Consumer Discretionary Sector Deep Dive

The Consumer Discretionary sector is holding where it needs to.

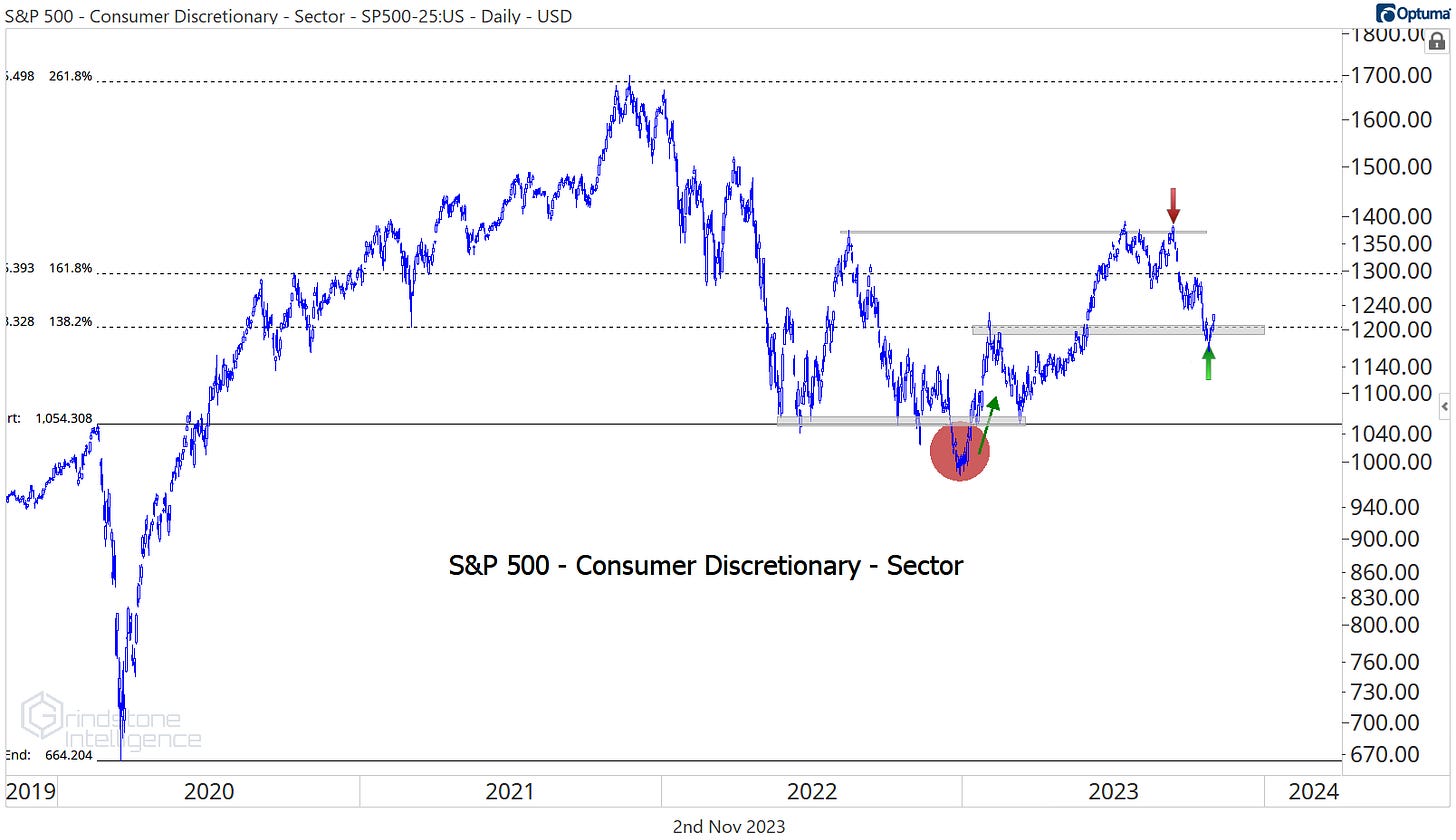

We discussed a make-or-break level for the S&P 500 Index earlier this week, and so far the benchmark index has managed to remain above that key level. The same can be said about the Consumer Discretionary sector.

