A Big Week for Precious Metals

Gold prices just closed the week at a new all-time high for the first time since 2011.

From 2001 to 2011, Gold rallied an incredible 650%, posting only 1 calendar year of negative returns, and annualizing at more than 20% for the decade. But, alas, no party lasts forever. The next several years were filled with nothing but frustration and disappointment for yellow metal investors, as prices stumbled along, digesting the run-up.

But having gained 60% in less than 2 years, including 5% last week, to reach new highs, Gold is having its day in the sun once more.

The strength last week wasn’t limited to Gold. Other precious metals are joining in the fun. Palladium, the strongest of the group over the last 5 years, jumped 10%. It’s spent most of the year digesting the blowoff top of late 2019 and early 2020, when prices doubled in 7 months, but another week like last would put Palladium above resistance at $2300, and closer to setting another new high.

Confirming the strength, Silver rose a staggering 17% last week, its best 7-day stretch since 1982. Prices started the year by dropping nearly 40% in a month and breaking to 11-year lows. But they quickly reversed, and last week’s performance took Silver to its highest level since 2013.

Like Gold, Silver’s rally from 2001 to 2011 was nothing short of spectacular – it rose more than 1000%. But it has underperformed Gold in the years since. To reach a new high of its own, Silver still needs to double.

Platinum has been even weaker: it hasn’t even managed to break the downtrend line since its 2008 peak. But just as the false breakdown in Silver prices spurred a rally to multi-year highs, the false breakdown in Platinum earlier this year may be the catalyst needed to turn things around. It climbed 9% last week, bringing prices back above the 200-week moving average and only 10% from its year-to-date high.

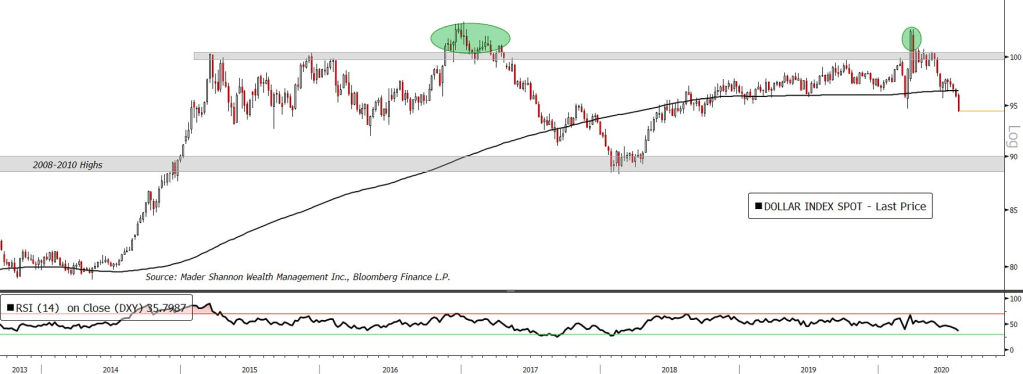

Broad strength in precious metals comes amid the backdrop of a weakening US Dollar, with a benchmark index falling to its lowest level since mid-2018 last week. The DXY has been trapped in a channel between 90 and 100 for the better part of the last 6 years, but early this year looked poised to head higher. A rally to 103, as global investors rushed to the safety of the world’s reserve currency during the onset of the COVID-19 crisis, was quickly reversed, and the Dollar has steadily trended lower since.

As long as the DXY falls in value, hard assets priced in USD can count on at least one tailwind to push them higher.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post A Big Week for Precious Metals first appeared on Grindstone Intelligence.