A Risk Appetite Assessment

They say the stock market climbs a wall of worry.

There sure is plenty to worry about - Twitter is all doom and gloom these days. Last week, New York Community Bank got cut in half, bringing back memories of the failures SVB and Signature Bank last March and sparking fears that weakness in commercial real estate will cascade through the banking industry. Job cut announcements are all over the newswire, raising concerns that the labor market is entering a downturn. And with Jerome Powell all but ruling out a March interest rate cut, the doomers are sure that a Fed-induced recession is imminent.

Maybe they’re right.

But New York Community Bank is a bit of an outlier. For one, NYCB acquired assets from failed SBNY last year, pushing them over the $100B mark. That made NYCB a Category IV bank, meaning they’re now subject to tougher capital requirements and stress testing. The adjustments they made last week to shore up their balance sheet and increase liquidity were in large part due to that regulatory shift. Second, NYCB has quite a bit more exposure to CRE loans than most lending institutions, meaning their peers are unlikely to be writing down loans to the same extent.

Even if they do, though, keep in mind that the regional banks are becoming less and less important every day. They make up just 0.8% of the S&P 1500 and even less of the S&P 500. And anyway, the S&P 500 Regional Banks sub-industry hasn’t even broken its mid-January lows.

As for those job cut announcements? Yea, they’ve surged in January. But they surged even more last January, and the labor market was able to absorb that without too many issues.

So what about the lack of a March rate cut?

Listen, I’m not so naive as to believe that Jerome Powell and his cronies are infallible, but I also think it’s laughable that nearly every person on Twitter seems to think they can do a better job setting monetary policy than the Fed. It’s a lot like complaining about the refs in this weekend’s Super Bowl matchup. Or about the umpires at a baseball game.

Everybody loves to hate umpires. There’s an entire baseball ecosystem out there dedicated toward pointing out bad calls, complaining about rule interpretations, and asking Angel Hernandez to retire.

The thing is, most of us don’t know the rulebook nearly as well as we think we do. I can attest to that firsthand. I gave umpiring a try a few years back, thinking it would be a good way to make some extra money while enjoying some time back on the diamond. There are so many rules that casual fans - and even former collegiate players like myself - just don’t understand. Like how many bases do runners get when a ball goes out of play? It depends. What is the correct appeal process for when a runner leaves early on a sacrifice fly? It’s complicated. And even the things we think we know are sometimes wrong. By definition, a tie does not go to the runner.

Umpires (and Fed officials) have a tough job. Sure, sometimes they’re going to get things wrong, but even when they get them right, they’re going to be ridiculed.

In short, I’m not going to sit here and pass judgment on Fed actions. People are screaming that the Fed just made a huge policy mistake that will send us into recession. People have been screaming about a Fed-induced recession since 2022, and here we are nearly 2 years later with 3% GDP growth, 3.7% unemployment, and inflation coming closer and closer to 2%. Maybe - just maybe - Powell & Co. haven’t done such a bad job.

Just as most baseball players don’t know the intricacies of the rule book, most investors don’t fully grasp the puts and takes of policy decisions in a global economy. Whether or not Powell made a mistake will only be known in hindsight.

The point isn’t that these risks to the market aren’t valid. It’s just that there will always be risks out there. And they won’t matter until they do. Confirmation is everything.

So what’s it going to take to make us more bearish?

