(Premium) February Consumer Discretionary Outlook

If there was one theme for January, it might have been the old market adage: From failed moves come fast moves in the opposite direction.

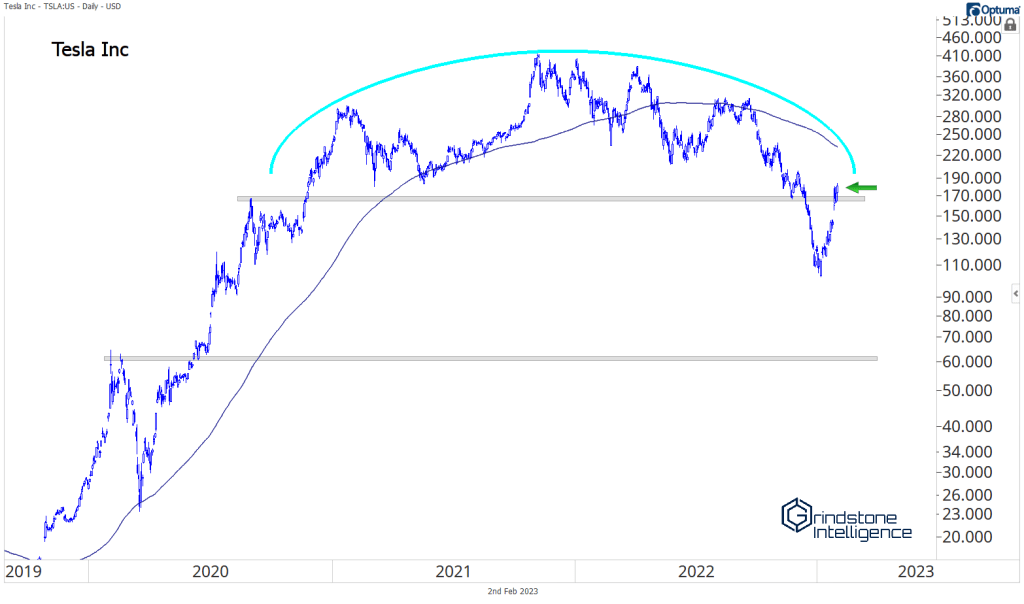

We upgraded the Consumer Discretionary sector to overweight in December, believing that underlying strength among the constituents would cause the group to rebound off its absolute and relative lows from last May. Instead, Tesla, the sector’s 2nd largest component, dropped 40% in December, pushing the group to new lows.

In January, though, Tesla’s rebound, along with continued strength from the rest of the sector, pushed prices back above those lows. From failed moves come fast moves:

The two biggest stocks in the sector – Amazon and Tesla – are back above support, and that bodes well for the sector’s prospects.

We’re more encouraged by the strength in other areas of this diverse sector, though.

Auto parts retailers lagged in January, but they’re all still in structural uptrends, and our targets are unchanged. Check out Autozone, Genuine Parts, and O’Reilly Automotive.

Auto parts manufacturers look healthy, too. For Aptiv, we can be long with a target of 135 if it’s above 112.

And we want to be buying a breakout in LKQ above 60, with a target of 70.

Homebuilders continue to lead. The ITB Home Construction ETF is moving higher out of a 15-year relative base. The bigger the base, the higher in space.

We keep hearing in the media about the ongoing ‘housing crash’, yet the homies have been outperforming since last April! If you want relative strength, that’s where to look.

The post (Premium) February Consumer Discretionary Outlook first appeared on Grindstone Intelligence.