Financials Sector Deep Dive - 1/26/2024

What's not to like?

So much for that banking crisis.

Back in March 2023, we all became experts on held-to-maturity securities and unrealized losses on bank balance sheets as we waded through the aftermath of some of the largest bank failures in history. The crisis proved to be short-lived.

Silicon Valley Bank failed on March 10, and the Financials sector found a bottom one week later on March 17. Since then, the Financials have been indistinguishable from the rest of the market:

Bank failures were no doubt concerning, but it was remarkable how well the sector held up even during the worst of the crisis. The Financials never even broke below their pre-COVID highs - a level that has a bit of historical significance.

If Financials were still hanging above their 2007 highs and even their October 2022 lows, we mused, how bad could things really have be?

Now, the Financials are closer to breaking out to new highs than they are falling to new lows.

And compared directly to the S&P 500, we’re seeing more constructive action than we’ve seen in quite some time. The Financials/SPX ratio is above its 200-day and just found support at a key, one-year rotational level. That sets the stage for outperformance in the weeks and months ahead.

Future leadership from the Financials fits with the strength we’re seeing below the surface. More than 90% of stocks in the sector are above there 50, 100, and 200-day moving averages. No other sector can say the same:

We’ve got an Overweight rating on the Financials, and we see no reason to change that. The Financials are innocent until proven guilty.

Digging Deeper

Unsurprisingly, the banks are the worst performing industry within the sector over the past year. All of the underperformance came last spring - since setting a bottom vs. the overall Financials sector last May, the regional banks have kept pace:

Until we see a resolution out of this 9-month relative consolidation, there’s no reason to either favor or avoid the regional banks. We’re just as well off buying the sector as a whole until we see whether the existing downtrend continues or reverses.

On an absolute basis, though, the regionals have completed the reversal. The sub-industry broke out to new 9-month highs and successfully backtested the breakout level.

That’s a good thing for the regionals, of course, but it’s also great information about the rest of the sector and the rest of the market. If even the regional banks are rising, what does that tell you about the type of environment we’re in?

Here’s a hint: The bears aren’t the ones in control.

Leaders

Since it’s not the banks that are leading, who is it? A quick glance at the leaderboard should give you a pretty good idea. The top 10 Financials sector performers over the last month are ALL insurance stocks.

Here’s IAK, the iShares Insurance ETF, pushing past resistance at the 161.8% retracement from the 2020 decline. This is one we’ve had in our model equity portfolio, and we think it can go all the way to $130.

Insurance stocks are showing relative strength vs. the rest of Financials, and Progressive is showing relative strength vs. insurance stocks. Here it is trying to break out of a 3-year base vs. the sub-industry.

We want to own PGR with a target of $205.

Brown & Brown is another one we like. It just gapped higher out of a nearly 2-year base. We want to be buying any pullbacks toward the breakout level of $74 with a target of $86.

Losers

Blackrock was among the biggest losers in the sector over the last month after it fell 3%, but of those on the losers list, it’s the closest to new 52-week highs. Just last month, BLK broke out of a monster base. We want to buy any pullbacks toward $780 with a target back at the former highs near $970.

More charts to watch

Jumping back to the Insurance theme, how can we leave out Mr. Buffett and Berkshire Hathaway? This is a great setup and we want to be buying any further pullbacks toward $360 with a target up near $420, which is the 161.8% retracement from the 2022 decline.

Globe Life probably has the cleanest risk/reward setup right now within the insurance space. It hasn’t het broken out to new highs.

We can buy GL above $125 with a target of $138, which is the 161.8% retracement from the 2020 selloff.

