Consumer Discretionary: Sector Outlook

Top charts and trade ideas

In 2023, the Consumer Discretionary sector was among the best places to be. Along with the other two growth-oriented sectors (Information Technology and Communication Services) Discretionary stocks outperformed the benchmark S&P 500.

Leadership in 2024 hasn’t been too much different. It’s still Communication Services and Information Technology leading us higher. But the Consumer Discretionary sector has been notably absent from the leaderboard.

Since year-end, only Utilities and Real Estate have been worse.

Despite the underperformance, one thing’s for sure: we’re not looking at a downtrend. After a 3.4% rally over the last week, Consumer Discretionary is a whisker away from setting new multi-year highs.

The next thing we’ll want to see is confirmation from momentum. RSI hasn’t managed to reach overbought territory since December - we’d feel a lot better about the sector’s prospects if buyers proved just how ‘in control’ they actually are.

Momentum has already shown significant improvement on a relative basis. Compared to the S&P 500 overall, Consumer Discretionary has been testing 10-months lows. But momentum for the Discretionary/SPX ratio stayed out of oversold territory on the most recent decline. Further confirmation of that bullish momentum divergence would set the stage for sector outperformance in the weeks and months ahead - consistent with an ongoing bull market in stocks.

The recent surge strength isn’t the product of a handful of mega cap stocks rallying, either. Beneath the surface, Discretionary is even stronger. The equally weighted sector already broke out to new 2 year highs.

And even the small cap sector is in a clear uptrend - something you can’t say about the small caps as a whole.

If we look at the large cap sector’s constituents in relation to their moving averages, we can see that 8 in 10 Discretionary stocks are above their 50, 100, and 200-day moving averages. That’s consistent with the broad strength we’re seeing in the rest of the S&P 500 index.

The stock market is definitely not in a downtrend, and that means we should spend our time looking for stocks to buy.

Digging Deeper

There’s still a bit of a dichotomy within the sector. On the one hand, you’ve got the Broadline Retail and Household Durables industries up 77% and 58%, respectively, over the last year. On the other, you’ve the autos falling apart. Automobile Components is off 23% over the last 12-months, and the manufacturers are down 16% year-to-date.

Within Household Durables, the homebuilders continue to dominate. Check out the Homebuilding sub-industry relative to the S&P 500 index. Since breaking out of a 2 year base at the beginning of last year, this ratio has been stair-stepping steadily higher.

D.R. Horton is knocking on the door of our $170 target and just hit a new all-time high yesterday.

Lennar is also nearing our target of $170.

And PHM reached our $117 target yesterday.

The homies have had a great run, and we certainly don’t want to be betting against them. But we set targets for a reason. We want to see how they respond to these potential areas of resistance before initiating new longs. On further strength, we’ll be targeting the next key Fibonacci retracement levels for all 3.

Leaders

Another area of strength has been the Hotels, Resorts, & Cruise Lines sub-industry. Relative to the S&P 500, they’ve been consolidating above former highs after a multi-year breakout.

NCLH was the top performing stock in the entire sector over the last 4 weeks, but within the cruise lines it’s Royal Caribbean that offers the best setup. RCL just hit a new all-time high.

The target on RCL is $200, which is the 161.8% retracement from the 2020 decline. We can be buying it as long as it remains above those former highs of $135.

Within the hotels, Hilton is making progress towards our $230 target.

And for Marriot, we’re still targeting $307.

Tractor Supply has been one of the sector’s best performers this year, gaining 24%. What we really like about it is this structural strength relative to the rest of the market. This is a textbook backtest after a big, multi-year base breakout.

And we finally got the absolute breakout we’d been waiting for. The risk/reward isn’t quite as good as it was when we highlighted this chart last month, but there’s still plenty of room to the upside. Our target for TSCO is $360.

Ebay is interesting. Last month we pointed out that EBAY had just broken down to its lowest level vs. the rest of the market in 20 years. From failed moves come fast moves in the opposite direction.

The risk level is very clearly defined here, too, since EBAY just broke out to new 52-week highs.

What we’d like to see for further confirmation is a completion of the reversal relative to the rest of the market overall. Compared to the S&P 500, EBAY is still stuck beneath the 2018-2022 lows. Until we see that, we’re a bit wary that the outperformance can continue.

Carmax is another downtrend reversal to keep an eye on. This is a beauty.

But we still haven’t seen enough on the relative strength side to have a lot of confidence in long-term outperformance.

The risk is so clearly defined that we’re fine with owning KMX above $86. But we only want to continue owning it for an extended period if it can break this downtrend relative to the rest of the market. Our target in that scenario is the former highs near $150.

Losers

Why has the overall sector lagged in 2024 if there’s been so much strength beneath the surface? Blame a lot of it on Tesla. Compared to the S&P 500, TSLA stopped going up in January 2021. and it’s fallen apart over the past few months.

