A Stay-at-Home Order for U.S. Investors

For the last several weeks, the United States has lived under a patchwork of stay-at-home orders. Americans have been advised that venturing out into the world can be a hazard to health. For American investors, venturing out into the world can be a hazard to wealth. Global equities are broadly stuck beneath key, coronavirus-triggered breakdown levels.

The German DAX, priced in USD below, has found resistance at its December 2018 lows – an area that provided little support during the March selloff. Each of the CAC 40, FTSE 100, FTSE MIB, and IBEX 35, indexes representing the largest economies in Europe, have similar signatures.

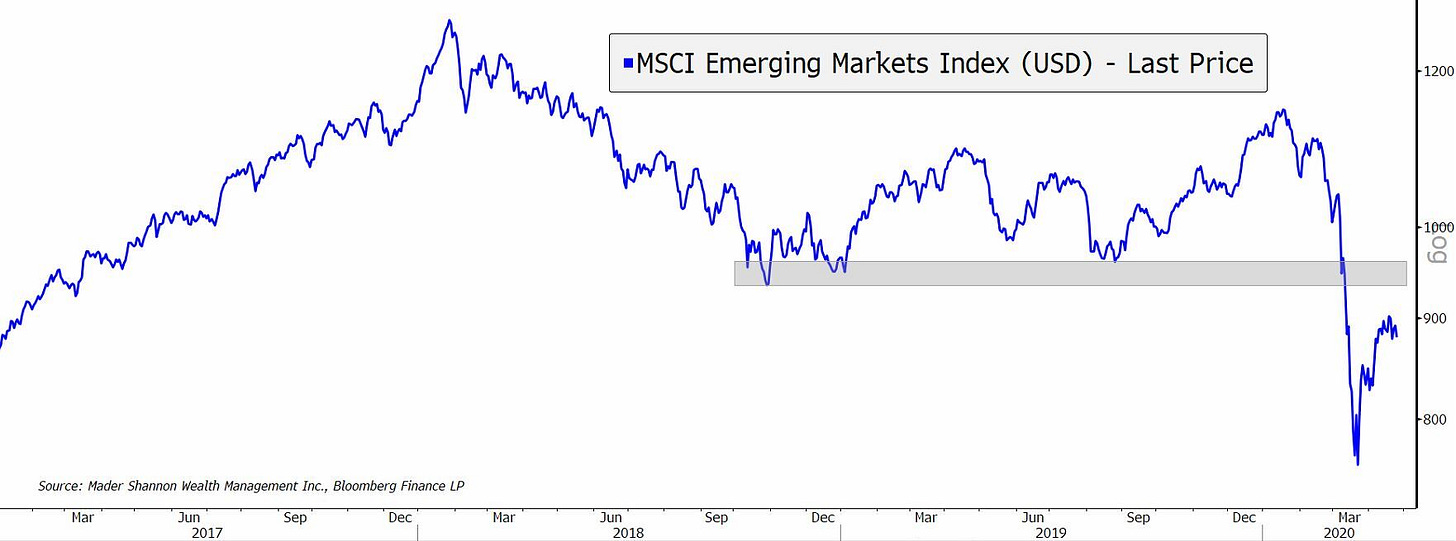

Venturing to less developed regions hasn’t helped. Emerging market stocks – again priced in USD – have thus far failed to challenge their own 2018 lows.

And the same goes for developed Asia. Here’s South Korea’s KOSPI Index:

I could show more charts, but what’s the point? They all look pretty much the same.

Of course, there are exceptions. In Europe, the Swiss Market Index and the Copenhagen 25 come to mind. Taiwan’s TWSE has outperformed, too, and the Nikkei 225 is currently above its 2018 lows. But a flower growing among weeds isn’t a garden. For investors tied to the almighty Dollar, the vast majority of global stock indexes are in downtrends until they prove otherwise.

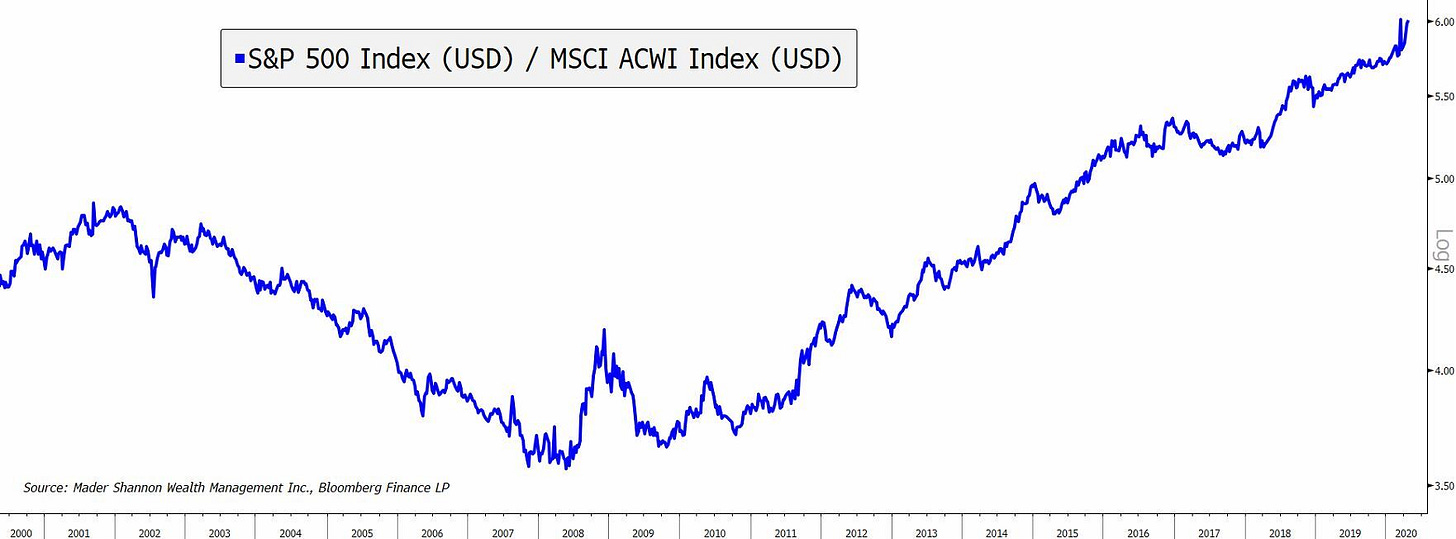

That said, U.S. outperformance is nothing new. Domestic equities have outperformed their international counterparts for more than a decade now, and in dramatic fashion.

The last two U.S. recessions – in 2001 and 2008 – marked turning points in the ratio. Given the COVID-19 induced shutdowns, a third inflection could certainly be in the making, but so far, the most recent economic slowdown has served only to accelerate the existing trend.

Until that trend changes, there’s no place like home.

The post A Stay-at-Home Order for U.S. Investors first appeared on Grindstone Intelligence.