(Premium) February Consumer Staples Outlook

We reduced our rating of Consumer Staples to equalweight earlier this month, when it became clear that its bullish resolution had turned into a failed breakout. Like we said, from failed moves come fast moves in the opposite direction. Staples are below their 200-day moving average relative to the S&P 500 for the first time in a year.

The sector’s action is even worse when you take it on an equally-weighted basis. Relative to the broader index, it’s breaking below support from last fall.

We’re approaching the sector from a neutral stance for now, but we’re leaning bearish. It’s not just the relative weakness that’s concerning. There were also big failed breakouts on an absolute basis.

We highlighted the bullish action from Campbell’s Soup in our last few newsletters. Now it’s back below overhead supply.

J.M. Smucker is another that we were watching. It had just broken out of a 6-year base, but now it’s back below those former highs.

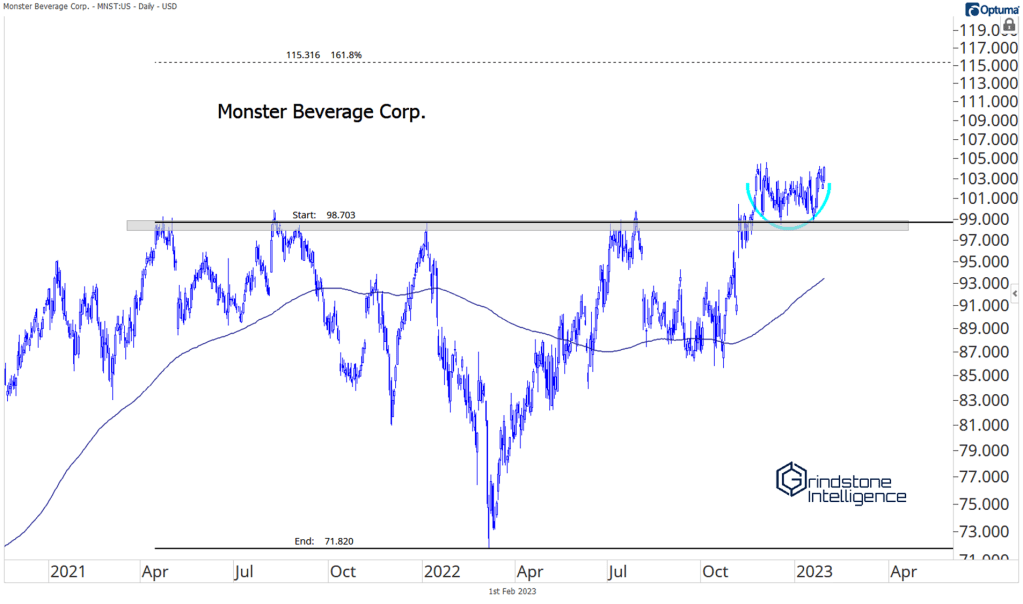

There are a few names still holding up, and it’s the ones with better fundamental growth prospects. If you’re looking for relative strength in the sector, we still want to be long Monster Beverage if it’s above 100, with a target of 115.

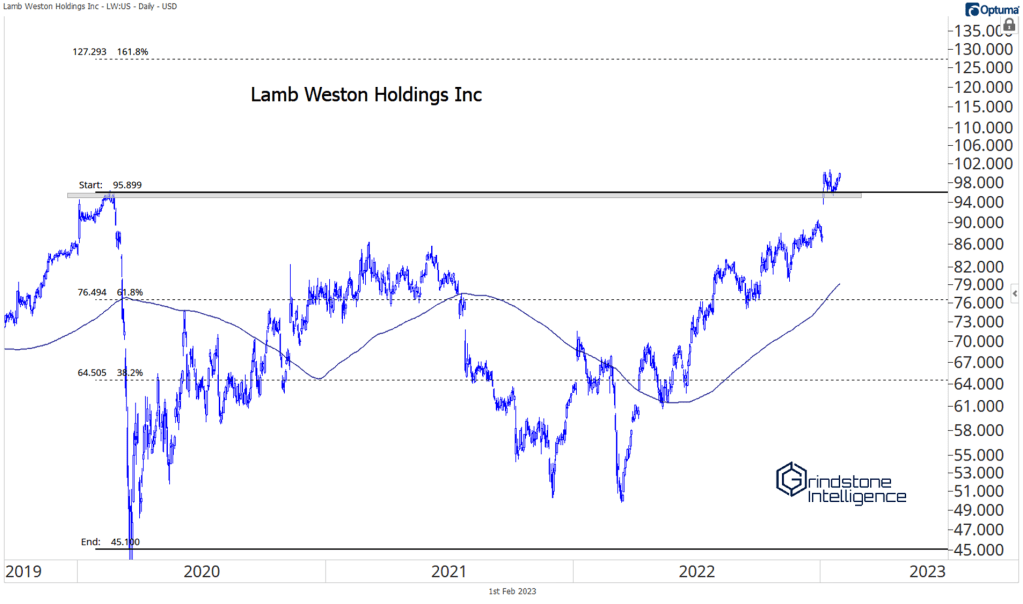

And Lamb Weston is bucking the trend of failed moves by consolidating above resistance. If it’s above 96, we think it’s got a path to 127.

Click on each section below to see the rest of our February outlook:

Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector – UNLOCKED Financials Sector Health Care Sector Industrials Sector Information Technology Sector Materials Sector Real Estate Sector Utilities Sector

The post (Premium) February Consumer Staples Outlook first appeared on Grindstone Intelligence.