February Market Outlook

What's not to like?

I’m running a bit behind schedule today.

Usually, I get to the office between 5:30 and 6:00 so I can put together charts and write the morning research note. Today, I pulled in the parking garage, grabbed my keys and lunchbox, reached for my keycard… and came up empty. Alone and coffee-less, with a good hour to kill before anyone else arrived to let me in the building, I reclined the seat and took a nap.

You know who else has been sleeping behind the wheel? The transports.

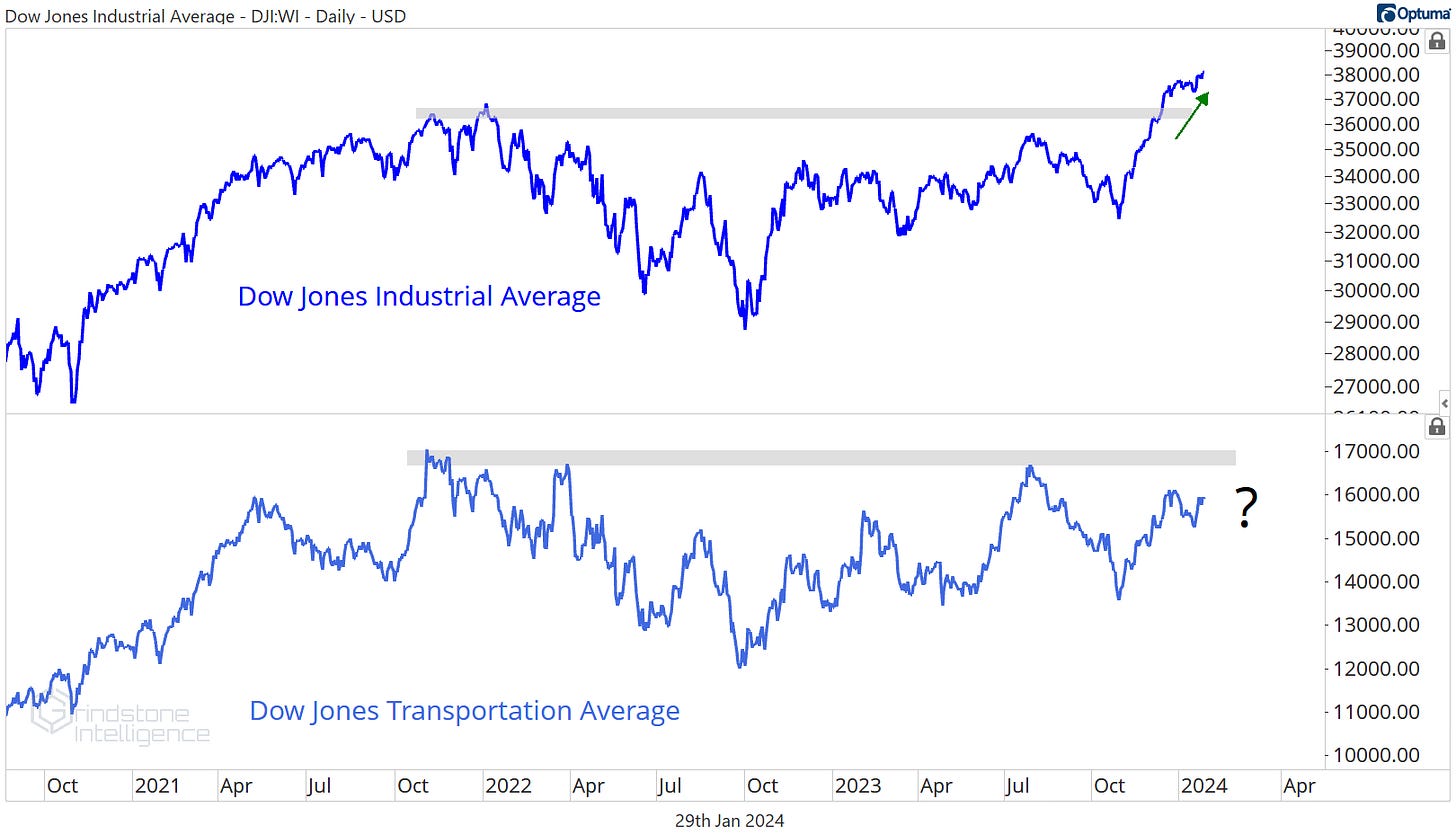

It’s been a month and a half since the Dow Jones Industrial Average broke out to new all-time highs, but the Dow Transportation Average is still 6% below the peak it set back in November 2021.

