(Premium) February Financials Outlook

We think the Financials sector could be a top sector in 2023, despite its slow start. For months, we’ve been watching and waiting for a breakout from this multi-year consolidation range.

Our view is simple: if Financials are breaking out on a relative basis, we want to be overweight the sector. But they just aren’t there yet.

The breakout finally happened on an absolute basis, so it’s not a question of whether or not the group is trending in the right direction. It’s just that their gains have been outpaced by other areas of the market.

Insurance stocks continue to lead. Ameriprise Financial broke out to new highs, and we’re targeting 500, the 423.6% Fibonacci retracement from the COVID selloff.

Globe Life is still tracking toward our target of 138

And Progressive is as smooth an uptrend as you’ll find.

We’ll need to see more participation from other areas, though.

JPMorgan is a mess, but it’s the single-most important stock in the sector. If it’s above 150, we’d have more confidence in a bear market run for the space as a whole.

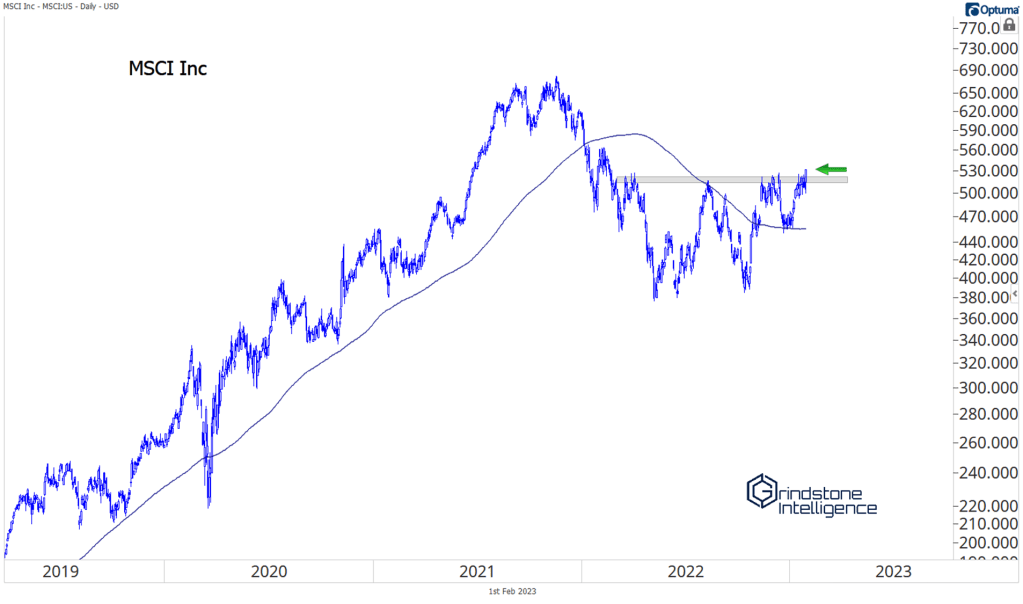

MSCI is showing positive signs. It just broke out to new multi-month highs.

For MSCI we can target the former highs near 690 if it’s above 530.

And we’re watching for a big breakout for Marsh & McLennan. If this one get’s above 175, we think it goes to 195 in a hurry.

For the most part, though, we’re in wait-and-see mode for the sector.

Click on each section below to see the rest of our February outlook:

Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector – UNLOCKED Financials Sector Health Care Sector Industrials Sector Information Technology Sector Materials Sector Real Estate Sector Utilities Sector

The post (Premium) February Financials Outlook first appeared on Grindstone Intelligence.