Better Beneath the Surface

It’s a market of stocks.

Sometimes we can lose sight of that simple fact. We live in a world dominated by indexes. The media tells us all about the S&P 500, the NASDAQ, and the Dow Jones Industrial Average. Our portfolios are benchmarked against those same indexes, or ones just like them.

It’s hard to blame anyone for this flaw – huge baskets of stocks are the easiest way to describe market action, especially in a world where time always seems to run short. The problem is, the indexes most of us see aren’t perfect or complete descriptors. Most are weighted by market capitalization, meaning the largest companies like Apple and Microsoft matter the most. The Dow Jones Industrial Average is allocated by price, so the stocks with the highest price per share hold the largest weights. Both approaches have their merits, but they can obscure what’s happening beneath the surface.

Right now, those approaches are hiding strength.

Most stocks are outperforming the indexes, and they have been for some time. The equally weighted basket of S&P 500 stocks is at its highest level since 2019 when compared to the market cap weighted index.

There are similar developments in some of the largest sectors of the market. The equal weight Consumer Discretionary sector has surged 25% since October compared to the more commonly used cap weighted sector. Behemoths like Amazon and Tesla (which together comprised more than 40% of the XLY last June) broke their October lows and kept falling throughout December. The average stock in the sector, however, stopped going down last summer.

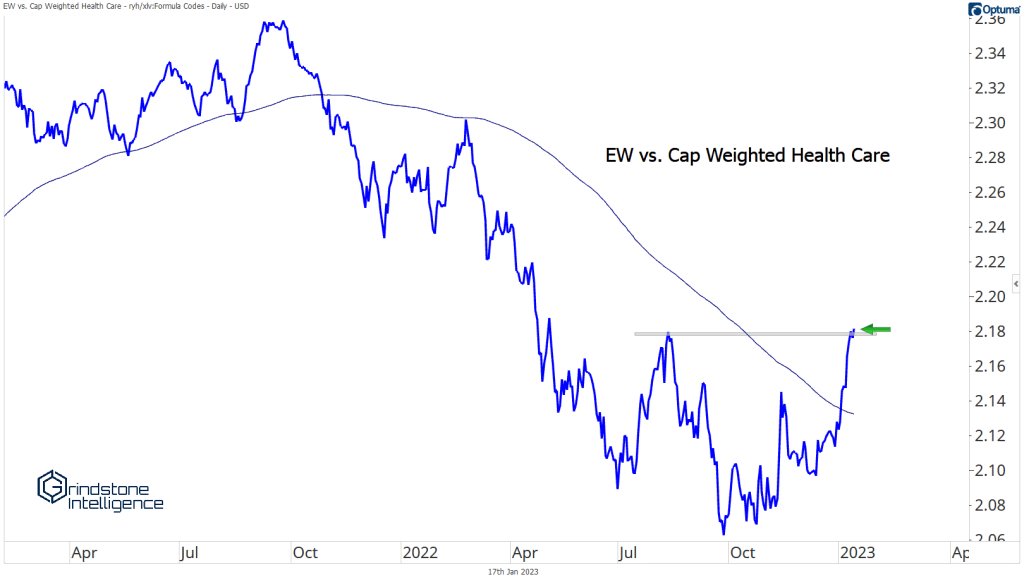

In Health Care, the EW sector is setting new 9-month highs on a relative basis.

The next shoe to drop could be in the United States’ largest sector: Information Technology. Here, the equally weighted group is working on forming a multi-year relative base after bottoming in September 2020. The group has steadily outperformed for the last 12 months, but a breakout above those 2021 highs could set the stage for a years-long rally.

The major indexes are off to a strong start in 2023, and we’re all hopeful it will last. It’s easier to make money in a bull market. Yet even if this rally falters, remember: it’s not just a stock market, it’s a market of stocks.

There are opportunities beneath the surface.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts are meant for informational and entertainment purposes only. See Terms for more information.

The post Better Beneath the Surface first appeared on Grindstone Intelligence.