Why does that matter? Because Charles Dow told us more than a 100 years ago that it does. One of Dow’s tenets says that new highs in one of the averages must be accompanied by a similar move in another to confirm the new trend. Without a breakout in the transports, we can’t definitively say this is a healthy, long-term uptrend for stocks.

So why aren’t we more bearish on the market? Because the market doesn’t have to follow anyone’s timeline. Much like my writing of this newsletter, sometimes things in the market fall behind schedule. But as long as the work gets done, does it really matter when it happens?

We just have to wait a bit for the transports wake up.

As long as they don’t oversleep, wake up to realize the day is lost, and decide to head home, we shouldn’t be too worried about the transports. The day is young.

What other bearish signals are out there? Maybe the lack of new highs? The list of new 52-week highs peaked in mid-December, even though the S&P 500 has been setting new highs for most of the new year.

Let’s be honest, we very much prefer an increasing number of new highs to a decreasing number of new highs. But declining new highs by itself isn’t bearish. It just means that fewer stocks are leading the market higher - and that was the case for most of the rally last year, too.

What would be concerning is if we saw an increasing number of new lows to go along with the lack of new highs. And we definitely aren’t seeing that. We track the S&P 500 constituents of each sector and categorize whether they’re in a cycle of setting new highs or new lows. Today, more than half of S&P 500 stocks have set a new 52-week high more recently than they’ve set a new 52-week low. More importantly, a whopping 85% of stocks are in a cycle of new 3-month highs.

You can’t set a new 52-week low without setting a new 3-month low, and the vast majority of stocks are setting higher and higher short-term highs. In order to get more bearish, you need to see some stocks moving lower. That just isn’t happening right now.

