December FICC Outlook – Unlocked

Currencies

The rally in stocks has been supported by weakening US Dollar. All year, the Dollar index has been the impetus behind stock prices, with each successive high in the world’s reserve currency driving stocks to a new low. Check out how closely the two have moved together, and how closely they continue to track while equity prices have risen:

The Dollar’s weakness relative to the Euro – which comprises the majority of the Dollar Index – has brought the EUR/USD cross back to the bottom end of its 5-year consolidation range.

Here’s a closer look at the action:

Based on everything we’ve seen so far this year, how the pair responds to this level could very well determine whether the lows for stocks are truly in.

Fixed Income

The bullish engulfing candle we highlighted in last month’s newsletter helped spark a strong November for bond markets. We believed a relief rally was likely following 12 consecutive weekly declines, and a relief rally is exactly what we’ve gotten.

It’s too early to call an end to the bear market in bonds, though. The June lows are near-term resistance and the first real test faced by Treasuries since this rally began.

Rates have been highly correlated with currencies and stocks all year. We don’t expect that to change. If the Dollar resumes its rise, rates will, too. And that won’t be good for stock prices.

Bitcoin

Bitcoin is stuck in an indisputable downtrend, having broken the summer lows in November following the FTX meltdown. Former support around 19000 is now overhead supply. The next area to watch on the downside is 13000.

From a sentiment perspective, it’s hard to imagine how things could get any worse for cryptocurrencies. The more we learn about Sam Bankman-Fried and his cronies, the more it seems no one in the industry can be trusted. The demise of SBF even graced the cover of the prominent Bloomberg Businessweek. From a contrarian’s perspective, now might be the perfect time to start turning bullish on cryptocurrency. We aren’t contrarians, though – at least not until we see some evidence that this trend has begun to reverse.

Precious Metals

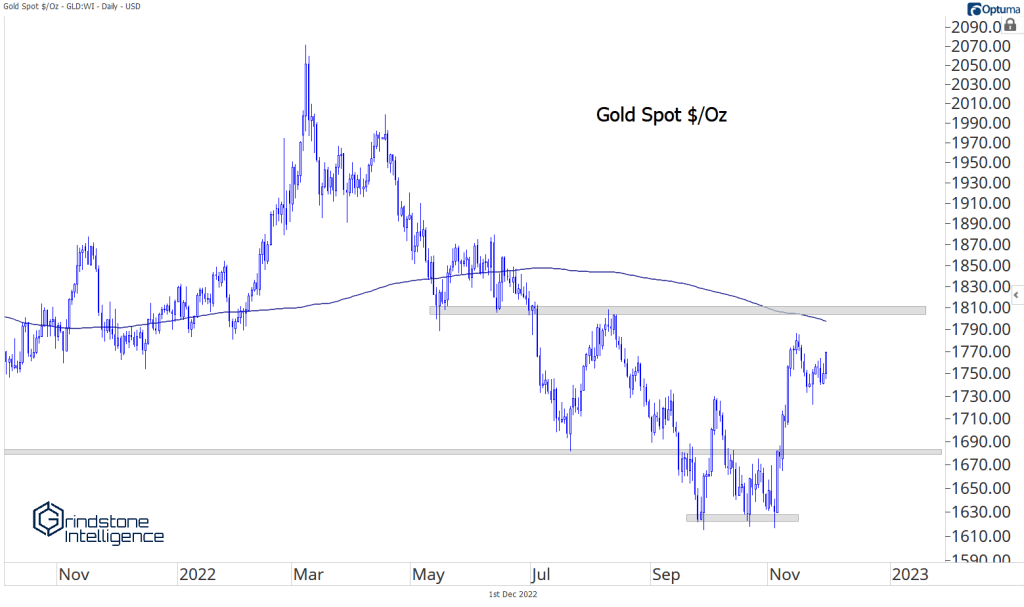

Metals pushed to the front of the pack in November. Gold and Silver both had their best month since 2020, and Copper prices rose by more than 12%.

Last month we pointed out the disappointing price action in Gold after it broke the 2021 lows, but we stopped short of being outright negative on the yellow metal. The reason had little to do with Gold itself. Instead, we were impressed by the relative strength in Silver. Silver tends to lead while precious metals are rising, so it was unusual to see Gold breaking to new lows while Silver was putting in what looked like a healthy base.

Silver looks even better today. If prices are above 22.40, we want to be buying precious metals.

That 22.40 is the bottom end of the 2020-2021 range, and if Silver is back above, we can set an intermediate-term target at the high end of that range, near 28. If we’re below 22.40, there’s no urgency to have a position.

For Gold, the level is 1800 – above that, we can comfortably be buying with a target near 2000.

On any failure back below 1680, we don’t want to be involved with Gold unless its on the short side.

The post December FICC Outlook – Unlocked first appeared on Grindstone Intelligence.