Consumer Discretionary Sector Outlook

Top charts and trade ideas

In 2023, the Consumer Discretionary sector was among the best places to be. Along with the other two growth-oriented sectors (Information Technology and Communication Services) Discretionary stocks outperformed the benchmark S&P 500.

Leadership in 2024 hasn’t been too much different. It’s still Communication Services at the top, and Tech is still an outperformer. But the Consumer Discretionary sector has been notably absent from the leaderboard.

Since year-end, only the Real Estate sector has been worse.

The year-to-date weakness has pushed Consumer Discretionary to new 11 month lows relative to the S&P 500 Index:

Consumer Discretionary is generally considered a ‘risk-on’ sector.

If the value of a stock is the present value of all its future cash flows, then the stock of a company that will grow future cash flows at an above-average rate should be worth more. If above-average growth rates fail to materialize, though, the higher price is no longer justified, presenting investors with considerable downside risk as valuation multiples correct.

That’s a key dynamic for the Consumer Discretionary sector - earnings trajectories for Discretionary companies are closely tied to economic strength, so during healthy economic periods, we should expect the sector to outperform. That fact that they aren’t outperforming is a warning sign.

Or perhaps not.

Discretionary’s relative weakness in 2024 has more to do with the disastrous performance of one especially large component (we’re looking at you Tesla). If we strip away the impact of market capitalization, we see a different story: Discretionary is still above its October lows.

And if we go one step further and look at the small cap space, risk appetite looks even more healthy. Here, small cap Consumer Discretionary is stair-stepping higher.

There’s more good news. Despite the selloff across the broader market landscape over the past few weeks, the sector is still in a clear uptrend on an absolute basis.

As long as last summer’s highs continue to act as support, we can continue to approach both the sector and the rest of the market from the long side.

Digging Deeper

Take a look at the year-to-date industry performance within Consumer Discretionary, and you’ll find a dichotomy. On the one hand, you’ve got Broadline Retail - home to Amazon, the sector’s largest component - up 18%. On the other, you’ve got Tesla and the Automobiles industry off 35%.

Tesla’s weakness isn’t anything new. Compared to the S&P 500, it stopped going up in January 2021. And it’s really fallen apart over the past few months. Now TSLA is threatening to hit multi-year relative lows:

It’s already hit new 52-week lows on an absolute basis.

There’s no reason to be buying TSLA down here. In fact, if you’re bearishly inclined toward the overall market, TSLA is a pretty attraction short option.

What’s interesting is that some of the other autos aren’t looking too bad at all. General Motors has been outperforming all year, and has successfully put an end to the relative downtrend that persisted from 2021-2023.

We really like the risk/reward potential here for GM as it tries to break out above the 2017 highs. We don’t want any part of it as long as it’s stuck below $46, but on a bullish resolution higher, we can be buying it with a target at the former highs of $65.

Leaders

Amazon reversed a multi-year downtrend relative to the S&P 500 index in the middle of last year, and it’s been rising steadily ever since.

An entry right here doesn’t make sense while it consolidates below the former highs, but we definitely want to be approaching it from the long side. On a breakout above $188, we think AMZN goes to $250.

Ebay is worth watching as it consolidates just below resistance from its 2018-2022 lows relative to the S&P 500. On a completion of this failed breakdown, we want to be looking for buying opportunities.

On an absolute basis, the risk is very clearly defined. We could see both absolute and relative resistance broken at the same time if the stock jumps above $52. And if that happens, we want to be buying EBAY with an initial target of $61.

