Almost Time for a Tech Breather?

Tech is unstoppable.

Just how unstoppable? Over the last 5 years, the Information Technology has risen more than 200%, 2x the return of the S&P 500 index. It goes even further than that, though. Tech’s dominance has been so extreme that every other sector has lagged the benchmark. 10 out of the 11 sectors are below ‘average’.

The run has helped the Tech sector completely erase the underperformance from the peak of the dotcom bubble. It took more than 20 years, but Tech is now setting new all-time highs compared to the rest of the market:

Don’t believe the narrative that it’s just a handful of stocks, either. The mega caps are certainly a big driver of the last few years of gains, but there’s strength below the surface, too. The equally weighted Tech sector is breaking out against the equally weighted S&P 500.

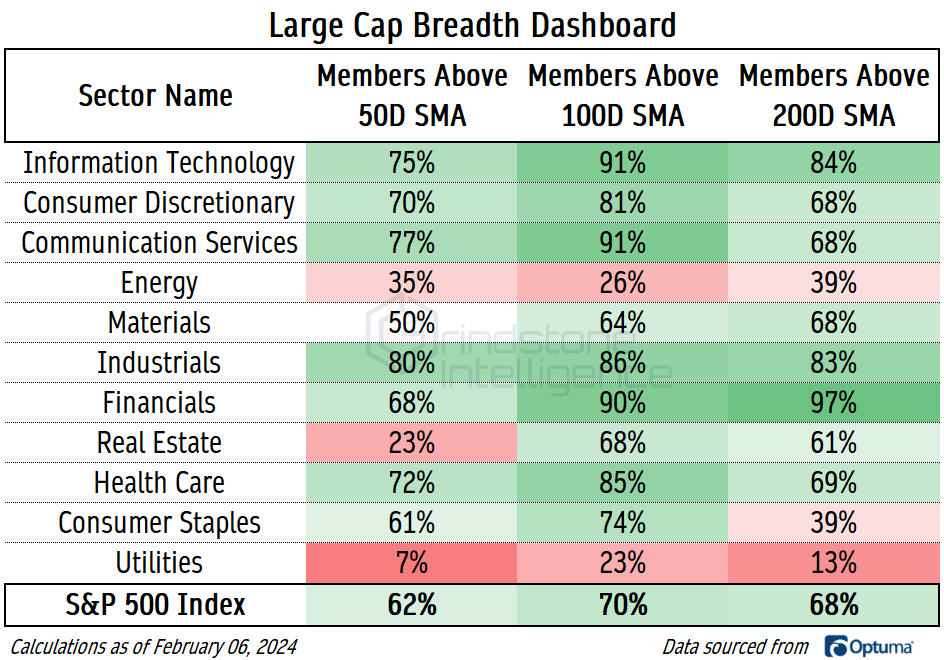

And the vast majority of Tech stocks remain in technical uptrends. Three-quarters of the sector’s constituents are above their 50-day moving average and even more are above their 200-day.

Of course, stocks don’t go up in straight lines - not in perpetuity. So how much further will Tech go?

We’re eying $215 for XLK, the SPDR Technology Sector ETF. That’s the 161.8% retracement from the 2022 bear market decline and a logical place to find some resistance.

