(Premium) February Technical Market Outlook and Equity Playbook

Stocks got off to one of their best starts ever in January. With every passing day, the climb looks less like a bear market rally and more like the start of a new bullish era. We aren’t out of the woods yet, but we think we see the light at the edge of the forest.

US Equities

We start our monthly technical outlooks at the top for a reason. In just a handful of charts, we can see exactly the type of investment environment we’re in. Are stock prices rising or are they falling? Should we be erring on the side of buying or selling stocks?

Last month, we had this to say about the world’s most important stock index:

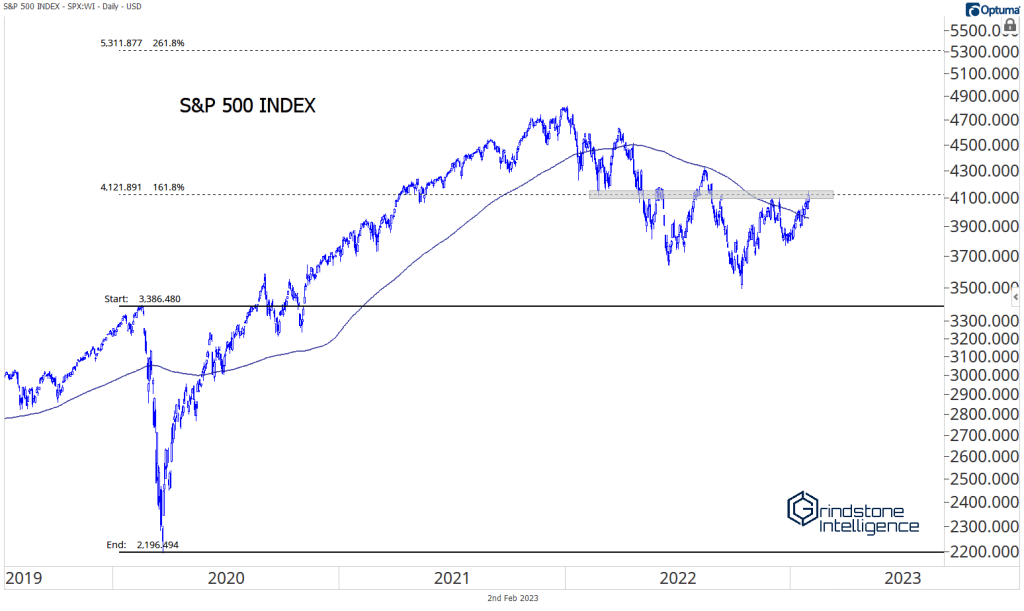

The S&P 500, a market cap-weighted index comprised of 500 of the biggest companies in the United States, is stuck below a falling 200-day moving average. At best, prices are stuck in a sideways trend. The line in the sand for the SPX is 4100. That’s the 161.8% Fibonacci retracement from the entire COVID selloff, and that’s been overhead resistance since May. If we’re above that, we’ll be looking for stocks to buy. As long as we’re below it, we need to err towards caution.

Since then, the index has surpassed its 200-day. That’s one point for the bulls. But we haven’t surpassed the resistance area near 4100. The bears have the upper hand unless and until that level is taken out.

(Editor’s note: If you’re having trouble seeing any chart in this report, click on it to view a larger version)

We’re watching closely, because a few more days like the last would quickly push us above it and give us confidence to flip from a neutral stance to one that’s more bullish overall. Remember, our goal is not to nail tops or bottoms, but to catch the middles of big trends. IF this is truly the start of a new, multi-year bull market, we can afford to wait for that confirmation.

It’s the exact same situation for the Dow and the Nasdaq. The Dow Jones Industrial Average has so far been unable to absorb all this overhead supply between 34000 and 35000. It wouldn’t take much to get a breakout, but this editor is from Missouri. It’s gotta show me.

