(Premium) February Industrials Outlook

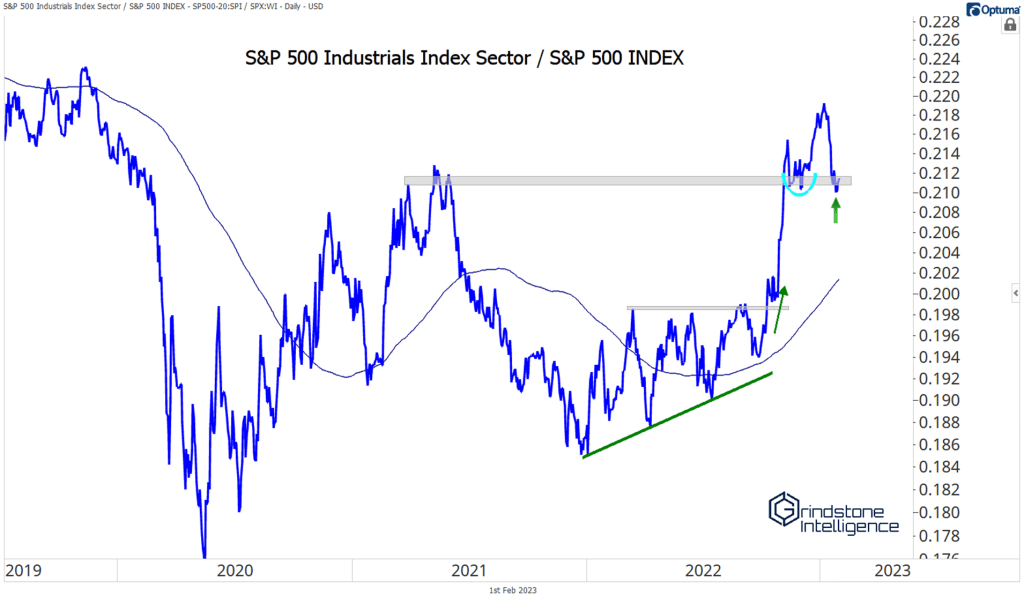

The Industrials sector weakened on a relative basis since our last update, but unlike the weakness we’ve described in Consumer Staples and Health Care, Industrials have NOT fallen below support.

In fact, on an equally weighted basis, Industrials are still near multi-year highs, and actually set a higher low in January. That gives us confidence in our overweight rating for the group.

Machinery stocks are still among our favorite names in the sector. Caterpillar continues to work, and we’re still targeting 335 with the stock above 240.

United Rentals is now halfway to our target of 500.

Paccar also broke out during January. We want to buy any pullbacks toward 104 with a target of 136.

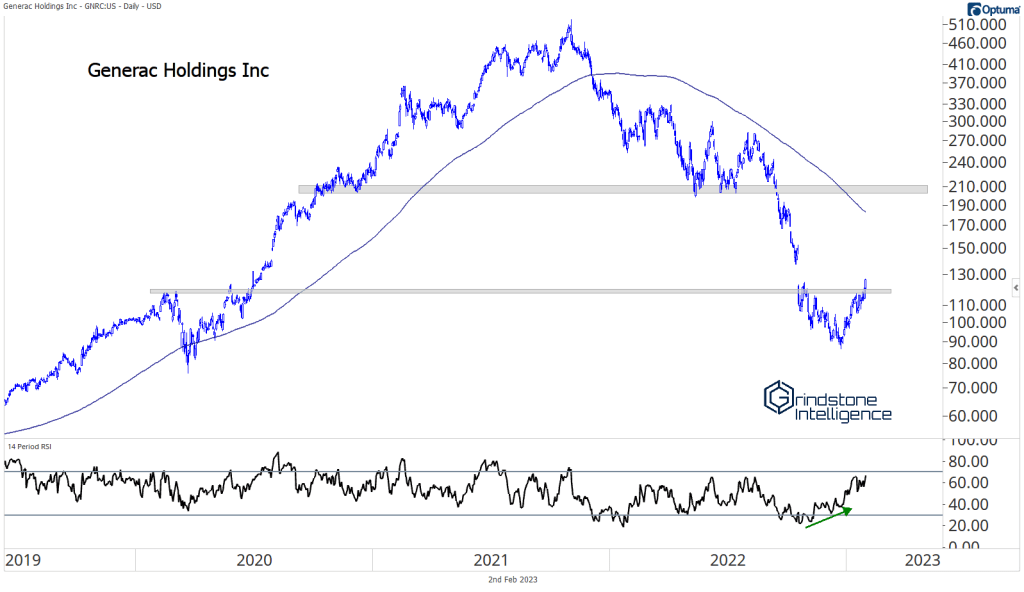

In January we noted that even the worst stocks in the sector were improving. We pointed out a huge bullish momentum divergence in Generac. It’s since rallied above its February 2020 highs, and could go as high as 200.

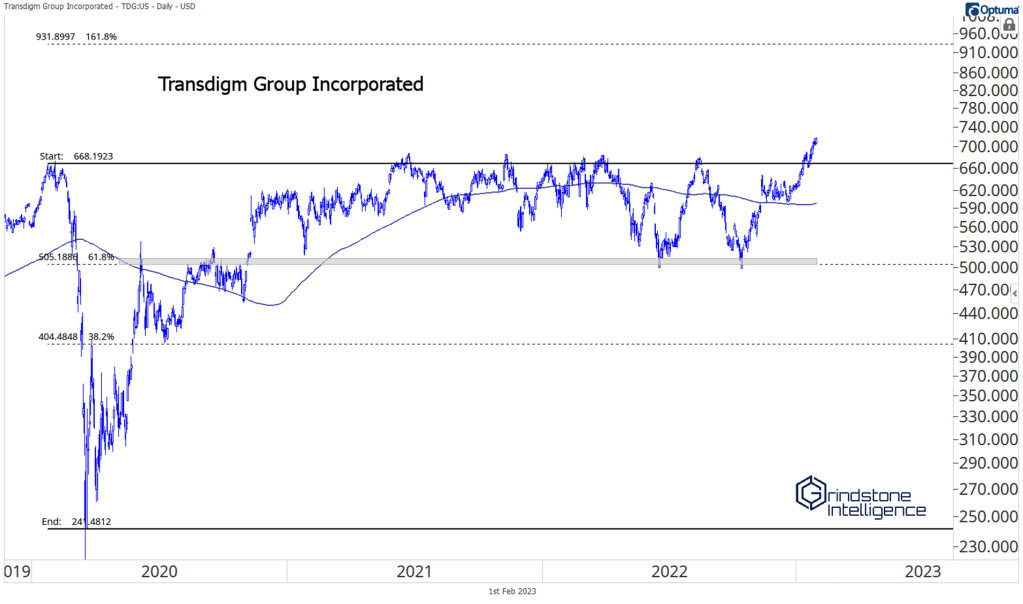

But we’re even more impressed with the broadening of strength (as opposed to lack of weakness) in the sector. Check out Transdigm breaking out to new highs. We want to be long if it’s above 670 with a target of 930.

Snap-on is another that’s resolving higher from a big base. We think it goes to 340 if it can get above 246 and hold it.

Click on each section below to see the rest of our February outlook:

Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector – UNLOCKED Financials Sector Health Care Sector Industrials Sector Information Technology Sector Materials Sector Real Estate Sector Utilities Sector

The post (Premium) February Industrials Outlook first appeared on Grindstone Intelligence.