Since reversing a sharp breakdown at the outset of 2023, Discretionary stocks have been some of the best performers of the year. The sector is one of just three to outperform the S&P 500 year-to-date. However, two attempts to break out above the highs from last August both failed. That set off a 15% decline, bringing the sector all the way back to the top end of the spring trading range, which is also the 138.2% Fibonacci retracement from the entire COVID decline.

We’re watching to make sure the sector can hold that key level and keep this year-to-date uptrend intact. A break below it would have us concerned about the future of the sector and stocks overall.

When compared to the S&P 500, Discretionary stocks have already fallen back below the highs they set back in February and have broken the uptrend line from the December lows. This ratio hasn’t deteriorated to the extent that we want to be betting on further relative declines, though. That would take a break below the swing lows from April, which were also a key low back in May 2022. For now, we’re neutral towards the sector with a bullish bias - a move back above those February highs would have us looking for further outperformance.

Fortunately for bulls, November is the single best month for stocks, and it’s especially good for the Consumer Discretionary sector. Since 1990, Discretionary stocks have gained 2.6% on average during the month.

And compared to the performance of the S&P 500 index, the sector has outperformed by an average of nearly 0.7% during the month of November, on par with its other two best months, January and March.

That doesn’t mean we’re out of the woods. Seasonality is a tailwind, but it’ll have to overcome weakening trends beneath the surface. Nearly 80% of stocks in the sector are in short-term technical downtrends, and two-thirds are in long-term downtrends.

