Consumer Staples Hit New Relative Lows

It is a bull market, you know

In bull markets, it’s the offensive areas of the market that lead. When prices are trending higher and the economy is booming, people don’t spend a bunch of time thinking about the risks. Who cares about those dividend-paying stocks that grow sales at 2% every year by selling toothpaste and diapers when you can buy a high-flying artificial intelligence pioneer with a trillion dollar TAM?

No one, apparently, because the sector that’s full of companies selling toothpaste, diapers, tobacco, and frozen peas keeps setting new lows vs. the rest of the market.

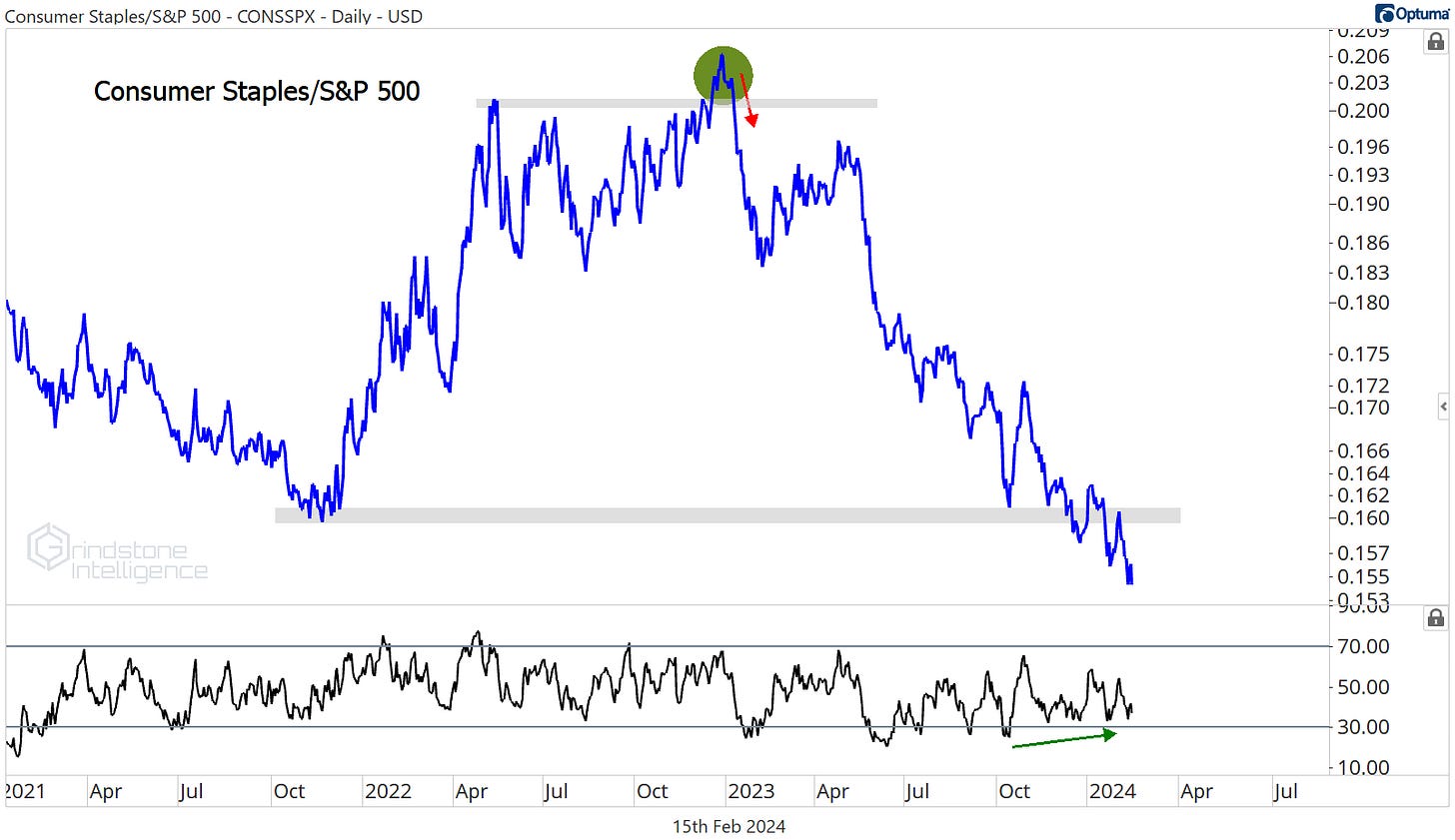

Sure, momentum for the Consumer Staples/S&P 500 ratio has managed to stay out of oversold territory since October, setting the stage for a potential failed breakdown and a mean reversion higher. But bullish momentum divergences don’t mean anything without price confirmation.

