Financials Sector Outlook

Top charts and trade ideas

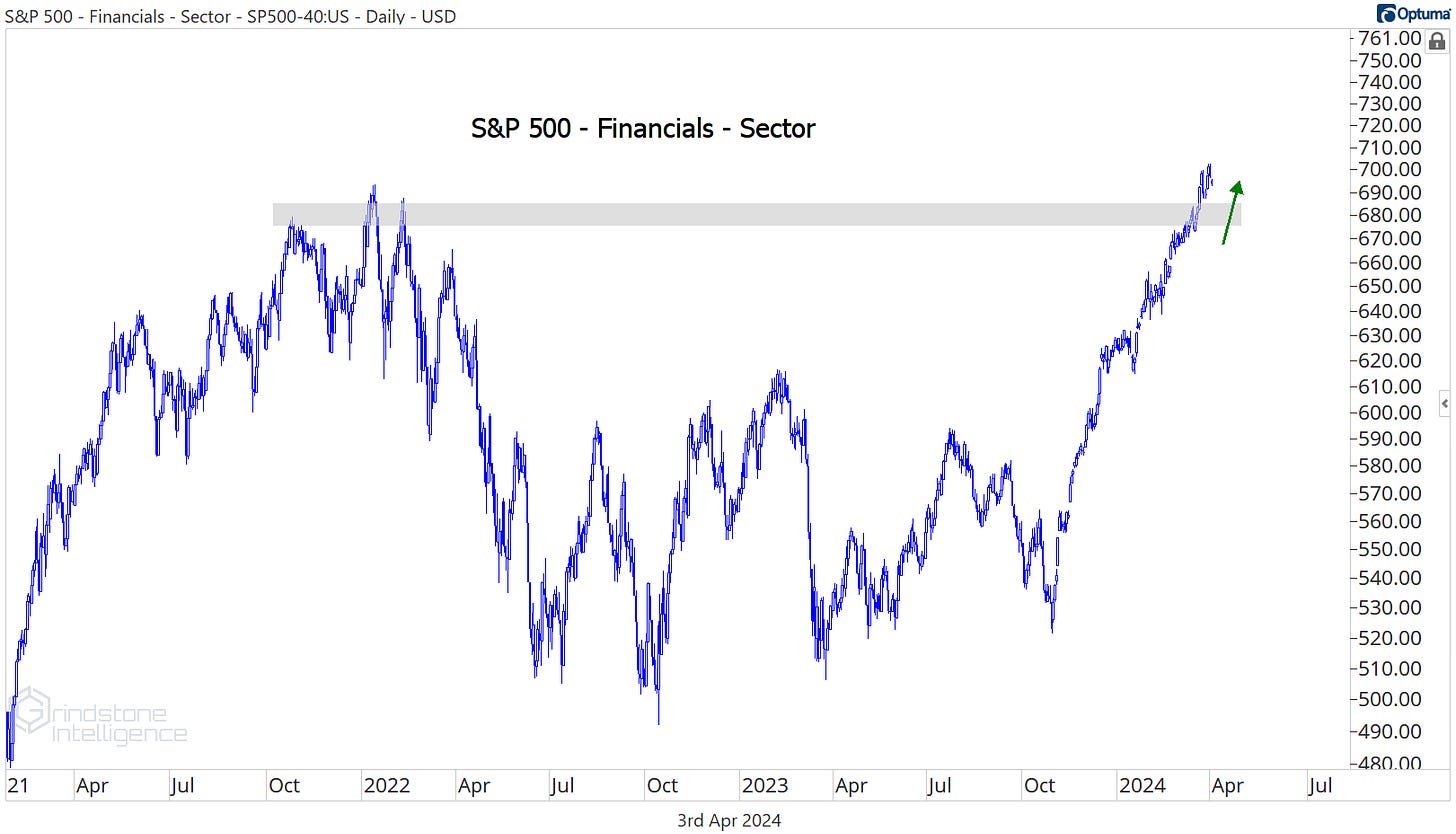

The Financials sector is setting new all-time highs.

It’s been more than two years since US equities began a bear market and 1 year since the collapse of Silicon Valley Bank sparked a panic that nearly upended the entire banking industry. Last March, everyone was scrambling to become experts on the accounting intricacies of held-to-maturity securities and the extent of unrealized losses on bank balance sheets. Even now, there are widespread concerns about the lasting impacts of the ongoing collapse in commercial real estate values.

