Elevated Earnings Expectations

The second quarter of 2021 has come to a close, and that means another round of earnings reports is about to start. Earnings are an important component in a weight-of-the-evidence based approach to investing. For one, remember that buying a stock is taking an ownership share in a company and its profits. At the end of the day, we’re buying earnings. Second, from a more tactical perspective, earnings are a helpful reflection of current economic activity. And finally, they’re an important input into valuation multiples. As we enter the Q2 earnings season, expectations are elevated, to say the least.

Below is a chart of S&P 500 aggregate operating earnings per share – both the forward 12-month consensus estimate (red), and actual trailing 4 quarter sum (blue). The pandemic slammed earnings expectations early last year, causing a rapid fall of ~25% in forward EPS. But just as quickly as estimates fell, they rebounded. By the end of 2020, forward EPS was nearly back to pre-COVID levels, and 6 months later it’s solidly in new high territory.

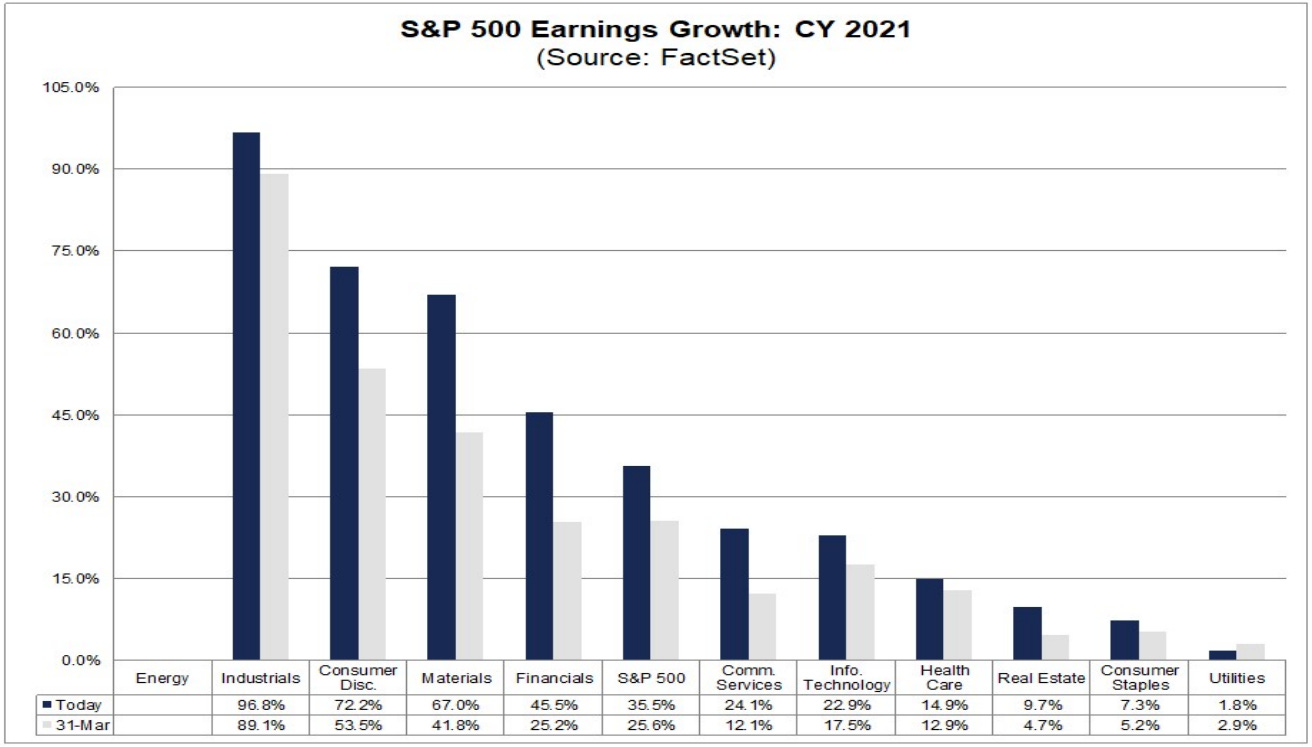

The translation to actual earnings was a decline of about 14% in 2020, the worst drop since the financial crisis more than a decade ago. Should actual earnings live up to current expectations, though, it will mean a 35% rebound in 2021, followed by another year of double digit growth in 2022. Given the long-term average growth rate of earnings is only about 7%, those are pretty robust estimates.

Hefty growth expectations are reflected in valuations. The S&P 500 forward P/E ratio is hovering near the highest levels since 2000. Equity index valuations are subject to a variety of factors, including interest rates, sector weights, and general risk appetite, but at nearly 22x forward earnings per share, this multiple certainly contains some degree of expectation that growth will be above its historical trend for a few years.