Down 30% for the year, this is the place buyers need to step in and defend. If TSLA is below $160, watch out. In any case, this isn’t something we want to be approaching from the long side. If trading big messy ranges is your thing, then sure, go ahead. But we’d much rather focus on uptrends and relative strength.

Relative weakness is something to avoid. Check out restaurants breaking down to new 52-week lows vs. the rest of the market.

Starbucks, McDonald’s and Darden are the ones to blame - they’re all on the biggest losers list for the last month. It’s not so much that those stocks are doing that badly. DRI and MCD aren’t far from their all-time highs. But the rest of the market is surging, and these guys haven’t participated.

Chipotle is a different story. It’s setting new highs on both an absolute and a relative basis, despite the weakness within the sub-industry. Our target on CMG is $4000, and we want to be buying any pullbacks towards the most recent breakout level near $2600.

Booking landed on the biggest losers list over the last month, but that’s not a reason to dislike it. We want to take advantage of pullbacks within uptrends. We like BKNG long above $3650 with a target up at $5200, which is the 423.6% retracement from the 2019-2020 decline.

Especially if it can complete this 10-year base breakout relative to the rest of the Discretionary sector.

More charts to watch

Amazon has reversed a multi-year downtrend relative to the S&P 500 index. That’s not bearish.

The setup isn’t too clean right here, but we definitely want to be approaching it from the long side. On a breakout to new highs above $188, we think AMZN goes to $250.