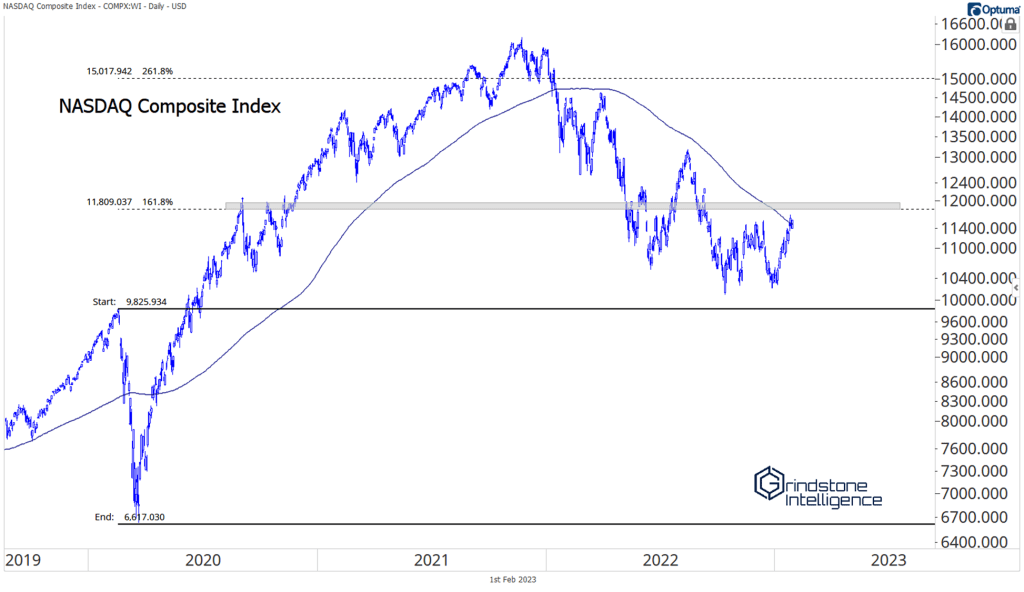

The level for the NASDAQ is 12000. That’s the 161.8% retracement from the 2020 selloff and the September 2020 peak, which marked the beginning of a regime shift as value stocks took the lead from growth. If the NASDAQ is above 12000, we can confidently be buying stocks.

Small Caps are the ones to watch. With the last few days of gains, the Russell 2000 is above its own key area of resistance. That’s a good sign – small caps were the first to find a bottom last year and could very well lead us higher in 2023. But if IWM is back below 190, expect the rest of the major US indexes to be failing, too.

Click on each section below to see the rest of our February outlook:

Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector – UNLOCKED Financials Sector Health Care Sector Industrials Sector Information Technology Sector Materials Sector Real Estate Sector Utilities Sector

Premium members can log in to see our sector outlook and US Equity Model Portfolio below:

Playbook and Model Portfolio

Sector Outlook

The Grindstone Intelligence Sector Outlook is based on our top-down technical approach. These ratings are based on our views over the next month but are subject to change with incoming data. If we feel the need to adjust our ratings before the next scheduled newsletter, we will notify subscribers via email with updated views and our justification.

We’re lowering our rating on Utilities and Energy to Underweight and upgrading Information Technology and Communication Services to Equalweight.

Grindstone Model Portfolio

The Grindstone US Equity Model Portfolio is a hypothetical allocation designed to align with our Sector Outlook and seeks to outperform the S&P 500 Index over the long-term. Our positions are chosen with an investment horizon of a few weeks to several months. The Model will invest only in exchange-traded funds that track sectors, industries, or categories of stocks. No individual stocks or cash positions will be used in the Grindstone US Equity Model Portfolio. Changes to the model portfolio will be communicated via email to subscribers, and official ‘trades’ will be executed at the next closing price. Fund performance will cause portfolio weights to drift between updates.

We’re making significant changes to the model portfolio to reflect our sector ratings changes and the aggressive shift in risk appetite we’ve seen so far in 2023. These changes will be effective at the close of day on February 2nd. The table below details the adjustments and the new positioning.

Please reach out with any questions. We’re happy to clarify any of our opinions, but the nature of our publication prevents us from providing personalized advice. For those questions, please contact your financial advisor.

The post (Premium) February Technical Market Outlook and Equity Playbook first appeared on Grindstone Intelligence.