Trying to Understand the Bear Case

I don’t know which direction stocks – or any other security – are headed next. No one does for sure. But whether your portfolio is positioned for equities to rocket higher or prepared for impending doom, it’s always important to understand both the bull and bear cases. By understanding where the risks to your thesis are, you’re more likely to know when your thesis could be wrong, and how to take corrective action.

With the stocks on pace for one of their best years ever, the bull argument isn’t hard to see. The S&P 500 closed at an all-time high on Thursday, and if there’s one thing we know about all-time highs, it’s that they happen in uptrends. Being a bull is easy. So today I’m putting on my bear hat and trying to find some cracks in the bull case. It starts with a false breakout.

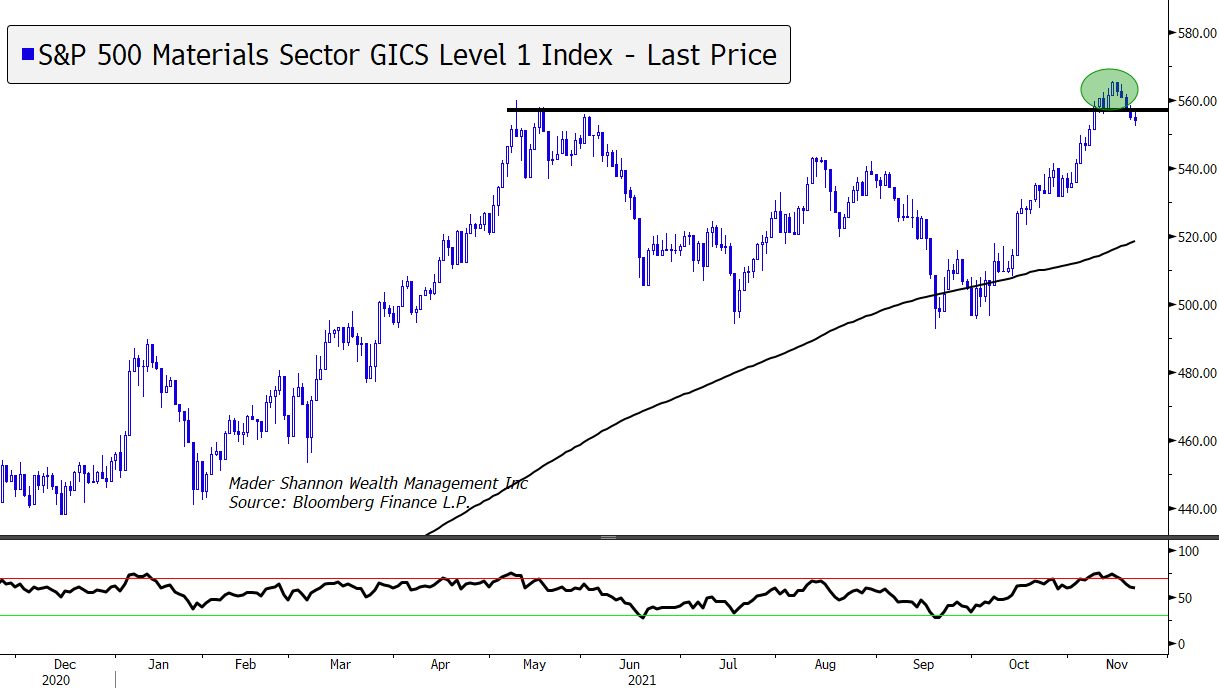

Last week I led things off with a chart of the Materials sector breaking out to new all-time highs. It was another feather in the cap for stock market bulls, whose biggest threat throughout the summer was a lack of participation as equity indexes climbed higher. With the latest breakout, breadth was continuing to broaden. But then Materials declined for 5 straight days. By Thursday they’d fallen back below those previous highs.

There’s a saying among technicians: from failed moves come fast moves. If Materials can’t reclaim that broken support, the risk is lower, not higher.