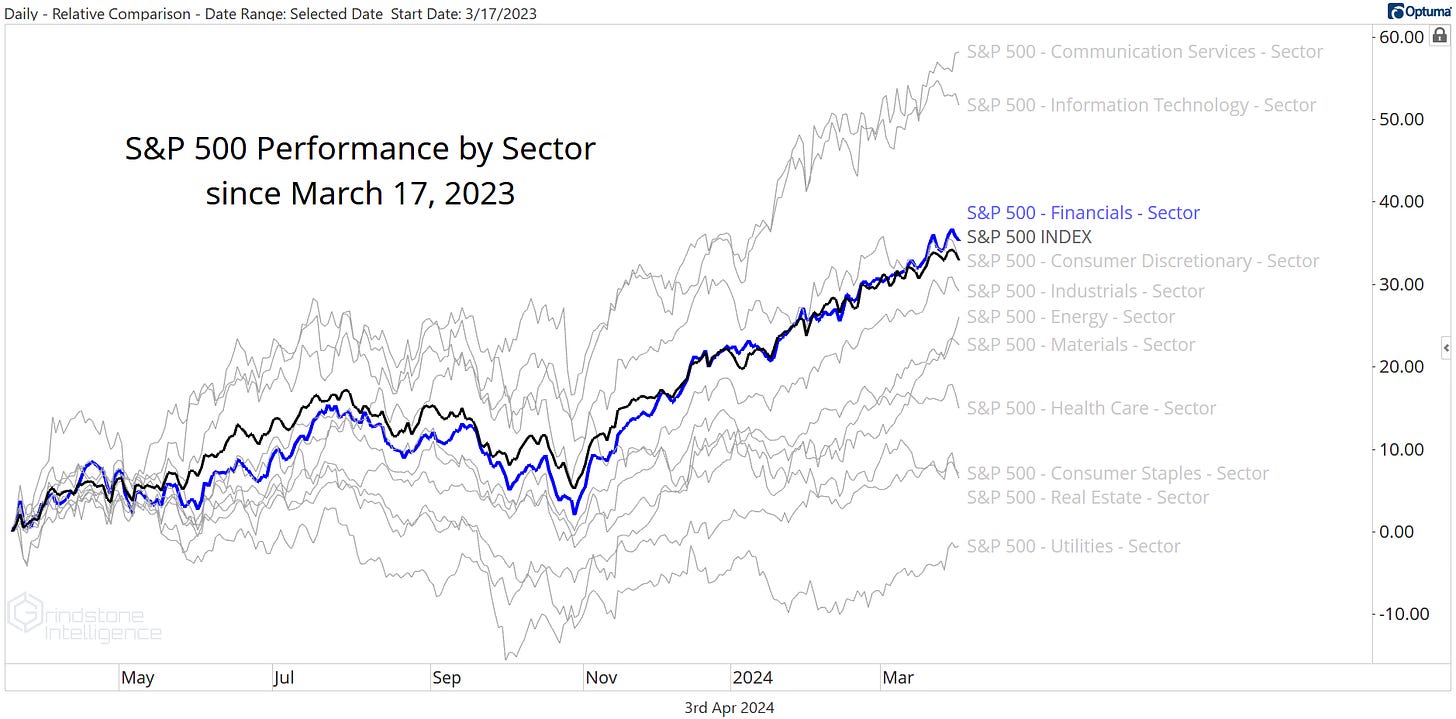

Despite all that, the ‘crisis’ was over almost as soon as it began. From the March 17th, 2023 lows to today, the Financials have outperformed the S&P 500 as a whole and trailed only the Communication Services and Information Technology sectors.

