Communication Services Sector: Top Charts and Trade Ideas - 12/1/2023

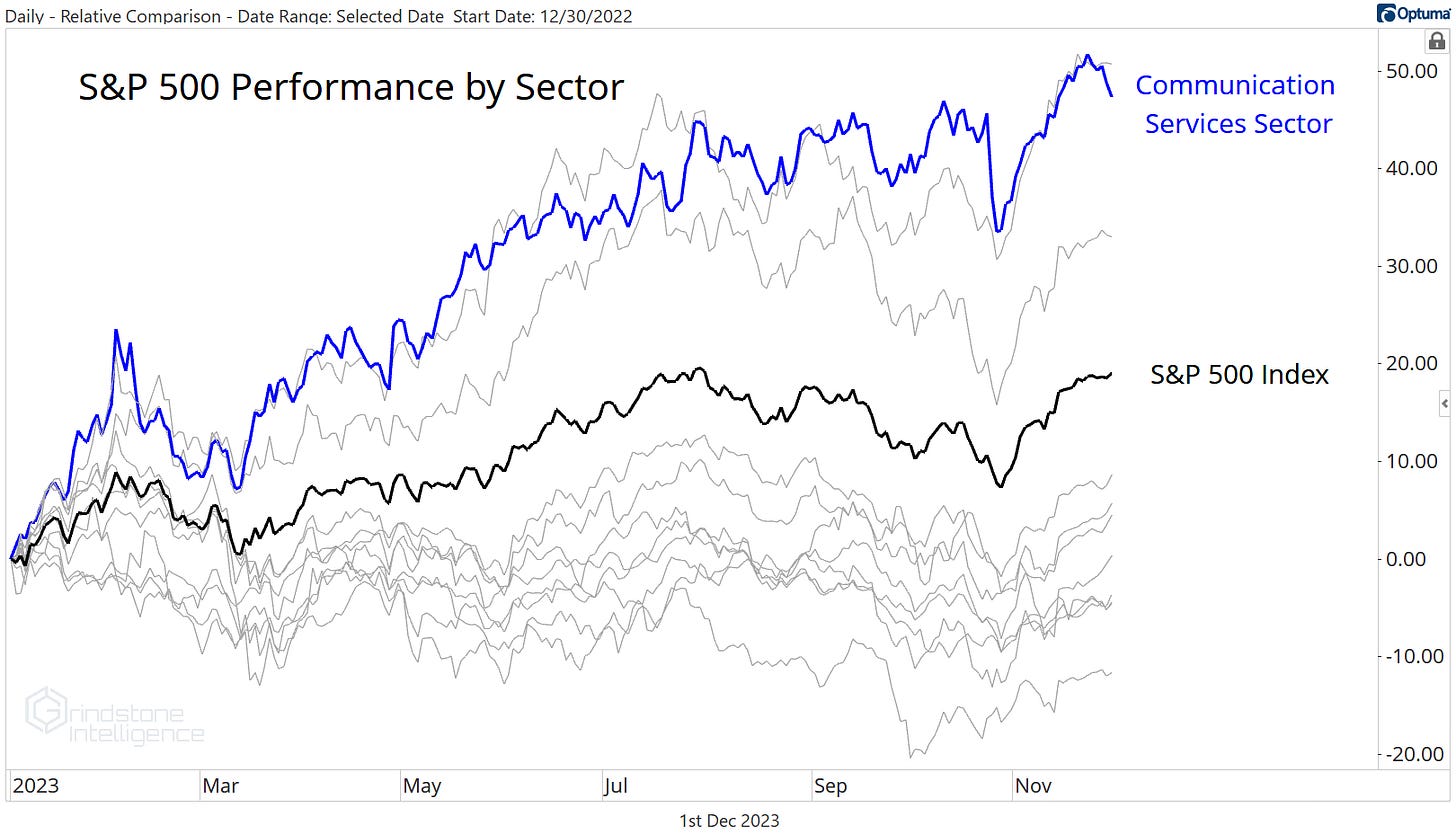

The Communication Services sector has been on a roll in 2023.

After huge gains for growth sectors in the first 6 months of the year, most of the equity market peaked in late July and sold off throughout the months of August and September. Communications, meanwhile, continued to hover near its highs, up more than 40% for the year. October was more of the same, with the sector even managing to touch new 52-week highs on the 11th.

