August Technical Market Outlook

At the outset of every month, we take a top-down look at the US equity markets and ask ourselves: Do we want to own more stocks or less? Should we be erring toward buying or selling?

That question sets the stage for everything else we’re doing. If our big picture view says that stocks are trending higher, we’re going to be focusing our attention on favorable setups in the sectors that are most apt to lead us higher. We won’t waste time looking for short ideas – those are less likely to work when markets are trending higher. We still monitor the risks and conditions that would invalidate our thesis, but in clear uptrends, the market is innocent until proven guilty. One or two bearish signals can’t keep us on the sidelines.

Similarly, when stocks are trending down, we aren’t looking to buy every upside breakout we see. We can look for those short opportunities instead, or look for setups in other asset classes.

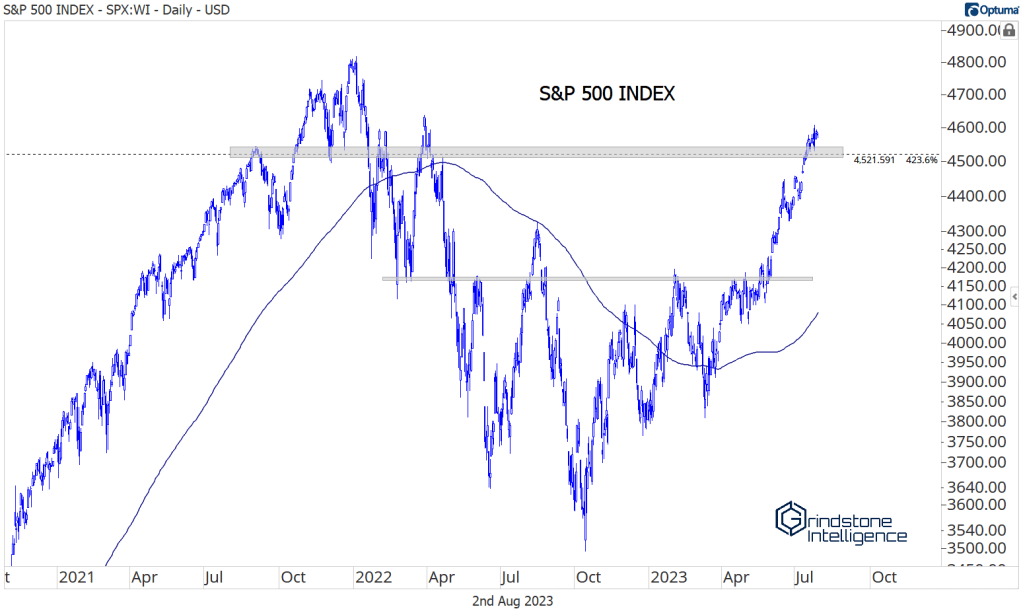

We’ve been decidedly bullish on stocks since May, when the S&P 500 broke out above a key resistance level near 4150. With prices setting higher highs, higher lows, and above a rising long-term moving average, how could we not be?

That’s still the case today – prices are undeniably in an uptrend. That means we shouldn’t be spending time trying to find stocks to short. Rather we should be asking ourselves how bullish we should be? How aggressively should we be looking for stocks to buy?

As we write this month’s outlook, the S&P 500 is in the midst of its first 1% daily decline since May. Growth stocks are leading the way lower, somewhat reminiscent of last year’s struggles. One day doesn’t make a trend, and we’re hesitant to put too much weight on these moves. But a few familiar foes are trying to make a comeback – and that means caution is warranted.

The US Dollar was a major headwind for stocks last year. Each time it moved higher, equity prices dropped to new lows. The Dollar Index peaked last September, and shortly afterward, stock prices set their bear market low. Then the correlation between the Dollar and stocks slowly disappeared as currency moves stabilized.

So what happens if the Dollar finds renewed strength? That looks to be what we have here: a failed breakdown that could send the USD screaming higher once again. Is that outcome inevitable? Of course not. Nothing in the market ever is. But we’re wary of further weakness for stocks in the near-term as we digest these currency moves.

Further Dollar strength would most likely accompany a breakout in interest rates. Like the Dollar, rates were a major headwind for stocks last year. When rates rose, equity prices fell. And again like the Dollar, rates stopped rising about the same time as the S&P 500 bottomed, and have largely been a non-factor ever since. Right now, though, 10-year Treasury yields are knocking on the door of year-to-date highs.

A breakout in rates would be a headwind for stocks.

And any retrenchment in the indexes would be starting from pretty logical levels. Check out the NASDAQ, this year’s big winner. This area near 14200 was a key rotational level throughout 2021 and 2022, acting first as resistance, then support, then resistance again. Should we really expect prices to blow right past it this time around?

The S&P 500 is hanging near a key rotational level of its own. In September 2021, the index was rejected at 4500. That same spot was support a few months later, then acted as resistance again in early 2022.

That level has some historical significance, too. It’s the 423.6% Fibonacci retracement from the entire 2007-2009 decline. Notice how much the market has respected these levels over the last 10 years? It would make sense to see us respect this one again.

Similarly, the Russell 2000 index is up against resistance of its own. Each time it’s been here over the last year, it’s failed. Will this be the time we finally see a breakout? Maybe. But let’s see.

To briefly recap, stocks are still clearly in an uptrend, which means we still want to be looking for stocks to buy. But with headwinds mounting and stocks near logical areas of resistance, we want to be more cautious until we see some resolutions.

So what would make us turn more bearish on stocks? Further increases in interest rates and the Dollar. With the Fed nearing the end of its tightening cycle and inflation well on its way back to 2%, a big move higher in rates would catch a lot of people off guard. Are growth stocks and their premium valuations really prepared for a move to 5% in the risk-free rate? We doubt it.

That kind of move isn’t necessarily what we’re expecting here – but we’re not ruling it out. And with rates near the high end of their one year range, we think it’s prudent to respect the possibility of a big resolution.

A move above 105 would catch our eye in the US Dollar index. For now, a rangebound USD between 101 and 105 would still be consistent with higher prices for stocks. But a full-scale trend reversal would force us to reevaluate our opinion.

What’s the bull case for stocks? More rotation. The Dow Jones Industrial Average led stocks over their lows last October, but it was largely left behind for most of the year. Over the last two months, though, breadth has improved, and the Dow is up near new 52-week highs. If a stalling out in the growth-focused NASDAQ is accompanied by further rotation into the the Dow and other value-oriented names, that would be a big feather in the cap for the stock market bulls.

We write about some of our favorite stocks and share other investment ideas each week with Members. Here are links to our most recent sector and asset class reports.

(Premium) Consumer Staples Sector Deep Dive – July

(Premium) Financials Sector Deep Dive – July

(Premium) Real Estate Sector Deep Dive – July

(Premium) Utilities Sector Deep Dive – July

(Premium) Health Care Sector Deep Dive- July

(Premium) Materials Sector Deep Dive – July

(Premium) Industrials Sector Deep Dive – July

(Premium) Consumer Discretionary Sector Deep Dive – July

(Premium) Information Technology Sector Deep Dive – July

(Premium) Communication Services Sector Deep Dive – July

(Premium) Energy Sector Deep Dive – July

The post August Technical Market Outlook first appeared on Grindstone Intelligence.