Catching Up on Housing: Is the Bubble Bursting?

The housing market is crazy. I know I’m not breaking news to any of you, but sometimes we don’t appreciate how crazy things really are.

Two years ago, the housing market was on fire. Demand was through the roof. Everybody was leaving the cities and headed for the suburbs, everyone wanted more space since we were all working from home, and everyone had more money thanks to government bailouts. I mean, personal income rose by the most EVER in 2020, and we were in a recession!

But housing supply isn’t something you can fix with a stimulus check. After the housing bust of the mid-2000s, the industry changed on a lot of levels. Obviously, the availability of credit dried up. Banks started requiring people to actually have jobs and income to qualify for a mortgage. Novel idea, I know. Homebuilding dynamics changed, too. Builders and their suppliers were brought to the brink of destruction. Many of them went belly up. Just like US oil producers following the energy collapse of 2014, the builders that survived changed the way they operated. Gone were the days of acquiring years and years of land supply and churning out as many homes as possible. Now, most of them control land through options, but don’t actually own them. And fewer spec homes are built, meaning more often than not, builders are waiting until a buyer is found before starting construction. The result has been a decade of underbuilding single-family homes in the United States. Then COVID struck, temporarily shutting down construction activity and wreaking havoc on supply chains – which still haven’t been fully repaired.

Pull out your Economics 101 textbook and find what happens when a surge in demand meets inadequate supply. Then look for “price elasticity of demand” and see how that’s impacted by an unexpected increase in income. Add in the effects of ultra-low mortgage rates on monthly payments, and you’ve got a recipe for… well, just see for yourself

To be clear, the housing market was crazy even before COVID hit. I remember, because my wife and I were living it. We decided to sell our home in January 2020. My wife was pregnant with our second daughter, and we wanted some extra space. The house we were selling was not exactly cream of the crop. Ok, I’ll be honest. It was a piece of shit. Built in 1927, this thing was rustic and not in a good way. It had a basement that was straight out of a horror movie – we lived there for three years, and you could count on two fingers the number of times my wife went down there. The electrical work was suspect, the roof had a tendency to leak, and the wasps living in the walls had a knack for finding their way inside. And I haven’t even made it to the town. Edgerton has a population of 648 people. There’s a single restaurant that doubles as a bar, a small convenience store with mostly expired food, and no gas station. The nearest grocery store not named Dollar General is a 40-minute round trip, and we drove a lot further than that to get to work each day.

It was a crappy house in a crappy town, and we loved (almost) every minute of it. It was some of the best years of my life. But I was terrified the house wouldn’t sell now that we were ready to leave. We got with our realtor and told her what we hoped to get out of the house. She stopped short of laughing in our face and gave us some version of “You should probably lower your expectations” instead. And who could blame her?

She was wrong, though. We had a signed contract and a backup offer within 48 hours.

We were thrilled, except now we had a major problem. The house sold faster than we ever expected, so we didn’t have a new one lined up, and my wife was six and a half months pregnant. We started off picky. “This house doesn’t have a fenced backyard. That one doesn’t have a dining room. It’s too old. The bedrooms are too small. This is the wrong school district.” It became clear pretty quickly that nothing in our price range was going to make the cut, so we increased our budget by 15%.

Then we found it: the perfect house. Tons of space, huge backyard, and close to friends. It was listed 10% above our already increased budget, but who cared? We could stretch a little for this place. It had been listed that morning, but two other families were already checking the place out when we arrived for a tour. We went into a bedroom with our realtor and closed the door.

Me: “What’s it going to take to get this house?”

Realtor: “They’ve already got an offer on the table, and they expect several more. You’ll win if you go another $10,000 above asking price.”

We went $15,000 above and breathed a deep sigh of relief. We had a house and we’d be moved before the baby arrived. We’d gone way over budget, but there hadn’t seemed to be any choice. Then we got a call. Our offer didn’t even make the final cut.

That was the housing market BEFORE the pandemic. We won out on another house a week later (against a dozen or more competing offers), and we moved in just a few days after the entire country shut down and a few days before my wife went into labor. What a week that was. My life calmed down after that, but the housing market was just getting started.

