Breadth Keeps Getting Better

If you’re still complaining about weak breadth in the stock market, it’s time to find a new slant. Breadth just keeps getting better.

When we talk about breadth, we’re talking about how many stocks are participating in a trend. The more stocks moving the same direction, the stronger that trend is. Sure, a handful of large stocks can drive market cap-weighted index indexes higher all by themselves. Sometimes they can do it for a lot longer than people expect. But they can’t do it forever.

Monitoring stock market participation is a way to monitor the health and durability of a trend.

In 2023, everyone knows that handful of mega cap stocks drove the vast majority of market returns. Even my friends that don’t really follow the market were telling me about how the S&P 500 was really just the S&P 7. They weren’t far off - the average stock lagged the S&P 500 return by the most since 1999 last year.

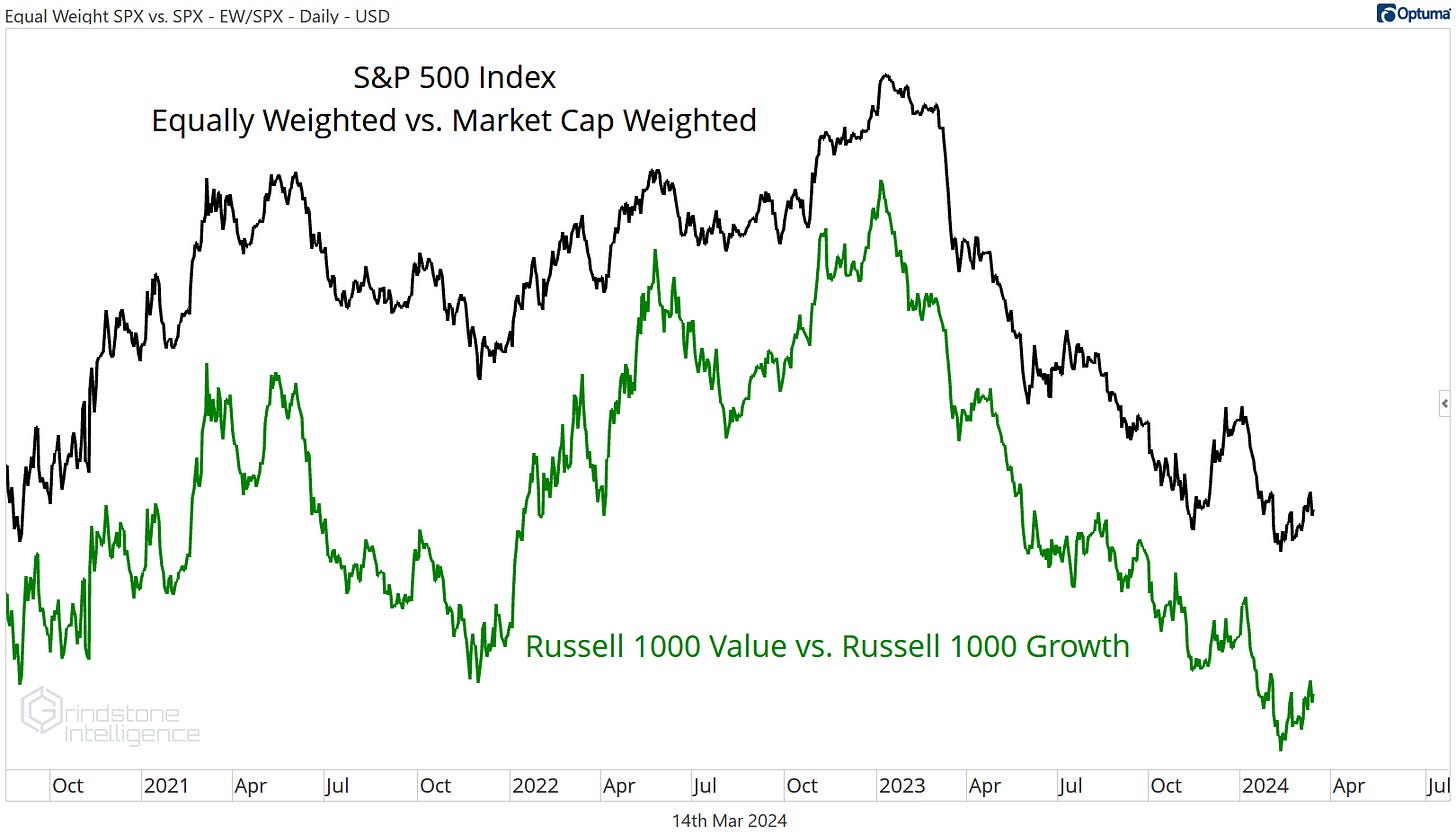

But just because the average stock is lagging the return of the market cap weighted index doesn’t mean breadth is bad. It just means that certain types of stocks are doing better than others. In this case, it was growth stocks rising faster than value stocks. Take the ratio of the equally weighted S&P 500 vs. the market cap weighted index and compare it to the ratio of the Russell 1000 Growth index vs. the Russell 1000 Value index. They look exactly the same. This chart is a leadership story, not a breadth story.

