Big Breakout for Small Caps

Small cap stocks stopped going up in March. While major U.S. equity indexes like the Dow, S&P 500, and Nasdaq enjoyed a (relatively) steady rise so far in 2021, the Russell 2000 small cap index spent nearly 8 months doing nothing at all.

The extended pause came after a strong rally off of the COVID lows, but, despite the lack of progress, prices never convincingly breached their 200-day moving average. In other words, the longer-term uptrend managed to stay intact, even without new highs. Trend analysis posits that we should always expect consolidations to resolve in the direction of the underlying trend, yet as the summer waned and an upward resolution failed to appear, fears of a trend reversal began to rise.

Those fears turned out to be unfounded. Small caps started November with a bang.

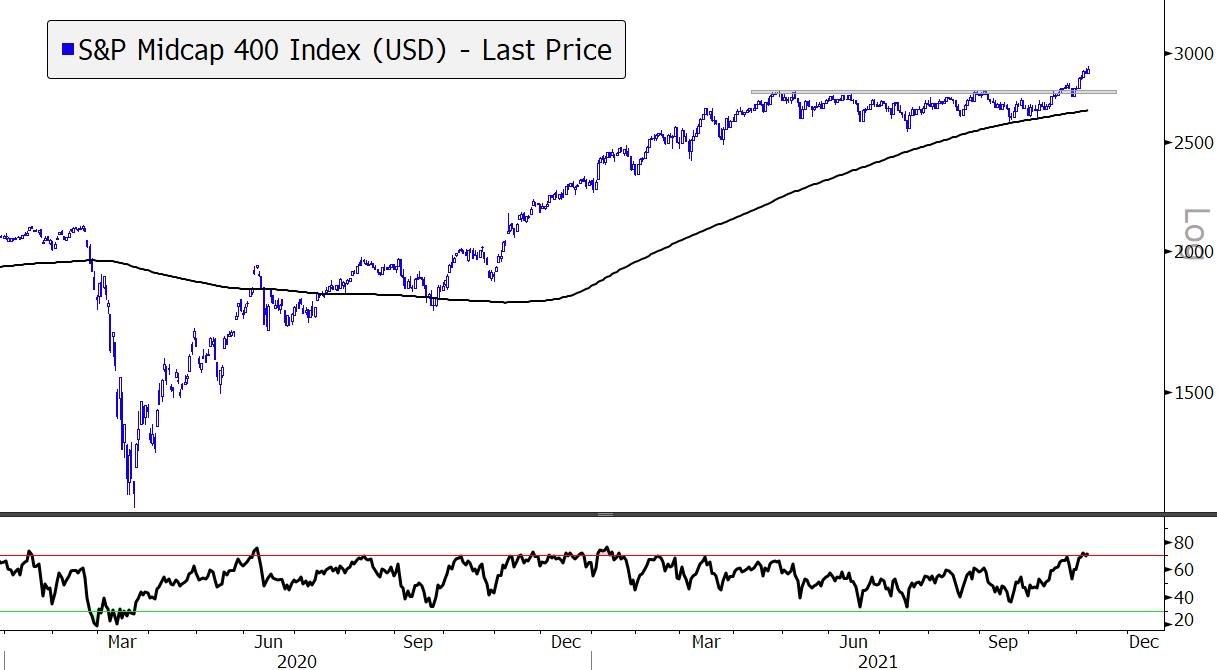

The move was foreshadowed by the mid caps, which suffered a similar fate throughout the summer, but began setting new highs in late October:

Fresh highs across the market cap spectrum should alleviate concerns about weak market breadth that plagued equity markets a few months ago, especially when coupled with recent breakouts in the NYSE Advance-Decline Line and the Value Line Geometric Index:

Also joining the list of new highs this week was the Dow Jones Transportation Average (‘driven’ by a certain member’s value doubling on Tuesday):

With participation in the rally broadening, the only question that seems to be left is who will lead the charge over the coming months. My crystal ball is no less foggy than anyone else’s, but if the trend over the past few weeks is any indication, risk appetite is back on the menu, and safety has fallen out of favor. The Utilities, Consumer Staples, and Health Care sectors have all dropped to new lows versus the benchmark S&P 500 Index:

Consumer Discretionary, dominated by risk-on companies like Amazon and Tesla, has led the recent rally after breaking higher from a year-long downtrend. It’s close to challenging all-time relative highs.