Home prices increased at the fastest rate in decades. My ‘horror story’ started to look like a cakewalk compared to the experiences of other buyers. All cash transactions, waived inspections, purchases sight unseen – it was the Wild West. The inventory of existing homes was virtually non-existent. The months supply of those homes was even worse.

Despite rampant talk of ‘bubbles’ and ‘2008 repeat’ predictions, housing prices kept on chugging. Supply doesn’t return at the flip of a switch, especially when builders were facing a shortage of labor, permitting delays, whack-a-mole supply chain disruptions, and skyrocketing material costs. Lumber costs alone quintupled(!) in price over the course of just a few months.

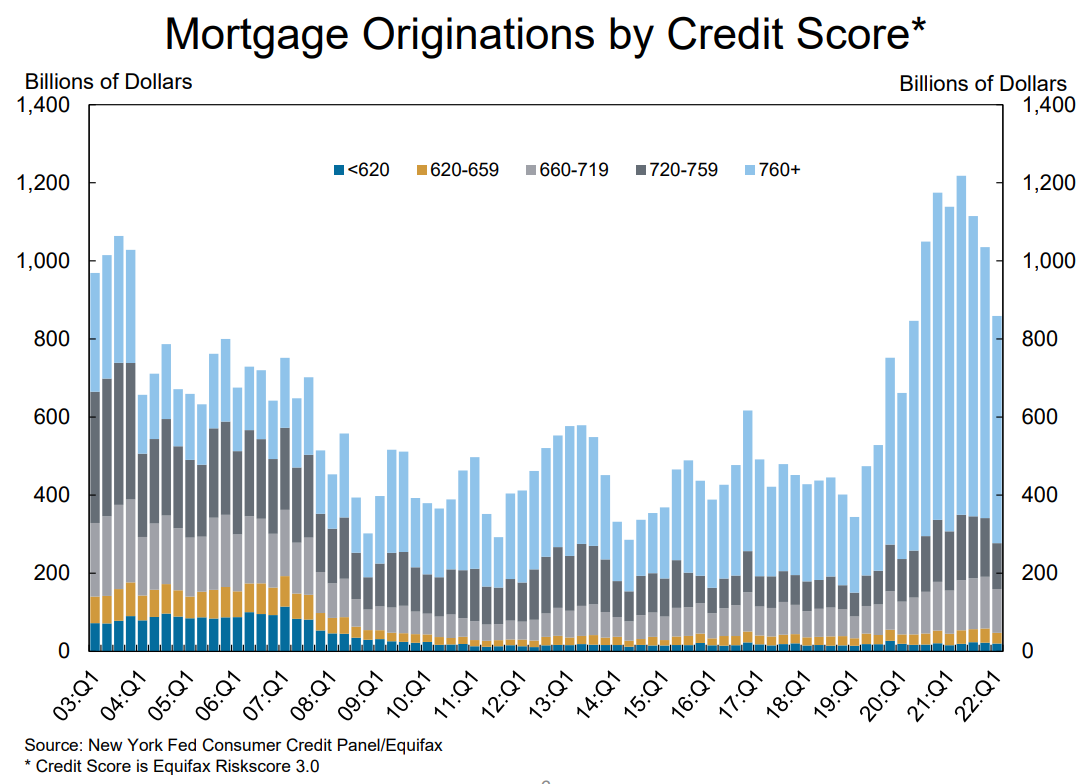

With demand running rampant and supply held in check, lenders kept on lending. First off, this is NOT the housing bubble of the mid-2000s reincarnated. Banks aren’t giving million-dollar adjustable-rate mortgages to minimum-wage workers. In fact, credit quality of borrowers is as strong as ever. The vast majority of mortgage originations are going to people with credit scores above 700, and that’s just as true today as it was a year ago.

One place where lenders perhaps looked the other way was on appraisals. We offered a healthy premium to the asking price on our home, and I was skeptical that the appraisal would support what we offered, but things went off without a hitch. Fast-forward 18 months, and interest rates were more than 1% below our original mortgage. We wondered if we could refinance our house near the new ‘Zillow estimated value’ to get rid of those pesky PMI payments and reduce our rate.