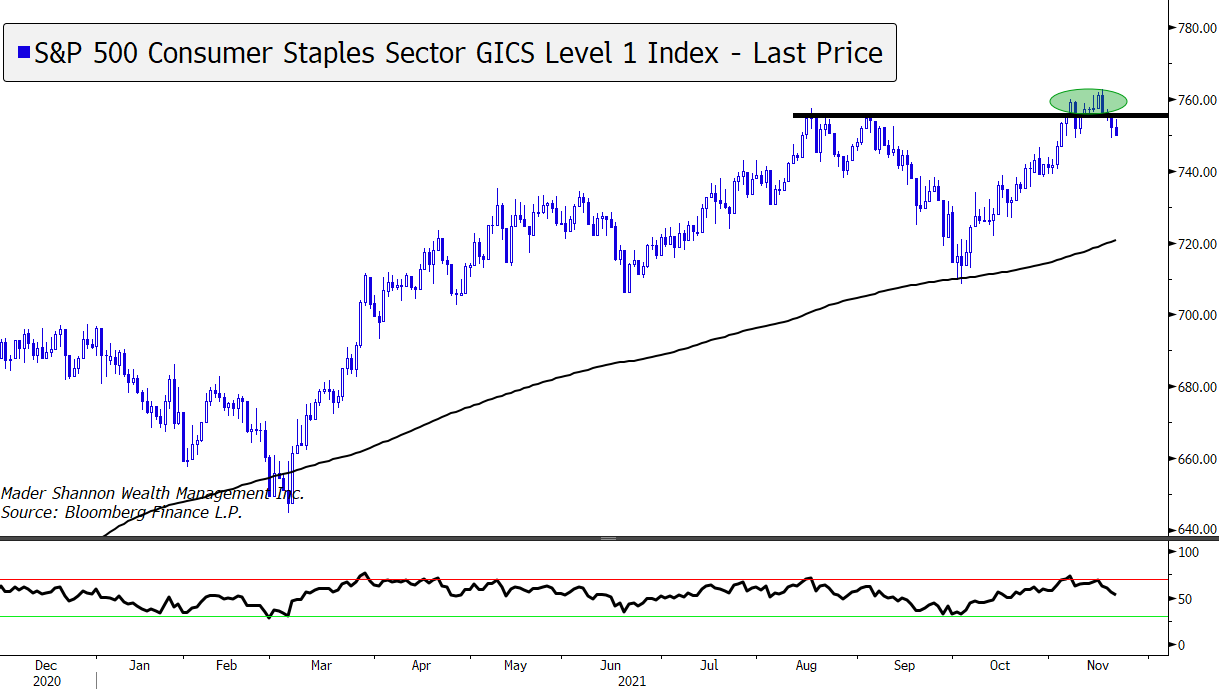

In the grand scheme of things, though, the Materials sector isn’t that important. Its total market cap comprises less than 3% of the S&P 500 Index, making it among the smallest sectors. The problem is, it’s not just Materials. There’s also a failed breakout in Consumer Staples.

