Consumer Staples Sector Deep Dive

What the Staples say about risk appetite

In bull markets, it’s the offensive areas of the market that lead. When prices are trending higher and the economy is booming, people don’t spend a bunch of time thinking about the risks. Why bother with a dividend-payer that increases sales at a measly 2% every year by selling toothpaste and diapers when you can buy high-flying growth companies with limitless opportunities?

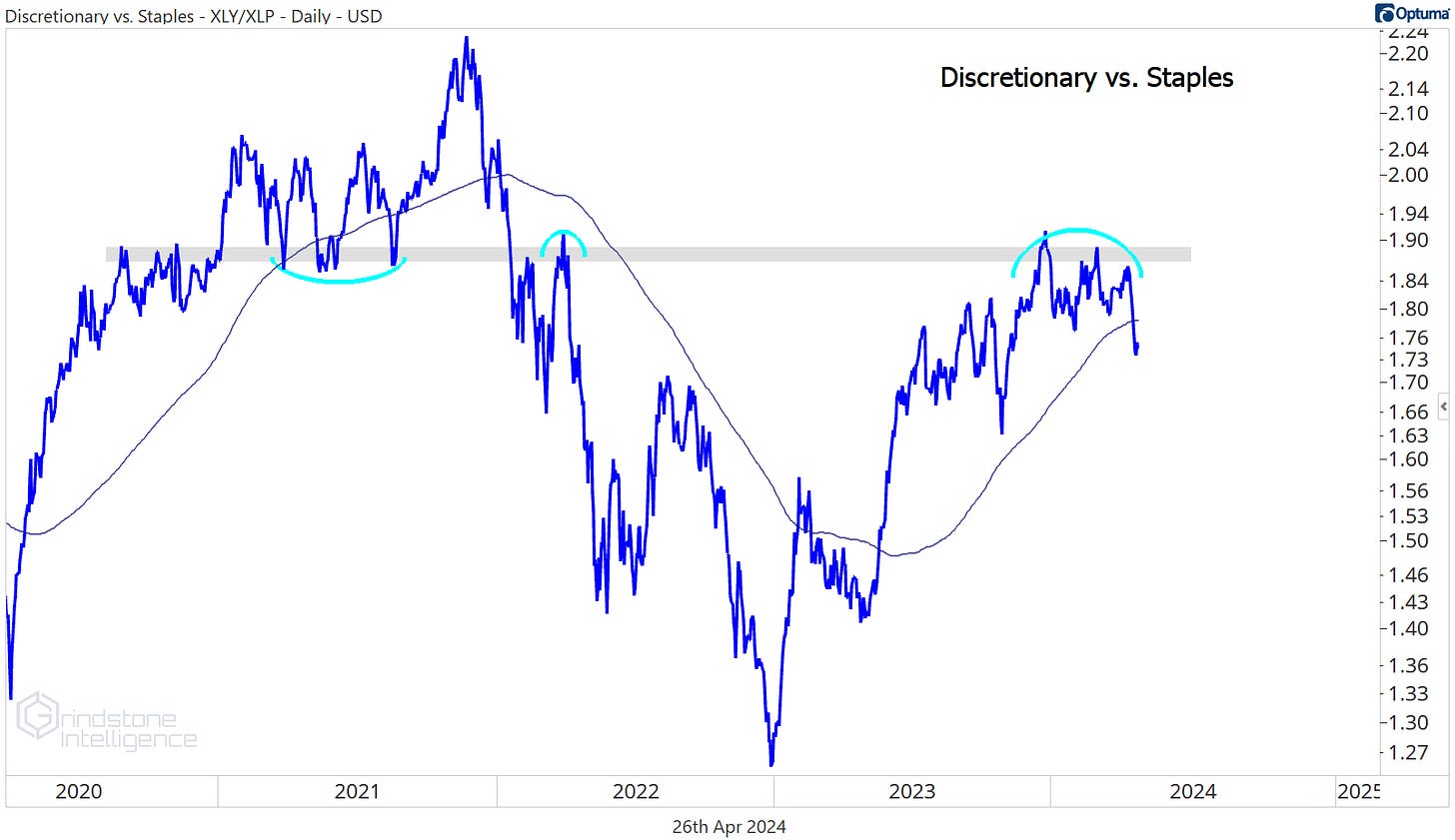

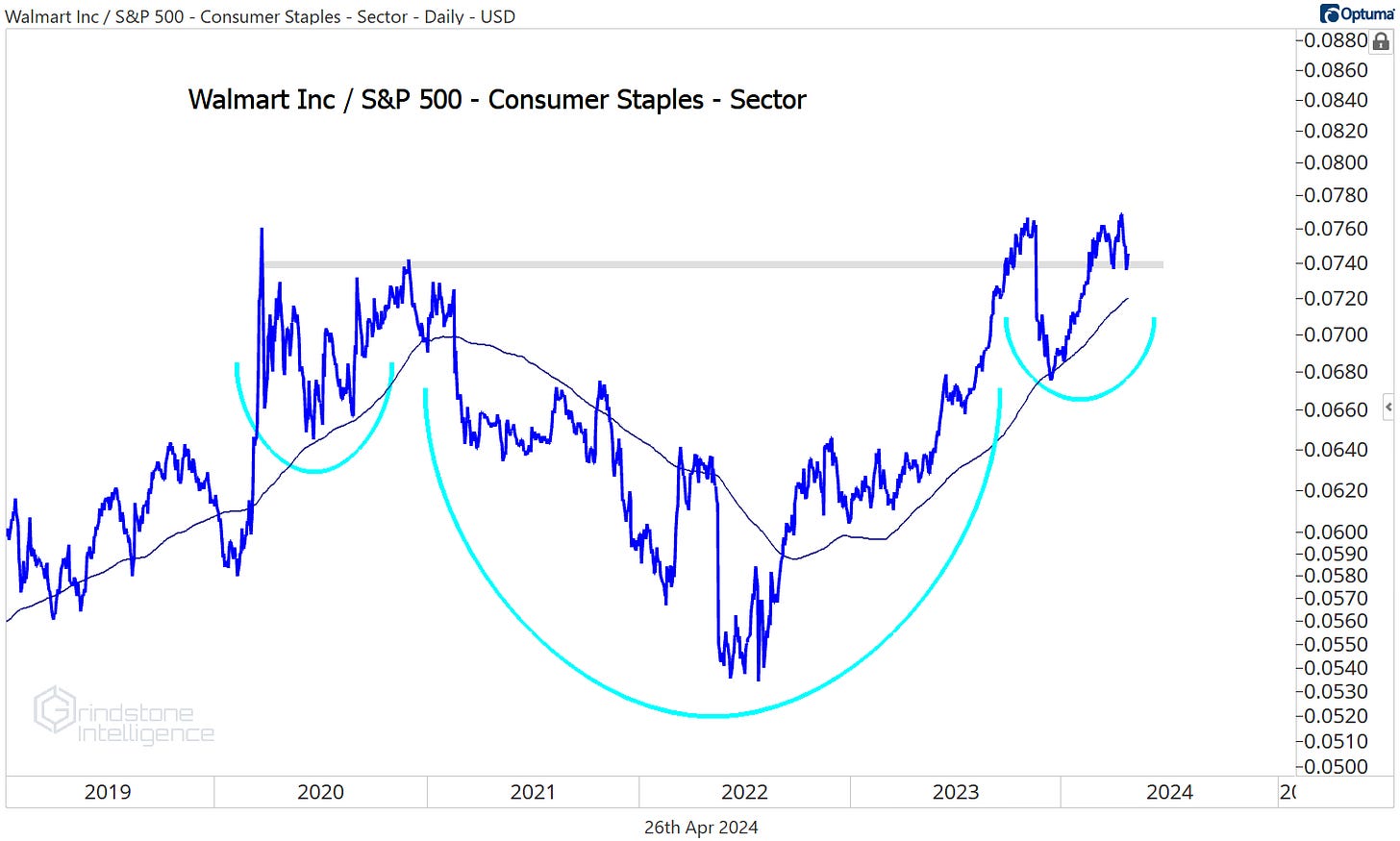

That’s the type of environment we’ve with been dealing with for most of the last year. The Consumer Staples sector - the one filled with companies selling toothpaste, diapers, tobacco, and frozen peas - peaked relative to the rest of the market in January 2023 and has been setting lower highs and lower lows ever since. Even though we saw a bullish momentum divergence and have gotten a mean reversion rally higher over the past month, the long-term downtrend is still intact. That’s the case so long as the 2021 lows are acting as resistance.

Another way to gauge risk appetite is to look at the Staples and compare them with the Consumer Discretionary sector. Consumer Discretionary companies are more similar to the Staples than say, a regional bank earning money on net interest margins, so we get a relationship that’s more apples to apples. The only difference is the products sold by companies in the Discretionary sector are more closely tied to economic strength. You’re probably not getting a new car or doing a big home remodel during a recession, but you’re still going to the grocery store and buying toilet paper.

So when the Consumer Discretionary/Consumer Staples ratio troughed at the end of 2022, then rose steadily for the next 10 months, that was evidence of buyers showing preference for the riskier, growthier stocks in the market.

However, the Discretionary/Staples ratio peaked in December after running into a key rotational level from the 2021 lows, and this week dropped to new 5-month lows.

Is that a sign of investors fleeing for safety and a harbinger of bad things to come? Maybe.

But things aren’t quite as bad as they appear at first glance.