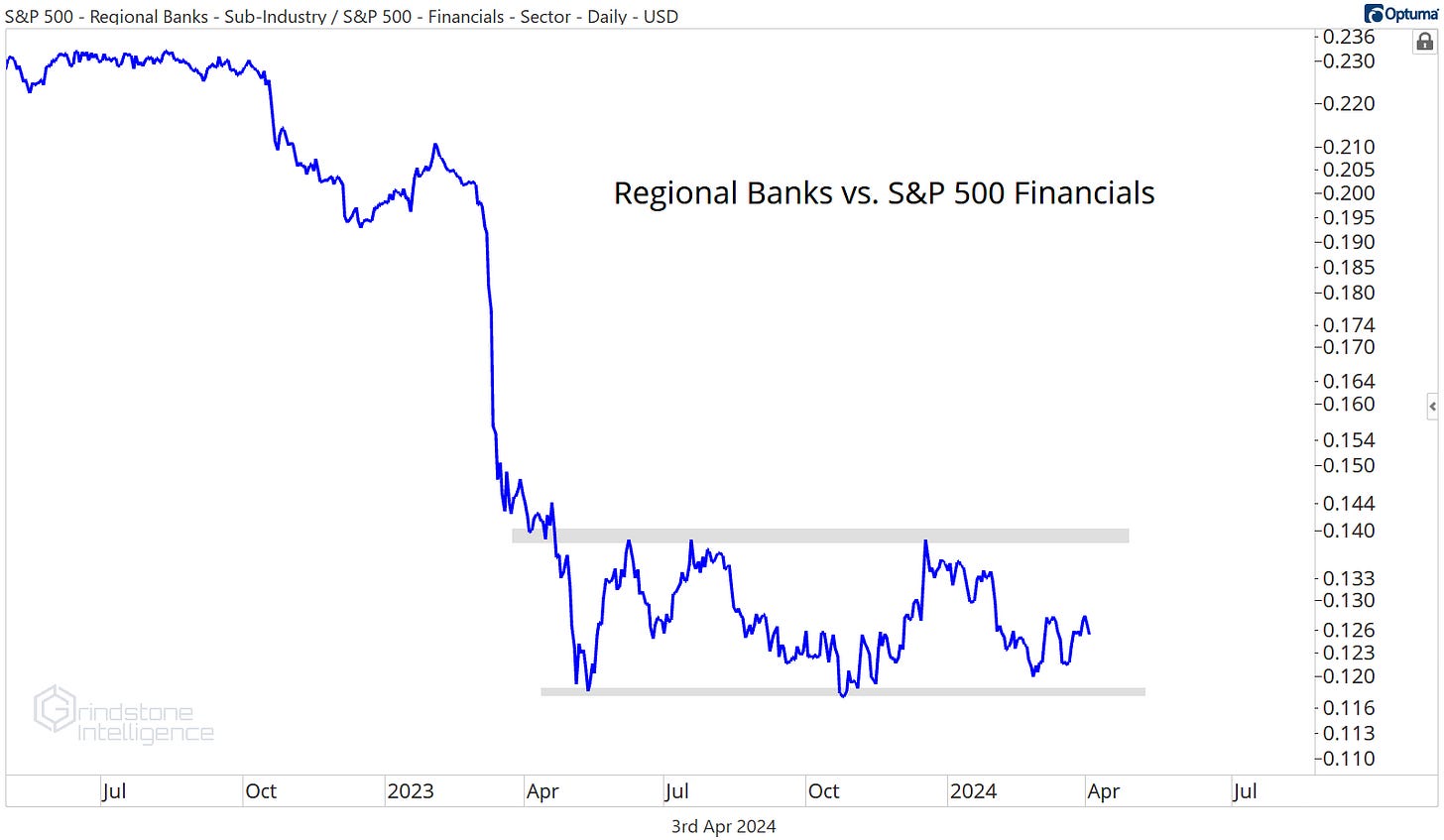

Risks to the regional banks are no doubt worth keeping an eye on, but as a group, they continue to hold up remarkably well. Even when negative NYCB headlines were running rampant earlier this year, the S&P 500 Regional Banks sub-industry never collapsed below last summer’s highs. Now, it’s setting new 52-week highs.

That doesn’t mean we have to be going out and buying a bunch of regional banks. As an industry, they aren’t showing any relative strength when compared to the rest of the Financials sector.

But the simple fact that one of the most troubled areas of the market isn’t falling is evidence of the underlying health across the equity landscape.

In other words, this is a bull market.

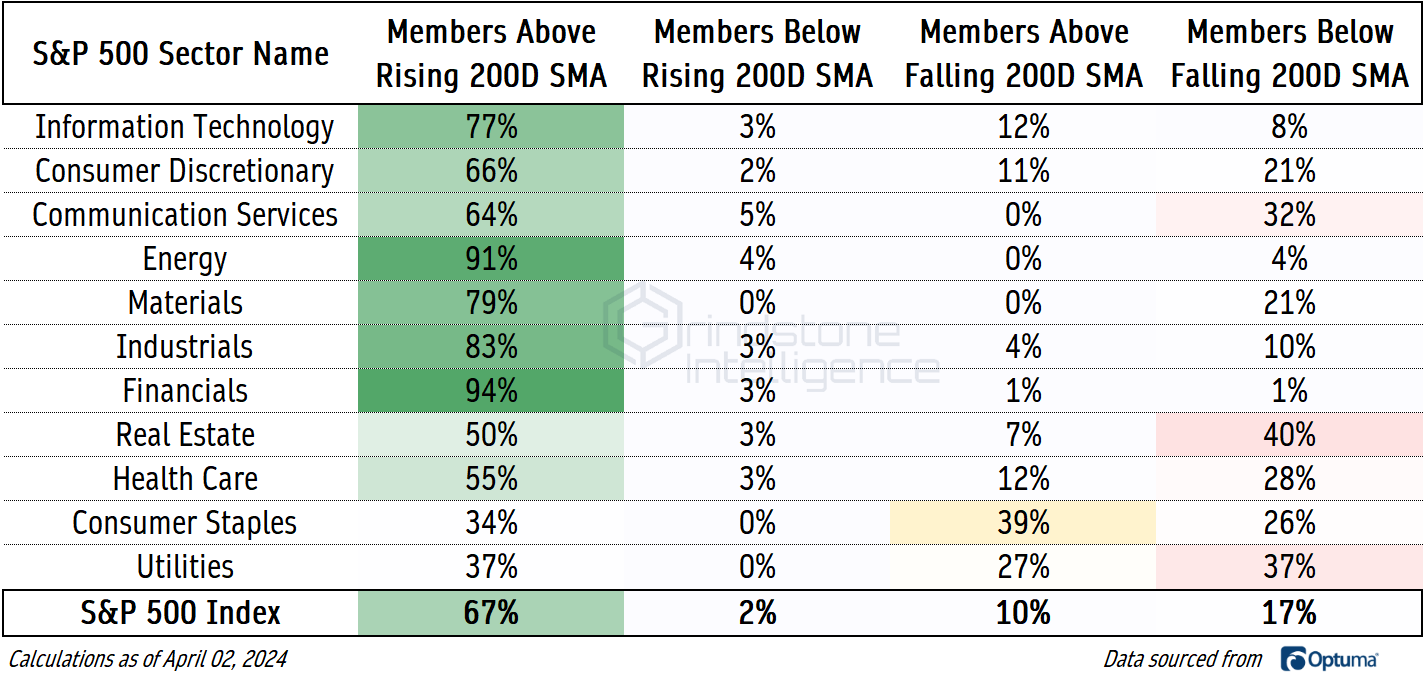

And in bull markets like this, most stocks tend to go up. Nowhere is that more true than in the Financials sector. Today, 94% of S&P 500 Financials sector stocks are trading above a rising 200-day moving average. Other value-oriented sectors - Energy, Industrials, and Materials - aren’t far behind.

Whether or not value stocks continue to outperform really comes down to the chart below. The ongoing retest of the 2020-2021 highs for the Russell 1000 Growth to Value ratio has big implications for which sectors lead going forward. A successful retest here would mean we should put renewed attention on AI and mega-cap growth names that have dominated the bull market thus far.

A failure, though, and we could find ourselves at year-end talking about the dominance of Energy and Financials stocks in 2024.