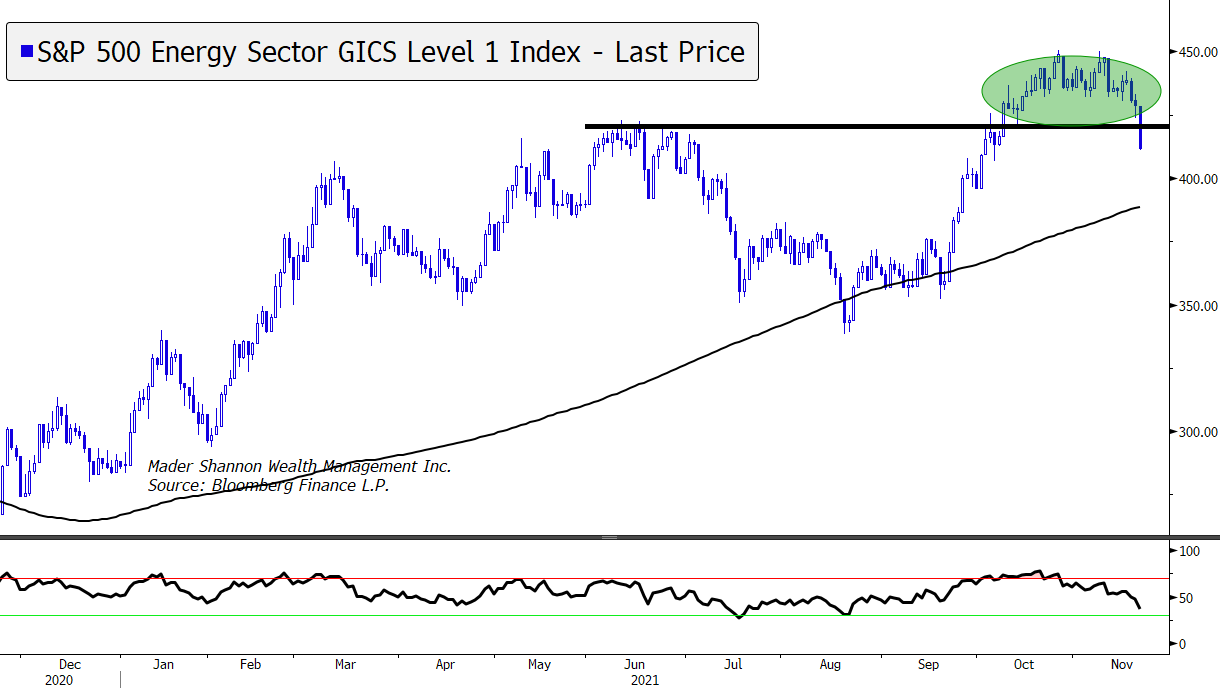

Look, Consumes Staples aren’t that important either. They’re only 5% of the index and not exactly the place you look for leadership during a bull market. I get it. But it’s not just Staples. After Friday’s ugly performance, you can add Energy stocks to the list of disappointing price action.

The Industrials sector has given back progress, too.