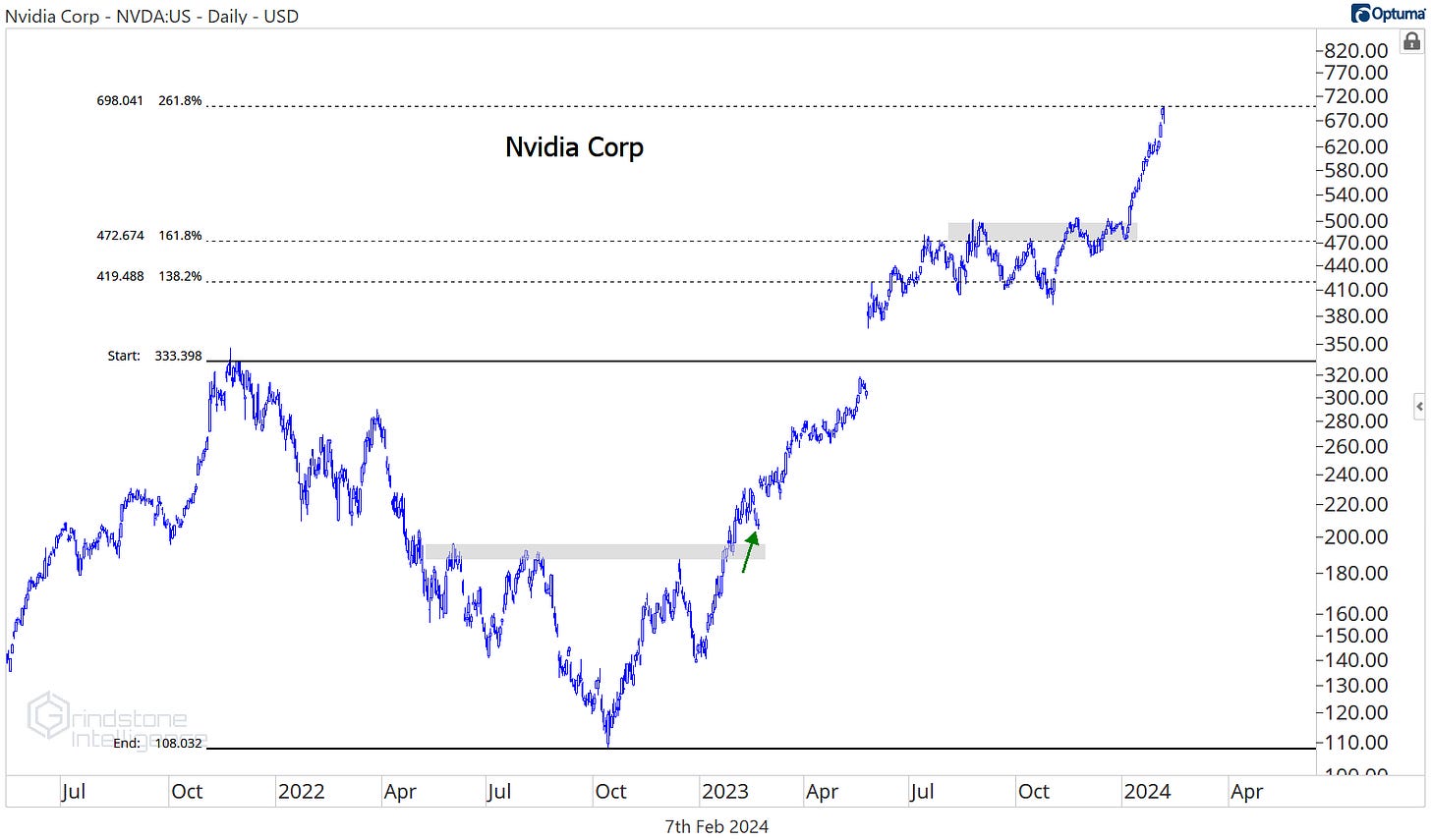

One major market leader has already reached our target. Earlier this week, Nvidia topped out at the 261.8% retracement from the 2021-2022 decline.

Does that mean we want to be shorting NVDA up here? Not unless you enjoy standing in front of a roaring freight train. Does it even mean NVDA has to stop going up? Of course not. The stock couldn’t care less what targets we put on it. But this is a perfectly logical place to see some digestion, and we like stepping aside and watching to see how it responds to this potential area of resistance.

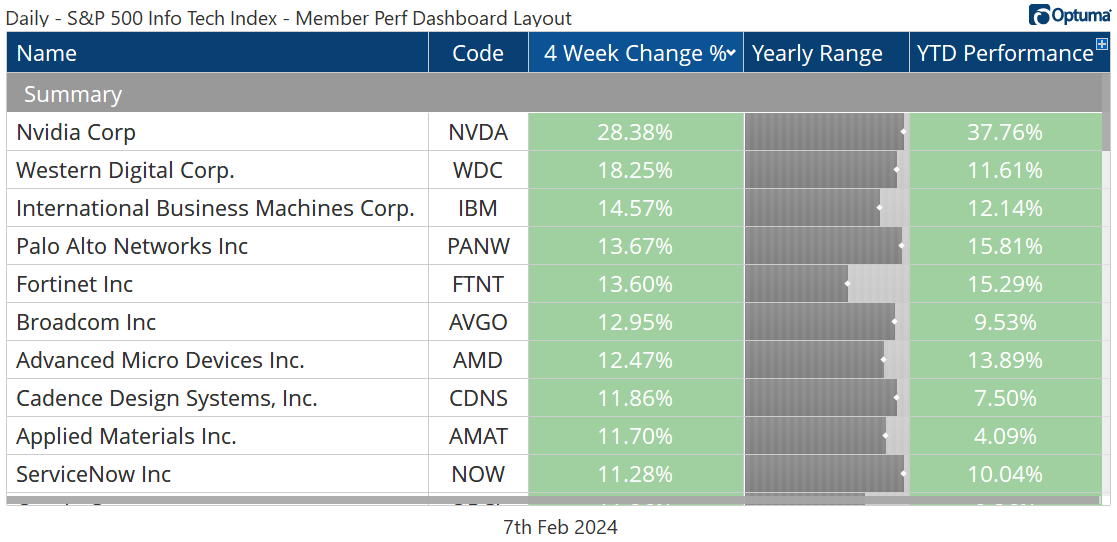

It’s not just Nvidia. Plenty of other Tech stocks are nearing our targets, too. That makes us cautious about initiating a bunch of new longs. Whether that caution turns into negativity will require more than just a stalling out, though. This is a bull market in stocks, and we aren’t going to be betting against the strongest sector in this bull.