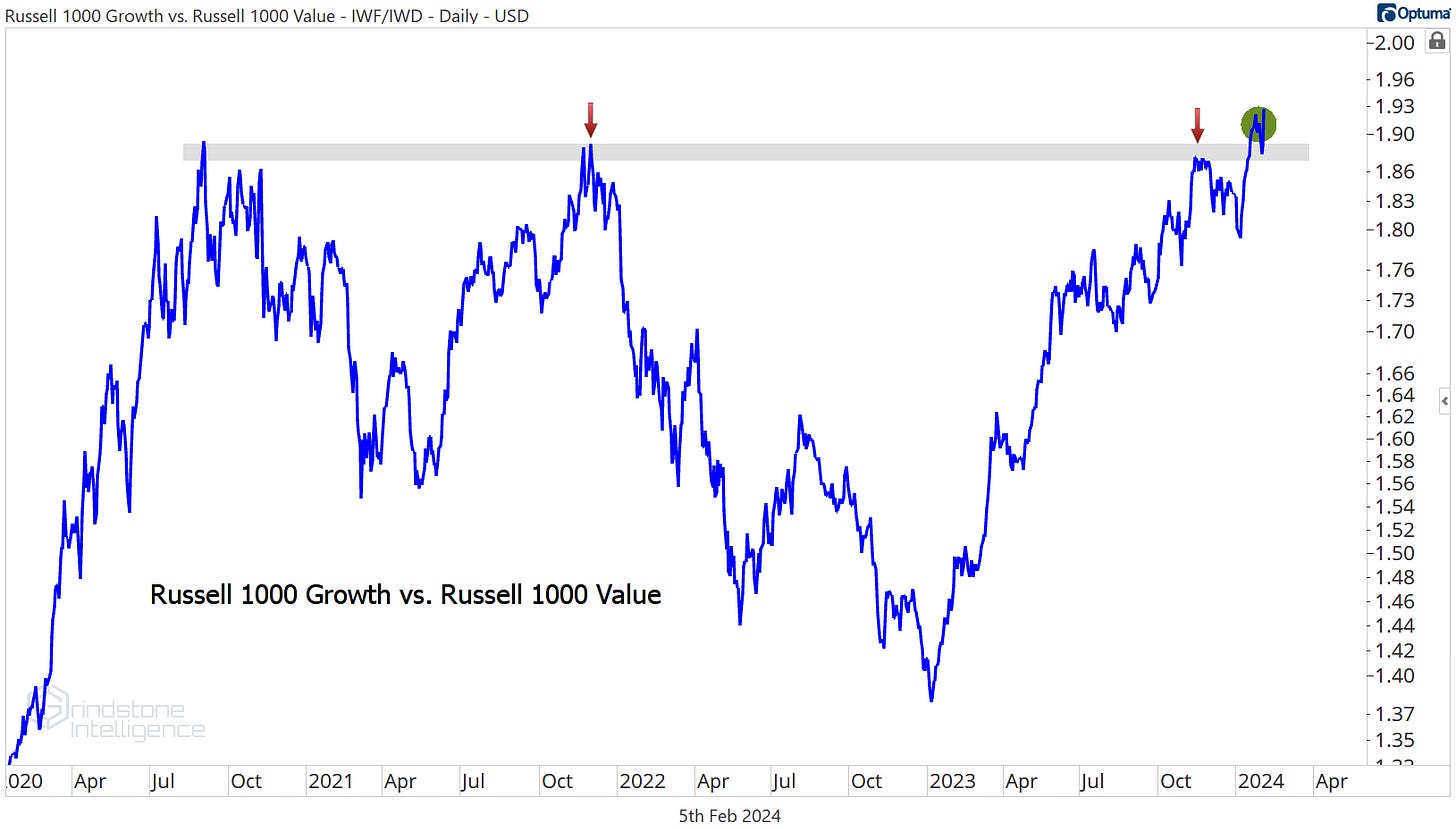

A failed breakout in the growth/value ratio would be a good start. We find it hard to believe that this ratio is hanging above the 2020-2023 highs in a world where stock prices are collapsing, so a break below support would be a key first step towards a major selloff.

That alone isn’t enough. A growth/value reversal could come from a surge in the price of value stocks, rather than a growth selloff. And value stocks taking on a leadership role would be bullish, not bearish.

No, it’s also going to take more risk-off behavior from investors. Like a reversal in the ratio of high yield bonds to Treasurys. When this ratio is moving up and to the right like it has been for the past 9 months, it’s a sign that investors are favoring riskier high yield bonds to risk-free Treasury issues. That’s classic bull market behavior.

A break back below the February and September 2023 highs would signal that something isn’t quite right.

Within the equity market, we’d need to see signs that investors are favoring less risky sectors. We’re not seeing anything like that in the Utilities. The Utes/SPX ratio just hit its lowest level ever.

The Consumer Staples may be a better indicator this time around, though, given the Utes’ outsized exposure to interest rate risk. The Staples just hit multi-year lows against the S&P 500, too, but they aren’t accelerating lower like the Utilities did. If this potential bullish momentum divergence turns into a failed breakdown below the 2021 lows, then we’ll need to give it some serious attention.

The biggest coup for bears would be failed breakouts in the major indexes. The S&P 500 and the Dow are both at record highs today.

If they’re back below the January 2022 peaks, anything could happen. And if that’s world we’re living in, all those risks we mentioned above suddenly get a lot more credibility.

That’s all for today. Until next time.