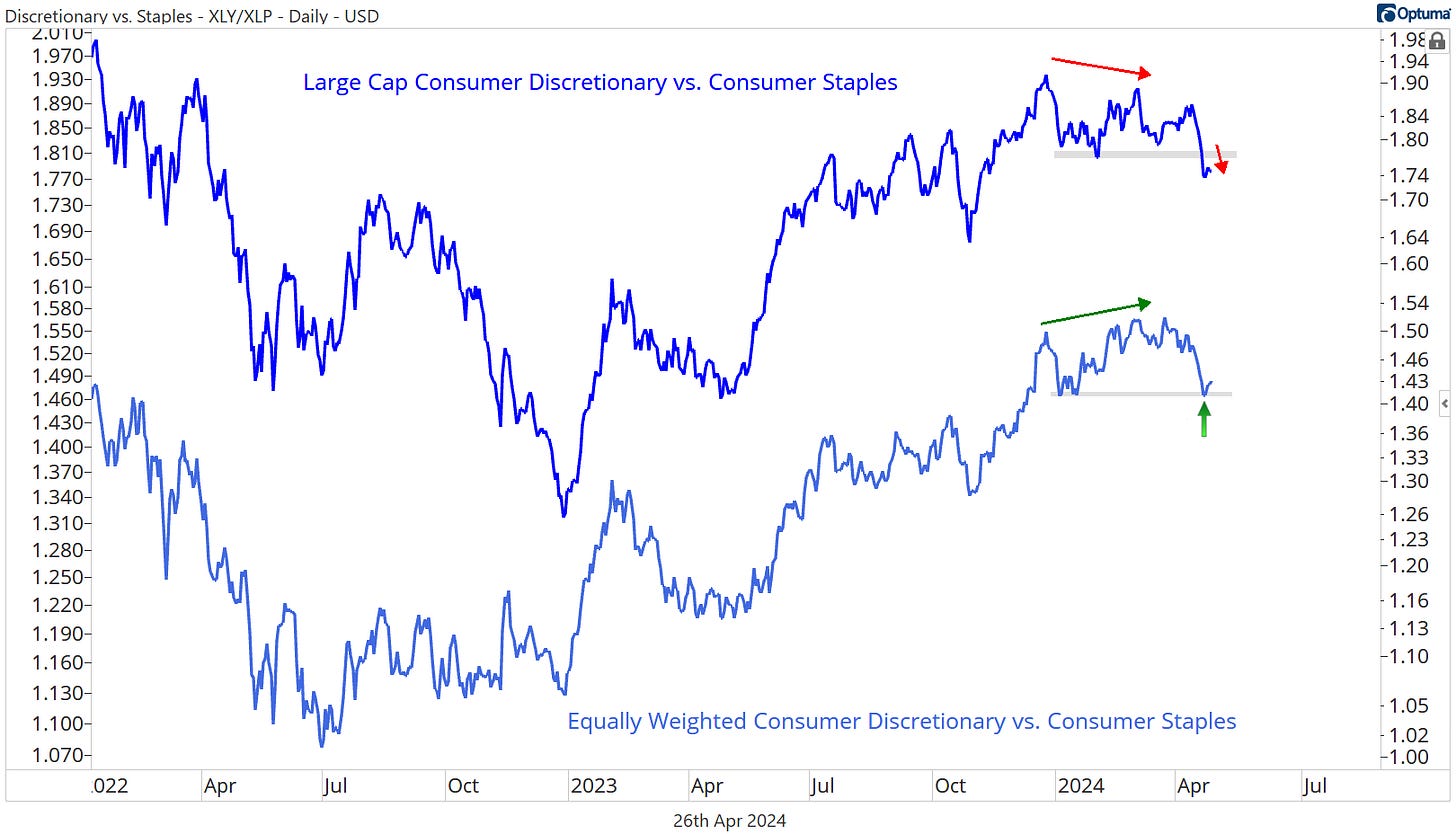

The relative weakness in Consumer Discretionary over the last few months is largely attributable to just one stock. Tesla is the second largest stock in the sector, even though it’s lost 40% of its value since last summer. If we strip away the outsized influence of stocks with big market capitalizations and look at equally weighted versions of the sectors instead, the Discretionary/Staples ratio hasn’t broken down.

If we see the equally weighted Consumer Discretionary sector break down vs. the equally weighted Staples, and also see the Staples stabilizing above their 2021 lows relative to the S&P 500, then we’ll have serious concerns about the level of risk appetite in the equity market. For now, that’s not the world we’re living in.

Here’s one more thing to keep an eye on: the Consumer Staples on an absolute basis are trying once again to break out of this 3-year trading range.

The Consumer Staples and other risk-off areas of the market don’t outperform by rising in bear markets, but by falling less. Breakouts are bullish.

Digging Deeper

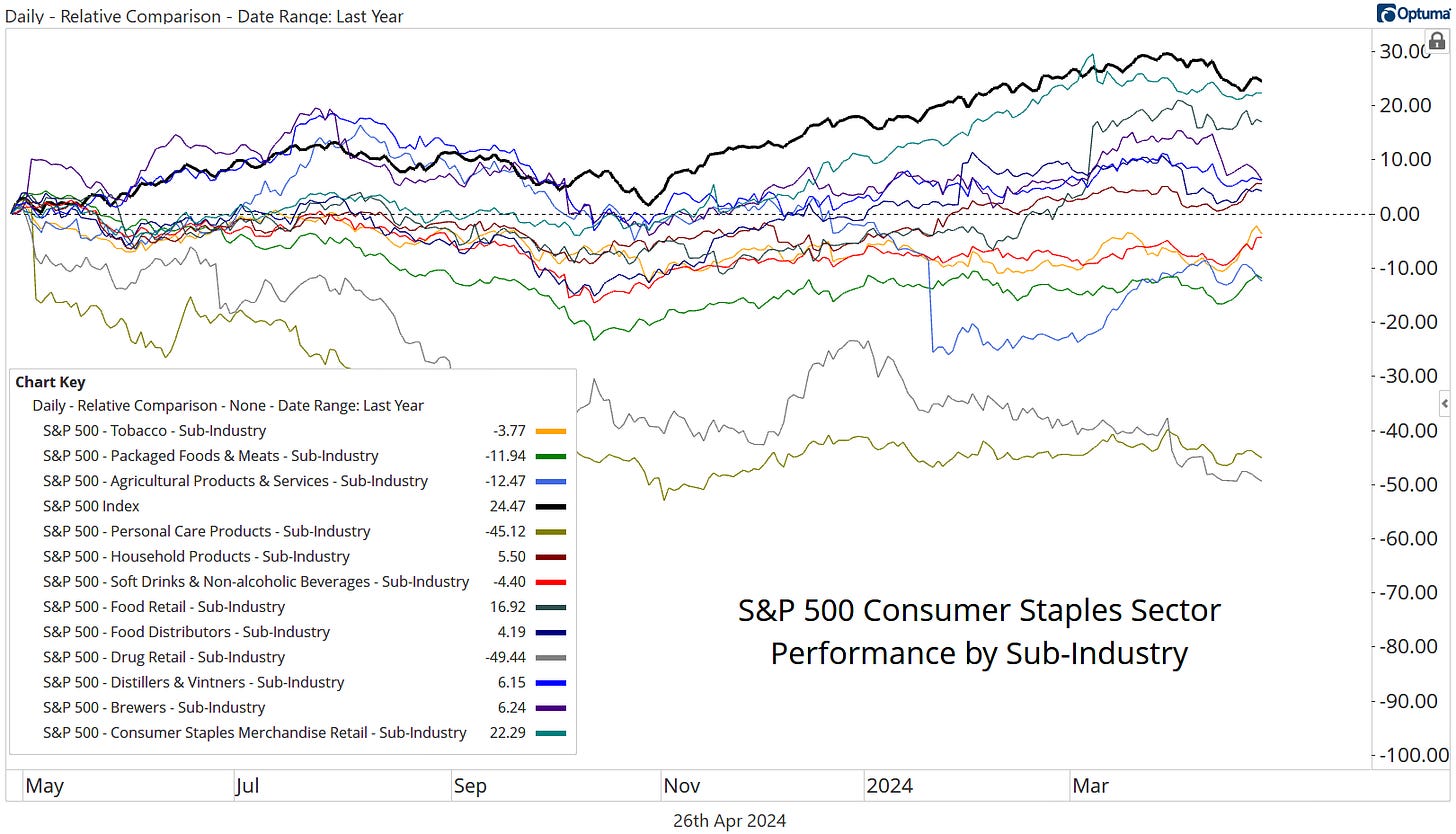

Only half of the Consumer Staples sub-industries have fallen over the past year, but the underperformance has been broader. No group has managed to outperform the overall S&P 500 index over that time.