If we look at Staples on a weekly Relative Rotation Graph, with our benchmark as the SPX, we can see just how weak the sector is. In a perfect world, we’d expect a sector to move around the RRG in a clockwise fashion, moving from the Improving quadrant (blue), to Leading (green), to Weakening (yellow), and then to Lagging (red) before the cycle repeats. But for the last year, the Consumers Staples have been stuck on the left side of the graph, unable to reach the Leading quadrant even on rallies. The Staples are guilty until proven innocent.

It’s not just a matter of mega cap growth dominance either. If we compare the equally weighted Consumer Staples to the equally weighted S&P 500, we see the same thing. Momentum is working on a bullish divergence, but that doesn’t mean anything until the Staples stop breaking down to new lows.

To be clear, seeing the Consumer Staples underperform is a good thing. The Staples should be underperforming in bull markets. That’s evidence of risk appetite, and risk appetite is what drives stock prices higher.

What would not be so good is seeing the Consumer Staples fall outright. We want prices to rise in bull markets no matter which sector we’re looking at. That’s why we’re watching this chart of the equally weighted Staples as they consolidate just above a key rotational level.

This area was resistance in the fall of 2020 before turning into support in 2021 and 2022, so there’s plenty of memory here. A break below would signal not only more trouble for the Staples, but also a headwind for the stock market as a whole.

