(Premium) February Information Technology Outlook

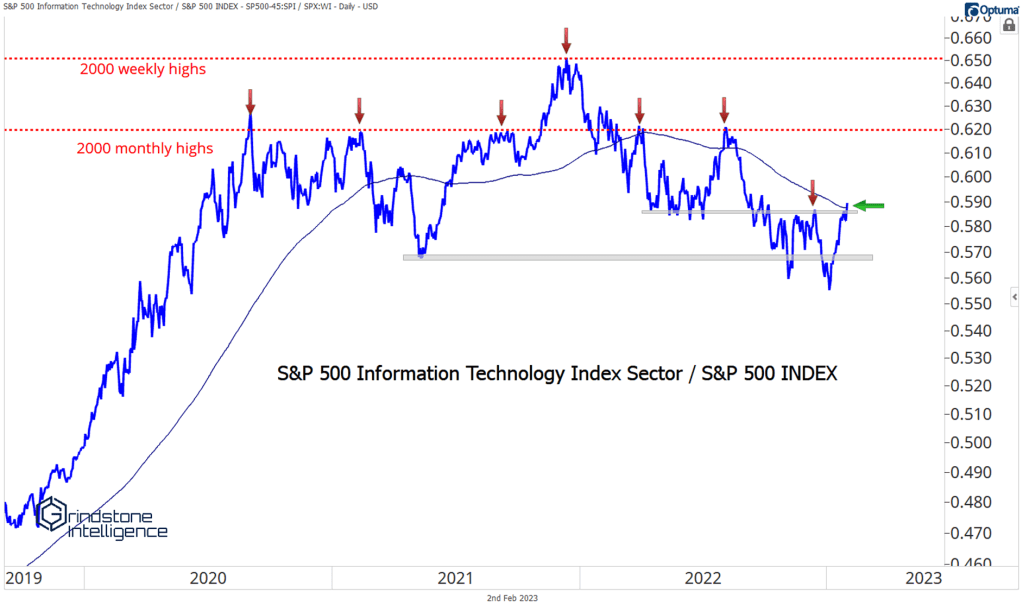

In January, market leadership shifted dramatically. For the first time in months, we saw growth stocks lead the charge in a material way. On a relative basis, Information Technology started the year at 52-week lows. Just a few weeks later, it’s setting multi-month highs.

We can’t ignore the fact that Tech is still stuck below the relative highs from the dot-com bubble (which we’ve covered extensively in these outlooks and in various market updates). Neither can we ignore the rapid reversal we saw in January.

In our last outlook, we said that Paypal would be one to watch:

If there’s one stock that we’re watching for the Tech sector and for risk appetite over the next few weeks, it’s Paypal. Paypal peaked in late 2021, before the rest of the sector, but it hasn’t gotten any worse since the end of June, even though Tech as a whole continued to fall until mid-October. This multi-month consolidation for PYPL should resolve in the direction of the trend – that’s lower. If it doesn’t, that tells us we should be approaching the sector and the market from a more bullish perspective.

Well, it didn’t. At least not yet. And that was indeed a good indication that we should be approaching the sector and the market from a more bullish perspective.

Apple is the sector’s largest component, and it had a failed breakdown of its own. With the stock above last year’s lows, it’s hard to be bearish on the sector as a whole.

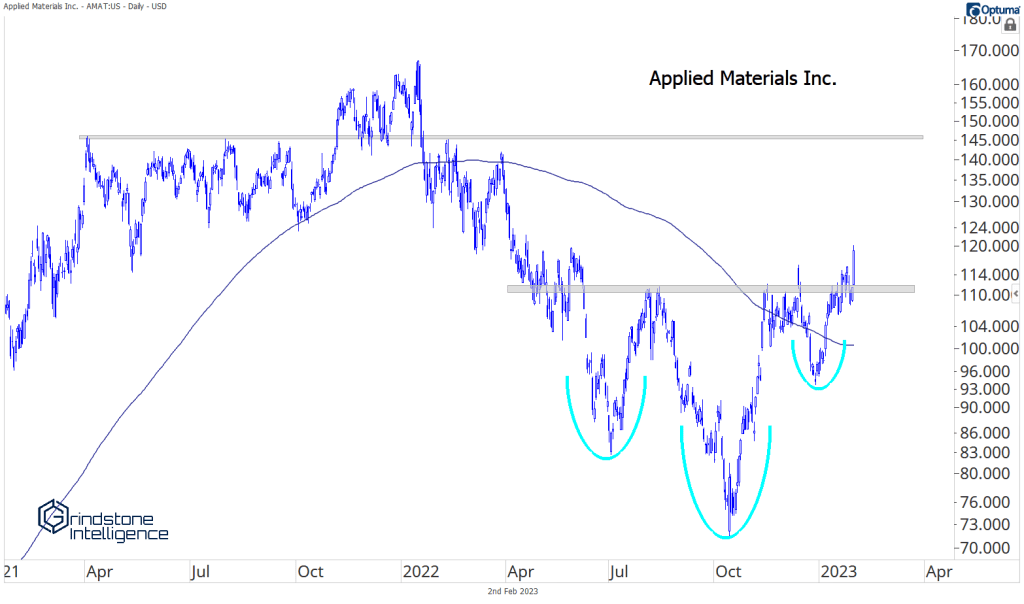

That said, there are better places than Apple to focus our attention. Applied Materials just completed an inverse head-and-shoulders reversal pattern. With the stock above 110, we think it can go back to those 2021 highs near 145.

Gartner has been one of our favorites for awhile. It was showing a ton of relative strength last year, setting new all-time highs while the rest of the sector was bumping along near its lows. We still like it above 320 with a target of 470.

On Semiconductor is another that’s shown lots of strength. With it holding its breakout above 75, we think it eventually goes to 127.

Click on each section below to see the rest of our February outlook:

Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector – UNLOCKED Financials Sector Health Care Sector Industrials Sector Information Technology Sector Materials Sector Real Estate Sector Utilities Sector

The post (Premium) February Information Technology Outlook first appeared on Grindstone Intelligence.