A Tumultuous Week for Stocks

Last week was a rough one for stock markets around the world. There’s no limit to the storylines available: I could write about how this was the worst week for U.S. equities since 2008. I could update you on the coronavirus. I could try to draw parallels to similar periods in stock market history, where signs of exuberance were followed by sharp corrections. Surely there’s a political angle to be worked, right? None of them seemed appropriate.

To be honest, I couldn’t find a single subject matter to focus on for today’s post. No single subject matter would do justice to the selloff we just witnessed, and to ignore the event entirely would serve only to minimize it, unfairly so. Instead, I decided to keep things simple. The last week was noteworthy because of changes in price. So let’s look at some of the price changes I found most interesting.

First, the elephant in the room. Here’s the S&P 500. Late last year, the index broke through the 261.8% extension from the crisis decline, but now we’ve given back that level. Momentum diverged at the most recent high, similar to other pre-selloff periods during the run since the 2009 bottom. Momentum was questionable several times during last year’s run-up, but this is the first time since late 2018 that we’ve seen a divergence confirmed by lower prices. (All charts today are weekly bars)

The S&P 500 Real Estate Sector declined 12%, similar to stocks overall. What’s notable though, is how the body of last week’s candle engulfed the bodies of the prior 37 weeks. If the sector had closed at its lows for the week, it would have reached 40. I’ve never seen anything like it.

Energy continues to be just terrible. The S&P 500 dropped 12%, and Energy still managed to underperform, falling 15%.

On the flip-side, Information Technology outperformed last week. It’s the biggest sector weighting in the S&P 500 index, and it’s been so strong of late that last week’s selloff didn’t even bring it to the swing highs from mid-2019. It did, however, backtest the 161.8% extension from the dot-com crash.

The S&P 500 Financial Sector just put on a supply-and-demand clinic. The February peak coincided perfectly with the top from 2007. Price has memory.

Not long ago, I posed the question: Will this breakout in European stocks hold? The answer was a resounding no. The STOXX 600 saw momentum diverge during recent weeks, then dropped back beneath the level it’s been fighting with for twenty years.

Interest rates are setting new lows, and that understates the fact. I’m struggling to find a weekly decline of this magnitude. Here are the benchmark 10 and 30-year Treasury rates.

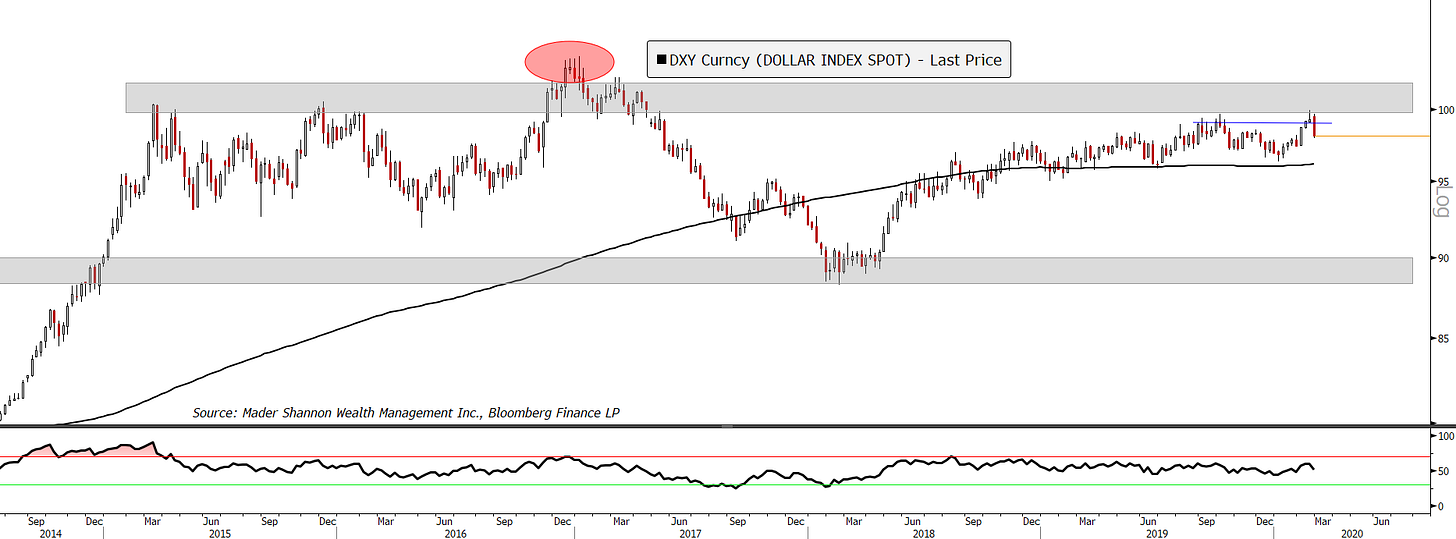

In mid-February, the U.S. Dollar index broke out above its late 2019 highs, continuing the upward trend that had been in place over the previous year. Last week’s USD weakness drove the index back below that breakout level, confirming significant resistance between 99.50 and 100 that’s been in place for the last 5 years.

Gold is often a safe haven that benefits from a risk-off environment. This time was a bit different. The precious metal accelerated during the week prior in apparent anticipation of the equity selloff, but then dropped as stocks collapsed. The result was a bearish engulfing candle for gold prices.

Crude oil deteriorated, dropping 15% to close near $45. In previous weeks, it had bounced off the $50 rotational level, but now it’s trying to hold support at $42. A drop below that and we’re forced to look to the collapse of 2015-2016 for potential stopping points – that decline found a bottom at $26.

Copper, commonly cited as an economic growth indicator, held up surprisingly well. Such sharp contradiction to the weakness in oil is worth paying attention to. If we’re headed toward a global recession, we shouldn’t expect copper to keep holding $2.50.

The last few days is a reminder of how quickly market sentiment can change. There’s no telling what’s in store for the weeks ahead, and the ‘why’ of what happens will always be more clear and predictable in hindsight. In reality, the best one can do is manage risk, monitor developments, and do our best to take advantage when the trends change.

The post A Tumultuous Week for Stocks first appeared on Grindstone Intelligence.