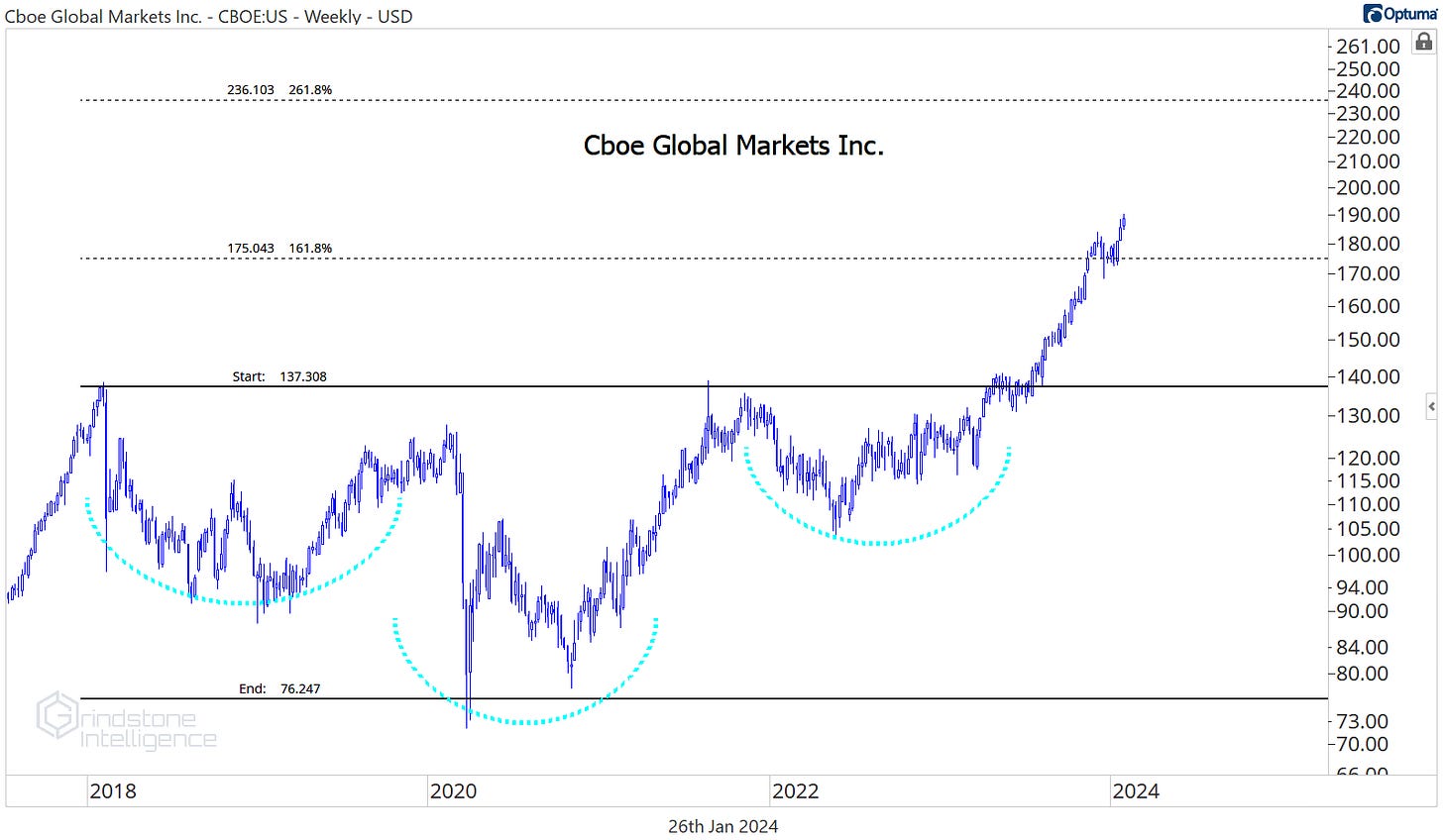

We stepped aside on CBOE in November after it hit our target of $175 as we wanted to see how it responded to potential resistance at the 161.8% retracement from the 2018-2020 decline. We’ve seen the response now, and it was a good one. With $175 as our risk level, we want to be long CBOE with a target of $235.

The relative strength here is what we really like about the stock. CBOE just broke out of a 5-year base relative to the entire Financials sector, then successfully backtested the breakout level in December. Not only do we think CBOE goes higher, we think it will outperform. And if we want to outperform the market, we need to own the things that are outperforming the market.