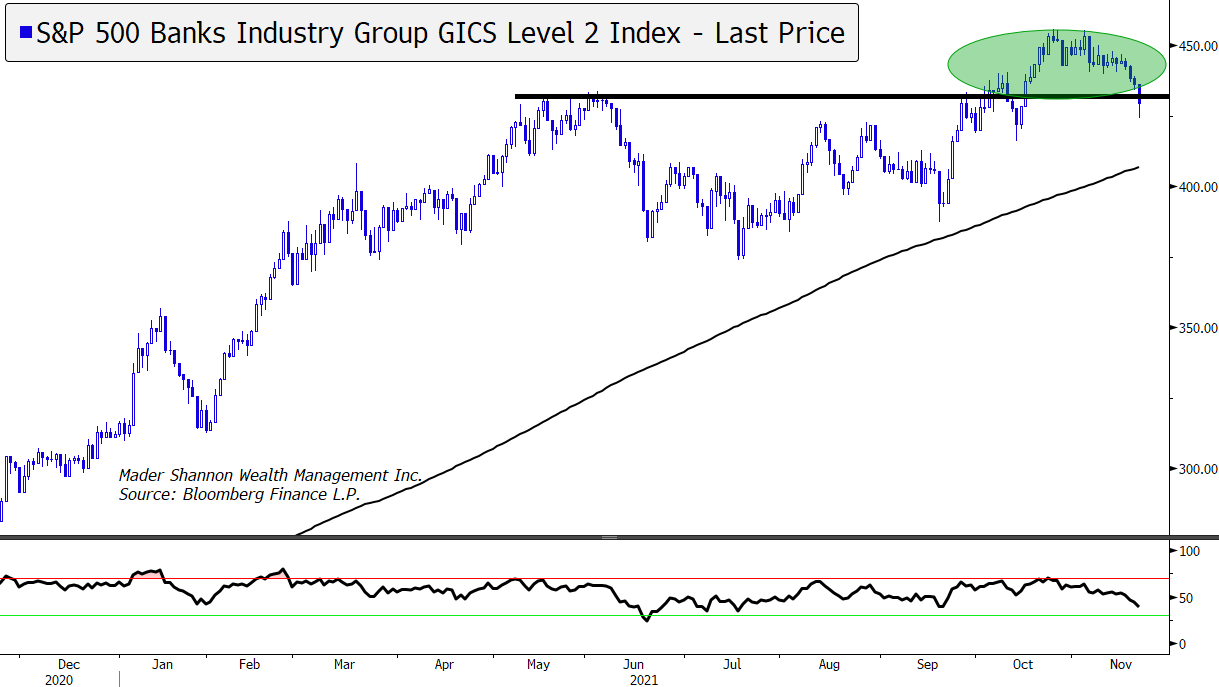

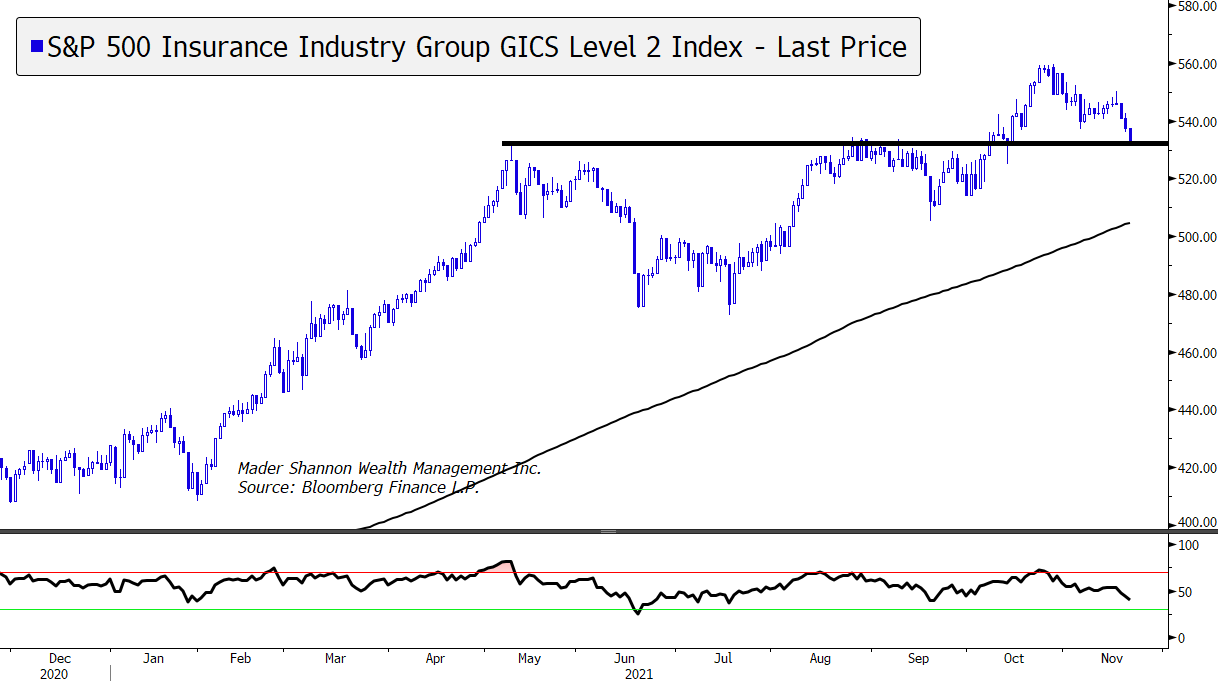

Financials got whacked on Friday, as well, but the key support level for them isn’t as obvious. The setups for two key industries – Banks and Insurance – are much cleaner, though. The damage? One failed breakout and one group hanging on by a thread.

