(Premium) December Information Technology Outlook

The chart below might be one of the most important charts in the world. We’d put it in the top 5.

Growth stocks were in control for more than a decade after the financial crisis. Being a ‘Value’ investor was synonymous with underperforming. That changed in September 2020, when Information Technology ran into the relative highs it set at the peak of the internet bubble. Lots of people will argue that technical analysis is a farce. Price moves are random, and historical moves have no bearing on the future. Even more folks will balk at the importance of prices from more than 20 years ago – let alone the ratio of two price indexes. Allow us to ask: Does that chart look random? Do you really think it’s just coincidence that after a decade-long bull market, Tech just happened to peak at exactly the 2000 highs – the height of the biggest Tech bull market of our lifetimes?

We don’t.

It took us two decades to get back to this level, so it makes sense that it would take some time to digest. How much time, and how much potential downside will be involved, is less certain. But we don’t want to be overweight Tech unless and until it can work through this level.

Semiconductors are similarly facing overhead supply. Here’s the PHLX SOX Semiconductor ETF running into the summer 2021 lows and a falling 200-day moving average. This level is also the 38.2% retracement from the entire 2022 decline.

Semis are one of the largest groups within the Tech space, so whether or not they can surpass the near-term resistance should tell us a lot about the true strength of the recent rally.

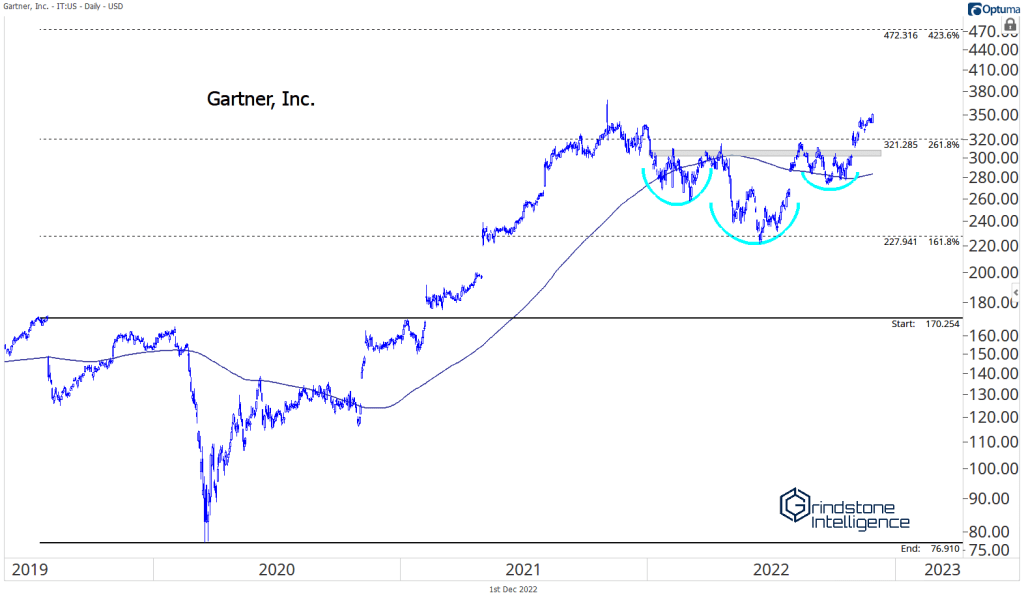

Gartner, which we highlighted last month, continues to rise after completing an inverse head and shoulders continuation pattern. If it’s above 300, we want to be long with a target near 470.

Keysight Technologies is another one that’s resolving higher. If it’s above 170, we can look for it to get back to its all-time highs at 210.

Here’s one more big base to keep an eye on within Tech. PTC Inc. put in a rounded bottom at its 2018 highs, and it’s been setting higher highs since early summer. Longer-term, it could go all the way to 200.

The post (Premium) December Information Technology Outlook first appeared on Grindstone Intelligence.