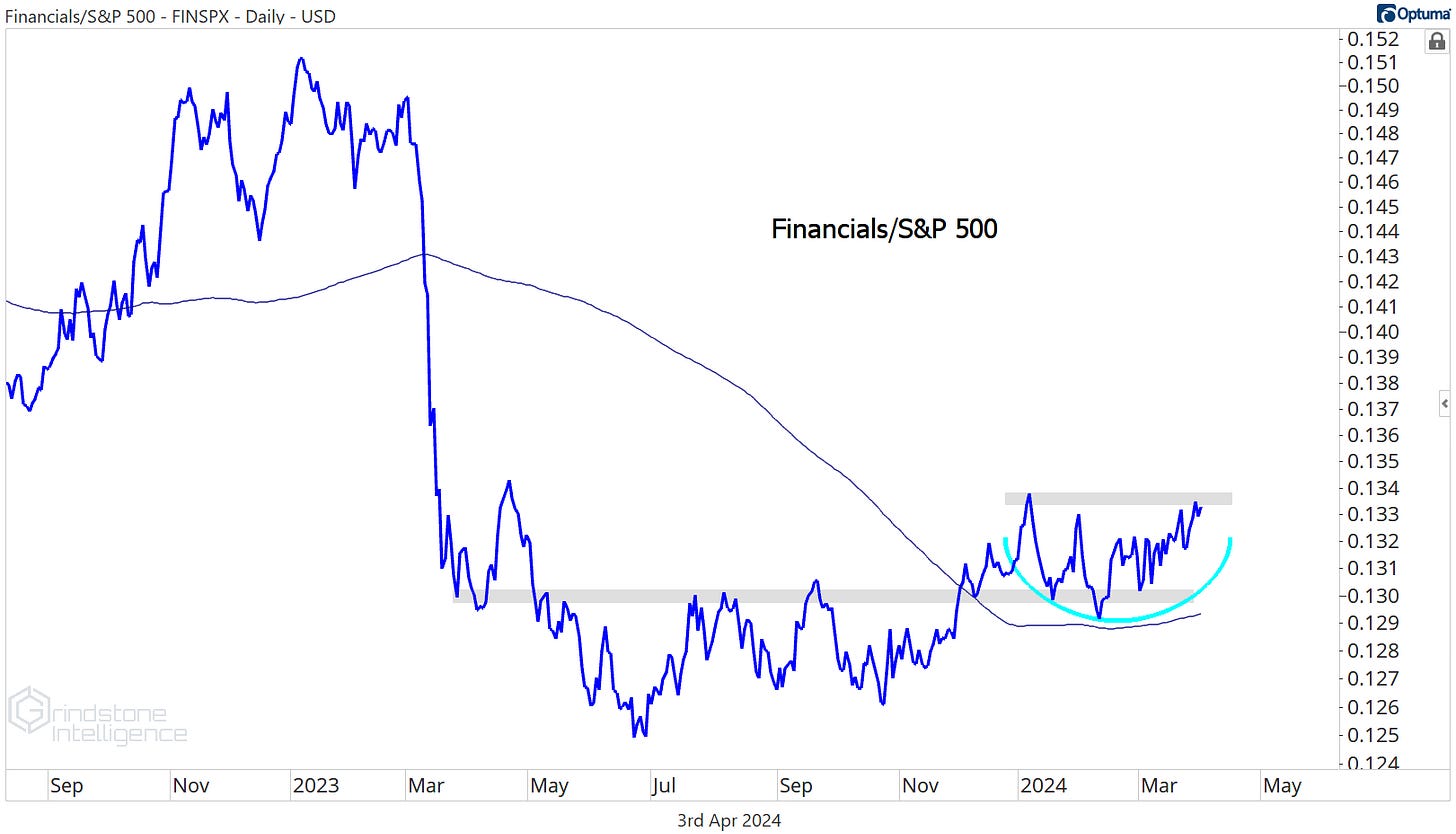

That would fit with a bullish resolution from this year-to-date consolidation for the Financials relative to the S&P 500. The ratio below is above its 200-day moving average and found support at a key, one-year rotational level earlier this year. A breakout would only serve to cement the the Financials as a leadership group going forward.