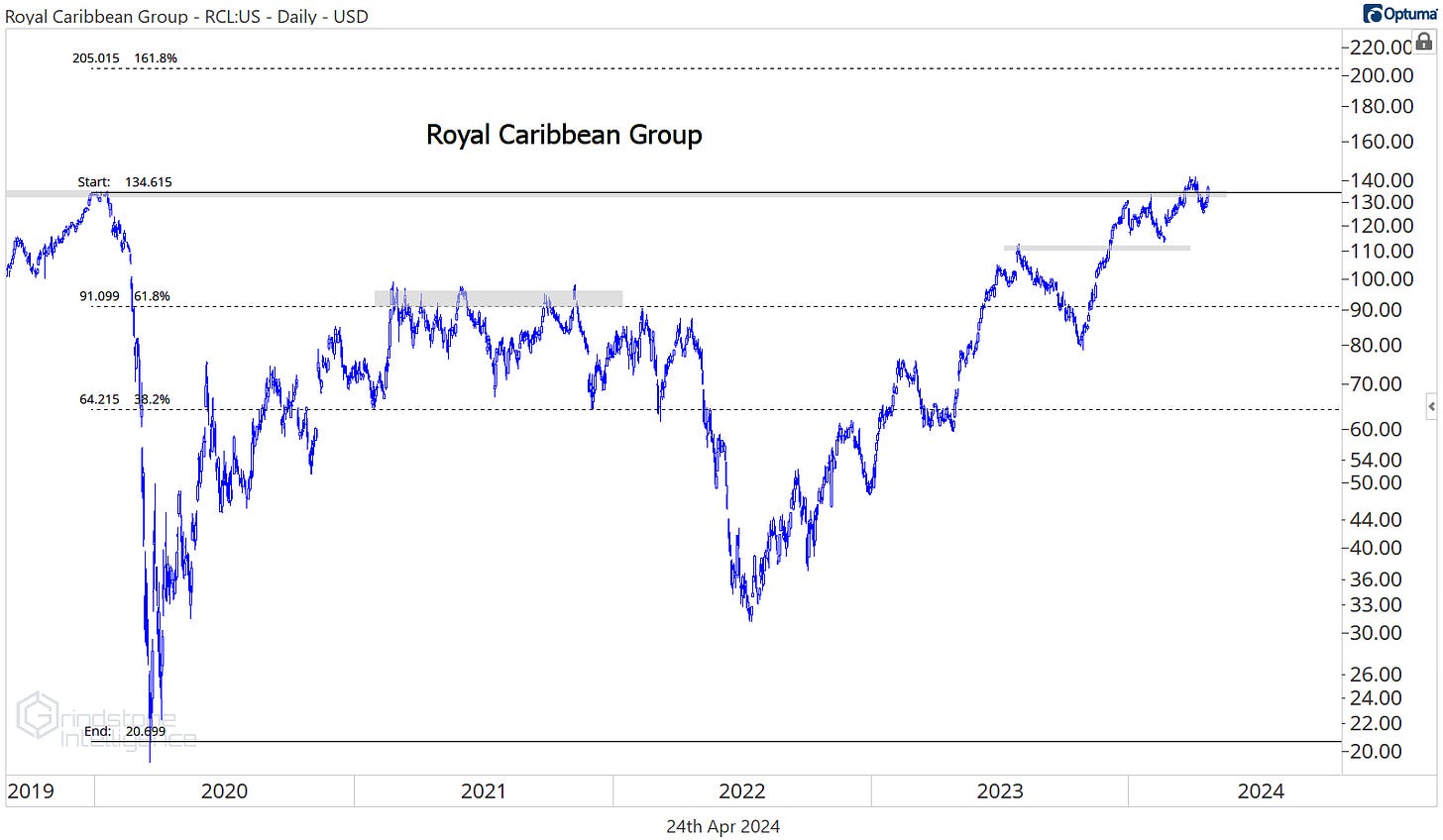

Royal Caribbean was down over the last 4 weeks, but it still snuck in on the biggest winners list. We love the relative strength profile in RCL - compared to the S&P 500, it just broke out of a multi-year base.

The target on RCL is $200, which is the 161.8% retracement from the 2020 decline. We can be buying it as long as it’s above the 2020 highs of $135.