Merchandise Retail has been close, though.

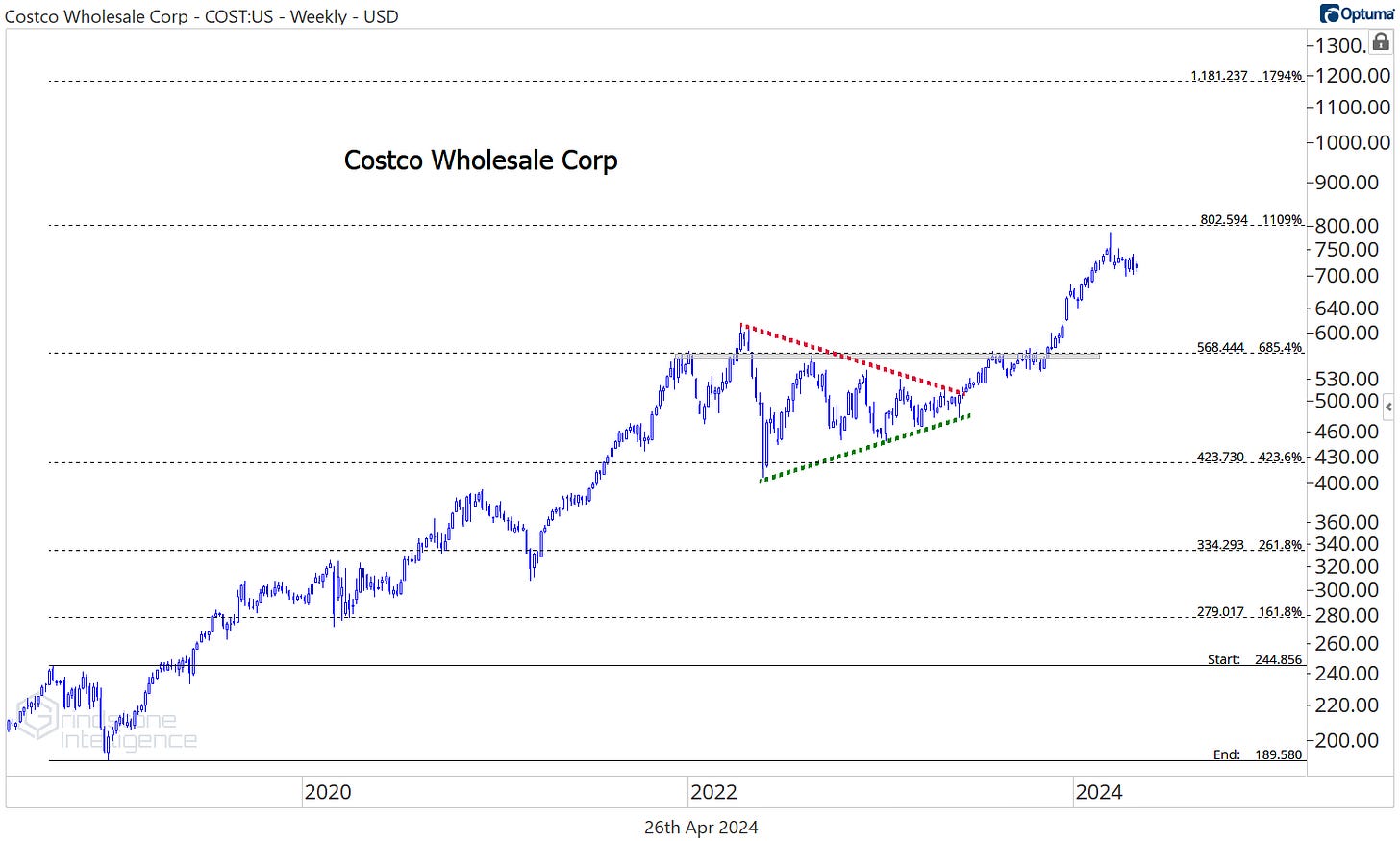

In a world where the Consumer Staples sector is getting crushed by the rest of the market, Costco is an outlier. Late last year, it broke out to new relative highs against the S&P 500. The pullback over the last few months hasn’t damaged the structure of the uptrend in place.

However, COST topped out just shy of our $800 target, and it could take some time to digest its gains over the last few months. This isn’t a great place for new entries.

Costco peer Walmart is similarly strong. It’s not showing quite as much strength relative to the overall market, but check out this inverse head and shoulders pattern shaping up vs. the rest of the Staples sector. That sets WMT up for a big run of outperformance.

We still think WMT will go to the 423.6% retracement from the 2018 selloff, which is at $66 (instead of $200) following the stock split earlier this year. Don’t ignore how momentum has stayed out of oversold territory for the last 18 months and is getting overbought on rallies - that’s a big feather in the cap for the bulls.