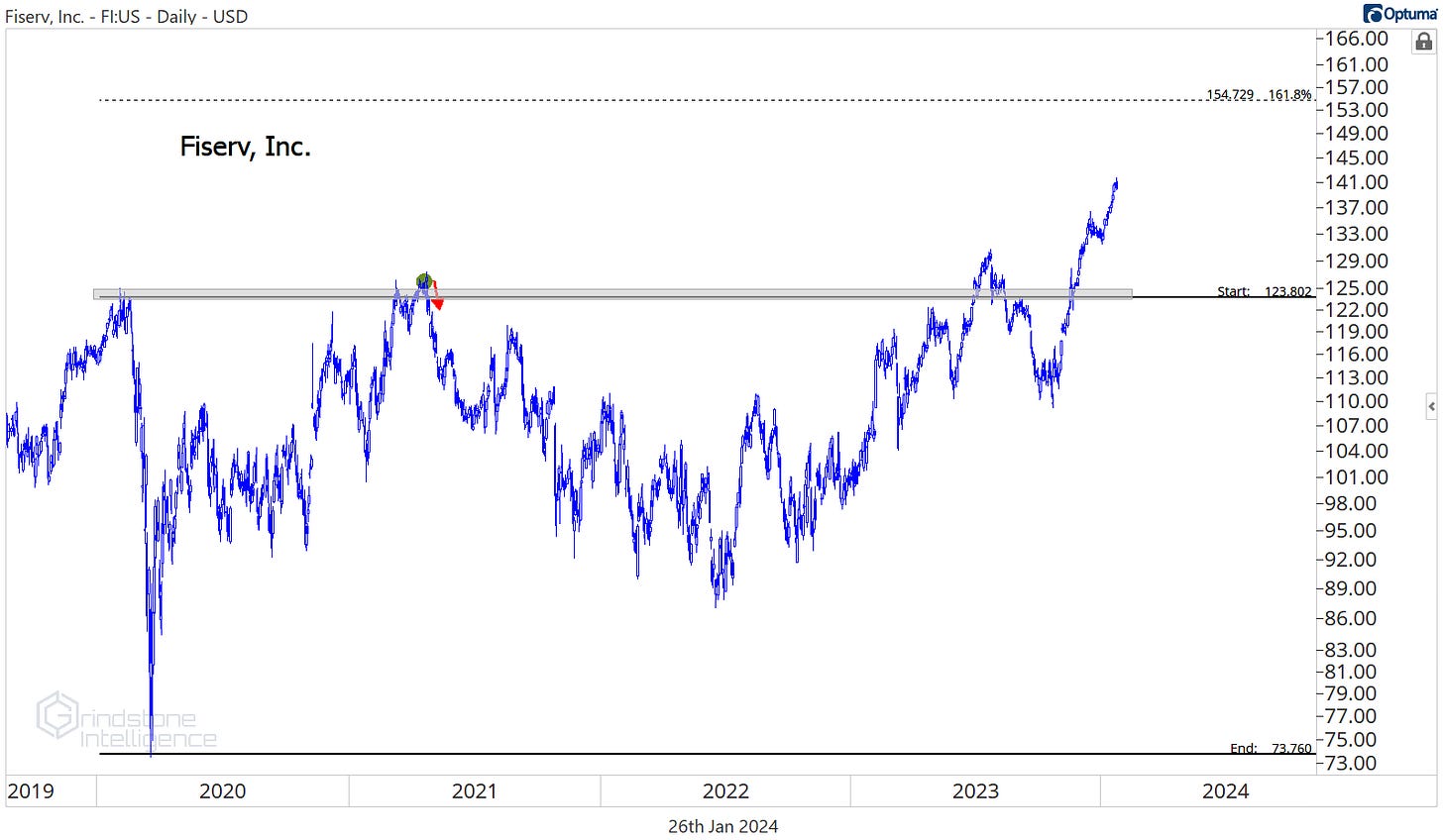

We continue to like Fiserv after it successfully broke out of this multi-year base. FI was one of the best uptrends you could find in the decade leading up to COVID, and now it’s had some time to digest all those gains. The first attempt to get going this summer resulted in a failed move, but after the false start, FI’s second attempt is bearing fruit. We want to be long above $123 with a near-term target above $150.

Fidelity National is the opposite of Fiserv in that it has show a ton of relative weakness over the past few years. But this downtrend looks to have finally run its course, and we think FIS could have make a big run. We want to own FIS above $63 with a target of $90, which is the 38.2% retracement from the entire 3 year decline.

Is there any Financials stock more important than JPMorgan? We don’t think so. If JPM is setting new highs, you’ll have a hard time convincing us that we’re in the midst of anything other than a healthy bull market. It’s been stuck below the 423.6% retracement from the 2007-2009 decline for the last few years, but we want to be buying JPM on a move above $180 with a target of $275.

Synchrony Financial is a good setup - we like it above $38 with a target back at the former highs near $54.

That’s all for today. Until next time.