Small Caps have obviously lagged equities as a whole since their absolute peak earlier this year, but the group tends to outperform its large cap counterparts during risk-on environments. And the group has outperformed since August after finding support at the 61.8% retracement of the 2020 rally.

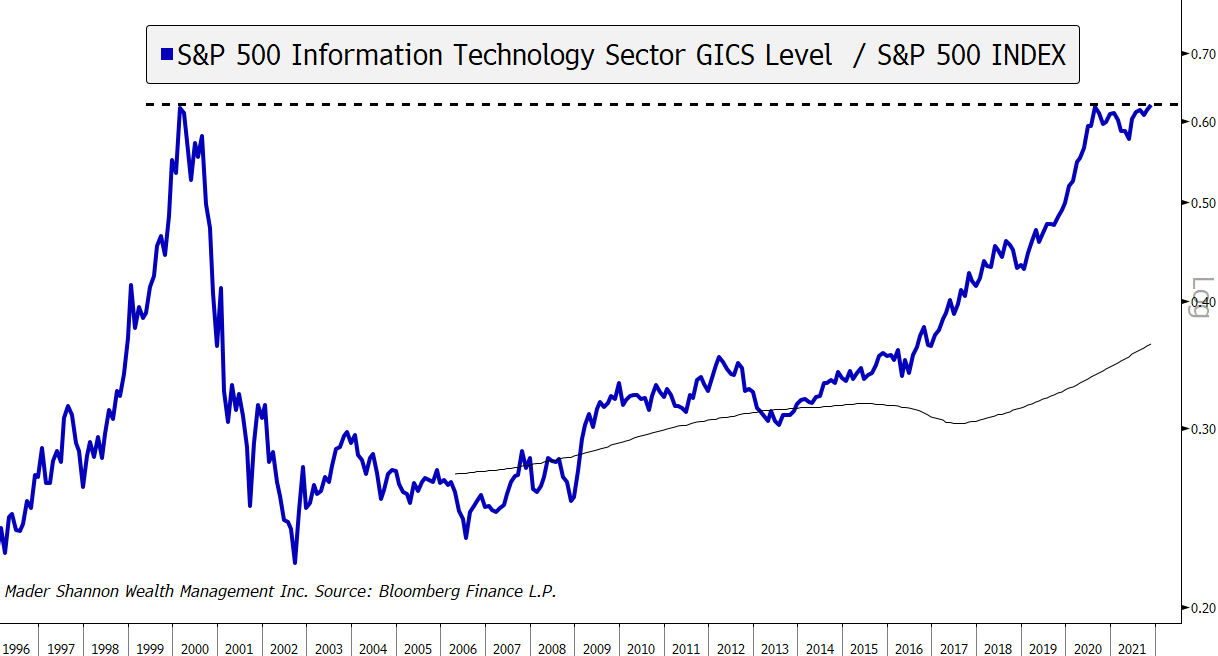

Perhaps the most interesting action, though, is taking place in Information Technology. Tech stalled on a relative basis last fall, coincidentally at the same level it did more than 20 years ago during the height of the dotcom bubble. The sector’s been consolidating below that resistance for a year now.

That could be about to change. On Friday, Information Technology had its highest close vs. the S&P 500 in over a year after finally breaking above tough resistance that’d been tested no less than half a dozen times.

Does that mean it’s time for Tech stocks to lead once again?

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Big Breakout for Small Caps first appeared on Grindstone Intelligence.