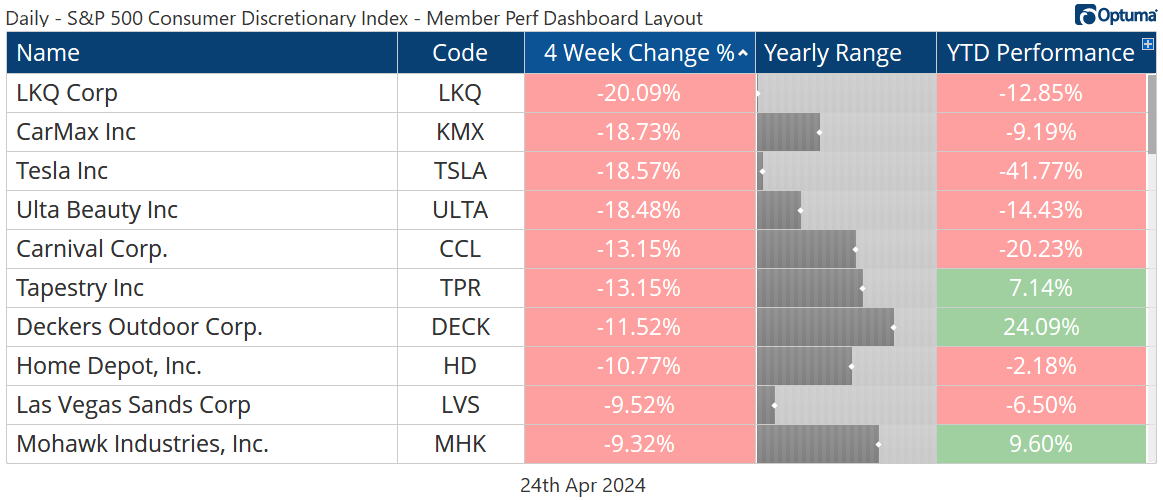

Losers

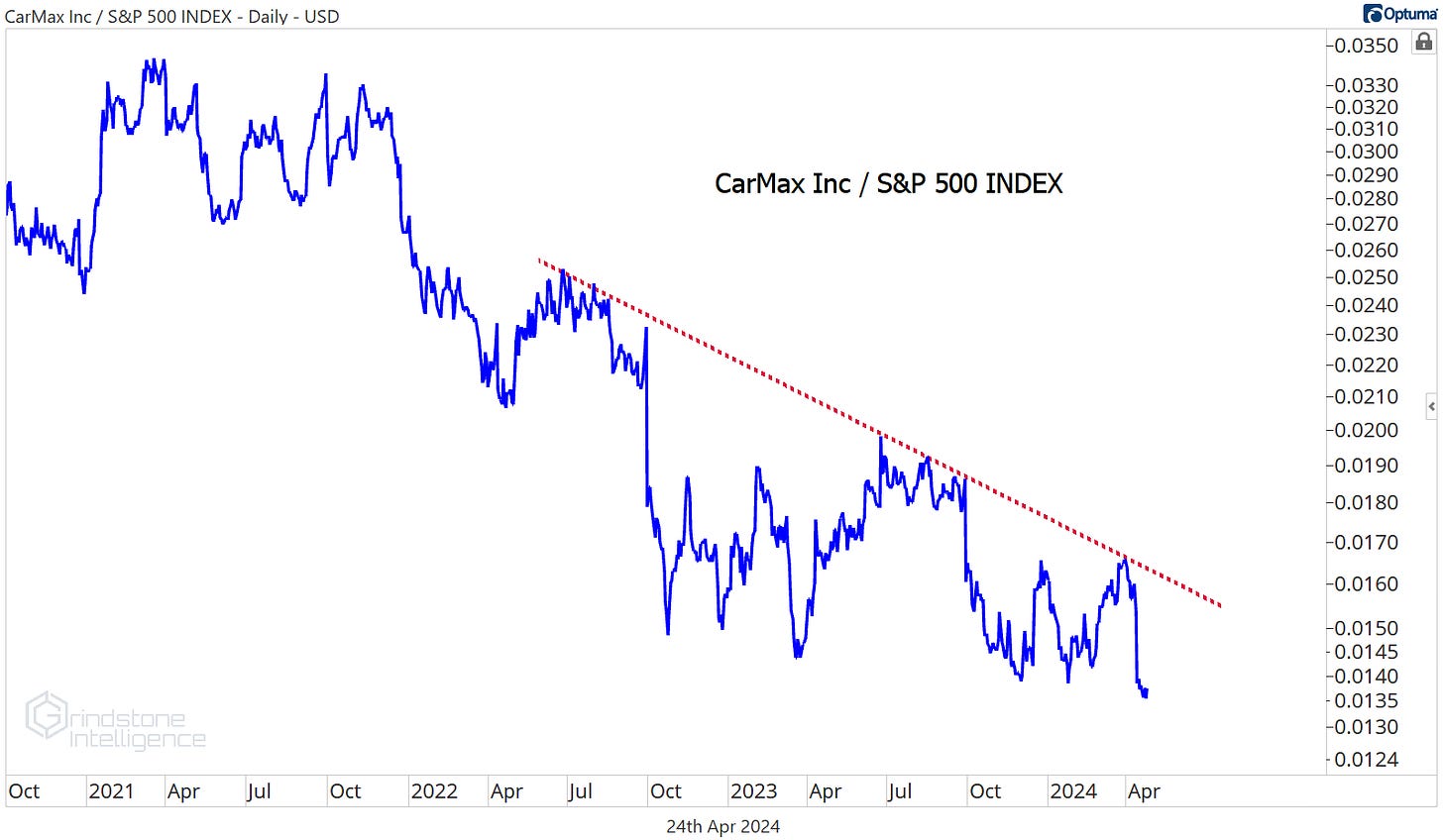

A month ago we had our eye on CarMax as it tried to break a 2 year downtrend line versus the rest of the market. Unfortunately for KMX, trends are more likely to persist than reverse course. This one is best left alone until it can show sustainable relative strength.

Deckers Outdoor is the opposite: it’s a picture of relative strength, despite an 11% drop over the past month. DECK broke out of a 10 year base versus the S&P 500 index in late-2022, and it hasn’t looked back.

Here’s how we’re looking at the stock right now. Longer-term, we’re targeting $1500, which is the 1109% retracement from the 2020 decline. But, as always, we want to be able to manage risk on our entry. We can do that on a pullback towards $615 (if it happens during the course of a broader market correction) or on a breakout above the 685.4% retracement at $950.