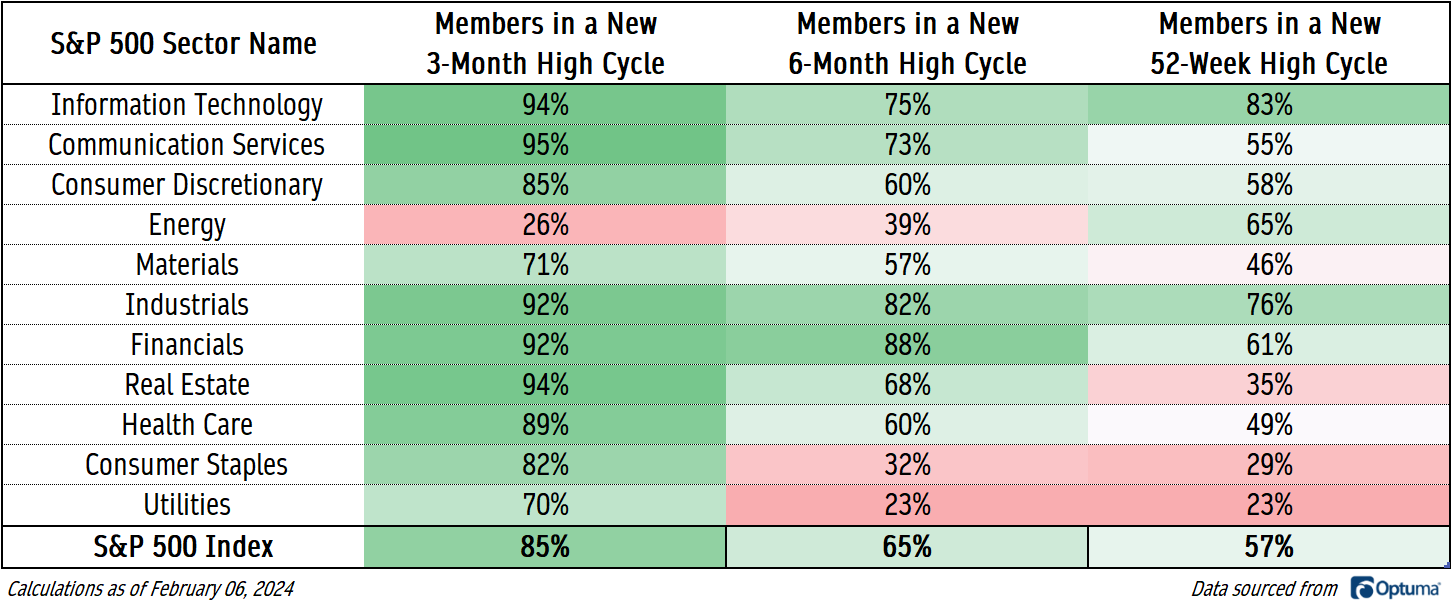

Not until we see some outright weakness, like a growing list of new lows. As of right now, 95% of Tech stocks and 85% of stocks in the S&P 500 have set new 3-month highs more recently than a 3-month low.

Zooming out to a longer-term basis, more than 80% of Tech is in a cycle of new 52-week highs, the best mark of any sector. Slice it any which way you want, that’s not bearish.

So let’s take a closer look at how things are shaping up beneath the surface.

Digging Deeper

The Tech sector has dominated returns in the S&P 500, and the semiconductors are dominating the Tech sector. Over the last 12 months, Nvidia and its peers have risen a combined 87%, the best performance of any sub-industry.

Apart from NVDA, the gains have been driven in large part by Broadcom, which just resolved higher out of a 5-year base relative to the rest of the Tech sector.

Like NVDA, though, AVGO is getting close to our target of $1360. That’s a logical place for the stock to stall out, so this isn’t the place to be initiating new positions until we see how it responds.

