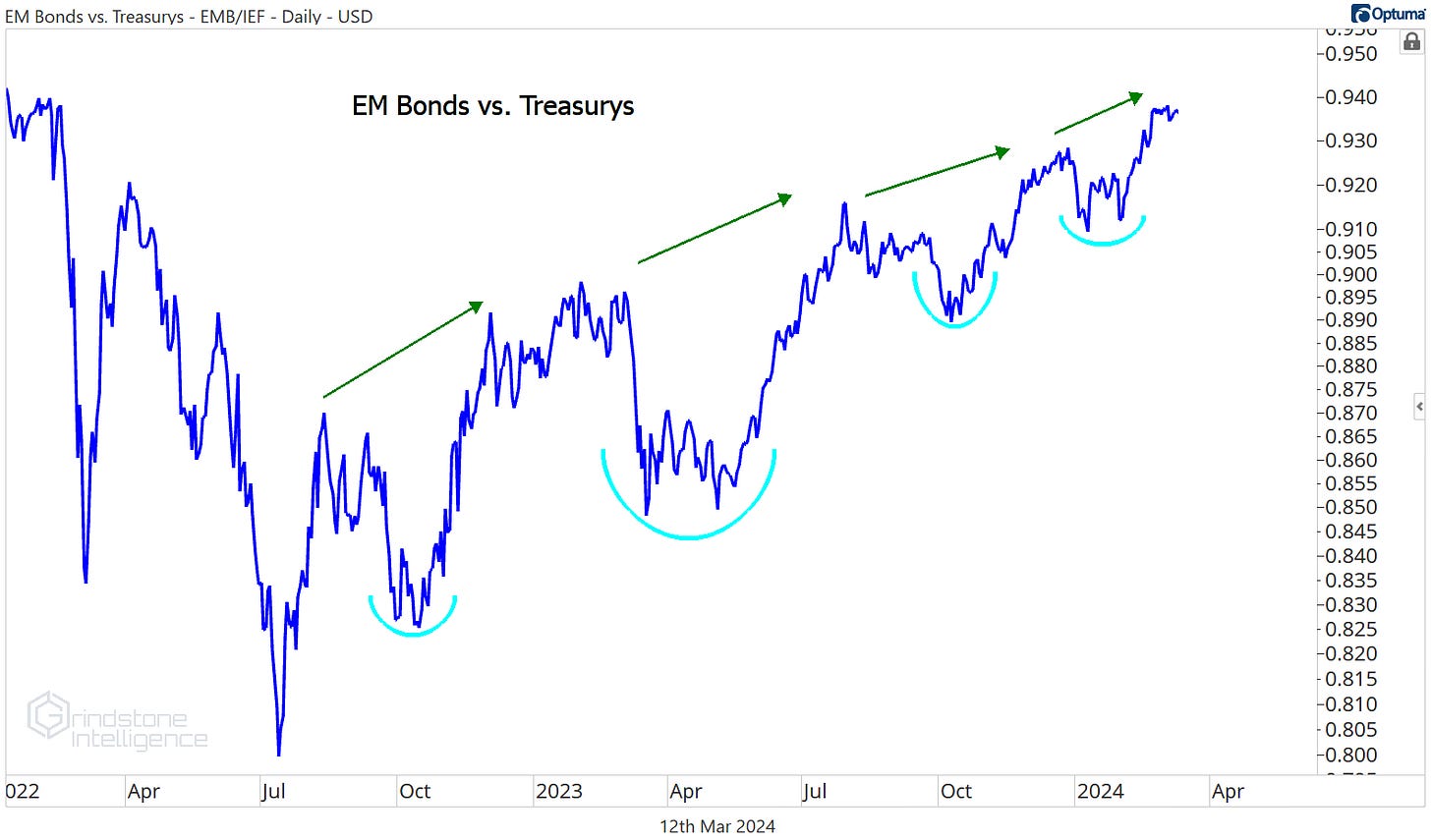

And check out the ratio of emerging market bonds relative to Treasurys. Higher highs and higher lows:

In what world do people favor the debt of a bunch of emerging market governments over that of the US Treasury? It’s not a world where those people are worried about economic downturn and a global credit crunch.