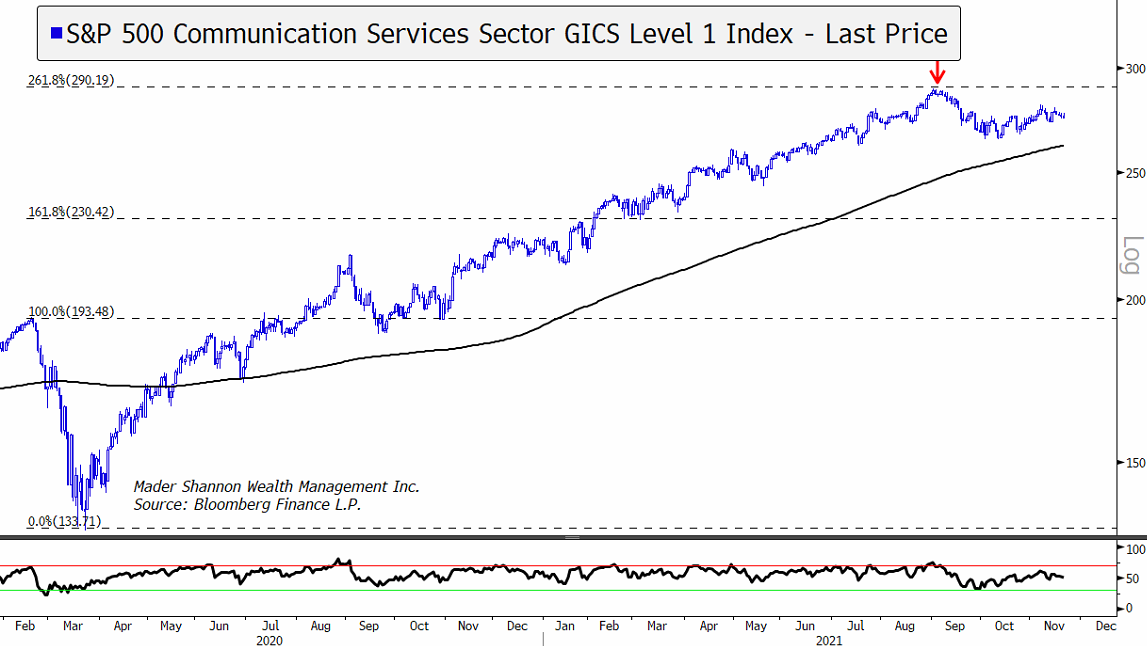

Meanwhile, former leadership groups have hit key extension levels from the COVID collapse. Communication Services peaked in August:

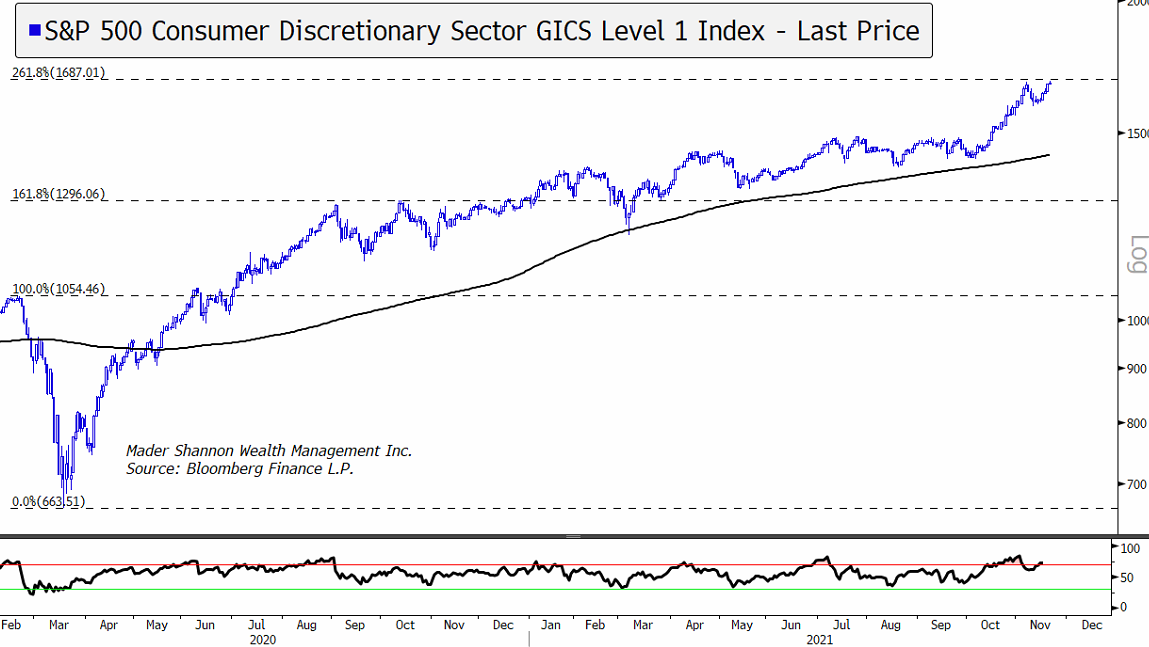

Consumer Discretionary kissed its 261.8% extension, backpedaled, and is testing resistance again. There’s no reason it can’t keep going higher, but this would be a logical place for an extended pause – or a reversal.