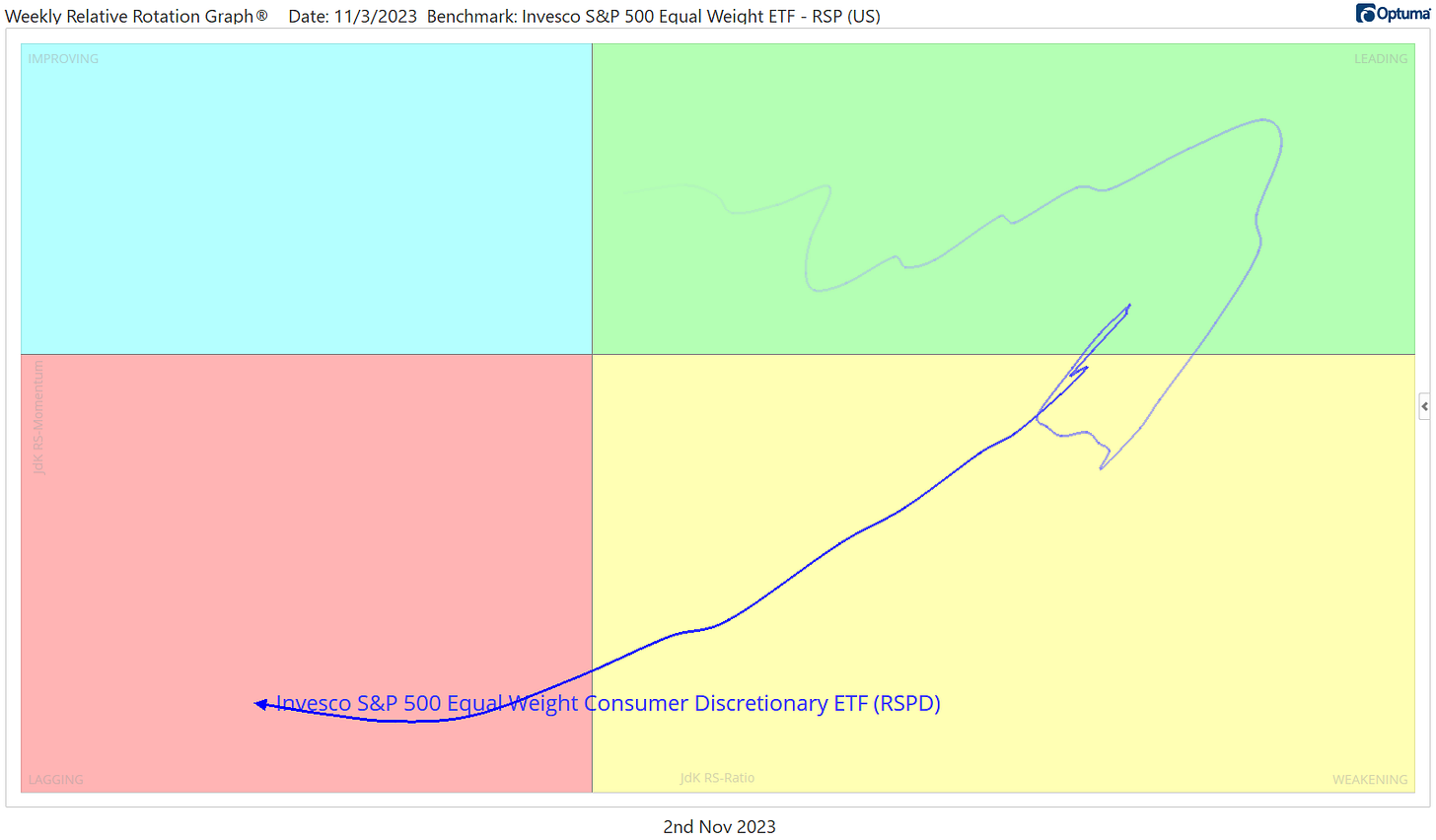

That internal weakness has the equally weighted Consumer Discretionary sector solidly in the ‘Lagging’ quadrant of the weekly Relative Rotation Graph.

And that equally weighted sector just hit its lowest levels of the year.

The 2018-2020 highs should offer significant support on further declines, but this isn’t a chart you’d describe with the word ‘uptrend’. Rangebound is more like it. And as long as that’s the case, it’s hard to bet on Discretionary as a leader for anything more than a few weeks at a time.