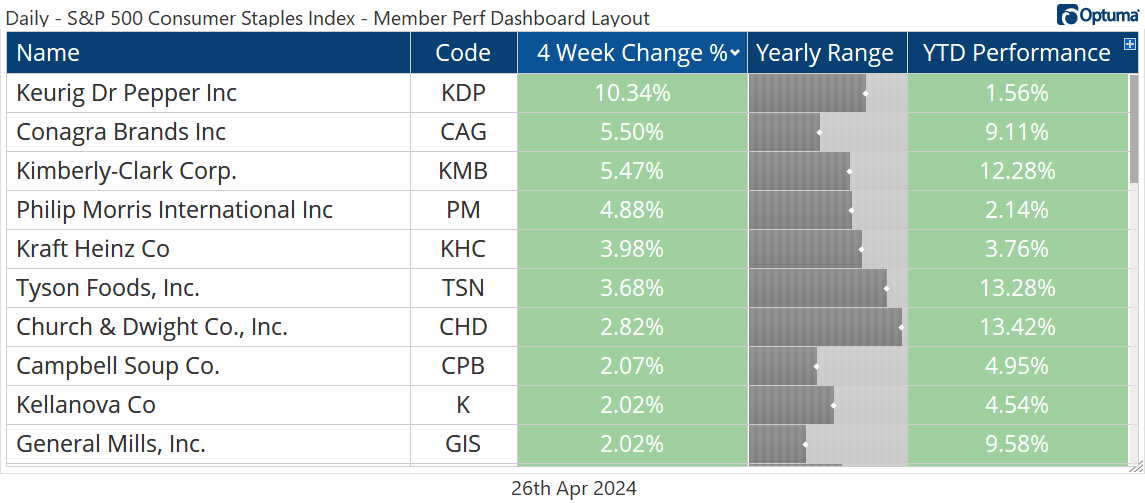

Leaders

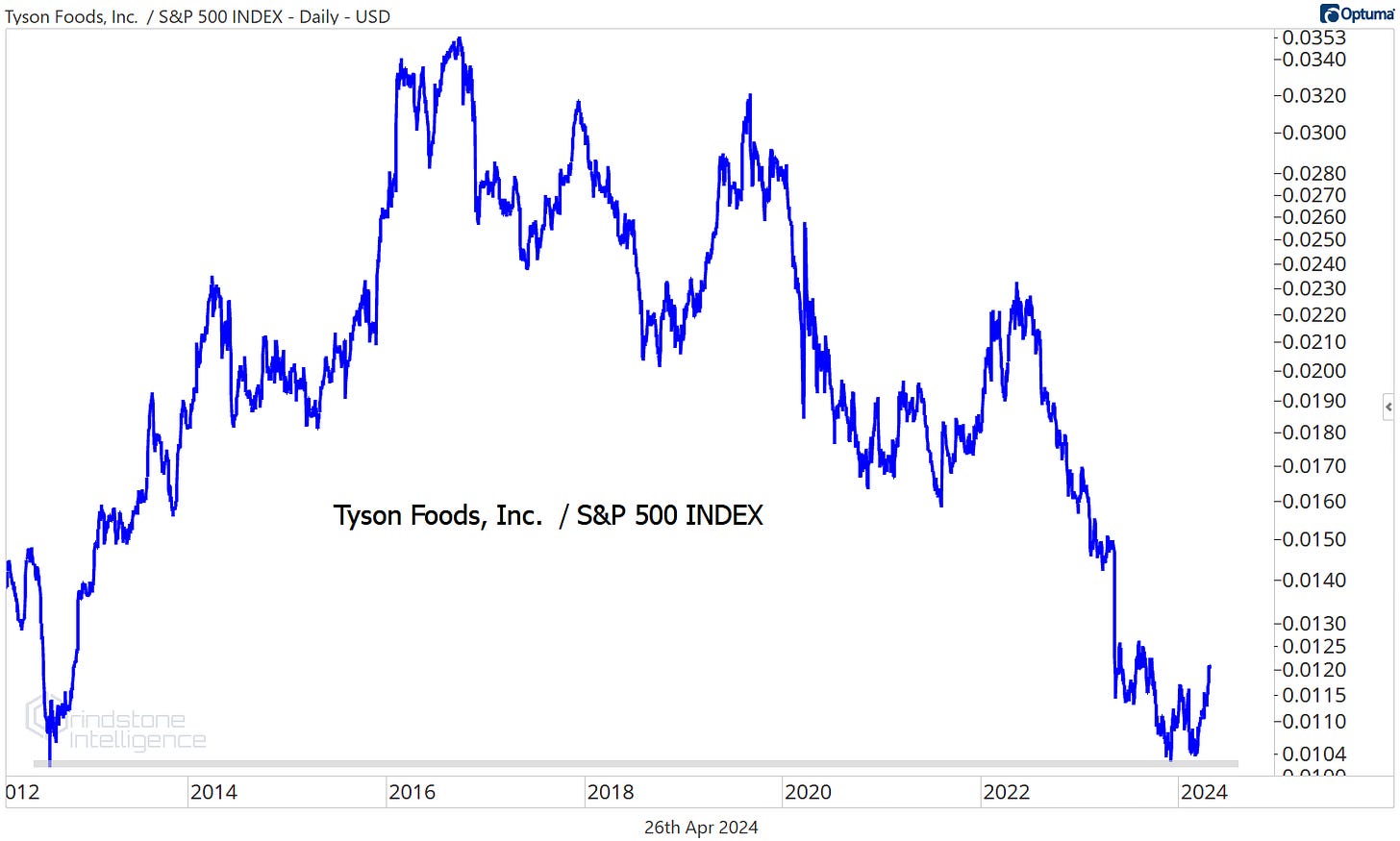

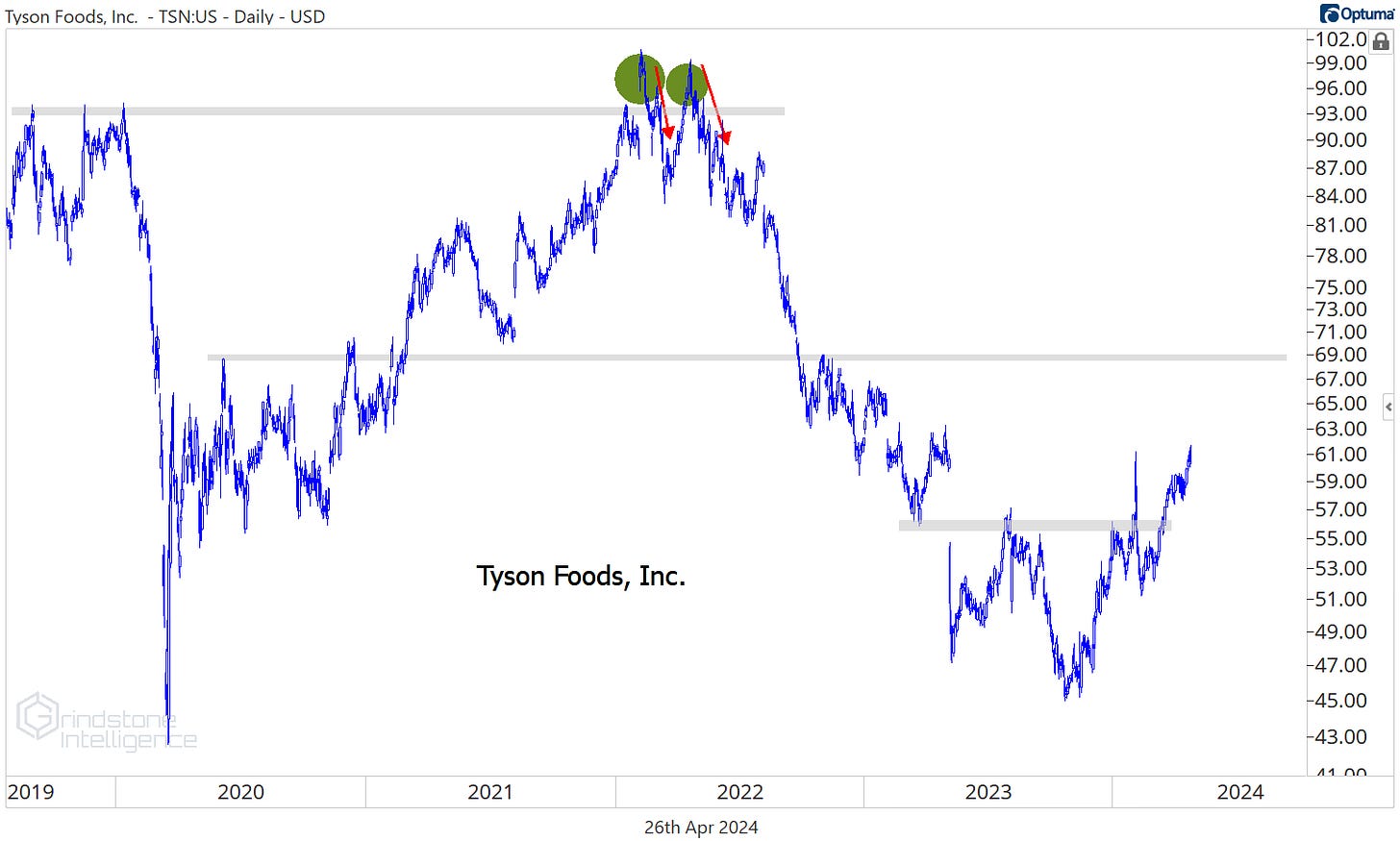

Tyson has been on our radar for a few months now given its potential for a massive reversal in relative strength. It’s trying to bottom against the rest of the market at the same level it did back in 2012.

We never want to be blindly betting on a trend reversal just because prices approach a logical level of support - we need to see price confirmation. For Tyson, that’s what we got. The stock rebounded from those former lows and just hit new 6-month highs vs. the rest of the market.

The bottoming action continues for TSN on an absolute basis, too. We’ve liked it long above $57 and continue to do so with a target of $70.