Digging Deeper: Leaders, Losers, and Trade Ideas

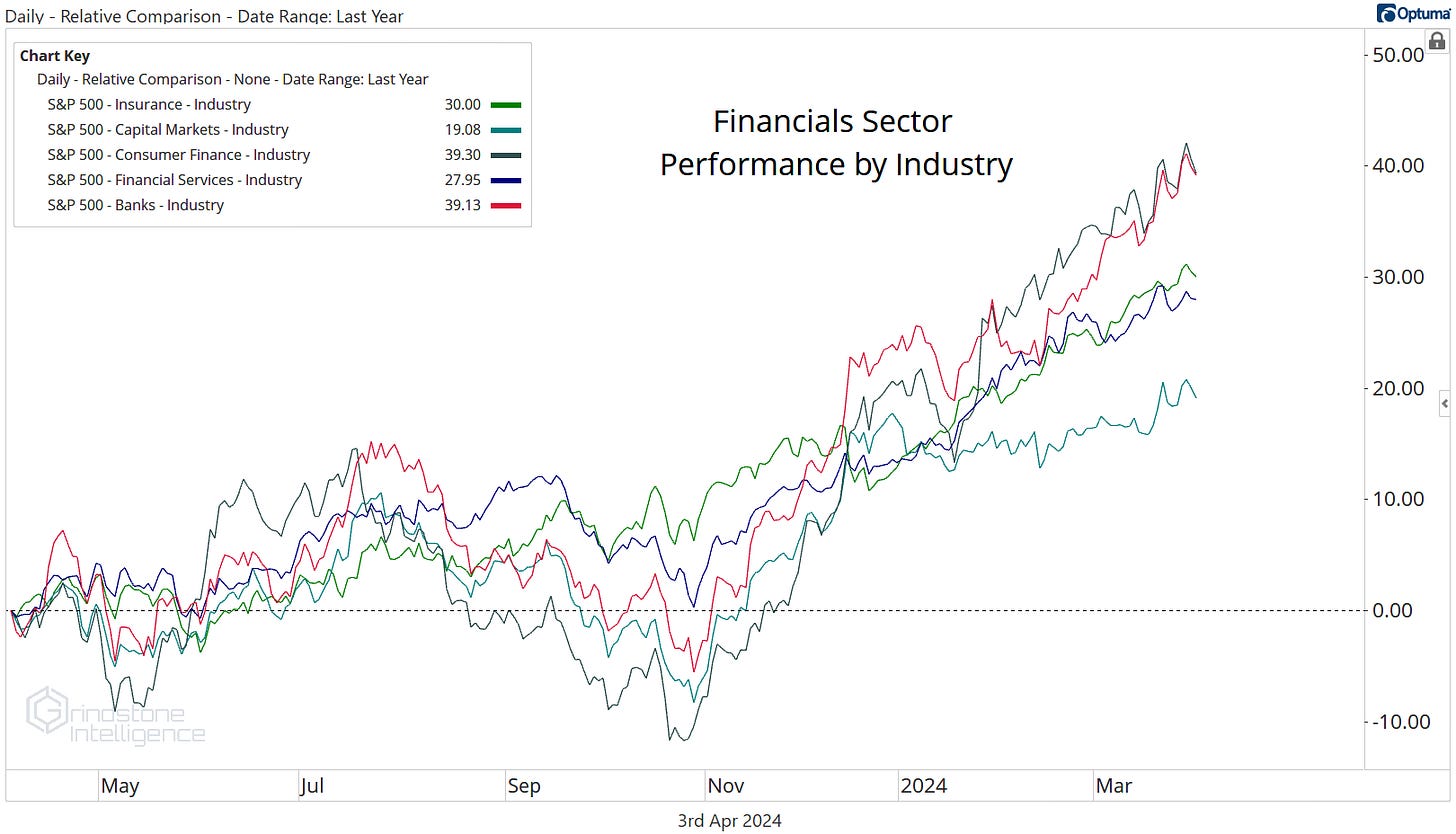

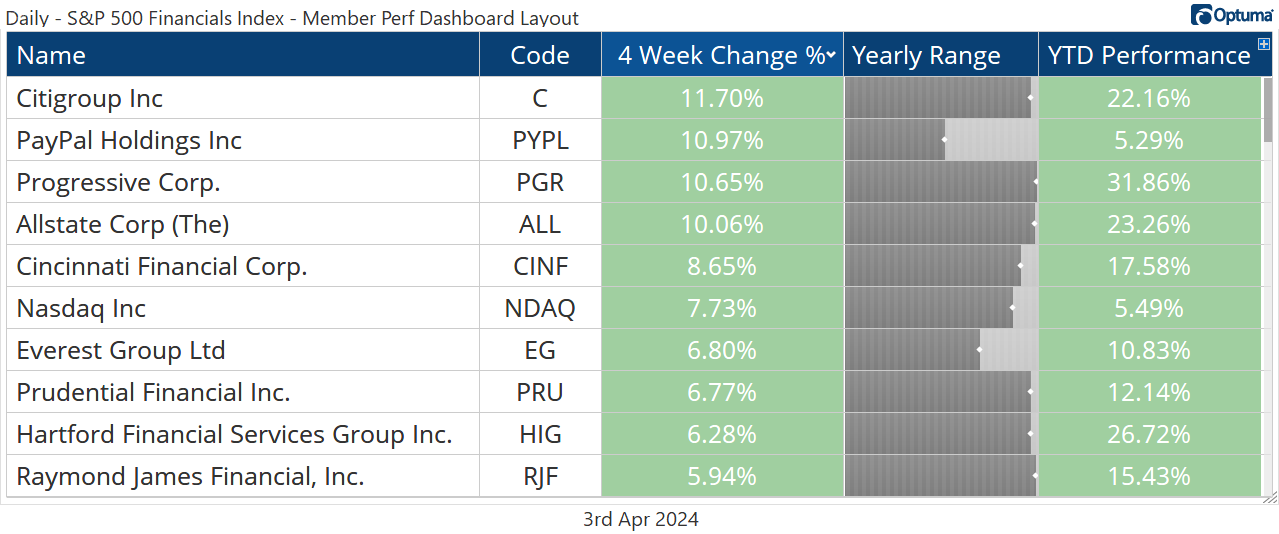

Often when we look at industry performances within a sector, we see a wide disparity in outcomes - some groups might see huge gains, while others end up in the red. With the Financials, that’s not the case. All five industries have gained at least 19% over the past year, and none have risen more than 40%.