Leaders

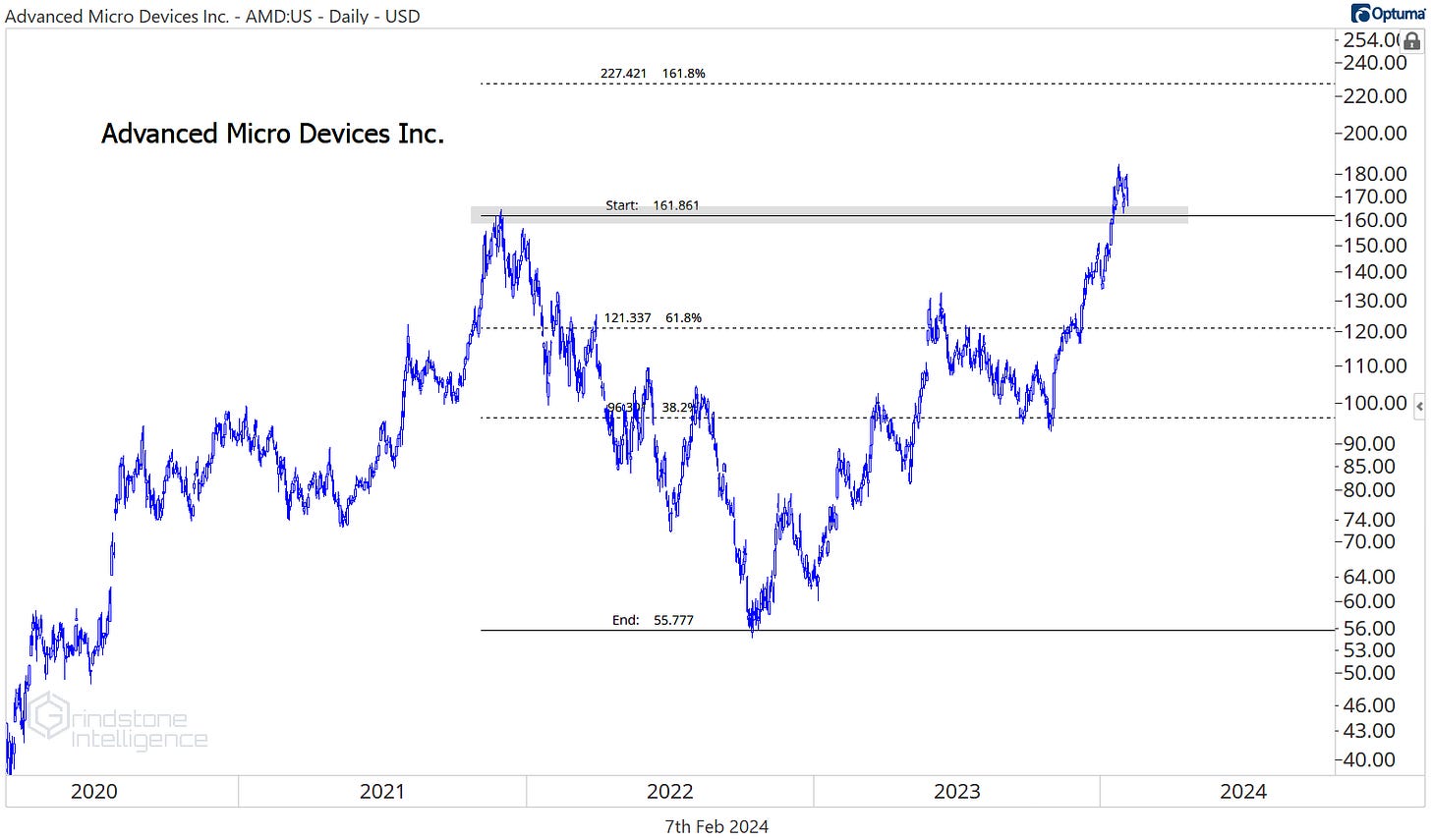

Sticking with the semiconductors, AMD just broke out above the 2021 highs. It’s almost doubled from the October lows, and some consolidation here makes sense. But consolidating above support is extremely bullish. We like the risk/reward in AMD above $160 with a target of $225.