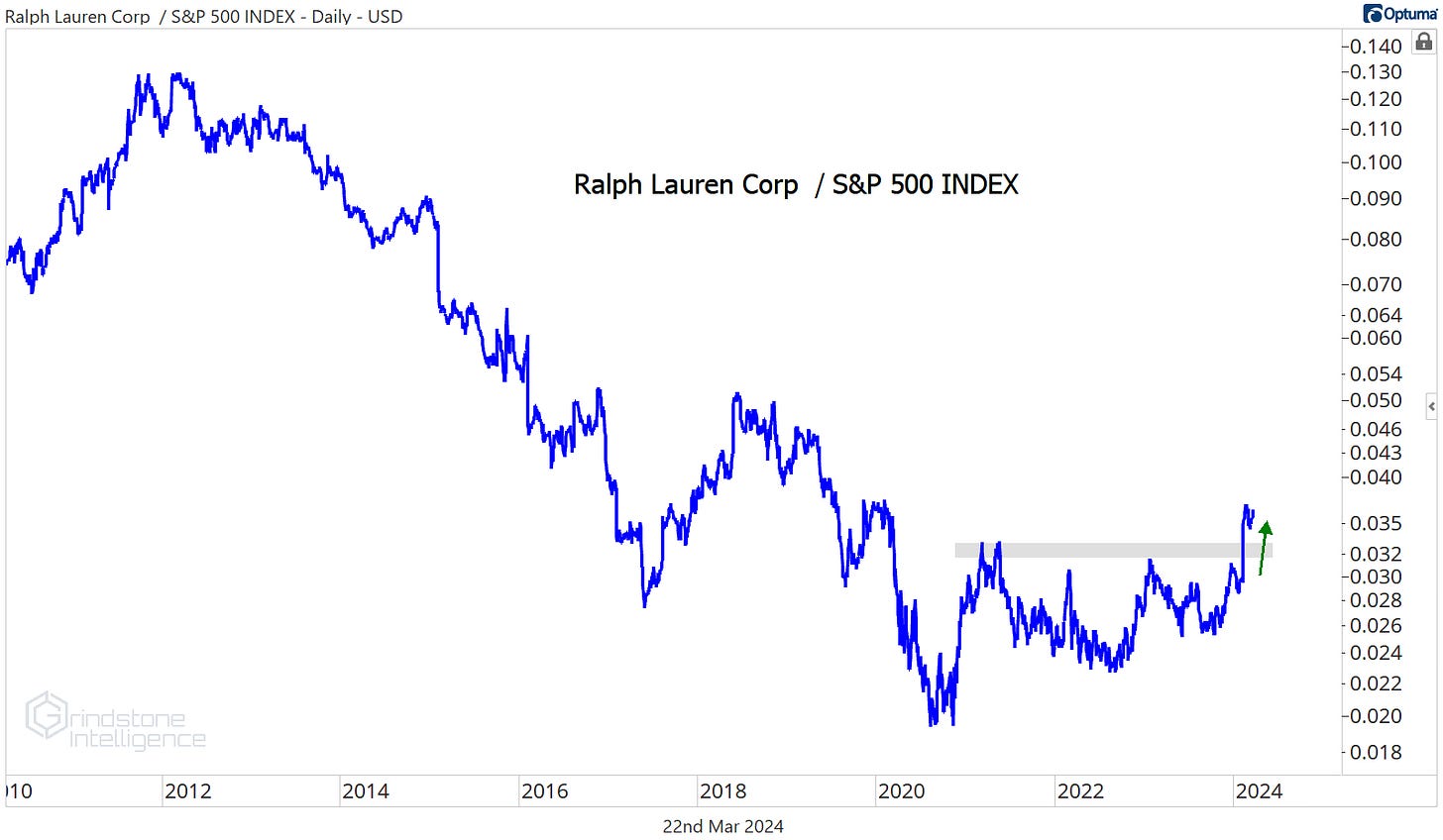

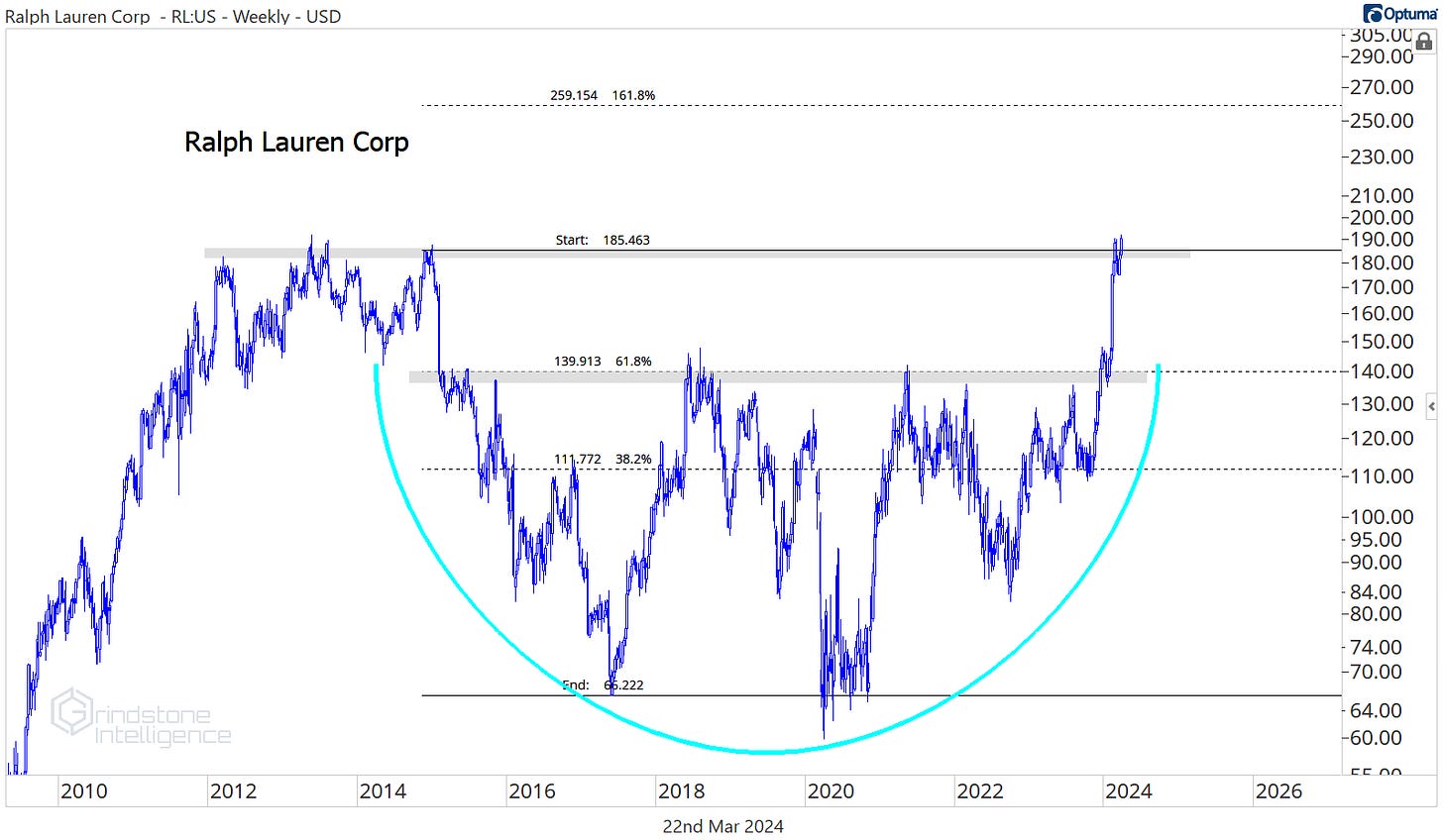

Ralph Lauren has completed a relative downtrend reversal of its own - this one lasted for 10 years.

On an absolute basis, these former highs are a logical spot for RL to take a breather. But longer-term, we like the relative strength profile and want to be looking for opportunities to get long. We want to be buying a pullback to support near $140, or on a sustained breakout above $185. Our target is $260.

The automobile manufacturers and the auto parts suppliers have struggled of late, but not the auto parts retailers. O’Reilly has been a monster.

Last month we pointed out this 18-month consolidation for ORLY vs. Consumer Discretionary after a multi-year uptrend. That looks like a textbook flag pattern to us, with a resolution higher. With relative strength like that, we think the stock goes to $1500. We want to be buying any pullbacks towards our risk level of $1060.

That’s all for today. Until next time.