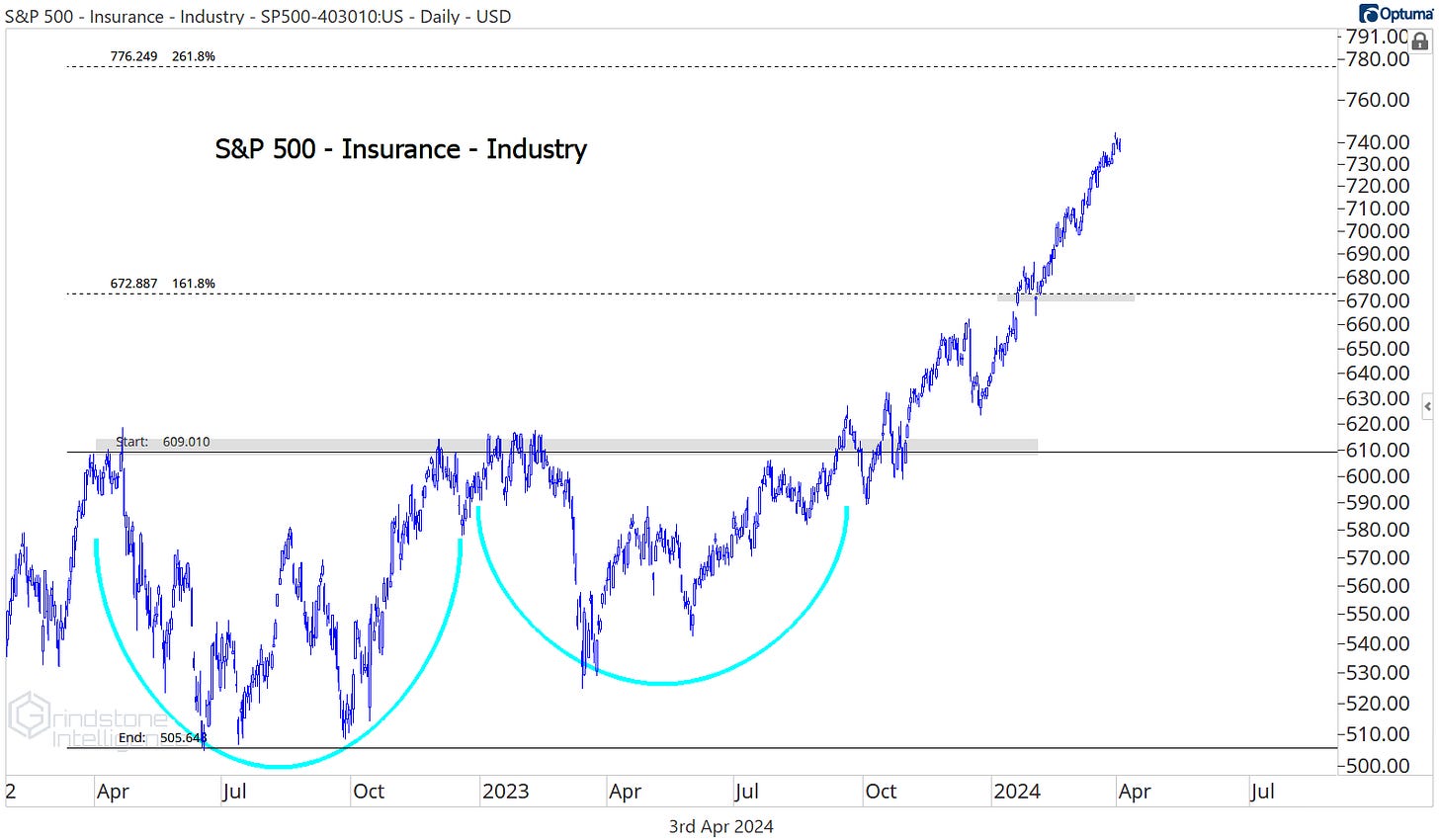

Insurance is in the middle of the pack at 30%, but it’s had the smoothest ride along the way. So far in 2024, it hasn’t had a pullback of more than 2%. We think there’s still room for the group to go higher, with potential resistance up at the 261.8% retracement from the 2022 decline.

