(Premium) December Energy Outlook

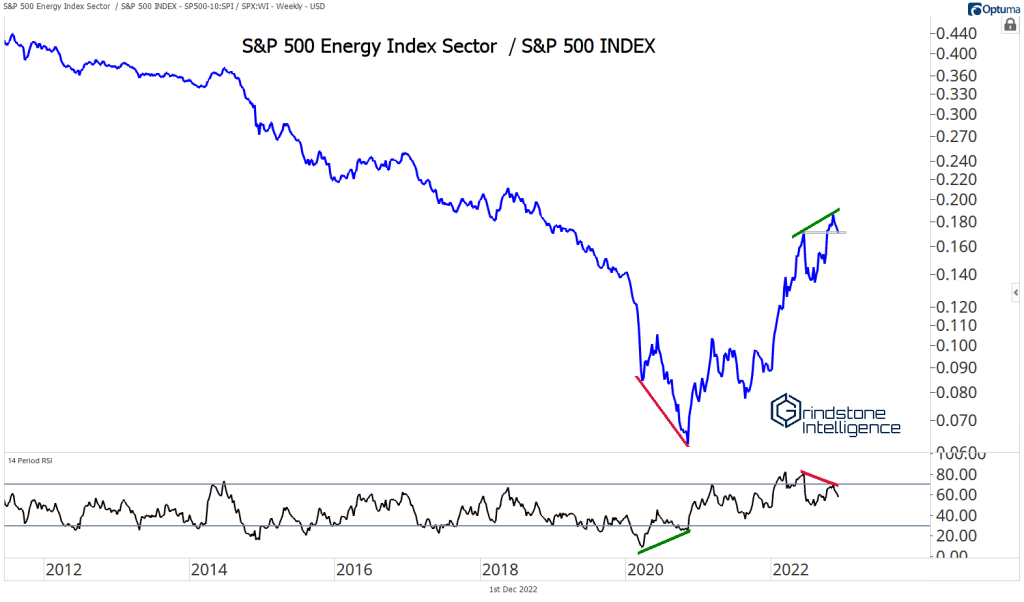

We’ve been bullish on Energy stocks relative to the S&P 500 for awhile now, but that run could be coming to an end. A major bearish momentum divergence is shaping up on the weekly chart.

We still need to see more confirmation from prices before removing our overweight opinion, but we’re watching closely.

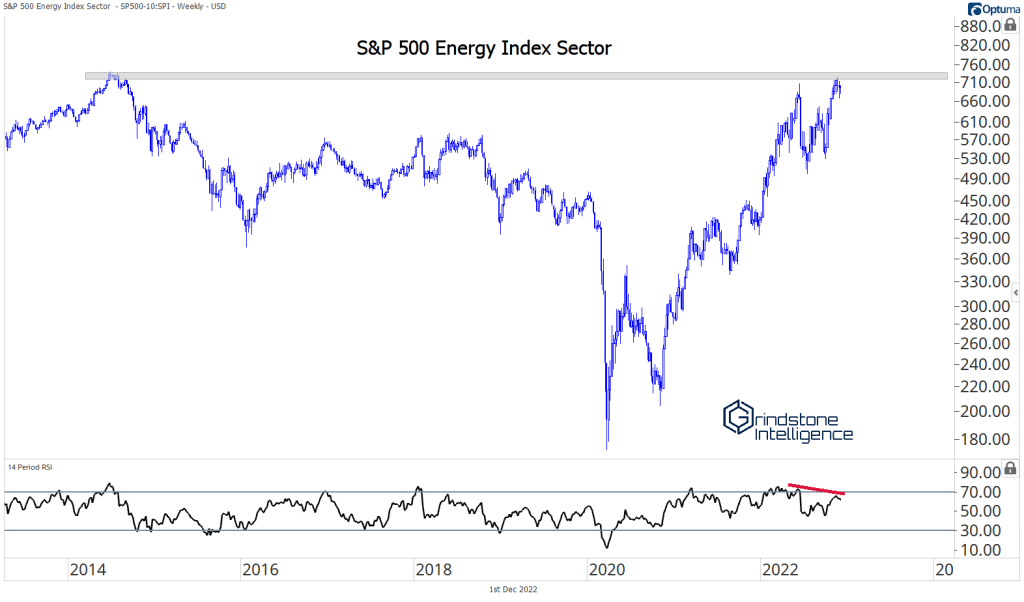

We’re seeing a similar negative divergence shaping up in the sector itself. Energy is back to the scene of its 2014 highs, the year that oil prices began a six-year collapse that culminated in 2020. In other words, this is a logical place for the sector to pause and digest the last two years of strength.

The bull case for Energy lies in how much relative strength the sector has shown vs. oil prices in recent months. Crude has been cut nearly in half since the spring peak. For now, it’s stuck between 75 and 95.

The breakeven price for most domestic oil producers is somewhere in mid-40s, so current prices near 80 are more than enough to generate healthy returns. If crude breaks this support level, though, those healthy returns begin to look a lot less certain, and we should expect Energy stocks to fall.

The post (Premium) December Energy Outlook first appeared on Grindstone Intelligence.