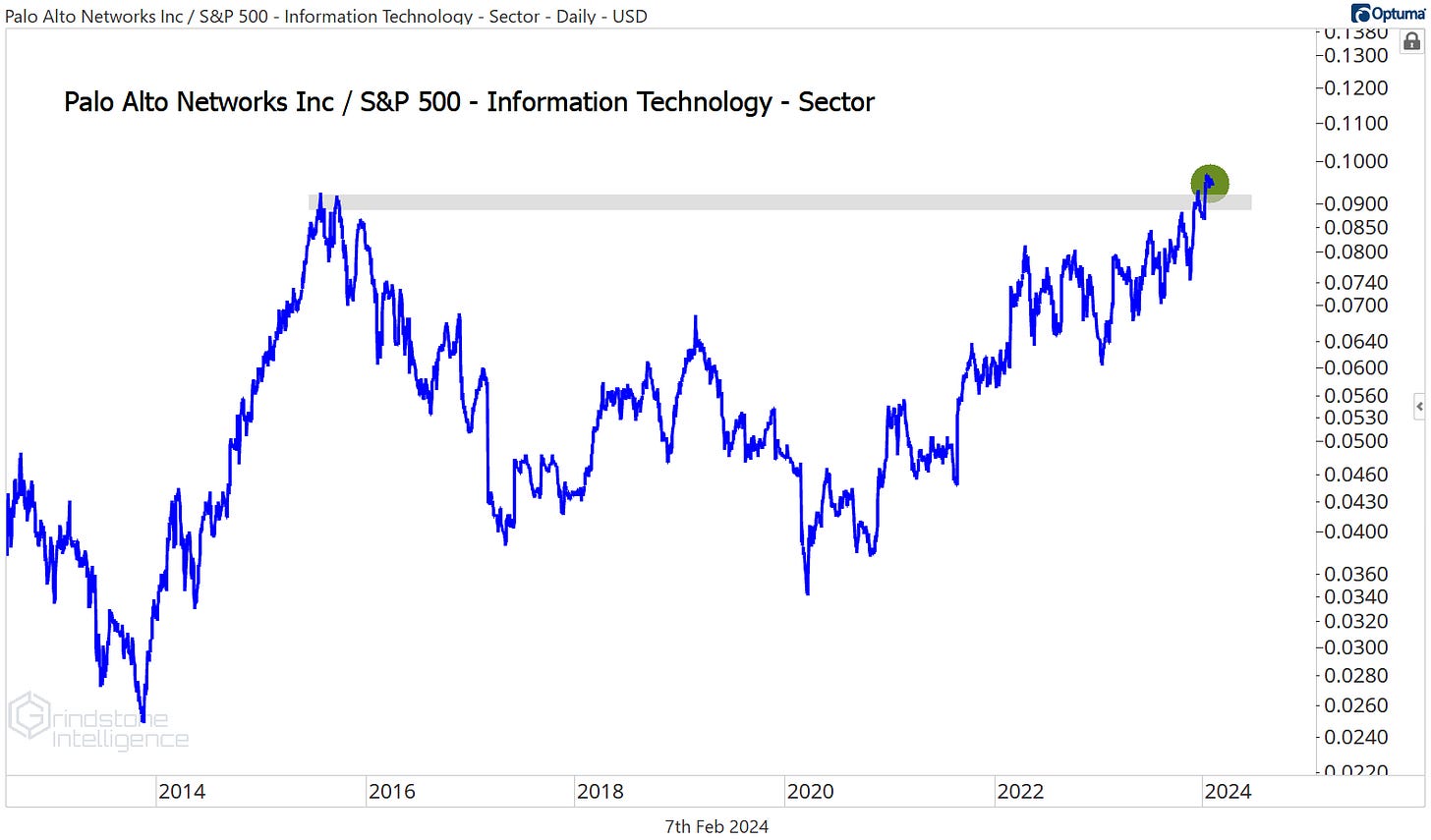

If it’s not the semis that lead the next leg higher, perhaps it’ll be software. Palo Alto Networks is consolidating above the 261.8% retracement from the 2022 selloff, and we like it as long as that’s the case. Our target is $450.

Most impressive about PANW is that it’s just now breaking out of a huge base relative to the rest of Tech. From big bases come big resolutions.

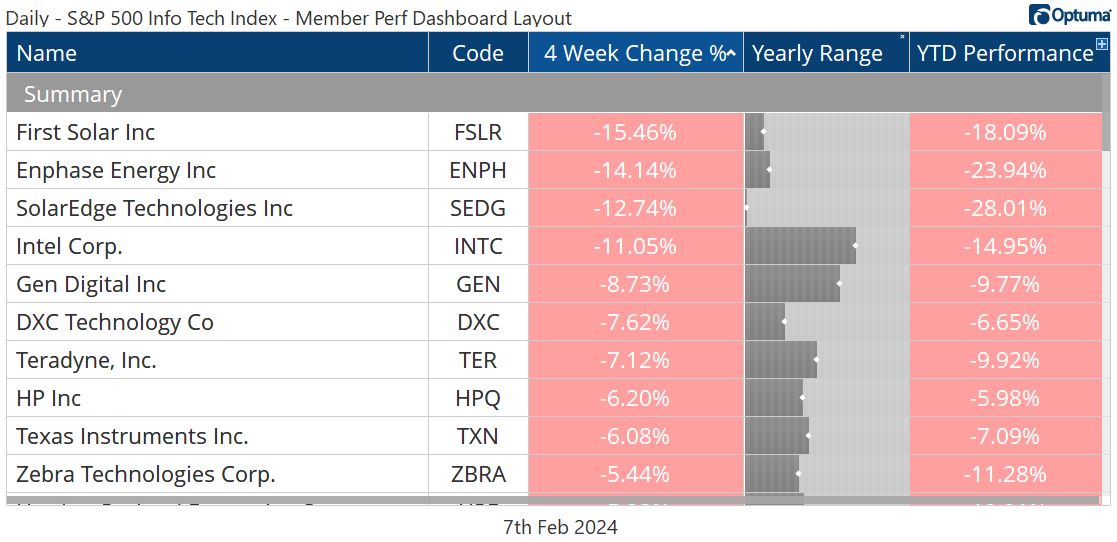

Losers

Last month we pointed out the underperformance of Enphase relative to the rest of the Tech sector, despite the stock’s 17% rally in the prior 4 weeks. That was a good reason to avoid the name - losers are losers for a reason. ENPH is down 14% over the last month.

The same goes for HPQ. It just hit multi-year lows compared to the rest of the Tech sector. Could it bottom tomorrow? Absolutely. Is that the most likely outcome? No. Relative weakness tends to beget more weakness. There’s no reason to be involved with this one.