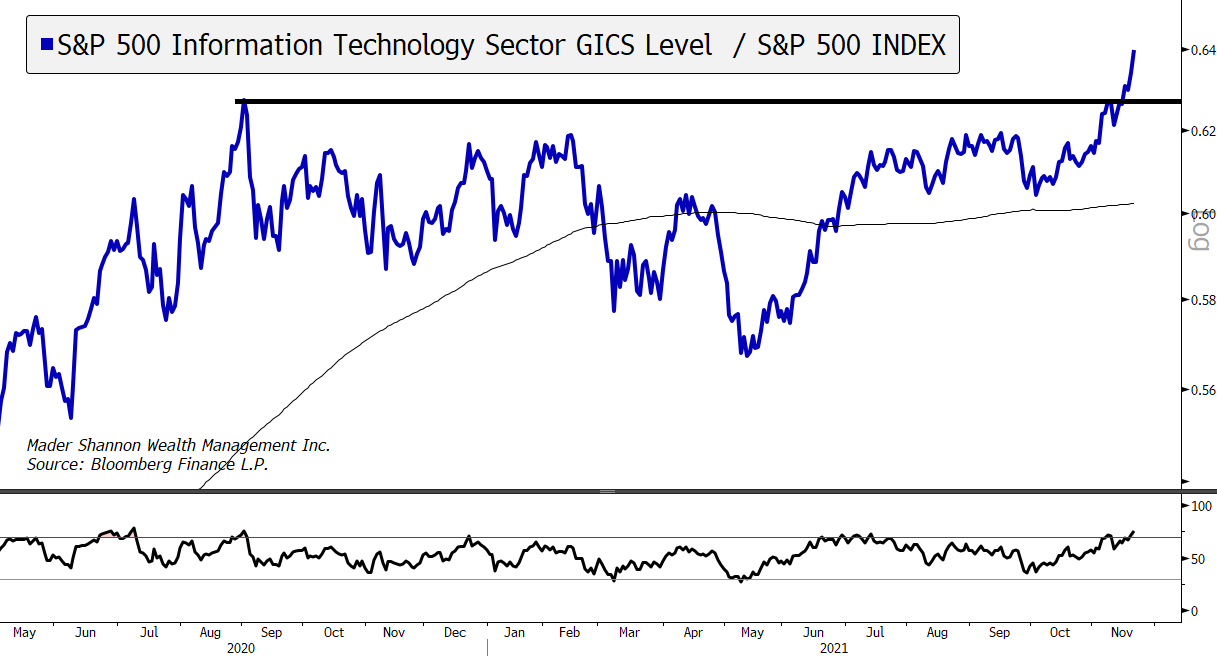

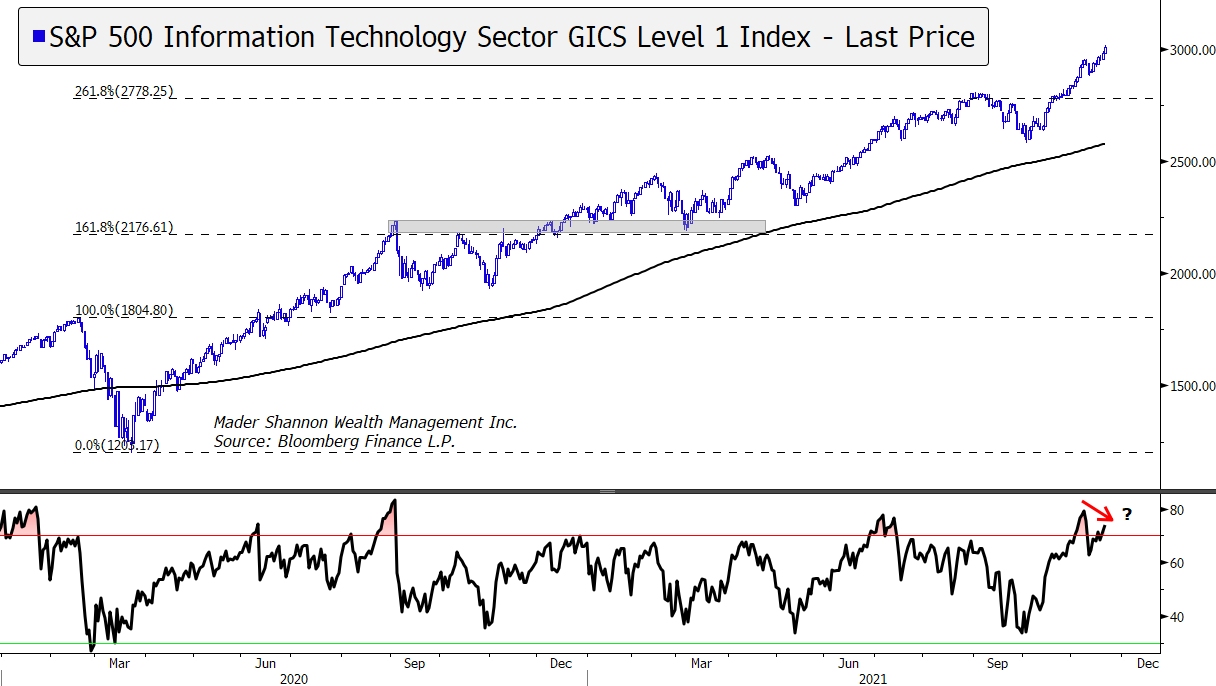

So who else could lead stock indexes higher? Health Care and Real Estate both peaked in the summer. The Utilities haven’t even challenged their pre-COVID highs. The answer, of course, is Tech. Information Technology makes up more than a quarter of the S&P 500, and not only has it trended higher with the market, it’s been showing relative strength.

If Tech continues to rise, the bear thesis is in trouble. Tech is big enough that it can drag the entire index higher all by itself (and it has before). And for bears, what evidence is there that Technology won’t continue higher? Not much. But since we’re actively searching for bearish signs, here’s one: momentum has yet to confirm the most recent highs.

