Energy Sector Deep Dive

Strong Seasonals vs. 15-Year Resistance

Long-term resistance for the Energy sector has been too much to overcome. We’ve been dealing with the 2008 and 2014 highs for 18 months now, and while the bears haven’t taken outright control here, the bulls haven’t been able to gain any ground either. At some point, maybe we’ll get the long-awaited breakout. Or we might not. In any case, the risk is skewed to the downside as long as this resistance level remains intact.

After a short stint of outperformance for the sector last summer, we downgraded Energy to Equalweight at the start of October, then took them a notch lower to Underweight at the end of November. It wasn’t so much that we wanted to be shorting Energy stocks. But the opportunity cost of owning something that’s stuck in the mud while the rest of the market is rallying is just too high. The Energy sector on its own is still knocking on the door of its 2008 highs, but compared to the rest of the market? It’s been hitting new 52-week lows.

Fortunately for Energy bulls, we’re in the midst of the most bullish seasonal period of the year. Energy has outperformed the rest of the market on average in February, March, and April since 1990.

Perhaps a strong spring is all it takes to push past this overhead supply once and for all. Here’s a closer look at that resistance level for Energy. If the XLE is above $92.50, we think Energy stocks can go a lot higher, and we need to be looking for more stocks to buy.

With a breakout probably comes outperformance relative to the rest of the market, too. The market cap weighted sector has been setting new 52-week lows relative to the S&P 500, but beneath the surface, things aren’t as ugly. If we take the equally weighted versions of each, Energy is still above last year’s swing lows relative to the SPX. As long as that’s the case, this just looks like a healthy consolidation after a a huge runup in 2021 and early 2022.

Further supporting the ‘consolidation within an uptrend’ narrative is the strength in breadth. Since the bear market bottom in October ‘22, only the Utilities sector has performed worse than Energy. Even the lowly Consumer Staples and Real Estate sectors have done better. But if we compare the stocks in each sector to their long-term moving averages, Energy is much better positioned than any of those other 3.

Just 17% of Energy sector stocks are below a falling 200-day moving average (the definition of a downtrend). Real Estate stands at 39%, Staples at 55%, and Utilities at a whopping 77%. So by and large, Energy stocks aren’t doing badly. They just aren’t doing as well as the other risk-on areas of the market.

We’re keeping an eye out for when that changes.

Digging Deeper: The Setups to Watch

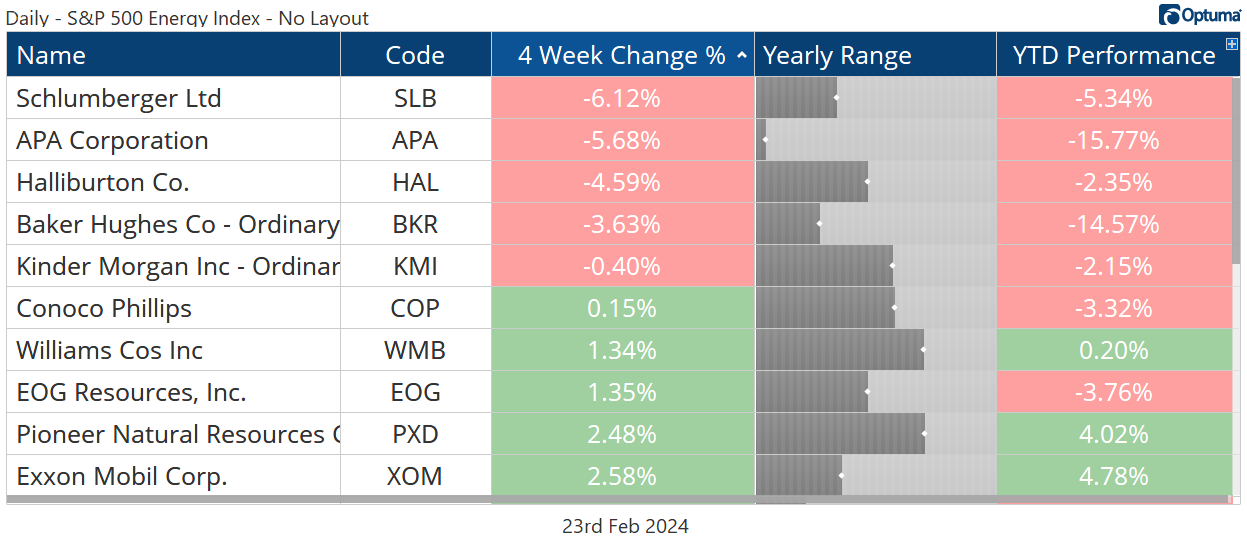

Over the past year, the Energy sector overall has gone virtually nowhere. The refiners, meanwhile, have bucked the trend by rising almost 30%. Relative strength begets relative strength, so if we’re looking for stocks to buy in the Energy sector, this is an area where we want to be focusing our attention.