More Charts to Watch

We stepped to the side on the homebuilders after they stalled out near our targets.

One of the homies continues to show relative strength, though, despite rising interest rates. NVR is setting new highs compared to the S&P 500:

And it’s consolidating above the 161.8% retracement from the 2022 decline. We like that we can manage risk with that $7500 level on new entries. From there, we’re targeting $9900.

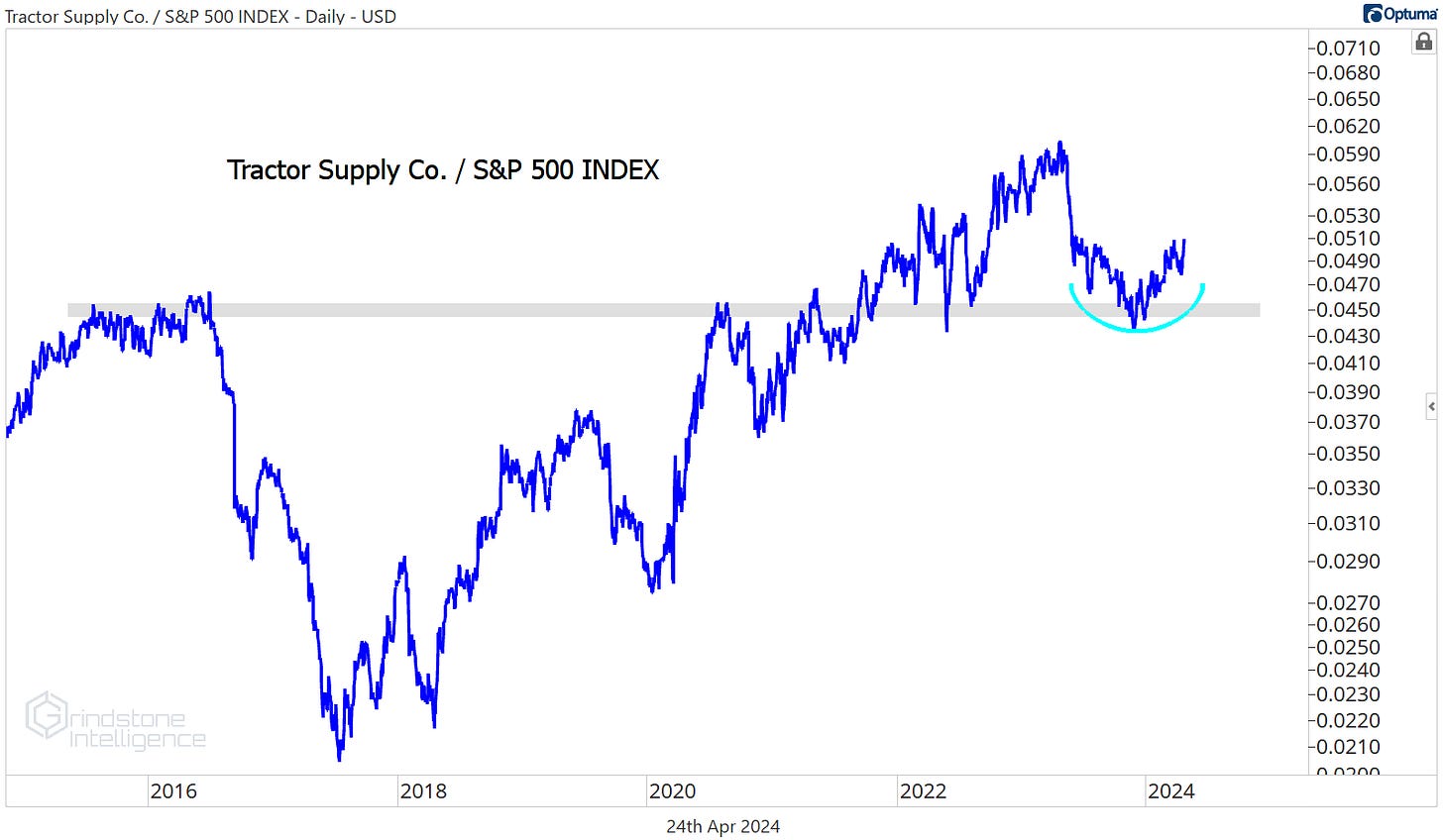

Tractor Supply has been one of the sector’s best performers this year, gaining 19%. What we really like about it is this structural strength relative to the rest of the market. That was a textbook backtest after a big, multi-year base breakout.

And we just got a big absolute breakout, too. The risk is very clearly defined as TSCO consolidates above the former highs of $240, which is also the 423.6% retracement from the 2015-2017 decline. Our target is the next key retracement from that decline, which is up at $360.

That’s all for today. Until next time.