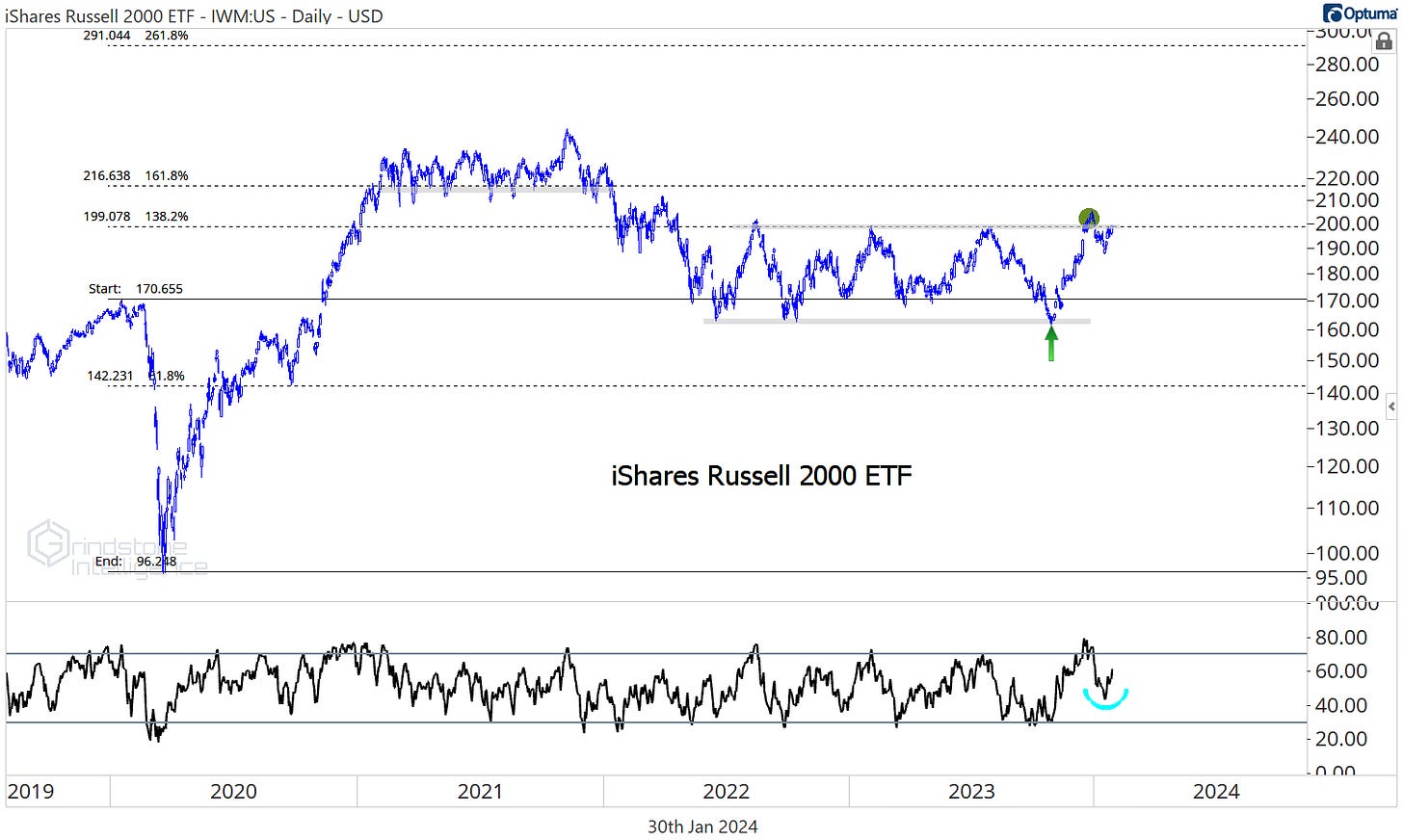

What about the small caps? The small caps haven’t gone anywhere at all for the past 2 years, as they’ve been rangebound between the pre-COVID highs and the 138.2% retracement from the 2020 selloff.

But there’s a difference between ‘not rising’ and ‘falling’. Does the chart above look bearish to you? The Russell 2000 is at near the top of the trading range following a failed breakout - a false start that didn’t push RSI even close to oversold levels. We don’t have to have the small caps leading in a bull market, we just need them to not be falling apart. And that’s exactly what we’re getting.

Risk appetite also favors further gains for stocks.

Looking across asset classes, the (risky) S&P 500 is setting new highs vs. (less risky) bonds. And compared to (less risky) gold, stocks are climbing out of a multi-year trading range. Both are evidence of more risk appetite in the market.

Within the fixed income market, credit spread continue to fall through the floor. If investors were tightening the purse strings, would they be paying a premium for riskier bonds? Of course not.

And within the stock market itself, the ‘safe’ sectors like Utilities and Consumer Staples are breaking down to their lowest levels in decades when compared to the benchmark.

That’s not bearish. That’s something we should see in bull markets, when investors are optimistic about future growth expectations and looking to increase their exposure to more cyclical (risky) areas of the market.

To sum it all up, we’re bullish on stocks. Our target for the S&P 500 is 5300, which is the 261.8% retracement from the 2020 decline.

We do this at the outset of every month, we take a top-down look at the US equity markets and ask ourselves: Do we want to own more stocks or fewer? Should we be erring toward buying or selling?

That question sets the stage for everything else we're doing. If our big picture view says that stocks are trending higher, we're going to be focusing our attention on favorable setups in the sectors that are most apt to lead us higher. We won't waste time looking for short ideas - those are less likely to work when markets are trending higher. We still monitor the risks and conditions that would invalidate our thesis, but in clear uptrends, the market is innocent until proven guilty. One or two bearish signals can't keep us on the sidelines.

So with the market clearly trending higher, we’re looking for stocks to buy. And we’re focusing our attention on growth sectors once again.

At the turn of the year, it looked as though the Russell 1000 Growth index would hand off leadership to Value at a familiar level, the same place Value began to outperform in 2020 and 2021. But this multi-year consolidation instead resolved in favor Growth.