Digging Deeper

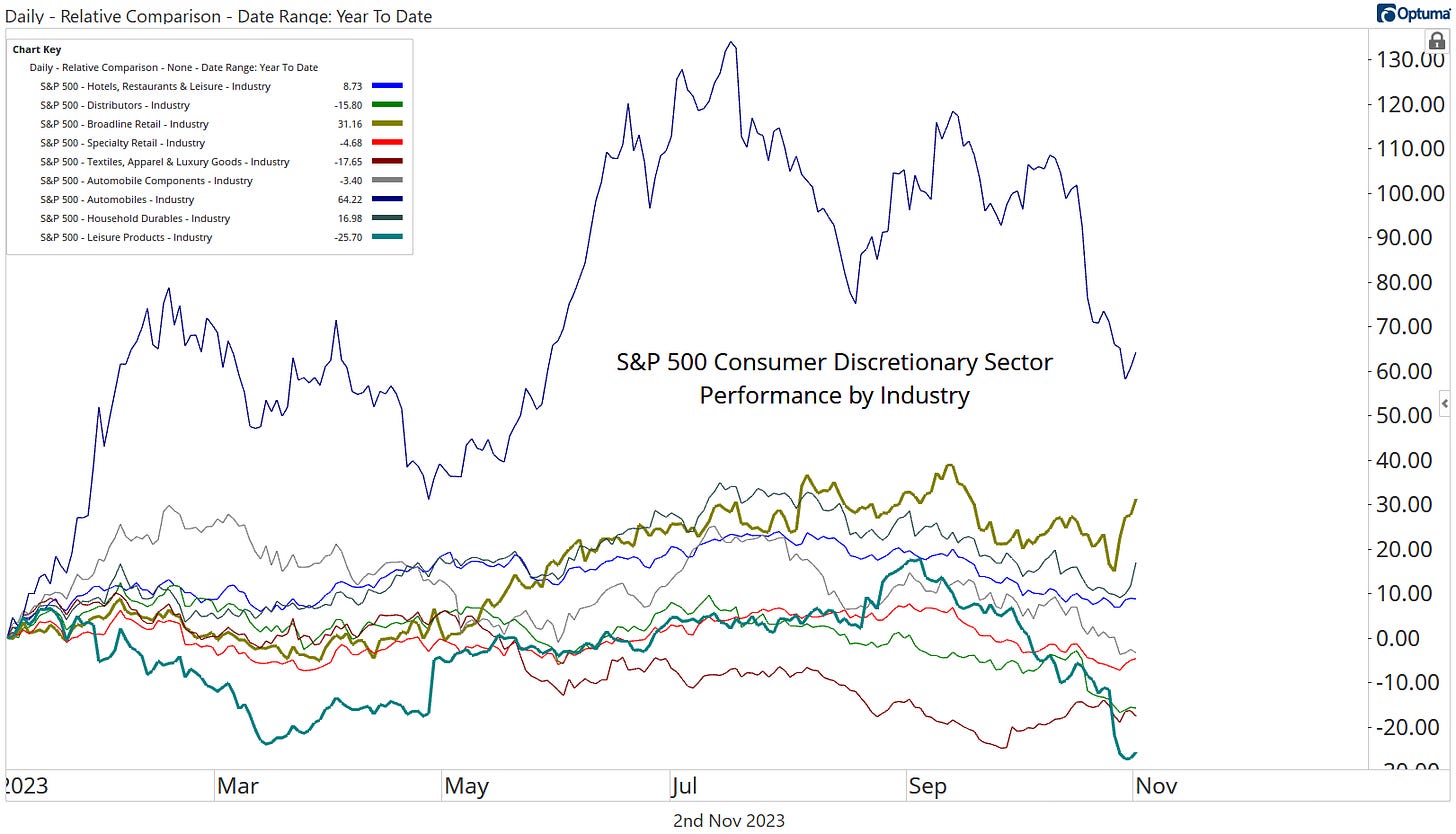

A new leader is arriving to the scene while a familiar laggard has returned.

The Broadline Retail Industry has risen sharply over the past week, its 14% rally far outpacing gains within other areas of the sector. Leading the way is Amazon, the industry’s largest component.

Amazon has been stuck beneath stiff overhead supply from the 2020-2021 trading range for the last 18 months, and it was rejected once again over the summer. But in recent days, the stock found support at the 38.2% retracement from the 2021-2023 decline, which was also near the 200-day moving average.

The rally was enough to spur an industry breakout relative to the rest of the Consumer Discretionary sector. Broadline retail surged out of a 1-year base and surpassed the May 2022 peak to reach its highest level since 2015.

