Precious Metals on the Move - 11/28/2023

Gold nears a breakout

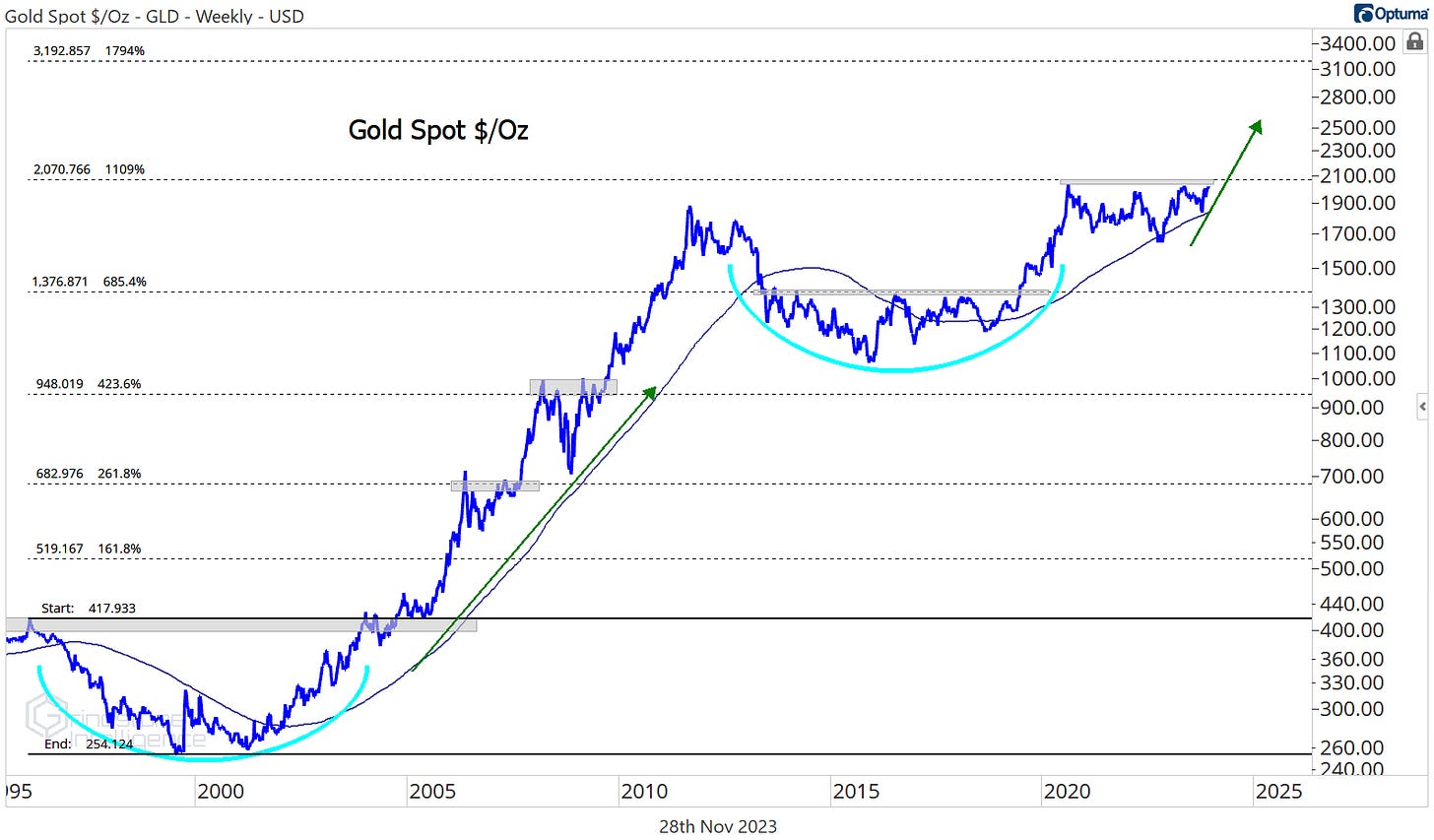

Gold just closed at its highest level since May, and the rally could just be getting started.

For the last 3 years, gold prices have been stuck below $2,050, a level that is also the 261.8% retracement from the COVID selloff in March 2020. Between those pre-COVID highs at $1,680 and resistance at $2,050, the yellow metal has bounced back and forth, digesting the gains from 2015 to 2020 and generally frustrating everyone that has been involved.

Eventually a resolution must come, though, one way or the other. And now that we’re testing the upper band of this trading range once again, the likelihood of a bullish outcome has never been higher. On a break above $2,050, we want to be buying gold with an initial target of $2,400.

That initial target, derived from the 423.6% retracement of the 2020 decline, would be a welcome development for the bulls, but it’s a rather conservative outcome from a big picture point of view. We’re eying $3200 longer-term. That’s the 1794% Fibonacci retracement from the 1990s decline. Prices have respected these retracement levels all the way up: The hiccups in 2006 and 2008 occurred near Fib levels, the ceiling from 2013-2019 was the 684.4% retracement, and right now, were stuck below the 1109% retracement. It would make a lot of sense to go up and touch the next one. Even $3200 might be a conservative expectation – prices rallied a lot more after the 2004 breakout.

Before that happens, we’ll likely need to see more participation from silver. Prices for silver and gold tend to be highly correlated, but silver tends to move in greater magnitudes. As such, when precious metals are rising, we expect silver to outperform. That’s what we’ve typically seen during gold’s best runs. For most of the year, silver has refused to lead. Each time gold has tried to make a push higher, the silver/gold ratio fails at its 2019 high.

If we see the silver/gold ratio back above those 2019 highs, that will be a big feather in the cap for precious metal bulls.

To its credit, silver has come alive lately. In the last two weeks alone, it’s rallied more than 10% from key support at $22.50 and broken the downtrend line from May peak. We’d feel comfortable owning it on a break above the year-to-date highs near $26, with a target above $32.

The catalyst to get both gold and silver moving over the last few weeks has been the fading US Dollar. After a nearly unprecedented streak of weekly gains from July to September that wreaked havoc on equity and commodity prices alike, the Dollar Index found resistance at the 50% retracement of its 2-year range. It’s fallen steadily ever since. The real turning point came on November 14, when the index slipped below 105.50 and back into the volatile range that held for the first half of 2023.

Another beneficiary of Dollar weakness has been Bitcoin. No major asset class has had larger gains than Bitcoin’s 120% rally through the first 11 months of 2023, and the trend here is clearly upward. We can’t be anything but bullish as long as prices are above 30,000. Traders can use 35,000 as a tactical position for entries with a near-term target of 47,000.

We don’t have a strong opinion on the fundamental prospects for Bitcoin - there are attractive qualities, surely, but tracking price action is much easier than joining a cult. And price action tells us that Bitcoin is in a long-term uptrend. While 47,000 is our near-term target, it could easily go much higher.

We see the former highs near 70,000 and the next key Fibonacci retracement level at 112,000 as logical stopping points over the next few years. Ignore it at your own risk.

Until next time.