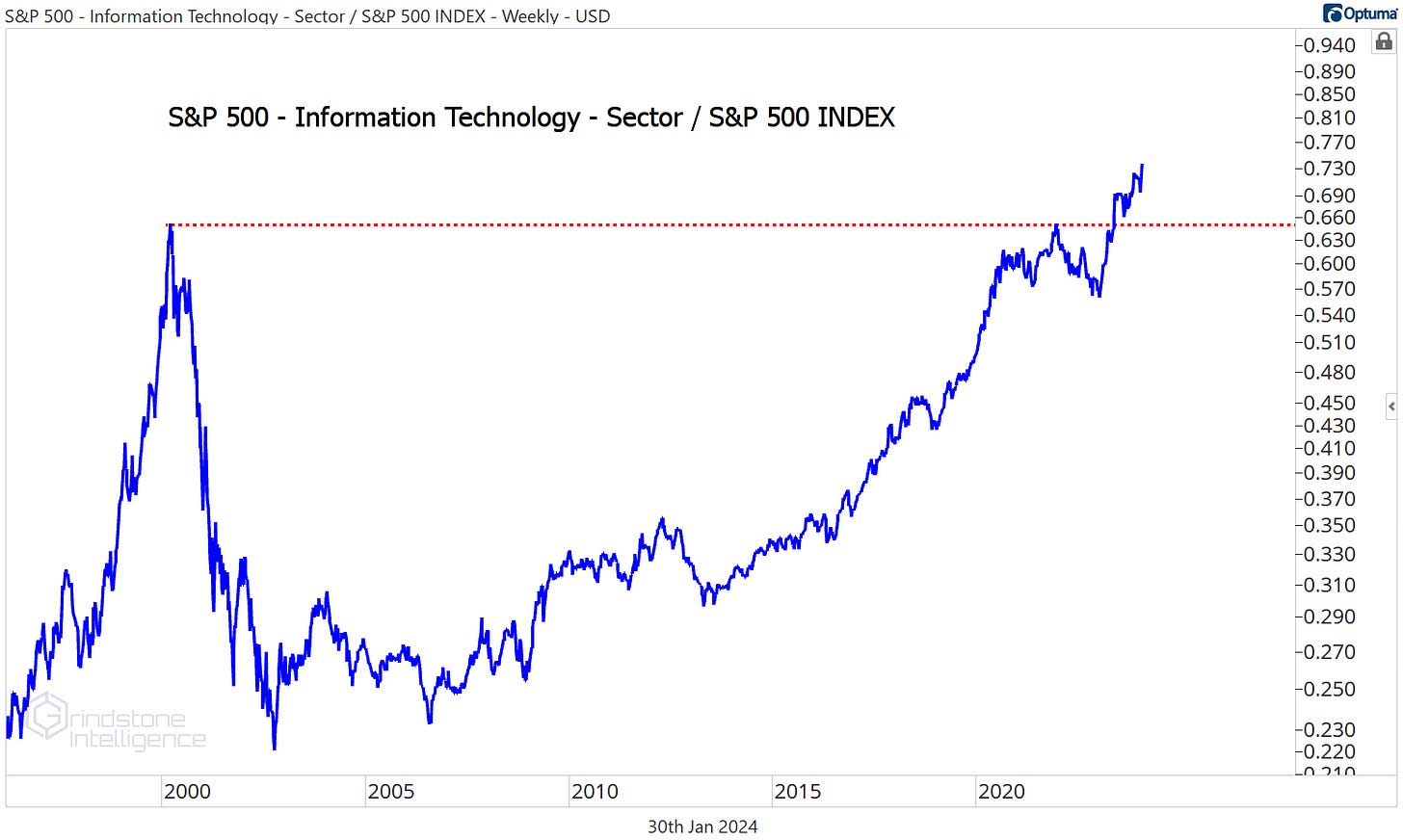

Information Technology, the largest and growthiest sector in the S&P 500, is a big part of that resolution. It finally surpassed the relative highs it set all the way back at the height of the dotcom bubble. And it’s barely stopped for a breather since.