It seems like a big ‘if’ given the strength, but if prices for the sector decline and confirm this potential momentum divergence, the bear case would start to look a lot more credible.

**Bonus Charts for the Bears**

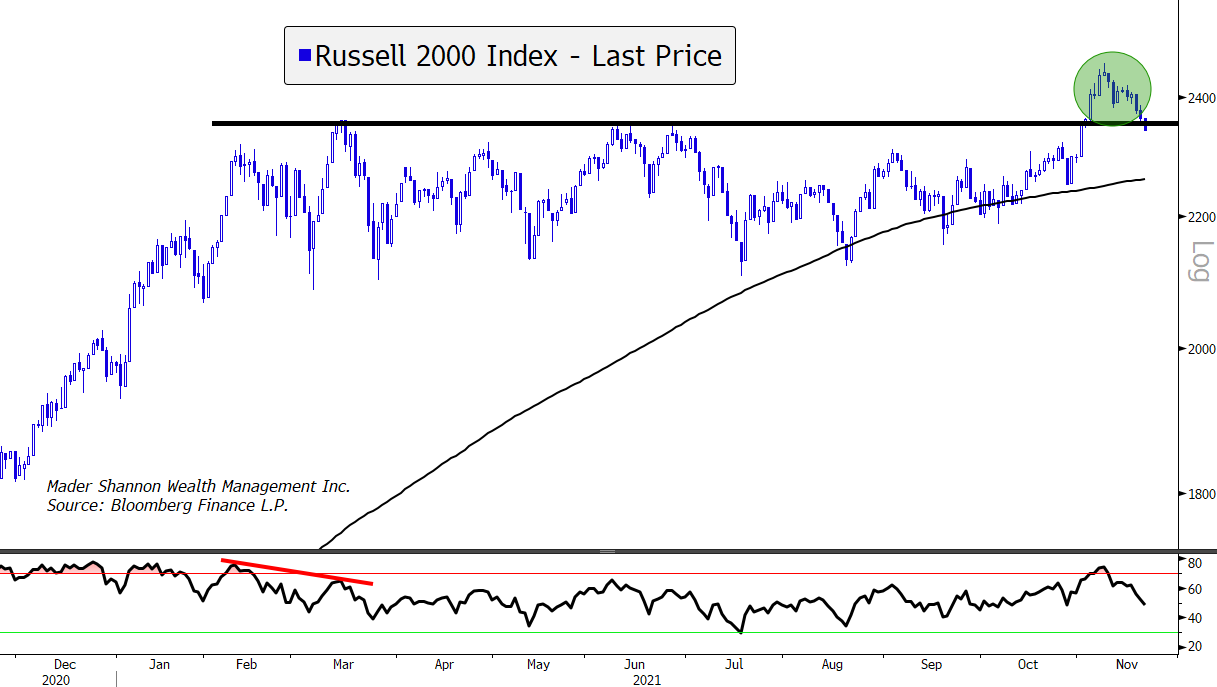

The discussion above was limited to S&P 500 sectors, but Small Caps are having trouble holding their recent breakout as well.

I’ve never talked about crypto on this blog, mainly because there are so many other people talking about it that not much more needs to be said. But Bitcoin can be a good indicator of risk appetite, and we can add it to the list of assets failing to stay above previous highs.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Trying to Understand the Bear Case first appeared on Grindstone Intelligence.