Then came earnings season. Alphabet reported results for its cloud business that disappointed the street, and the sector’s most important stock dropped 9.5% on the news.

Just as quickly as things fell apart, though, they came back together. November was one of the best months ever for stocks, as the S&P 500 closed 8.9% higher. That put Communications up more than 50% for the year at one point, and the sector trails only Information Technology since last December.

How long can the outperformance last? Let’s take a look.

Structurally, the group is still in a relative uptrend versus the rest of the index, despite the Google-led weakness that plagued the group in October. The 2018 lows are the line in the sand. We wouldn't be surprised to see the ratio backtest its breakout above that key rotational level, but we definitely don't want to see break back below. If we do, it'll be best to approach this sector from the underweight side.

We’re also keeping an eye on the summer highs for the sector. We only want to be long Communications as a group if the November breakout remains intact. Otherwise, we’d be looking at a significant failed move that could result in a full-fledged trend reversal.

Breadth for the group remains healthy, with at least half of its constituents in clear technical uptrends on short, intermediate, and long-term bases, and only 1/3 in technical downtrends.

Digging Deeper

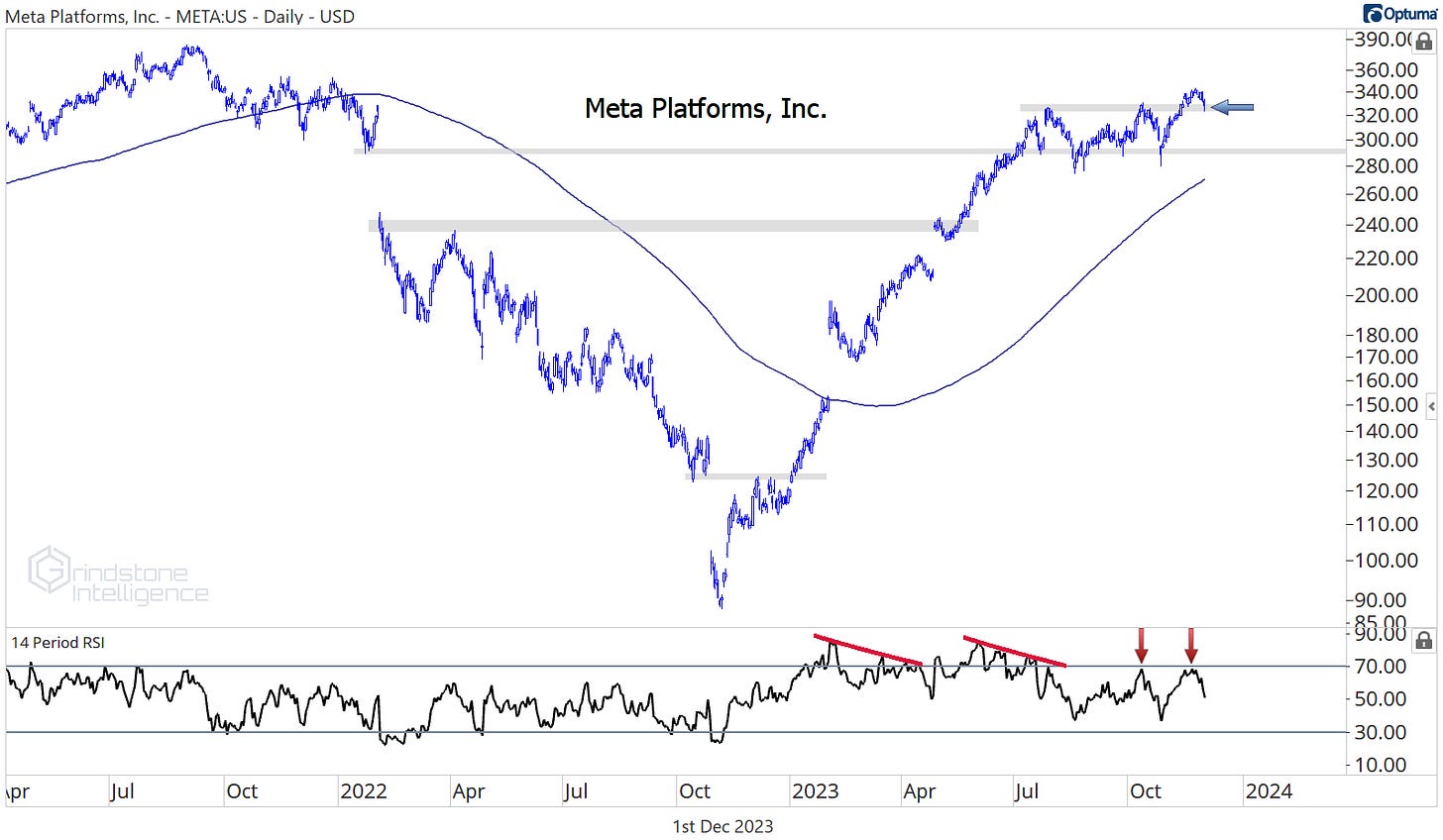

Meta Platforms (formerly Facebook) is far and away the sector’s best performing stock this year. META has jumped 170%, leading the Interactive Media and Services Sub-Industry to a 75% YTD gain. Similar to the sector overall, though, we only want to be long if the