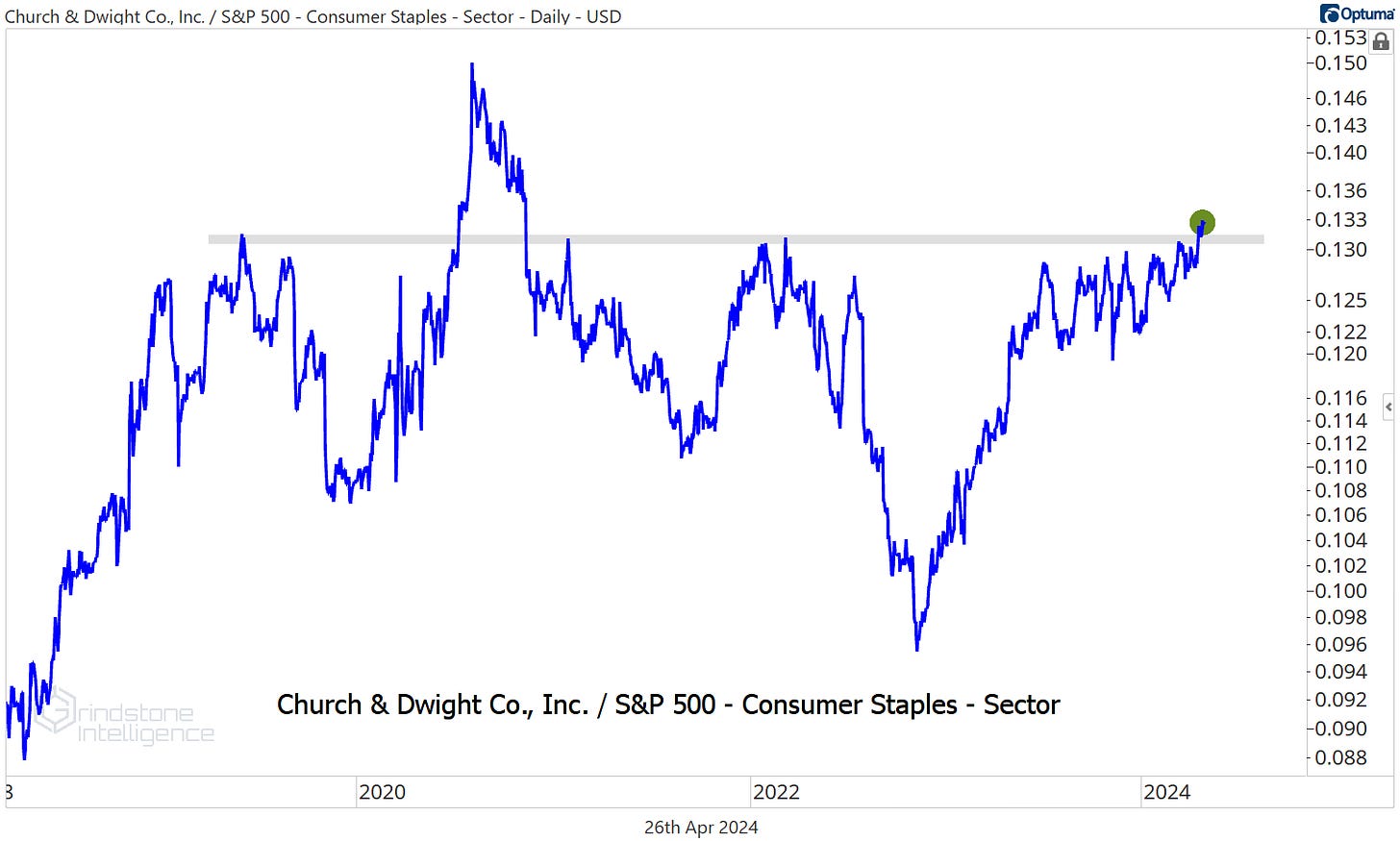

We like Church & Dwight, too, but for different reasons. This isn’t a downtrend trying to reverse - CHD just hit a new all-time high.

And compared to the rest of the sector, it’s breaking out above a key resistance level that’s been in place for most of the last 5 years.

We can be buying CHD above $105 with a target of $126.

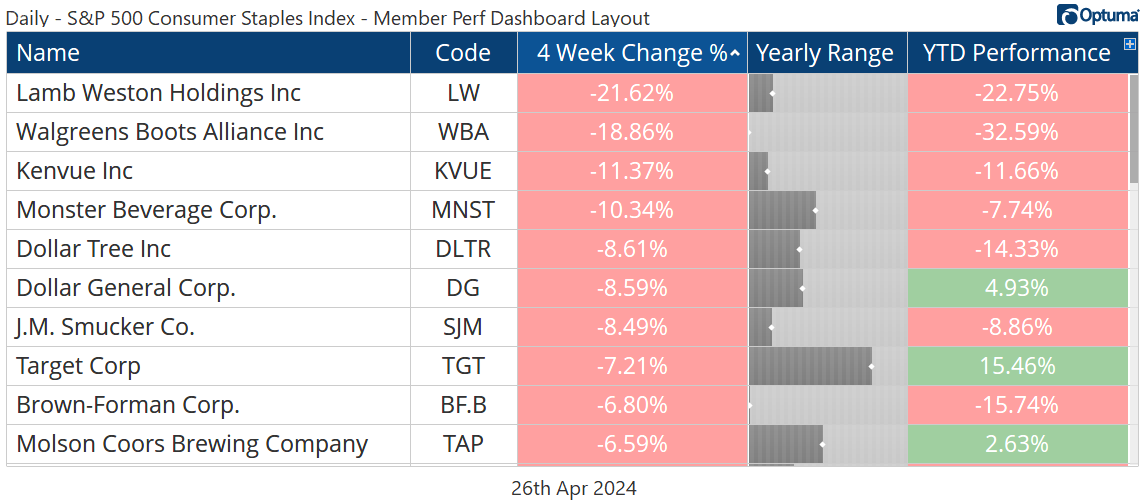

Losers

“We never want to be blindly betting on a trend reversal just because prices approach a logical level of support - we need to see price confirmation.”

We just said that when talking about Tyson. Here’s why:

