Bullish Divergences vs. Bear Markets

Stocks jumped almost 5% for their best week since June. Increased volatility, favorable seasonality, and extreme negative sentiment have brought an all-important question to the top of mind for many investors: Were the October lows the bottom for stocks, or just a bottom?

I don’t know the answer, of course, and neither does anyone else. But I can say that last week’s rally took place after momentum showed significant improvement in several key sectors.

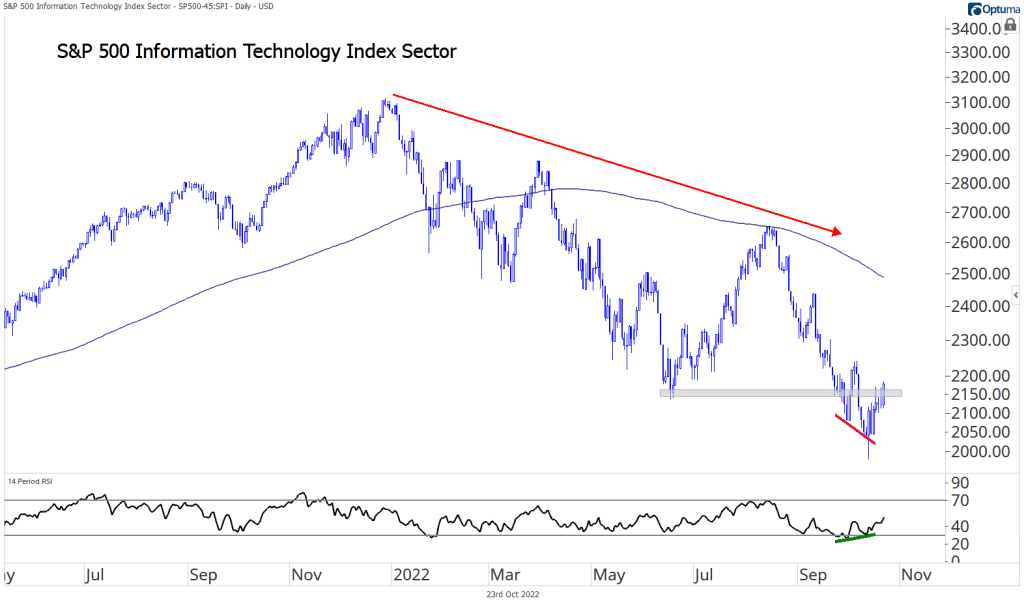

Information Technology is the biggest and most important sector in the benchmark S&P 500 index. It’s been all lower highs and lower lows since the sector peaked in January – the textbook definition of a downtrend.

There’s no question of whether or not Tech is in an uptrend. It’s not. But the first step towards an uptrend is for prices to stop going down, and last week’s rally was more evidence that just maybe the sector has stopped falling. Momentum (as measured by a 14-day RSI) failed to get oversold on the most recent decline, and now we’re back above the June lows.