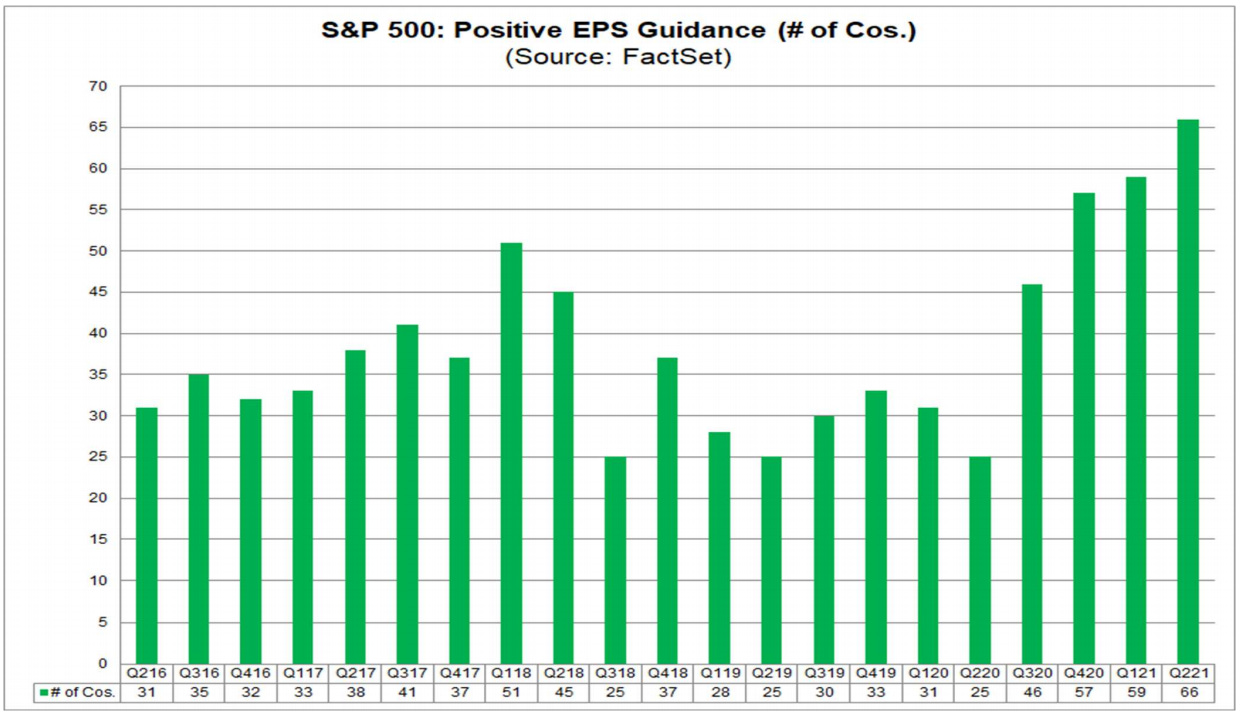

For its part, business is living up to expectations thus far. According to FactSet, a record 59 companies issued positive guidance ahead of their Q1 EPS reports. Sixty-six have issued positive guidance for Q2, leading to a 7.3% increase in earnings estimates over the last 3 month. That’s higher even than the first quarter of 2018, which benefited from a last-minute cut to the corporate tax rate.

Whether earnings can continue to meet and exceed heightened expectations will likely depend on margins. Revenues seem to be in a good place – they track economic activity even more closely than earnings, and economic activity is still recovering at a healthy pace. Historically, year-over-year revenue growth has tracked pretty well with the Institute for Supply Management’s measure of Manufacturing PMIs (below). With PMIs up near their best levels of the last 30 years, it’s hard to be overly concerned about the trajectory of revenue growth, barring a domestic virus resurgence. Additional fiscal stimulus could even lead to an upside surprise.

There’s significantly more uncertainty surrounding costs and profit margins. Inflation continues to be front of mind for both management teams and the analysts that cover their companies. Almost 40% of S&P 500 companies cited the word ‘inflation’ during earnings conference calls, and dozens more used alternate phrases to express worrisome cost and price dynamics.

Between breathtaking increases in commodity prices, rising freight costs, semiconductor shortages, a lack of qualified labor, and ongoing tariff disputes that further disrupt supply chains, businesses face a myriad of issues that could cause them to fall short of earnings projections. The pace of global re-openings and the labor market recovery will be both bear watching in the months ahead.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Elevated Earnings Expectations first appeared on Grindstone Intelligence.