Marathon Petroleum is at the top of the list. Earlier we noted that the sector as a whole was trading near 52-week lows relative to the rest of the market. MPC is close to all-time relative highs.

Our target on MPC is $200, which is the 261.8% retracement from the 2018-2020 decline. We only want to be long if the stock is above $130.

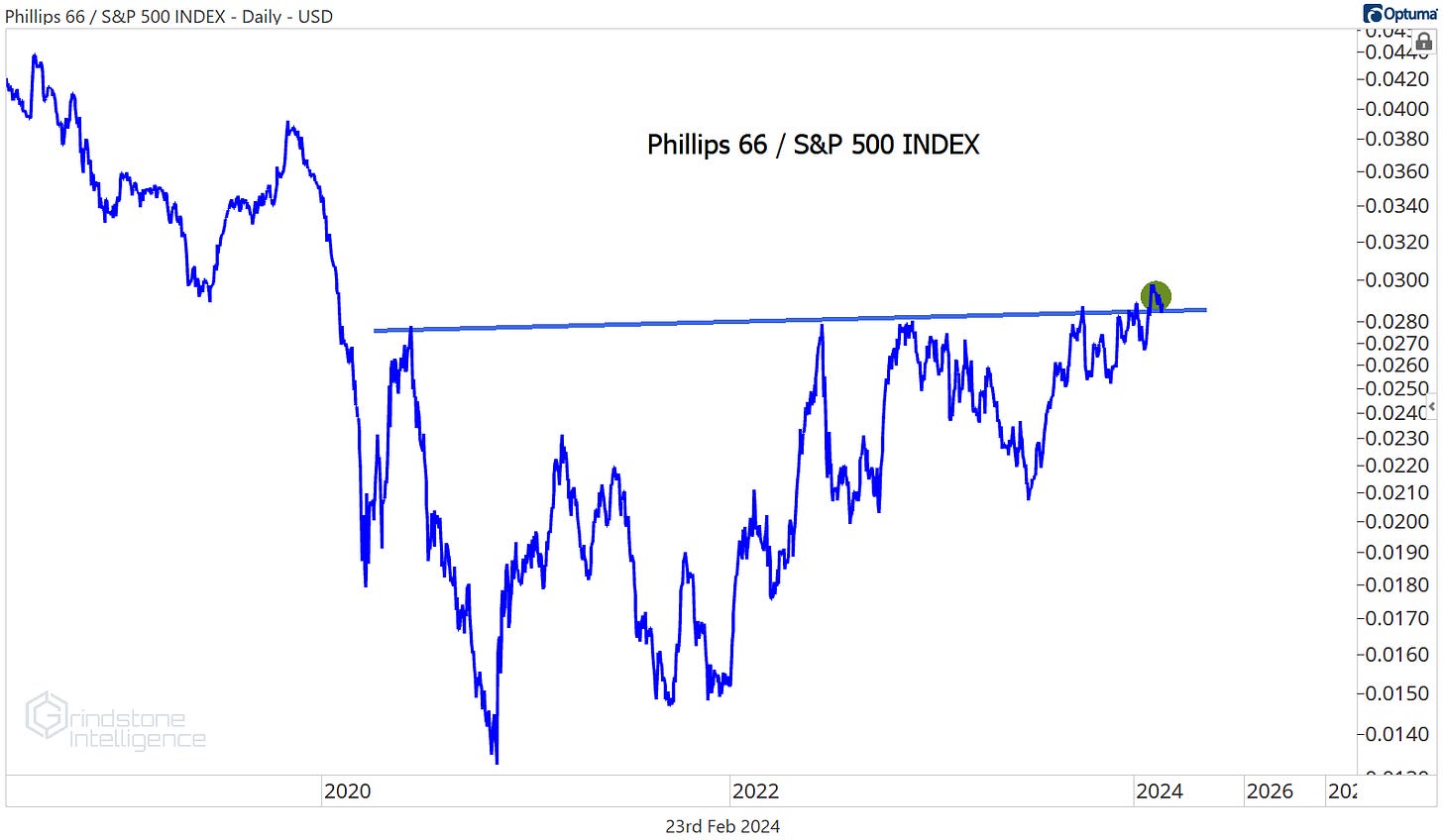

Phillips 66 has been another great one as it nears our target of $150.

The risk/reward doesn’t warrant initiating new positions here on PSX, but that doesn’t mean we want to ignore it completely going forward. It just broke out of a multi-year base relative the S&P 500, so we’ll be watching closely for a new setup from the long side.

Leaders

Targa Resources surged 14% over the last 4 weeks, eclipsing our target of $96.

This is a perfect example of why we focus so much on relative strength. A month ago we were pointing out that Targa was holding up better than the rest of the Energy sector, which meant it was likely to outperform if Energy stocks as a whole started to rise. That’s exactly what we got.