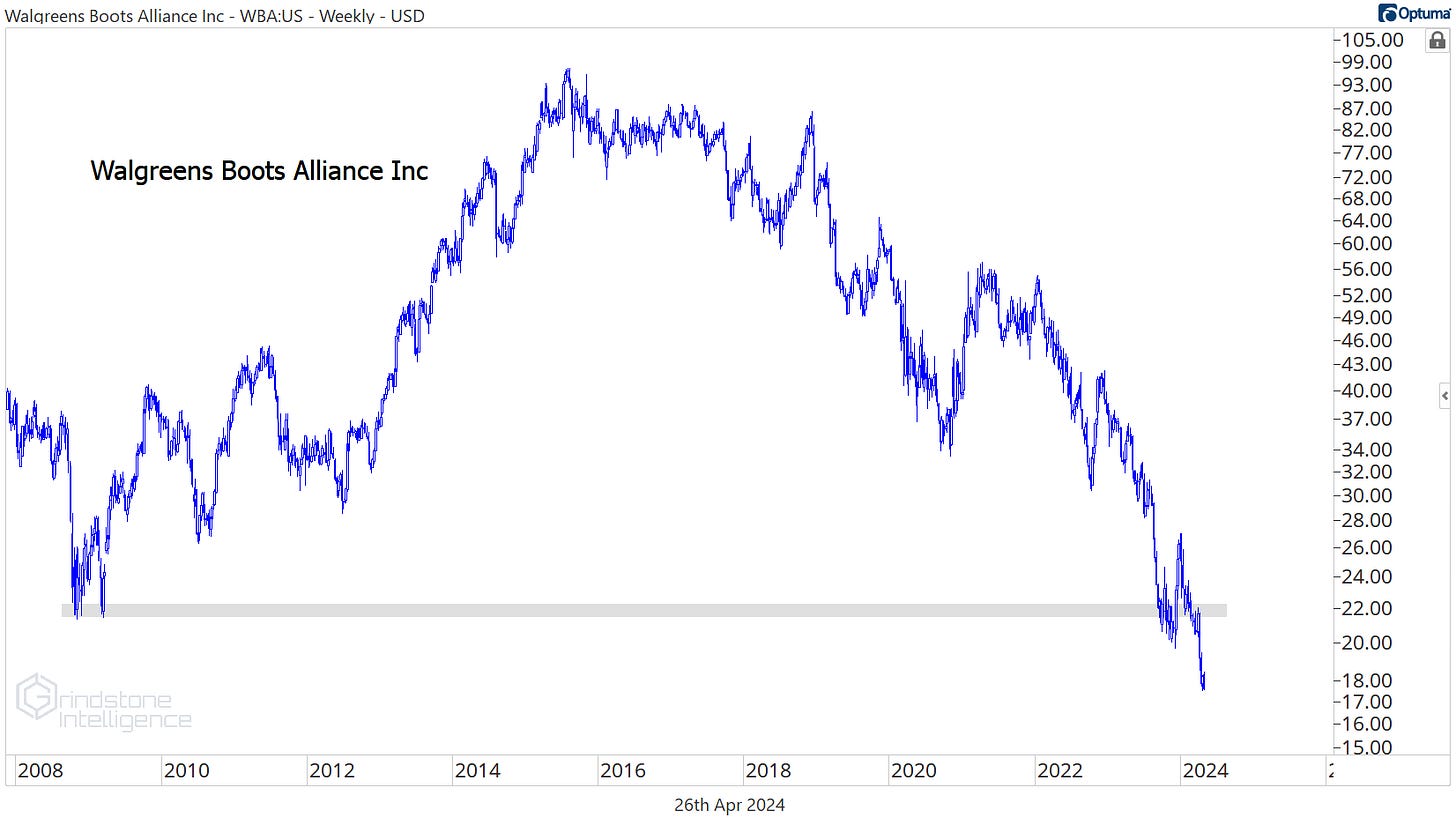

Walgreens had all the pieces in place for a bottom. It still wasn’t able to stop going down. We probably say it too often, but we’ll say it again. Trends are always more likely to persist than they are to reverse.

One more to watch

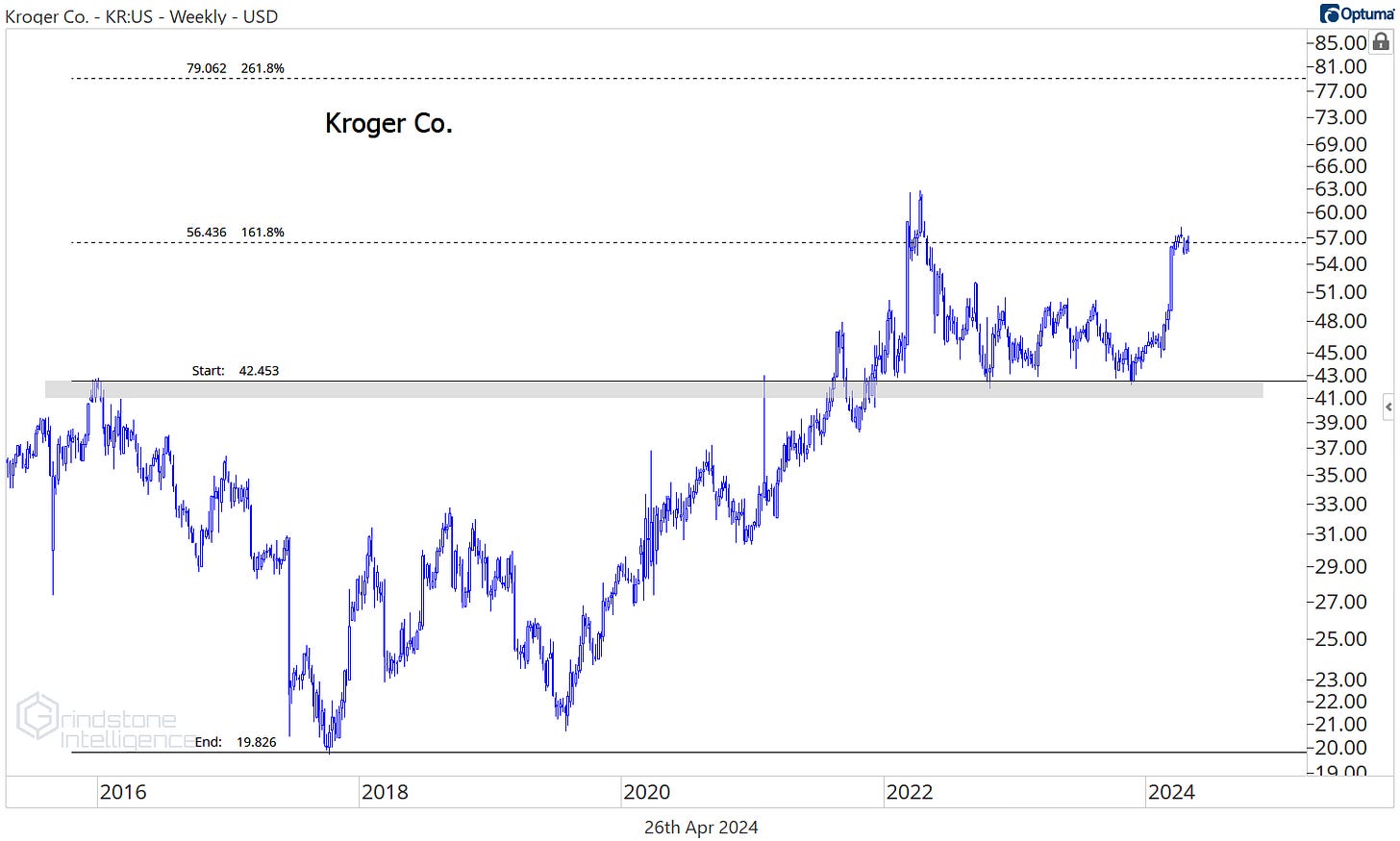

Kroger hails from a different sub-industry than Walmart and Costco - that leadership area we mentioned earlier - but KR is showing relative strength of its own. So far this year, no Consumer Staples stock has been better. The risk/reward today in KR is much cleaner than it is in those other two supermarket names, too, as the stock tries to break out of a 2-year consolidation. We can be buying Kroger above $57 with a target up at $79, which is the 261.8% retracement from the 2015-2017 decline.

That’s all for today. Until next time.