So when we look at breadth, we aren’t so much concerned with the magnitude of moves in each stock, but the direction. As long as the majority of stocks continue to move higher, we can be confident that underlying breadth remains healthy and the current bull market will continue.

That’s what’s happening right now.

If the goal is to count uptrends and downtrends, one of the simplest ways to do it is with moving averages: a stock higher than its average price over the last month or year can be assumed to be trending higher, and vice versa.

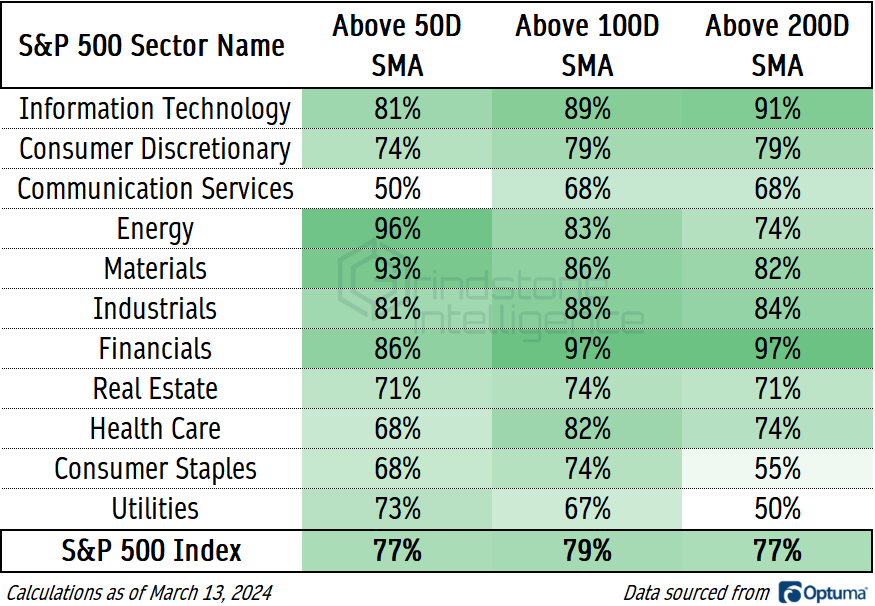

Today, about 80% of large cap stocks are above their long-term moving average. That’s the strongest reading for this breadth measure since September 2021.

Of course, breadth was still stronger in early 2021, when more than 90% of S&P 500 stocks were above their 200-day. In order to repeat that feat, we’ll need to see some improvement from defensive areas of the market like Utilities and Consumer Staples, where only half of stocks in those two sectors are in long-term uptrends.

Improvement is exactly what we’ve been getting. Only 7% of Utilities stocks were above their 200-day in mid-February, and just one quarter of the Consumer Staples. The short-term trends are even stronger.