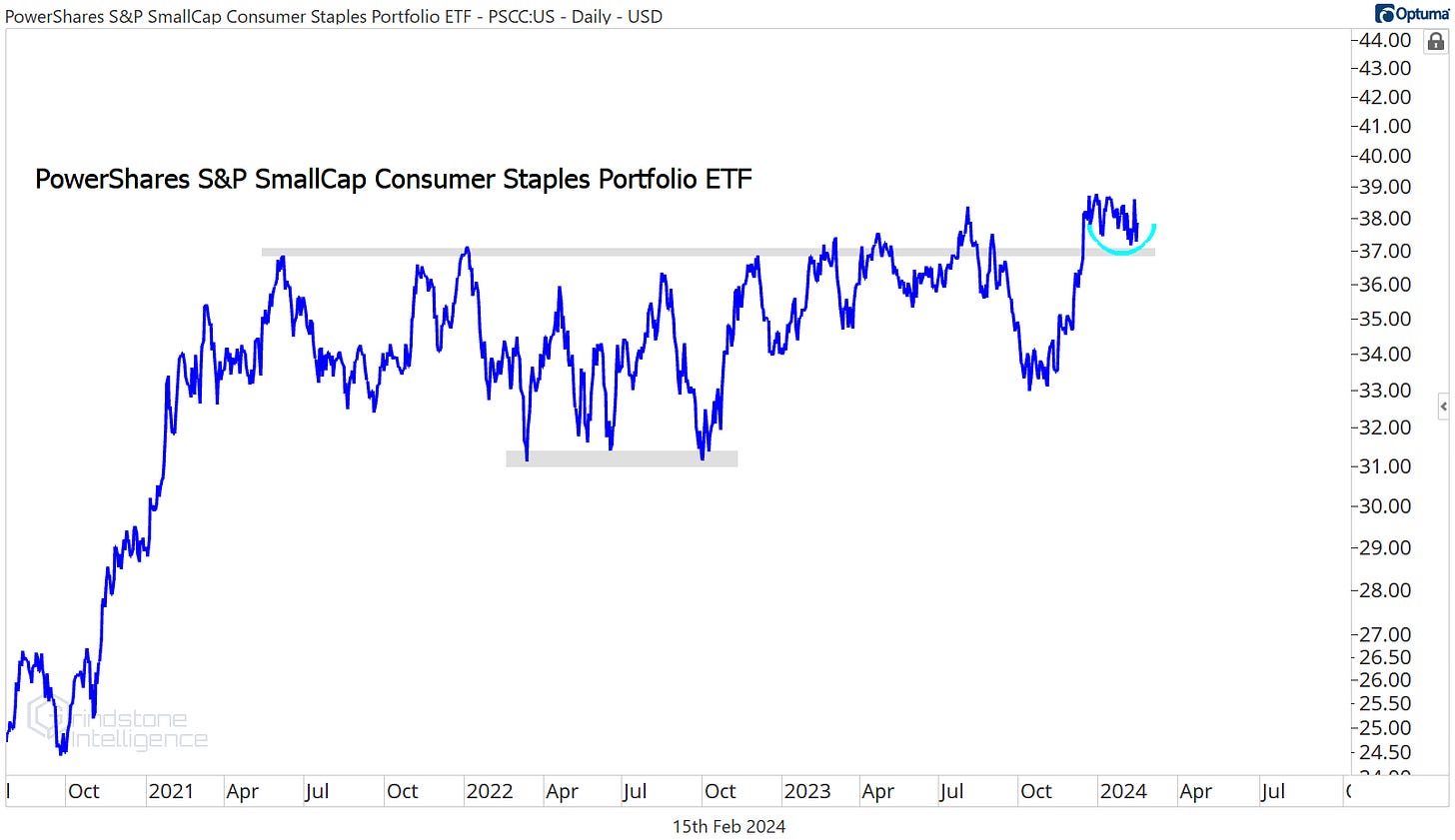

It could be that this is just a large cap problem, though. The small cap Consumer Staples are doing just fine. They were hitting new all-time highs at the end of December and are consolidating above former resistance from the 2021-2023 consolidation range.