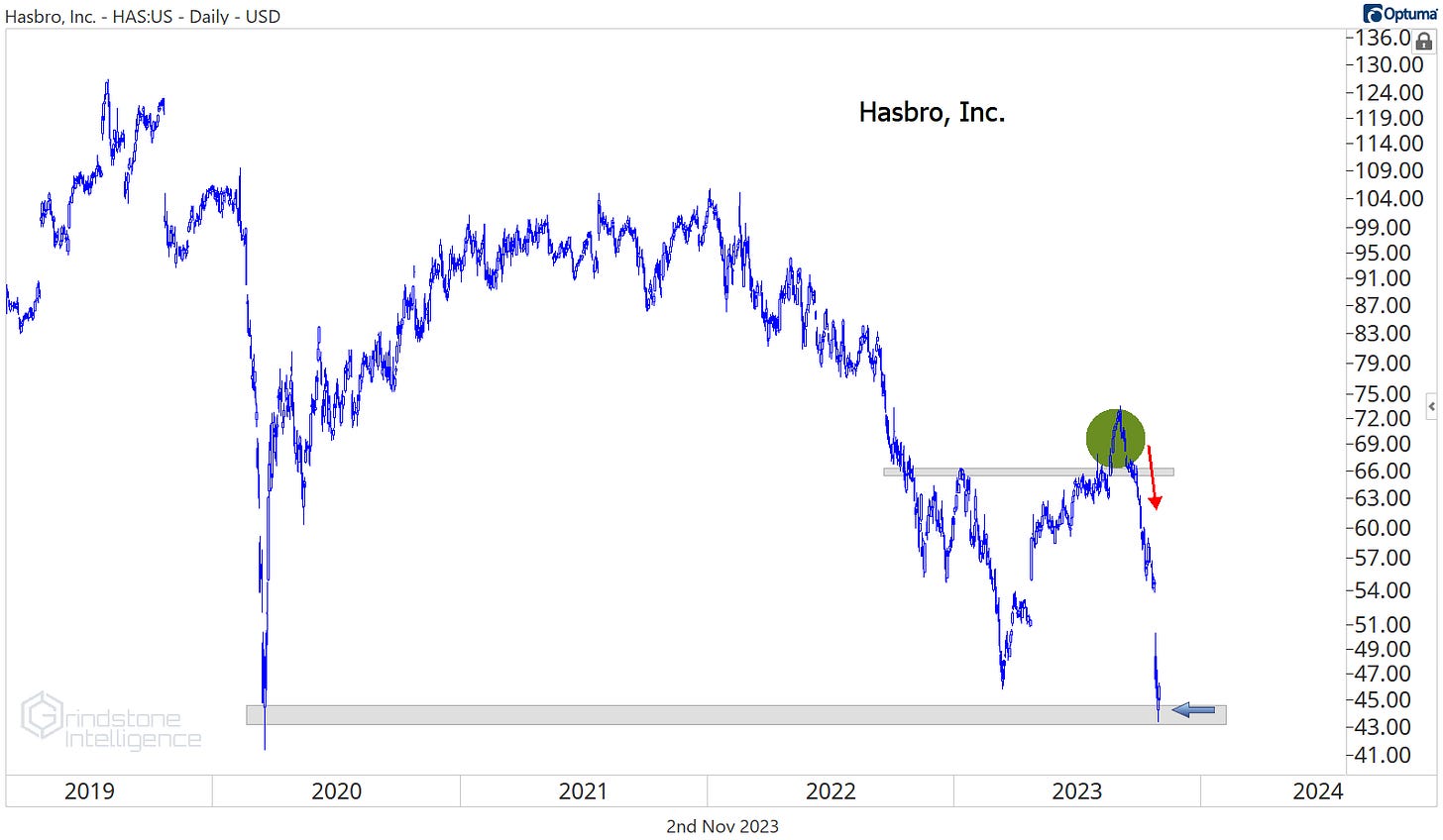

Leisure products, meanwhile, fell back to the bottom of the performance derby, a position the industry held for most of the spring. Here’s Hasbro, which reversed sharply lower following a failed breakout over the summer, and now is trying to find support at the COVID lows.

Despite the weakness, we don’t want to be shorting something that’s at such a significant area of former support. We’re not trying to catch a falling knife, either. Instead, we’re watching this one closely for informational purposes. If even the weakest stocks in the market can hold support instead of breaking down, that’s a sign of underlying strength in the market.

Leaders

Garmin outpaced even the gains in Amazon over the last 4 weeks, as it finally broke out of a tight consolidation range near the pre-COVID highs. We’re targeting a move to $132, which is the 161.8% retracement from the 2020 decline.

