Breakouts Aren't Bearish - 11/15/2023

Yesterday, the Information Technology sector broke out to a new all-time high. If there was any remaining doubt whether the bear market that began in January 2022 had ended, now there is not. There’s nothing bearish about all-time highs, especially when those highs occur in the biggest and most important sector in the market.

Tech’s dominance over the last 6 years is truly something to behold. Take a look at how each of the 11 sectors has performed relative to the index they comprise since the end of 2017:

The Tech sector is so big and has risen so much, that investing in literally any other sector would have yielded a below-benchmark return. It’s hard to think of a more awe-inspiring chart than this. (Or a more depressing one for someone like myself, who spends hours and hours every week looking for opportunities all across the market landscape instead of spending all their time focused on one particular sector).

But don’t be fooled. Just because Tech has been far and away the best place to be, that doesn’t mean it’s the only place showing bullish characteristics.

Communication Services just broke out to new 52 week highs too. This was the worst sector to be for most of 2022, but it’s come back with a vengeance this year. After yesterday’s breakout, Communications is up 47% for 2023.

The mega cap growth names driving this year’s rally - ones like NVIDIA, Meta, Microsoft, Amazon, Broadcom, each of which set new 52-week highs yesterday - would by themselves be enough to drag the market higher. And that’s what they have been doing for most of the year.

But don’t believe the narrative that only a handful of stocks are on the rise.

147 S&P 500 stocks have set a new 3-month high within the past week. So have 19 S&P 500 Industries.

66 stocks in the index just set new 6-month highs, and 61 just set new 52-week highs.

It’s not just large caps, either. The number of stocks setting new 6 and 12 month highs on the total NYSE is accelerating. Both measures are at the highest level since the summer, while the number of NYSE stocks setting new lows has dwindled.

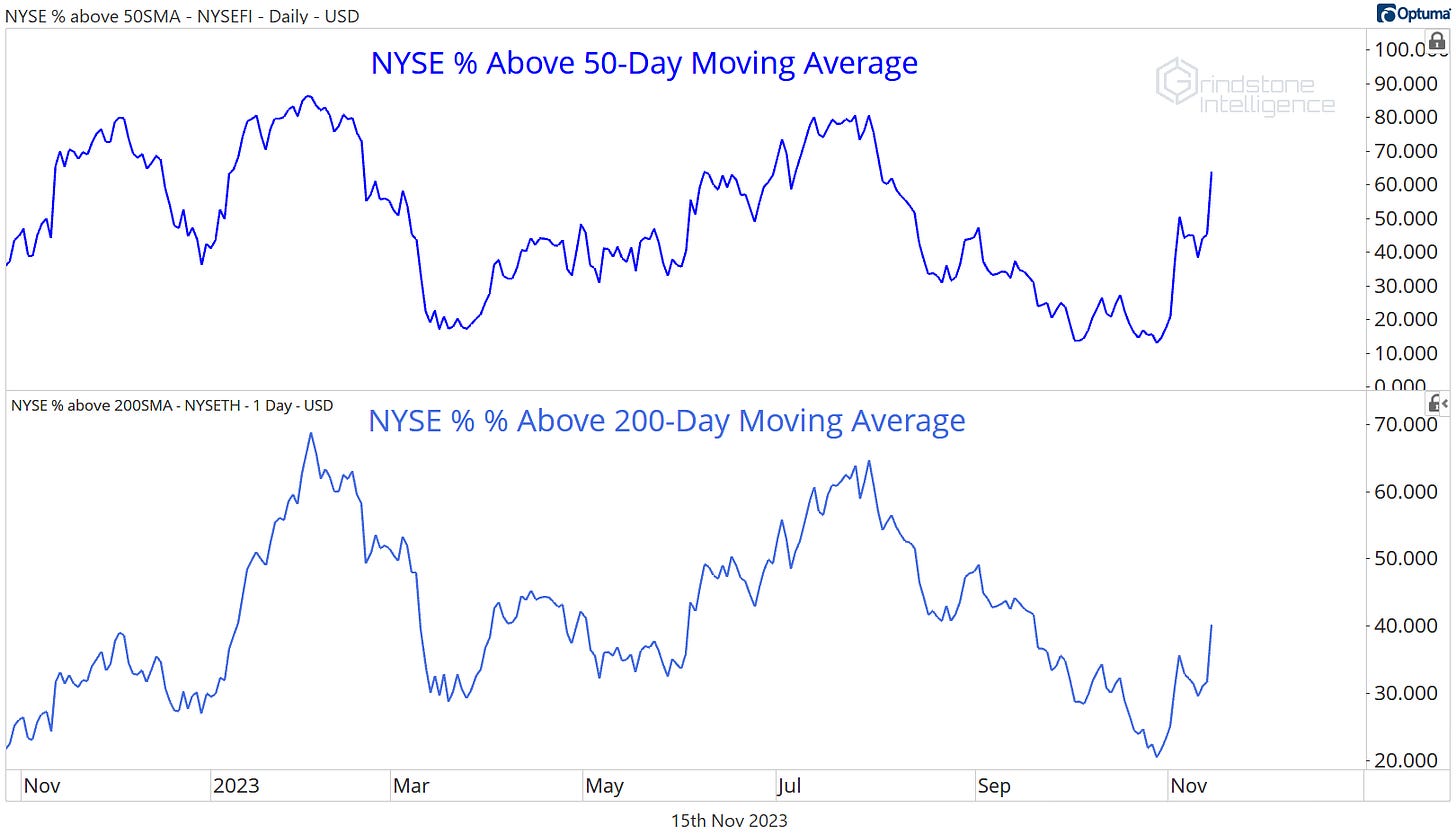

And moving average breadth is improving, too. The share of NYSE stocks above their 50-day moving average is at multi-month highs, and the share above their 200-day has rapidly improved from an October low of ~20% to above 40%.

We’ve been erring toward buying stocks since the May breakout, so long as the S&P 500 remained above 4150. There’s no reason to change that now.

After all, breakouts aren’t bearish.

Until next time.