(Premium) December Consumer Staples Outlook

Consumer Staples are a great measure of risk appetite. When the economic outlook is uncertain, investors tend to favor companies that offer stability. Consumer Staples fit that bill. Recession or not, we’re going to keep buying toothpaste and toilet paper, but we may hold off on buying that new TV for the man-cave. Staples, then, offer a great measure of risk appetite. When these stable companies outperform the broader index, it’s a sign that investors are cautious. When Staples lag, investors are adding risk to capitalize on faster expected growth.

Right now, we’re waiting on a clear signal about how investors are feeling.

Staples have tracked the broad market rally step-for-step, and that has several names touching new all-time highs. General Mills was just breaking out when we looked at them a month ago, and now they’re halfway to their target of 95 – the 161.8% retracement from the entire 2016-2018 decline.

Monster beverage just broke out of an 18-month base. 115 is the target as long as we hold above 98.

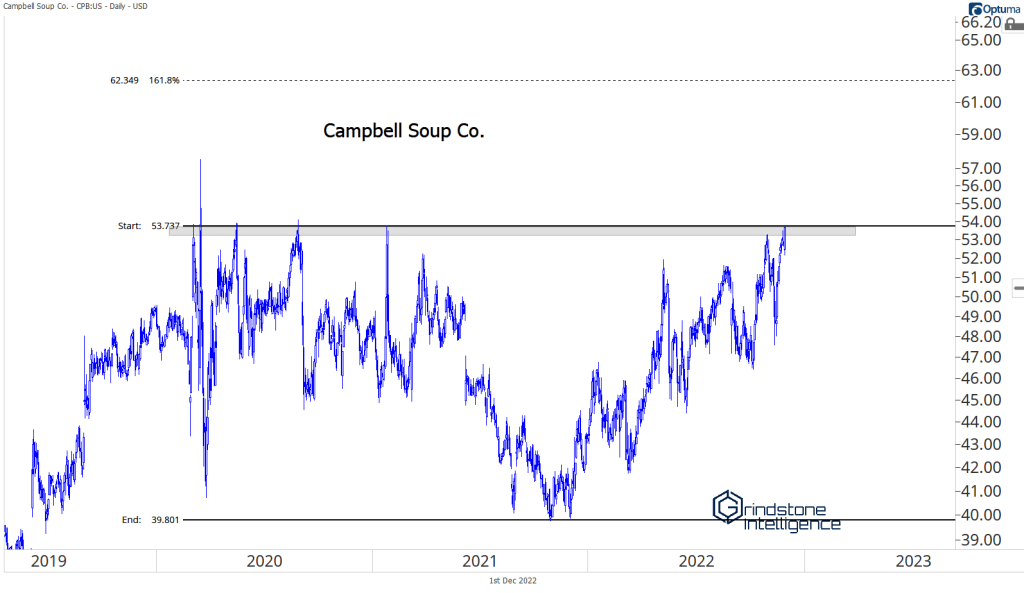

Campbell Soup could be the next to go. The 161.8% retracement from its 2019-2021 decline is up above 60, close to the all-time highs.

The post (Premium) December Consumer Staples Outlook first appeared on Grindstone Intelligence.