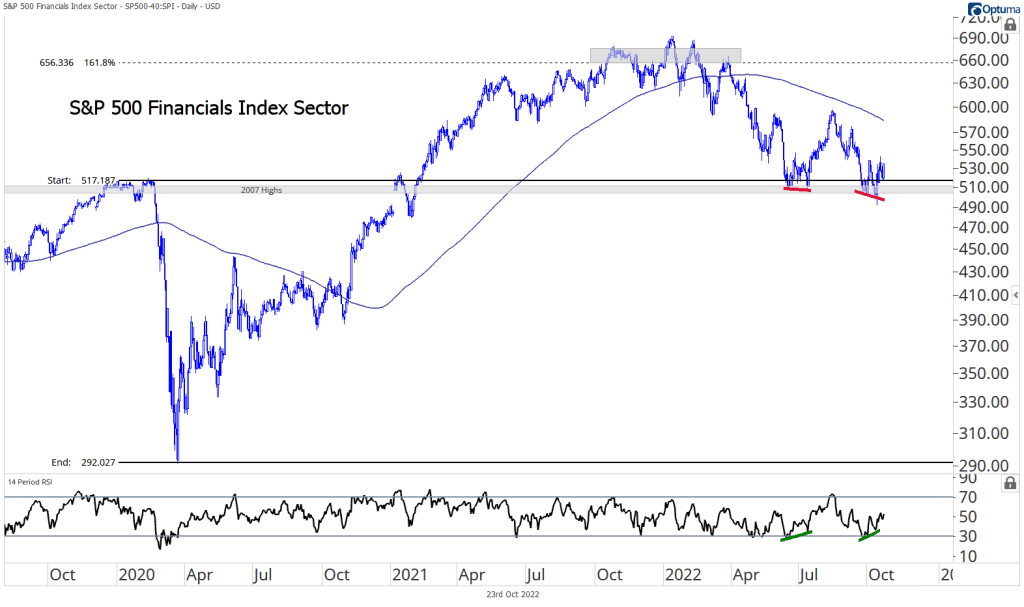

The last couple weeks have looked similar for Financials. Momentum stayed out of oversold territory and set a higher low, even while prices set a lower low. When RSI fails to confirm a new low in price, that’s when we need to pay attention. Mean reversions tend to follow.

For stock market bulls, this Financials chart is one to watch. New bull markets start with the strongest areas of the market, and, right now, that means cyclicals like Energy, Industrials, and Financials.

Unlike Tech in the chart above, bears couldn’t push Financials below their June lows (which also happen to be the highs from 2007 and 2020). The market’s largest sector is back above its June lows, and the areas showing relative strength never even broke them.

In other words, the Tech sector is trying to stop falling, but Financials already have.

So are those positive developments enough give us confidence to say the lows are in?

Maybe.

But we need to see more. In a bull market, bears struggle to hold down even the weakest areas of the market.

It’s early, but we may have seen the first signs of that over the past two weeks. The worst sector all year has been Communication Services, and just like the other sectors we’ve looked at, momentum put in a bullish divergence at the most recent lows.

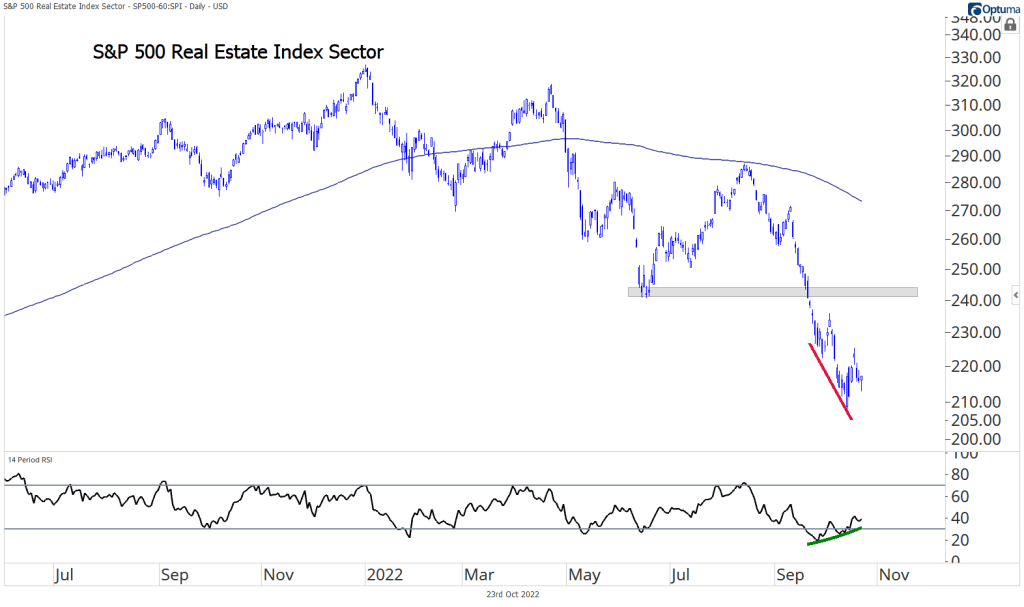

It’s the same story for Real Estate, another sector that has drastically underperformed.

Rallies sparked by momentum divergences are mean reversions until they’ve proven otherwise. But all new bull markets have to start somewhere.

Let’s hope this is the real deal. Bull markets are a lot more fun.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Bullish Divergences vs. Bear Markets first appeared on Grindstone Intelligence.