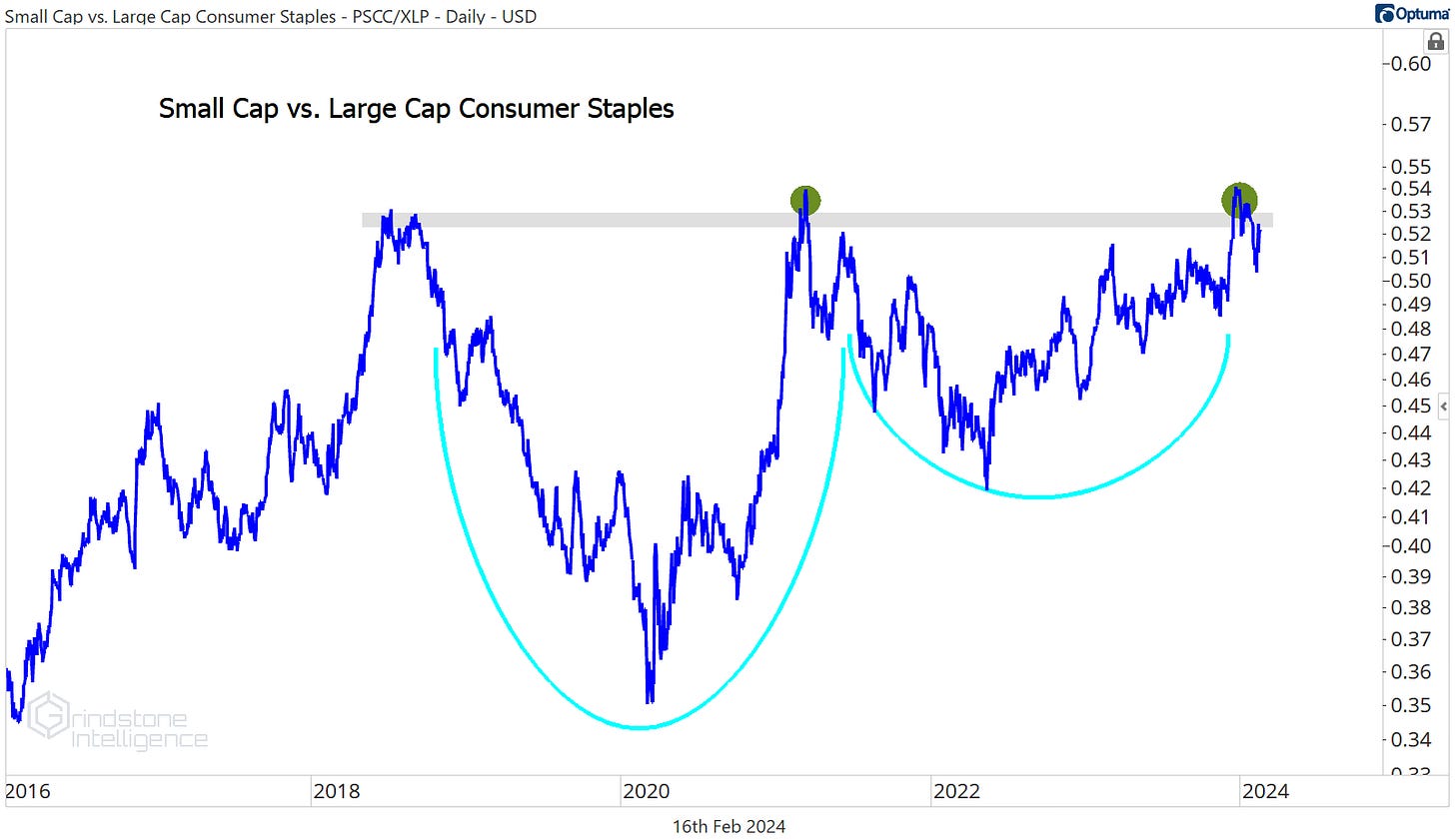

And if we compare the small caps directly to the large caps, we can see the small cap Consumer Staples sector is threatening to break out of a huge, 5-year cup-and-handle base relative to the large cap sector. The bigger the base, the bigger the resolution.

So if you’re in a position where you have to own the Staples sector, don’t sleep on the small caps.

Digging Deeper

Half of the Consumer Staples sub-industries have fallen over the past year. That’s pretty shocking when you consider that the total S&P 500 has risen 20% over that timeframe. In fact, every single group has lagged the benchmark index.

Among the worst offenders lately is the Packaged Foods & Meats sub-industry, which failed to hang above the 2021 relative lows.

The one to watch here is Tyson, which is trying desperately to find support at lows from more than a decade ago.

For now, there’s absolutely no reason to own TSN if it’s below $57. The first attempt to get past that level turned into a nasty failed breakout, which could set the stage for a breakdown to new lows. Or it could have just been a false start. If TSN can take some time to regroup and get back above $57, we like it long with a target of $70.

Leaders

If you’re looking for a headache, spend some time looking at Estee Lauder. It was the top stock in the sector of the last 4 weeks, gaining 13.8%. Yet somehow, it’s still down for the year.

EL is working on finding a bottom here near the 2020 lows, but it’s still got plenty of work to do. After the initial failed breakdown, we saw a mean reversion back to the 200-day, and now further digestion is likely. The risk/reward is ok from the long side as long as EL is above $137, but we’d rather just avoid this one entirely and focus on stocks that are showing relative strength.

Like Costco.

In a world where the Consumer Staples sector is getting crushed by the rest of the market, Costco is an outlier. Here it is setting new relative highs against the S&P 500.

We continue to think COST goes to $800.