Now, I love Zillow. One of my favorite pastimes is looking at homes I can’t afford in places I’ll never live. But Zillow’s estimated value is just that, an estimate. No one from Zillow is coming in and looking at the condition of homes. For context, they estimated my old POS home in Edgerton was worth anywhere from $50,000 to $190,000. It’s just an algorithm based on homes that may or may not be comparable. So when Zillow said my new house was already worth 30% more than what I paid, well, I took that with a grain of salt.

But I reached out to a lender just in case and told them what I wanted to do. The response? “Well Zillow says your house is worth that much, so it should work.” Umm, what? He can’t be serious, right?

So I went ahead with the application. Name, social security number, income, nothing out of the ordinary there. Estimated value of my home? Insert ridiculously high Zillow value here aaand submit. What’s the worst that could happen? Their appraiser shows up and tells me I’m crazy?

Except there was no appraiser. They just gave me the thumbs up, reduced my mortgage payment by a couple hundred bucks and sent me on my merry way.

I’ll say it again. That housing market was crazy.

Alas, that kind of market couldn’t last forever. Unless it could? The world reopened, spending on services and experiences returned, inflation spread, and pent-up savings dwindled. Even after all that, housing showed few signs of slowing, let alone outright distress. Still, the biggest test was yet to come: How would demand hold up in the face of rising interest rates?

With inflation spiraling higher around the world, global monetary authorities decided to stop waiting for ‘transitory’ price increases to transition. One by one, they raised interest rate targets, stopped or reversed asset purchases, and recommitted themselves to controlling inflation. The Federal Reserve started hiking rates in March and hasn’t looked back. Mortgage rates have risen in kind, from a 2021 low of under 3% to more than 7% as of quarter end. On a median existing home with a 20% down payment, that equates to an additional cost of $800 per month!

The effect on housing has been undeniable. Home sales and home starts have slowed, and price increases have decelerated. It appears lending standards are tightening some, too. My sister and her family are about to close on a new house this month after being forced to relocate for work. They had no problem selling their old house (which had many of the same features as my esteemed Edgerton residence), but they ran into one major problem with the purchase: the appraisal. I’ll take this moment to remind you all that I’m a Zillow scanning veteran, and I generally have a pretty good idea what houses are worth. So when I tell you the house they’re buying was worth every penny of the asking price, you know it’s a credible assertion (at least as credible as a lender saying my home’s value had increased by 30% without actually seeing it).

Instead, my sister’s house appraised a full 10% below the list price. And what’s more, the seller worked with them to adjust the price! That would NEVER have happened in late 2020 or 2021. Demand has clearly been shifted by developments of the past year, bringing the market more into balance.

Supply is still a problem, though, and that will continue to put upward pressure on home prices. Will it be enough to keep them from falling off a cliff? It has so far. And for homebuilders, that may be enough.

The homebuilders index peaked in December 2021, before home prices showed any signs of slowing. From there, they dropped more than 40% to their June lows.

The stock prices may have collapsed, but the businesses themselves never did. Sure, new orders for homes slowed, but that was largely an intentional act by management. They were seeing so much demand and having so much trouble completing homes due to material shortages, that lead times were exceedingly long. They literally stopped making homes available for sale until they were closer to completion. And even though costs were out of control, demand was so strong that pricing more than offset the increased expense. Gross margins for the industry grew from near 20% to near 30%, and profits ripped to record highs.

Today, home prices may be peaking. But material costs are falling, too, and that will help to offset pressure. Spot prices for lumber tend to lead homebuilding lumber costs by about 6 months, as orders for delivery are contracted well in advance, and lumber has dropped 70% since March. That brings the spot price back in-line with the high-end of normal historical levels. The dynamics are similar for other inputs as supply chains are slowly repaired.

Perhaps that’s why homebuilders are holding up as well as they are. In fact, they’re doing more than just holding up. They’re outperforming the broader market. Relative to the large cap index, builders last week touched six-month highs after a series of higher lows.

The headlines surrounding housing keep getting worse and worse, and there’s no shortage of calls for collapse. But stock prices for homebuilders are shaking off the news. It makes me wonder what would happen if the news started to improve.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Catching Up on Housing: Is the Bubble Bursting? first appeared on Grindstone Intelligence.