We continue to like the homebuilders, especially DR Horton, which rose 5% over the last month after a failed break below the 2021 highs.

The risk-reward setup is very favorable here. We only want to be long above last month’s lows at $100, with a long-term target of $170. That level is the 423.6% retracement from the entire 2005-2008 decline.

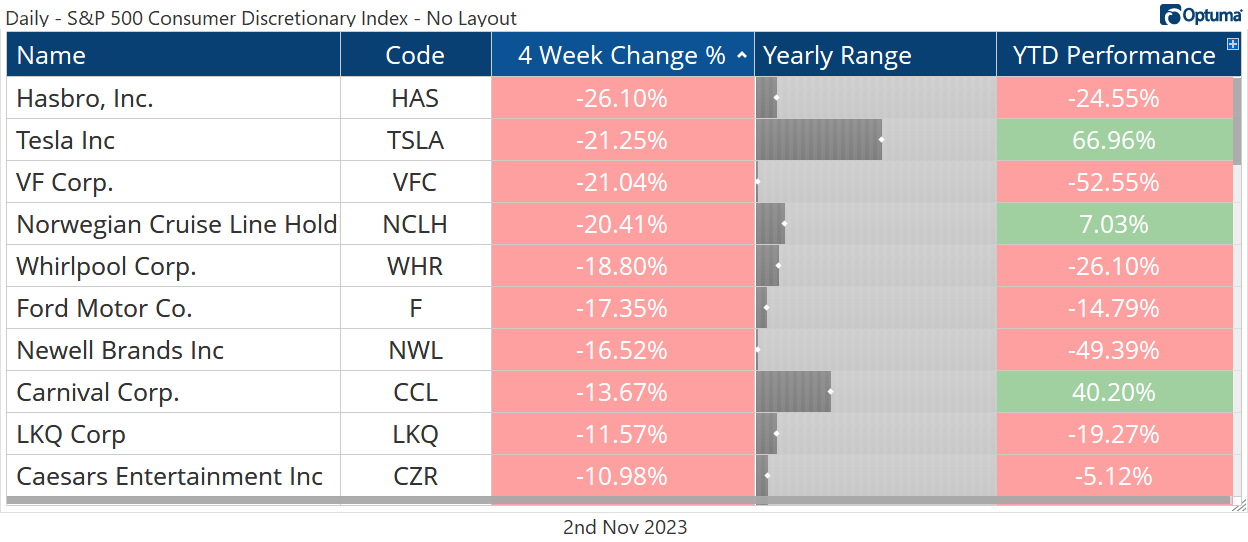

Losers

Carnival Cruise was one of the worst performing stocks in the sector over the last 4 weeks, but the decline wasn’t enough to push prices below their summer breakout level. The level to watch here is $11. As long as the stock is above that, we can be long with an initial target of $14, which is the 161.8% retracement from the late-2022 trading range. If stocks as a whole are rallying, though, CCL could easily get back to the year-to-date highs near $20.