More Stocks to Watch

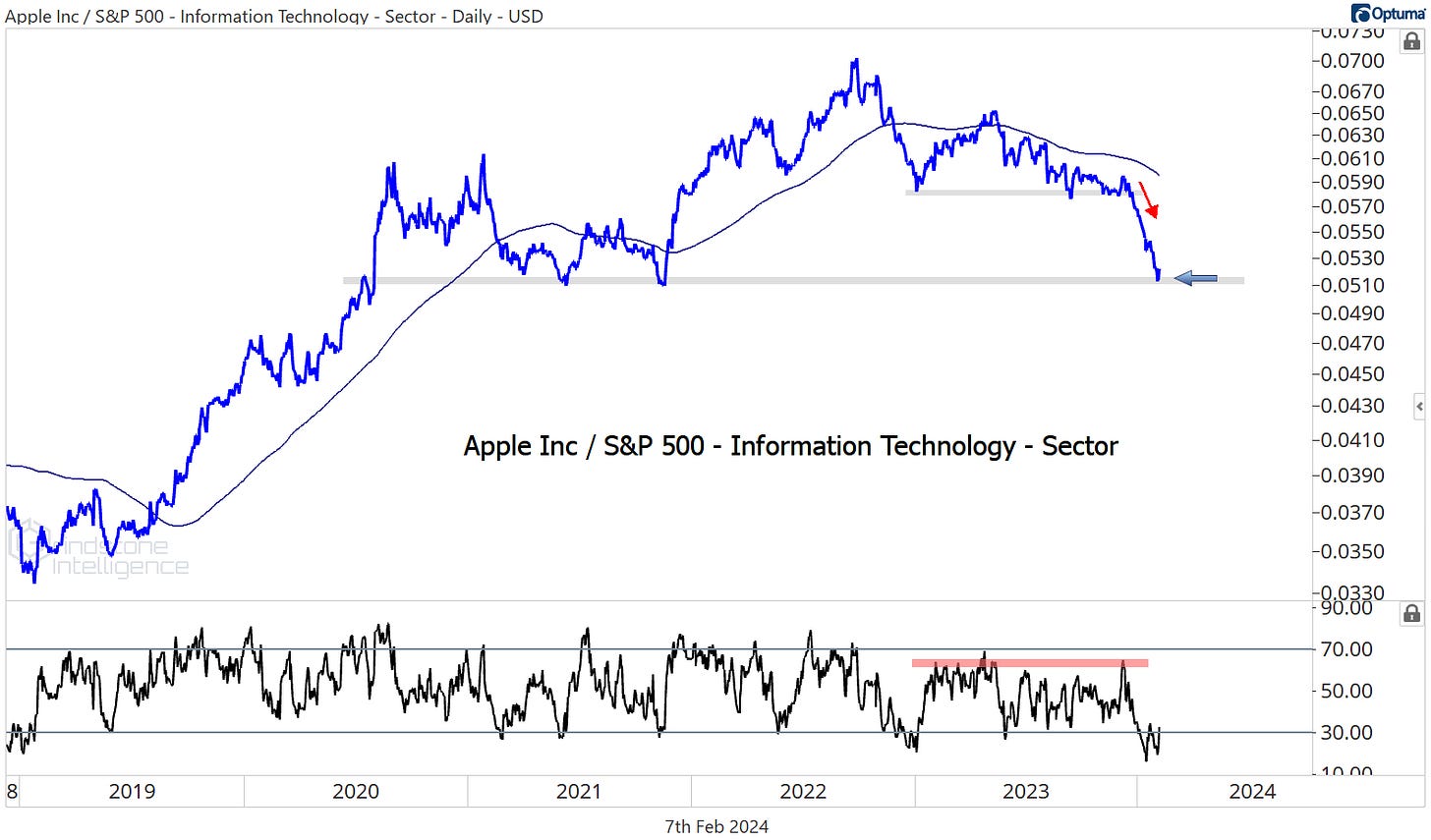

We’ve pointed to the relative weakness in Apple as a reason to focus our attention elsewhere, and that proved to be the right approach. Apple has lagged the sector by 10% since mid-December.

These 2021 relative lows are a good level for AAPL to find some support, though. A breakdown would have us avoiding it like the plague, but as long as the AAPL/Tech ratio is above those former lows, we can approach the stock from the long side.

Our target is $250, but only if we’re above $170.

Synopsys remains in a long-term uptrend. We don’t need to wrap more words around it than that.

As long as SNPS is above $520, we want to be buying with a target of $775.