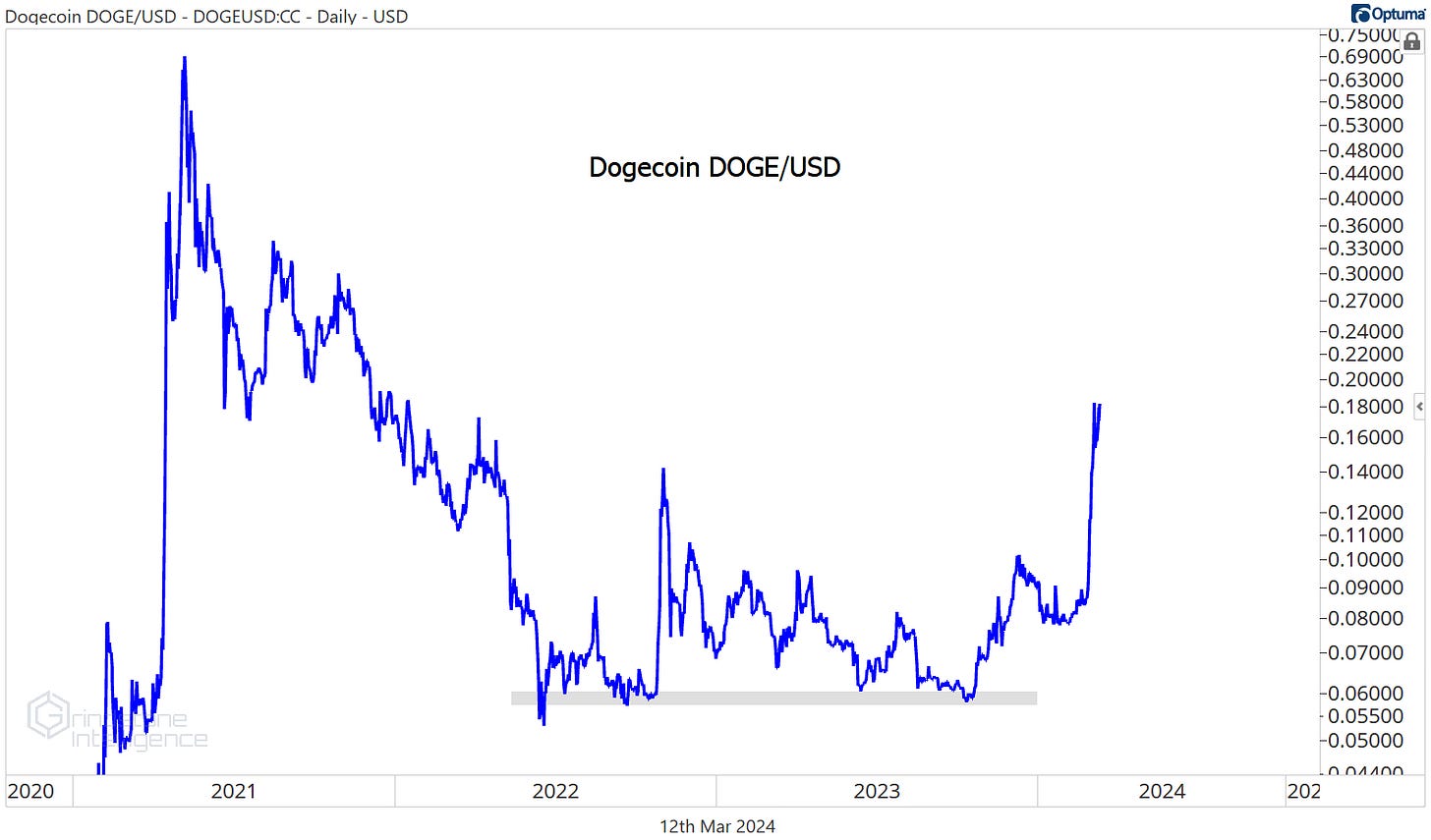

Does that mean a widespread recession can’t happen? Of course not. But it does mean that risk appetite is running rampant. And when risk appetite runs rampant, the riskiest assets are the ones that benefit. In crypto land, Bitcoin just broke out to new all-time highs.

Don’t think Bitcoin is that risky? Fine. We’re not here to debate that viability decentralized digital currencies. But you won’t convince us that Dogecoin is a leading contender to replace the USD, and DOGE just hit 2 year highs. That’s definitely not evidence of risk aversion.

This is a bull market, and in bull markets, people like taking risk. It’s when they stop taking risks that we need to really start paying attention. That’s just not happening today, but we’ll be the first to tell you when it does.

Until next time.