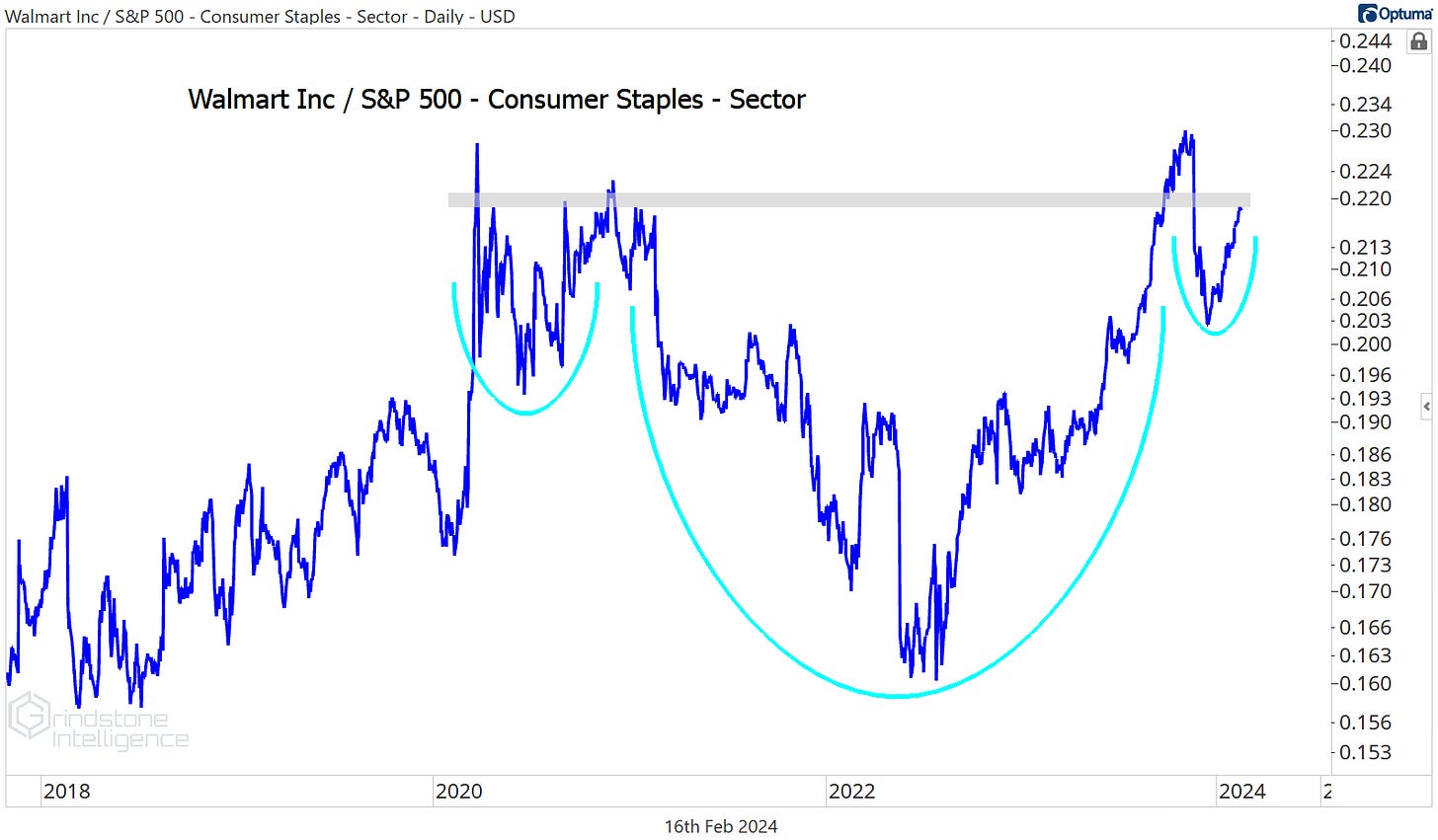

Costco peer Walmart is similarly strong. It’s not showing quite as much strength relative to the overall market, but check out this inverse head and shoulders pattern shaping up vs. the rest of the Staples sector. A breakout here would set WMT up for a big run of outperformance.

We can be long WMT above $152 with a target up near $200, which is the 423.6% retracement from the 2018 selloff. Don’t ignore how momentum has stayed out of oversold territory for the last 18 months and is getting overbought on rallies - that’s a big feather in the cap for the bulls.

Target has been the laggard in this space, which means we’ve avoided been avoiding it for quite some time - laggards tend to continue lagging. But no trend lasts forever, and TGT is making good progress towards a reversal. More importantly, the risk/reward setup here is better than it is right now in COST and WMT. We can be long Target only if it’s above $140 with a target back at the summer 2022 highs of $180.

Losers

Archer Daniels was the worst stock in the sector over the last month after reports of accounting discrepancies hit the wire and the CFO was placed on administrative leave. The drop has ADM trying to find support at the 2015 highs.

If catching falling knives was our thing, maybe this would pique our interest. Catching falling knives is not our thing.

More Charts to Watch

We do like this bottoming action in Hershey Company. It was a big disappointment in 2023 after being a big winner in 2022, but it really stopped falling almost 6 months ago, and it did so at a pretty logical place: the Fibonacci 138.2% retracement from the 2020 decline. That’s also where prices stalled out in mid-2021.

We really like the risk/reward setup for HSY when compared to the rest of the Staples. In ‘22 the Hershey/Staples ratio broke out of a huge cup and handle base. It’s reversed sharply over the last year, but now that we’re backtesting the initial breakout level, we’re watching for signs that a new leg higher is beginning.

We want to be long HSY above $190 with an initial target of $215. Longer term we think it goes back to $240.

Monster Beverage continues to consolidate below the 161.8% retracement from the 2021-2022 decline.

This was one of the best stocks in the world over the past 25 years, and even though it hasn’t gone anywhere for the past year, its uptrend relative to the rest of the Consumer Staples sector hasn’t been damaged at all. We want to be long MNST with a target of $470, which is the 261.8% retracement from the 2021-2022 trading range.

We’re less excited about the prospects for Dollar General. It’s possible that DG just blows right past the COVID lows - which are currently acting as stiff resistance - in an attempt to fill the gap from last summer, but we’d rather take a wait-and-see approach on the stock for now.

Especially with the relative weakness we’re seeing. Compared to the S&P 500, DG is failing at resistance from the 2014-2017 relative lows.

Remember, losers have an unfortunate tendency to keep on losing, and this stock isn’t showing us any evidence of a reversal yet. There’s no reason to be involved from the long side until it does.

Until next time.