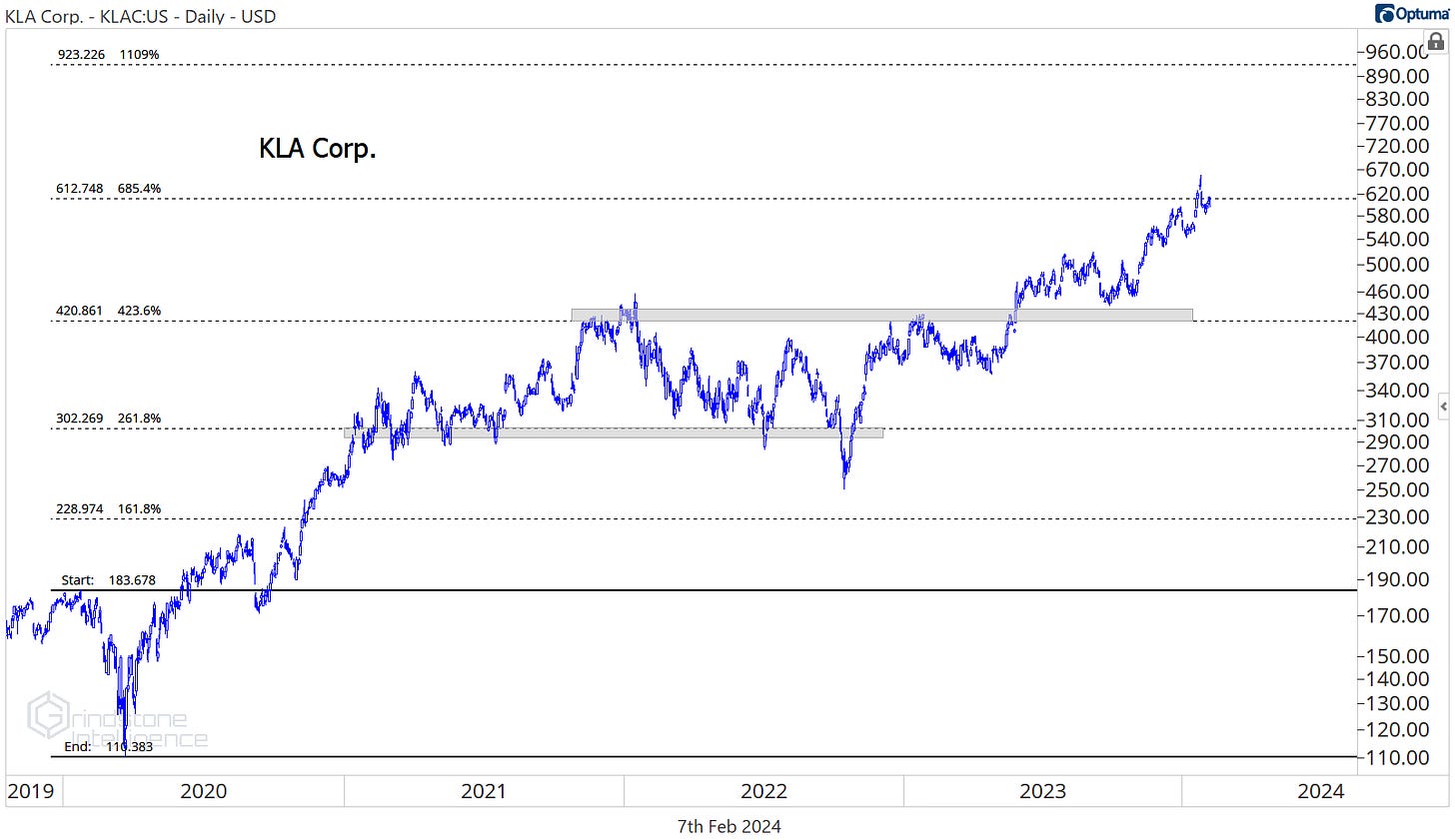

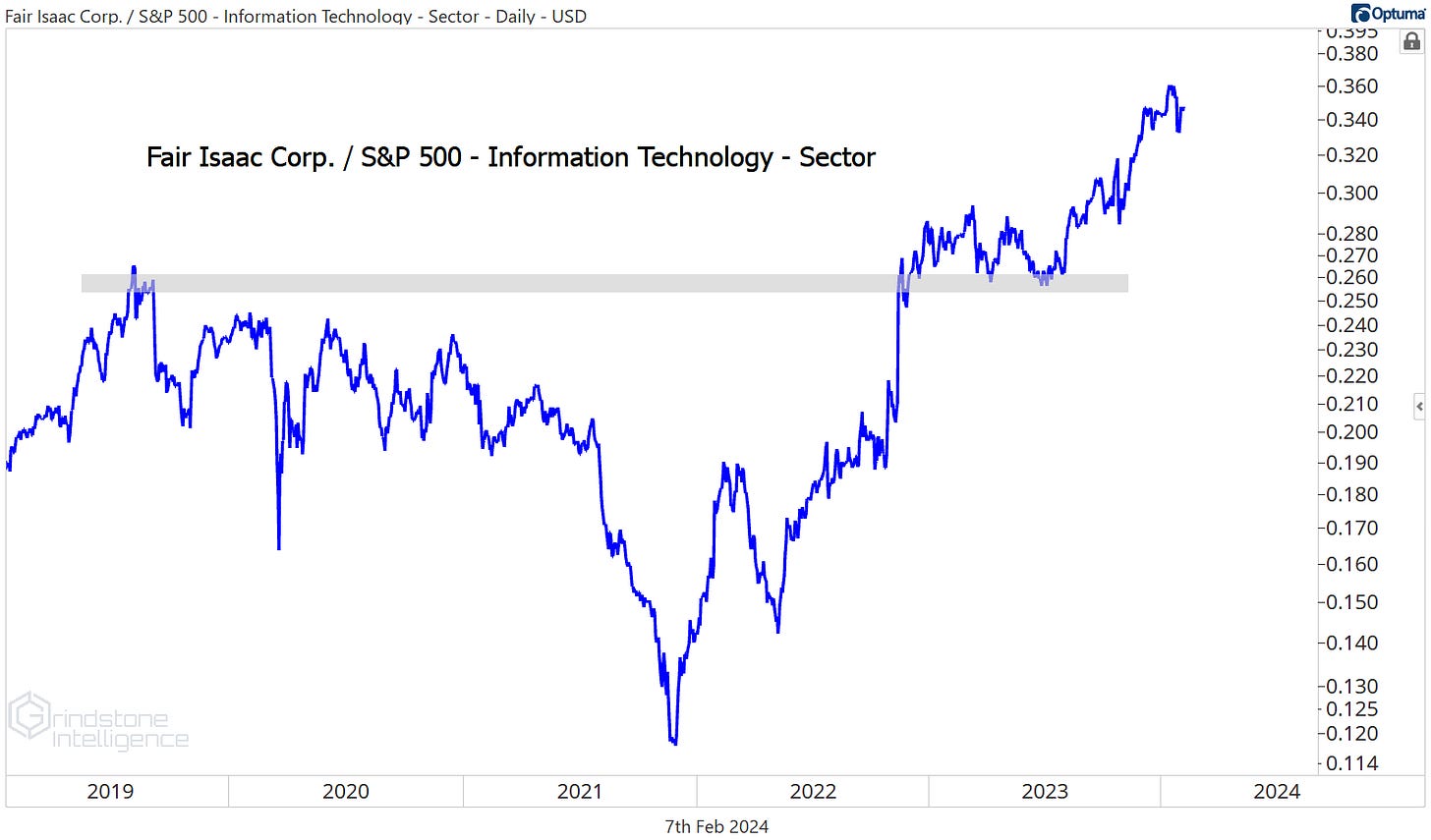

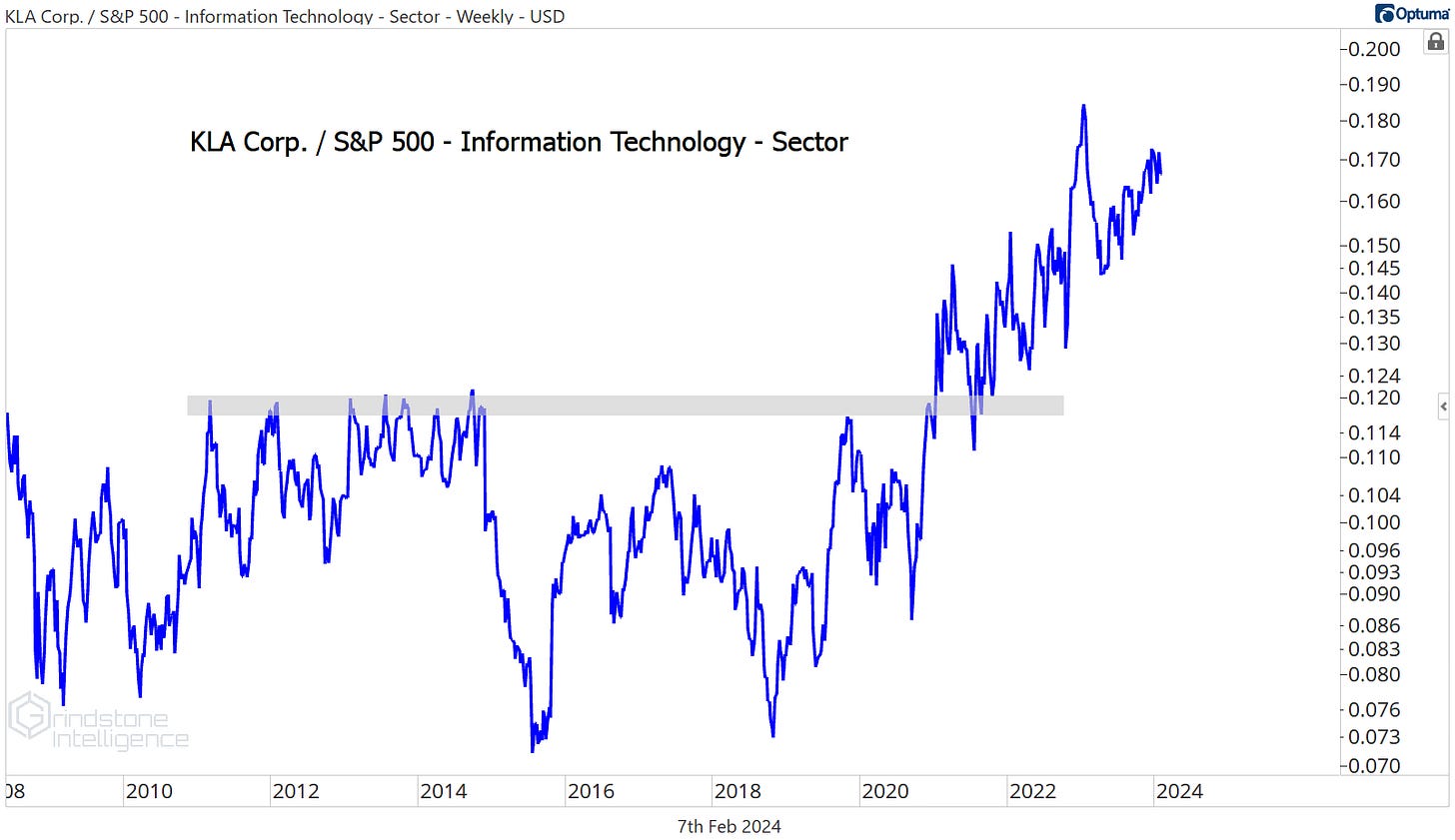

Arista Networks, Fair Isaac, and KLA Corp are all at or near targets.

All 3 are also still pictures of relative strength.

We’re don’t want to be initiating new positions for these right here, but they’re all ones to keep on the watchlist going forward. Maybe if the Tech sector ever takes a breather the risk/reward setups will improve.

Until next time.