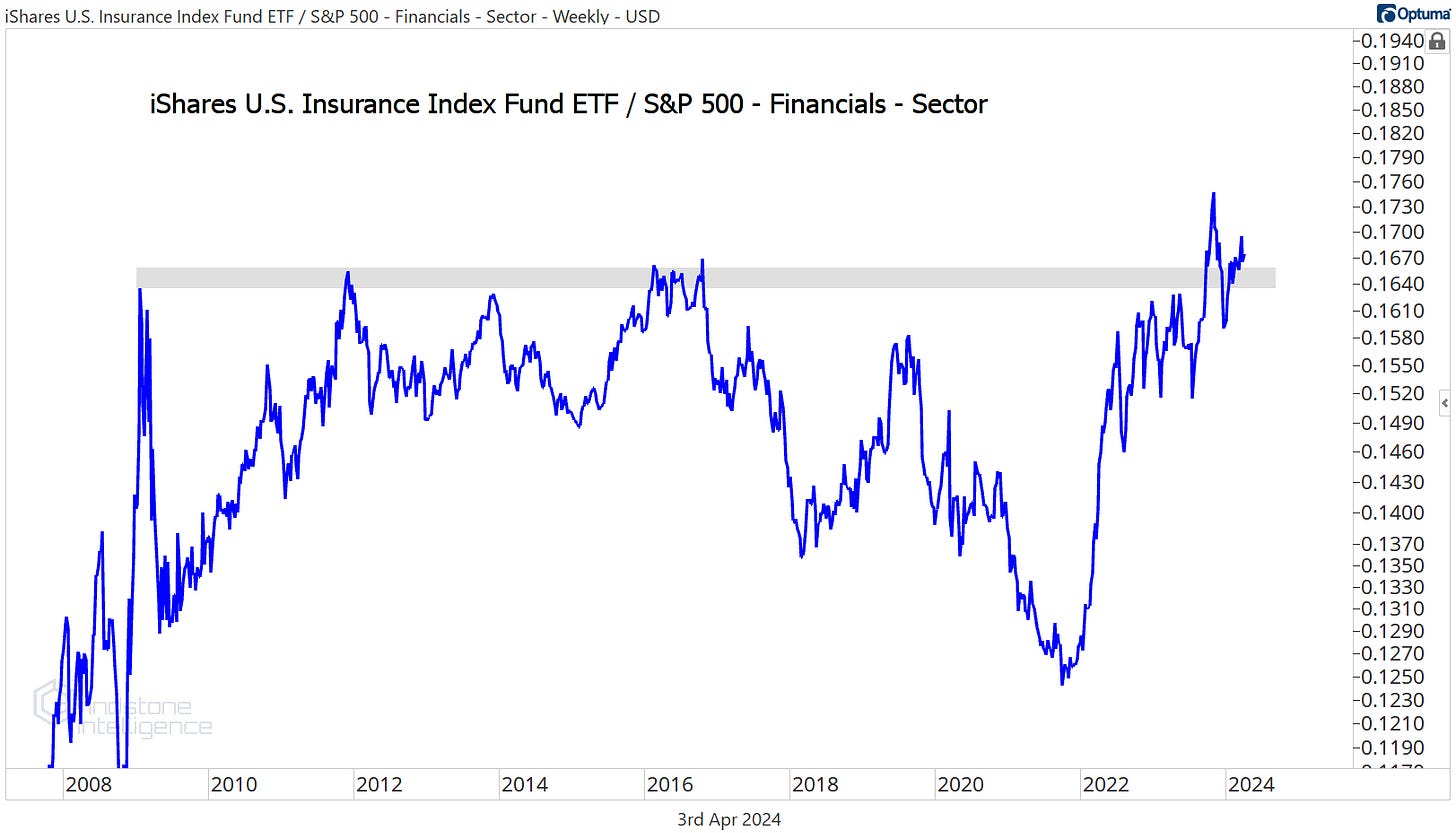

More impressive than the steady strength this year is the massive 15-year base for IAK - the iShares Insurance ETF - relative to the rest of the sector. If insurance stocks are above their 2009 highs vs. the Financials, how can we not be buying them?

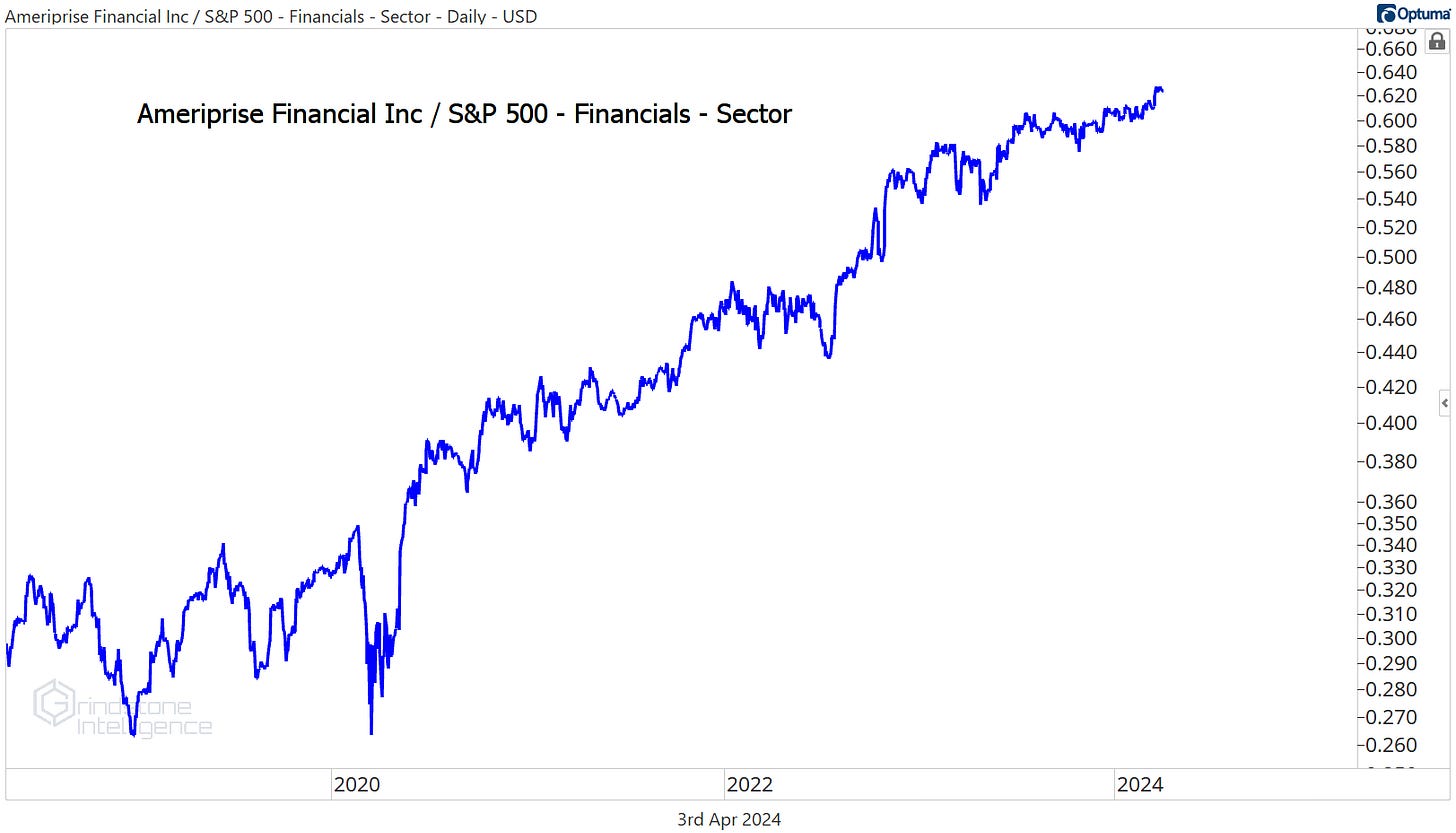

Ameriprise has been a monster. It’s setting new highs relative to the rest of the sector, and it’s been doing so steadily for the last few years.