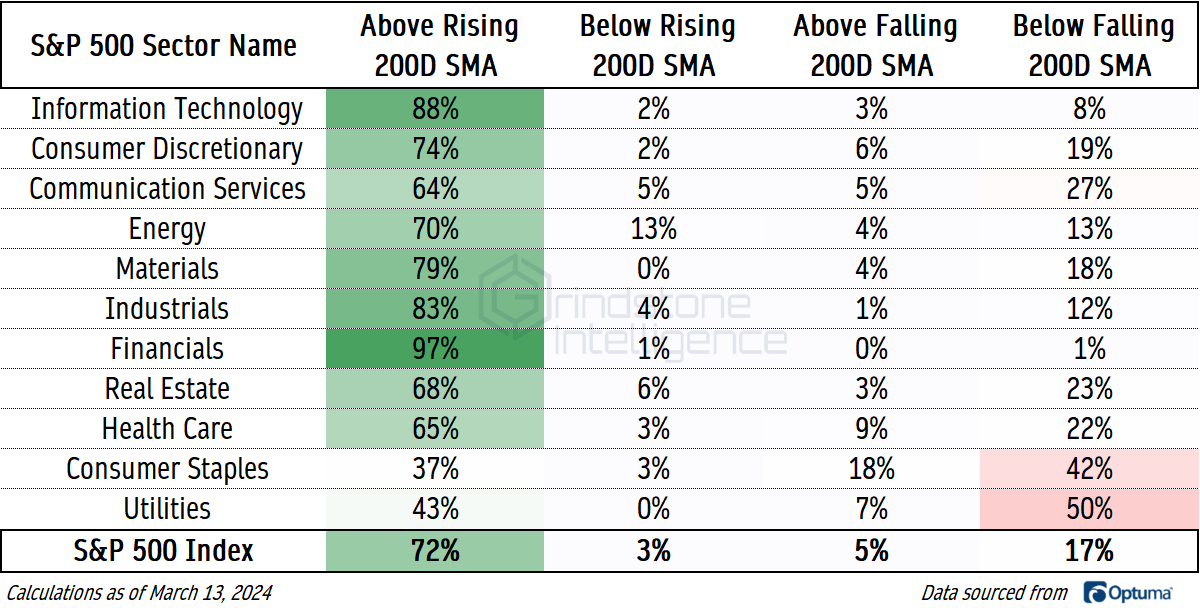

Comparing the current price to a moving average is fine, but we can take it one step further to glean even more information. A stock whose price is above a rising moving average cannot be in a downtrend. A stock whose price is below a falling moving average cannot be in an uptrend.

Adding this component only confirms what we saw above. In offensive sectors like Information Technology, Financials, and Industrials, 80% of stocks are above a rising 200-day moving average. They’re undeniably in long-term uptrends. Even in the weaker sectors, we’re seeing a much more balanced view as opposed to the outright bearish characteristics of a month ago.

New Highs and New Lows

If a stock is rising, that stock will set new highs. If lots of stocks are rising, lots of stocks will set new highs.

Throughout the first two months of the year, we were keeping a close eye on the list of new 52-week highs in the market. Even though index prices were still rising, the number of stocks setting new highs had peaked in mid-December. That’s still the case for the NYSE and the NASDAQ, but we’re encouraged by the steady improvement over the past few weeks.

What would really be concerning is if we start to see an expansion in the number of new lows. A stalling out in the number of new highs might mean that an uptrend is slowing, but we can’t be talking about a new downtrend unless stocks start falling. One way to monitor that is by looking at the difference between the number of new highs and new lows - a ‘net’ new highs index. We also like throwing a short-term moving average on that net to smooth out the day-to-day action and help us identify the underlying direction.

It’s clearly positive. The 20-day average of the net new 52-week highs on the NYSE just hit its highest level in almost 3 years.

But wait, is it really fair to be looking for new 52-week lows when the market is at all-time highs? Maybe not. But even on a 6-month basis, the list of new lows is a ghost town. That’s another win for the bulls.

On an even shorter-term look, the story is the same. We can look at whether a stock has more recently broken out or broken down and determine whether that stock is in a cycle of setting new highs or new lows. 81% of S&P 500 members are in a new 3-month high cycle. No sector has fewer than half.

We’ll be more concerned about breadth when this dashboard starts to show more red than green.

Momentum

What about momentum? When stocks are rising, they tend to get overbought. When stocks are falling, they tend to get oversold.

If we look at whether a stock’s 14-day RSI has eclipsed 70 or fallen below 30 more recently, we get another assessment of whether the buyers or sellers are in control of a stock. 81% of S&P 500 stocks are in an overbought momentum regime, unsurprisingly led by offensive sectors like Financials and Information Technology. The standout here is Real Estate, though, which has been one of the absolute worst places to be, yet has 90% of its members getting overbought. The sellers are not in control.

The Averages

The cumulative advance-decline line might be the most well-known breadth indicator out there. Its calculation is fairly simple: an index is created by cumulatively adding or subtracting the net of rising vs. falling issues for each trading day. If a greater number of stocks are rising than falling, the advance-decline line rises, and vice versa. No indicator is infallible, but the NYSE Advance-Decline line has diverged from prices before several major stock market selloffs.

That’s not what’s happening today. The NYSE A/D line just hit a new 2 year high.

If anything, the A/D line is confirming the rise in stock prices. It’s certainly not sending us a bearish signal here.

Even the small caps, which have been notably absent from the bull market that began more than a year ago, are starting to get something going. The Russell 2000 just closed at a 2 year high itself:

When the bears can’t even keep down the weakest areas of the market, that tells you a lot about what kind of environment we’re in. We’ve talked a lot about the potential for a leadership change in the market this year, but let’s be clear about one thing: we’re still spending our time looking for stocks to buy.

Until next time.