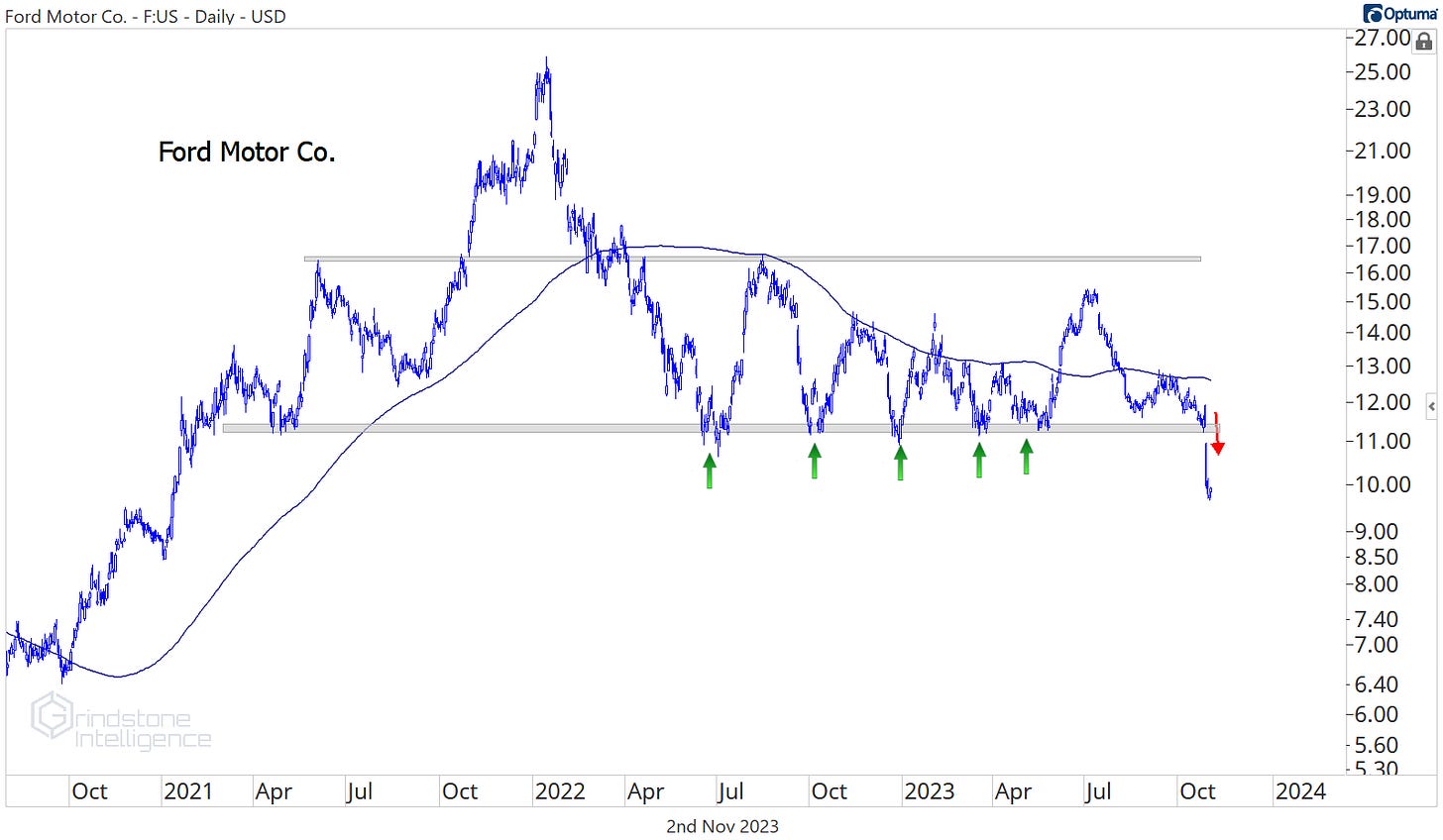

Ford was another big loser over the month, but the outlook here isn’t nearly as favorable. F dropped to its lowest point in nearly 3 years after breaking below key support at $11.25 - a level that had been tested half a dozen times over the last 18 months. Now, that former support will act as resistance on any move higher. We want to be shorting Ford on rallies toward $11.

Growth Outlook

True to its identity as a growth sector, Consumer Discretionary is expected by analysts to be a growth leader over the next two years. The group is on pace for 25% EPS growth in 2023, and analysts think the bottom-line will annualize at 14% in 2024 and 2025.

Those aggressive growth targets depend on significant margin expansion. If expectations are to be believed, Consumer Discretionary profit margins will reach 9.4% in 2025. The highest mark from 2010-2022, meanwhile, was 7.7%. The difference is at least partially due to a growing share of earnings contributed by higher margin businesses like Tesla. But there’s certainly a healthy amount optimism baked into these projections.