For now, we want to see how TRGP responds to the 161.8% retracement from the 2022 decline at $96. As long as it’s above that level, though, we can comfortably be long with a target of $120.

Losers

So what happens if Energy as a whole starts to weaken here? What if the sector lags during its strongest seasonal period and we start to see more individual names dip below a falling 200-day moving average? In that case, we want to stay away from buying Energy at the least, and perhaps even looking for names to short.

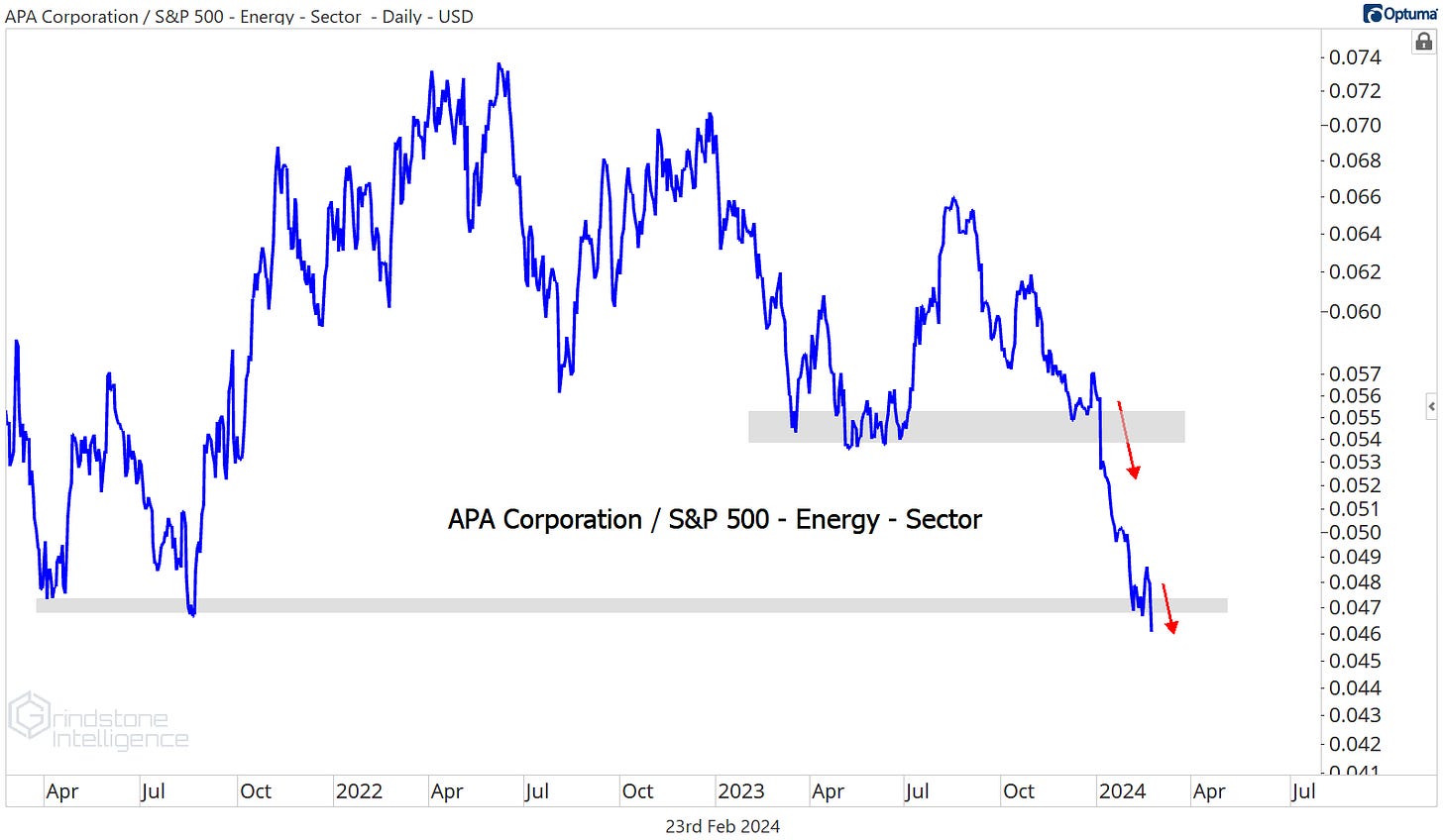

Apache continues to offer a great setup for bears. It’s breaking down to new lows versus the rest of the sector (which itself is breaking down to new lows vs. the rest of the market).

The risk/reward is very clearly defined here, too. We can be shorting APA below the pre-COVID highs of $33 with a target down near $23, which is the 61.8% retracement of the 2020 collapse.

That’s all for today. Until next time.