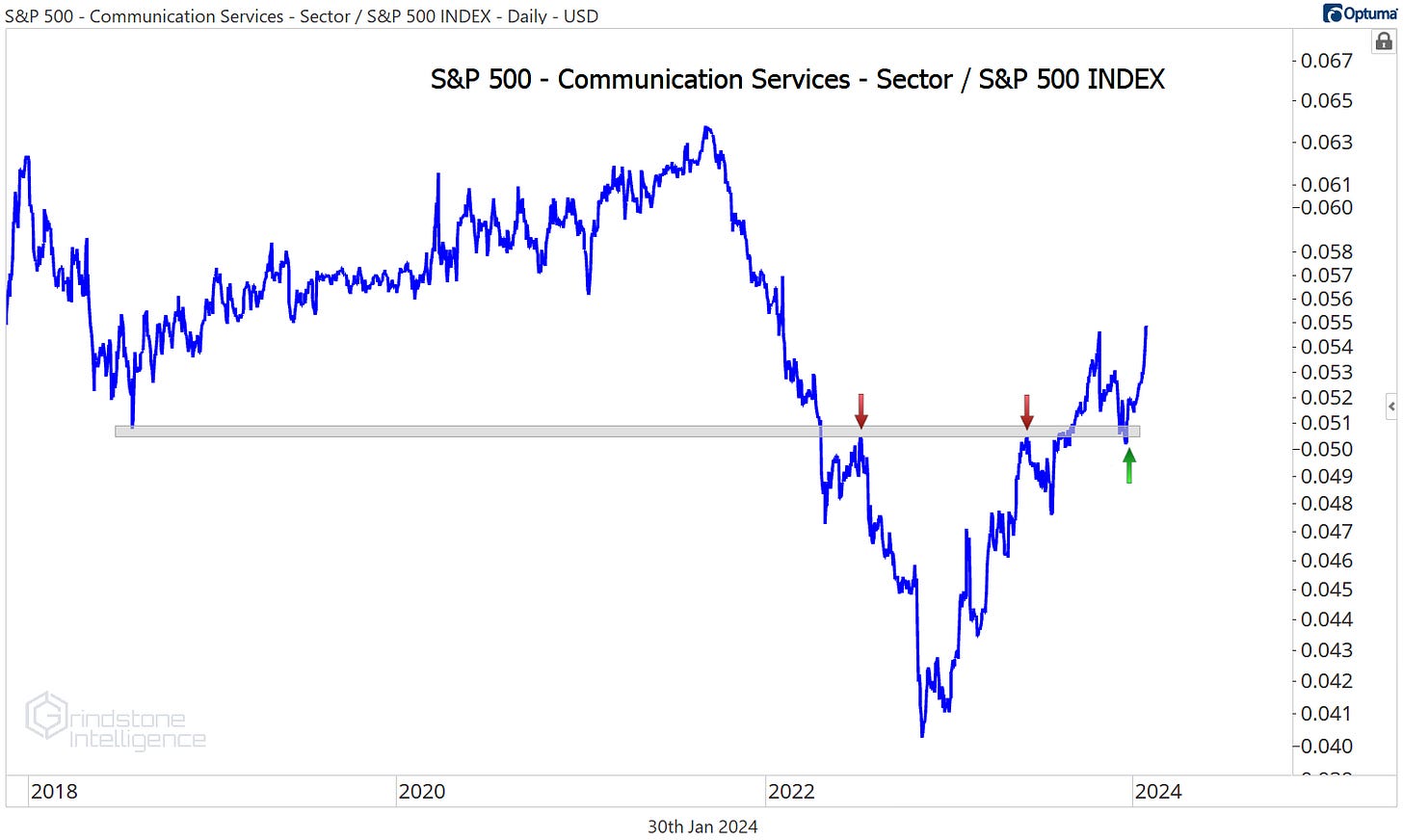

Not far behind is the Communication Services sector, which found support in mid-December at the 2018 relative lows, then outperformed the rest of the market by 9% over the next 6 weeks:

If we want to find the best stocks, looking in the best sectors (and avoiding the worst) is a good way to stack the odds in our favor. That means spending more time on Tech and Communications and ignoring the Utes and the Staples.

Where could it all go wrong?

Remember the bear market of 2022? The only thing that mattered that year was interest rates and the US Dollar. Every time rates moved higher and the Dollar surged, stock prices fell to a new low.

Last year really wasn’t that much different. The US Dollar was subdued and rangebound, and that was good for stocks. Still, big swings in the DXY were mirrored by moves in the S&P 500.

The last month has been different. The Dollar has been strengthening all year, but stocks have ignored the move. Is that because the correlation has come to an end? The USD/SPX correlation wasn’t always so strong, so perhaps this is a return to ‘normal’.

Or it could just be that the US Dollar is rangebound and completely trendless, and it won’t be important again until that changes.

The index is trading right on top of the average price for the last 200-days, and that 200-day moving average has been perfectly flat for almost 3 months. What a snoozefest.

Wake me up when the Dollar is above 105 or the number of new lows starts to rise - hopefully the transports wake up first.

Until next time.