November breakout remains intact. The stock’s inability to get overbought on rallies over the past few months is evidence that the uptrend is weakening, and after such massive gains this year, we don’t want to be on the wrong side of a potential mean reversion lower.

Leaders

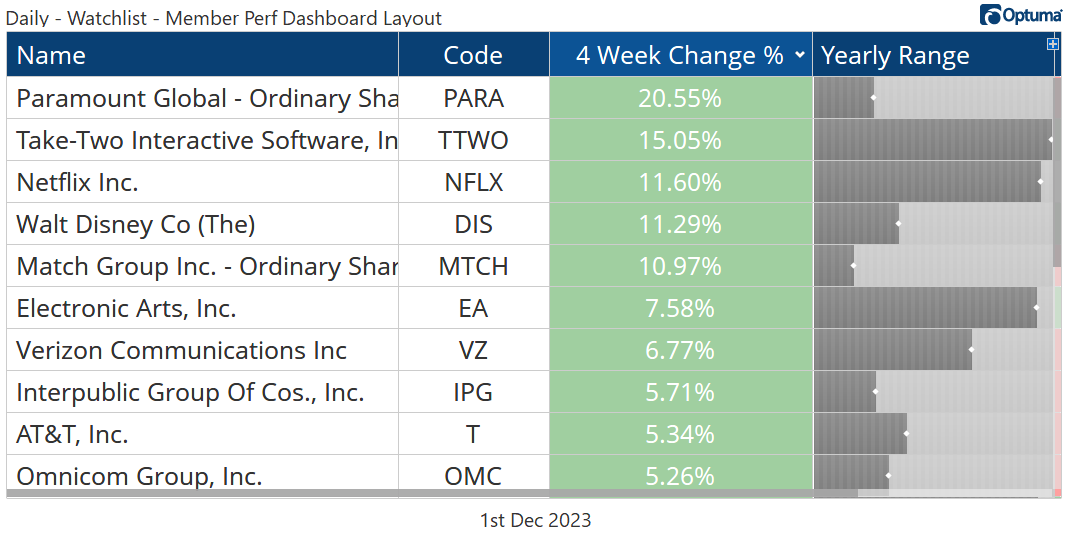

Take-Two jumped 15% over the last 4 weeks, helping the stock complete a bearish-to-bullish reversal against the S&P 500. Check out the stock setting new 52-week relative highs:

We want to be long TTWO above $150 with a target of $185, which is the 261.8% retracement from the 2019-2020 selloff.

Losers

Only 5 stocks in the sector fell over the last month. Alphabet is still rising, as it gained 4% over the period, but a look at GOOGL compared to its benchmarks, tells us there are better places to be for now. Check out this nasty failed breakout for the stock when compared to the S&P 500. From failed moves come fast moves in the opposite direction, and we don't want to be on the other side of this reversion. Even in a bullish outcome, it will likely take some time to repair this damage.

We’re much more constructive on T-Mobile, which is knocking on the door of a multi-year breakout. We want to be long TMUS above $150 with a target of $175.

T-Mobile isn’t an outlier. It’s the entire Integrated Telecommunications space. This sub-industry has been one of the worst places to be for a long time, but it just completed a bullish reversal pattern and has risen further above its 200-day moving average than at any point in the last 2 years.

For Verizon, we can own it above $35 with a near-term target of $42 and an intermediate-term target up near $50.

That’s it for today. Until next time.