The risk/reward isn’t great here for AMP as it trades halfway between support at $340 and potential resistance near $500, but it’s definitely one to keep a close eye on for when the setup improves.

Progressive is much cleaner. It just moved past our former target of $205, and now we can reset and use that level to manage risk on new entries. We like PGR long above $205 with a target of $265.

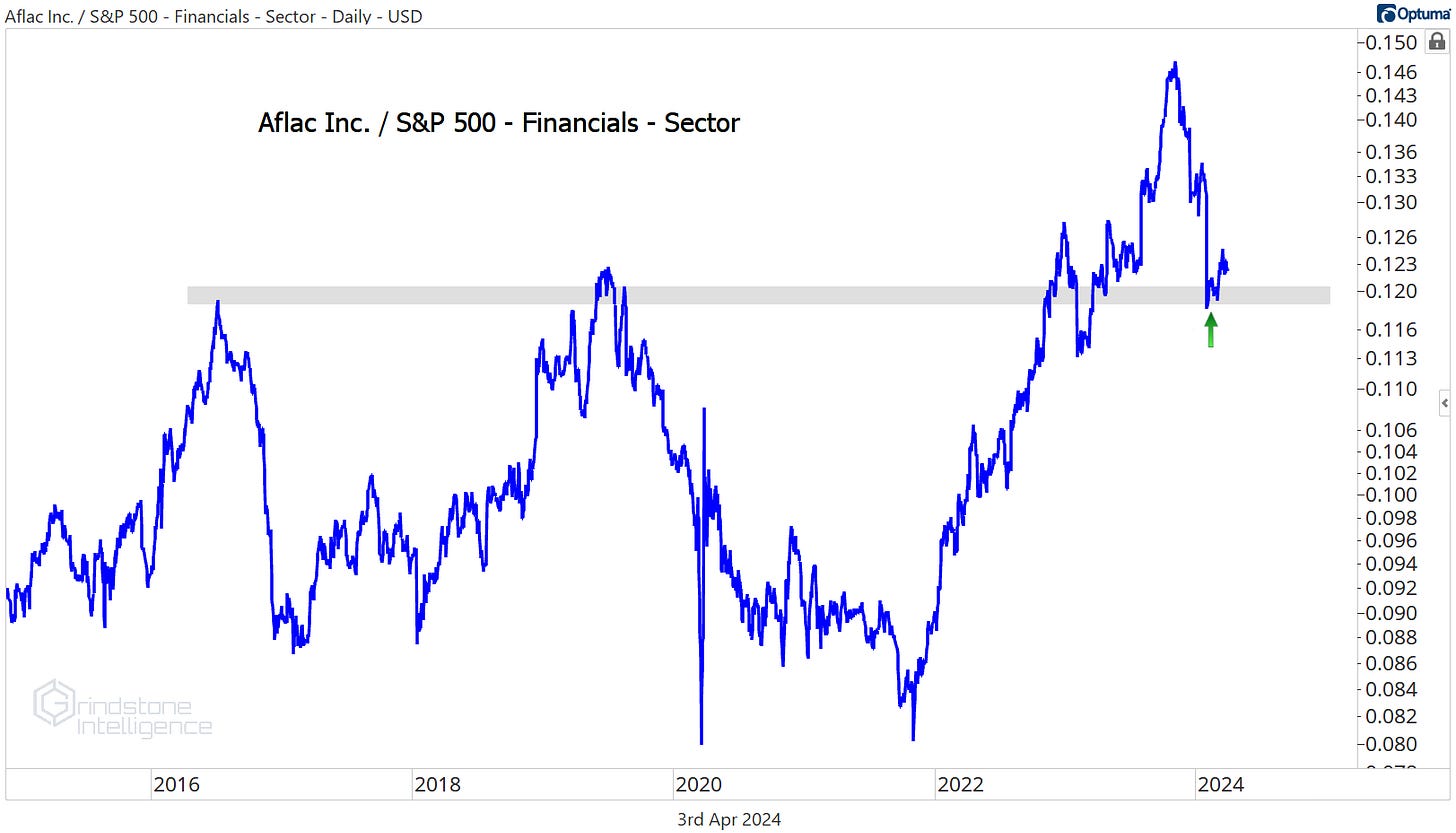

Aflac is another great one. On a relative basis, AFL just pulled all the way back to its 2016-2021 highs. Pullbacks within longer term uptrends always get us excited.

Especially when the uptrend on an absolute basis remains as healthy as this one does. AFL has been consolidating above the 161.8% retracement from the 2019-2020 decline, which gives us a great risk/reward setup from the long side. We like it above $78 with a target up at $112.

Leaders

We like buying pullbacks in uptrends, but we want to avoid buying rallies within downtrends. That’s what we’re seeing in PayPal. It jumped 11% over the last 4 weeks, but the stock is still stuck below resistance from the 2022 lows.

And compared to the rest of the Financials sector, the downtrend line is still very much intact.

Maybe PYPL has bottomed and these are the early stages of a new uptrend. But we don’t want to be betting on trend reversals until we see clear and convincing evidence of a new trend in place. Leave the falling knives to other folks.

Raymond James is intriguing. It snuck onto the biggest winners list with a 6% gain over the last month, and it’s trading at all time highs. The risk is really easy to manage here as it trades just above the former highs at $120, too. We can buy it with a target of $170,

This basing action versus the rest of the S&P 500 is the most interesting part, though. RJF is setting new 52-week relative highs.

Losers

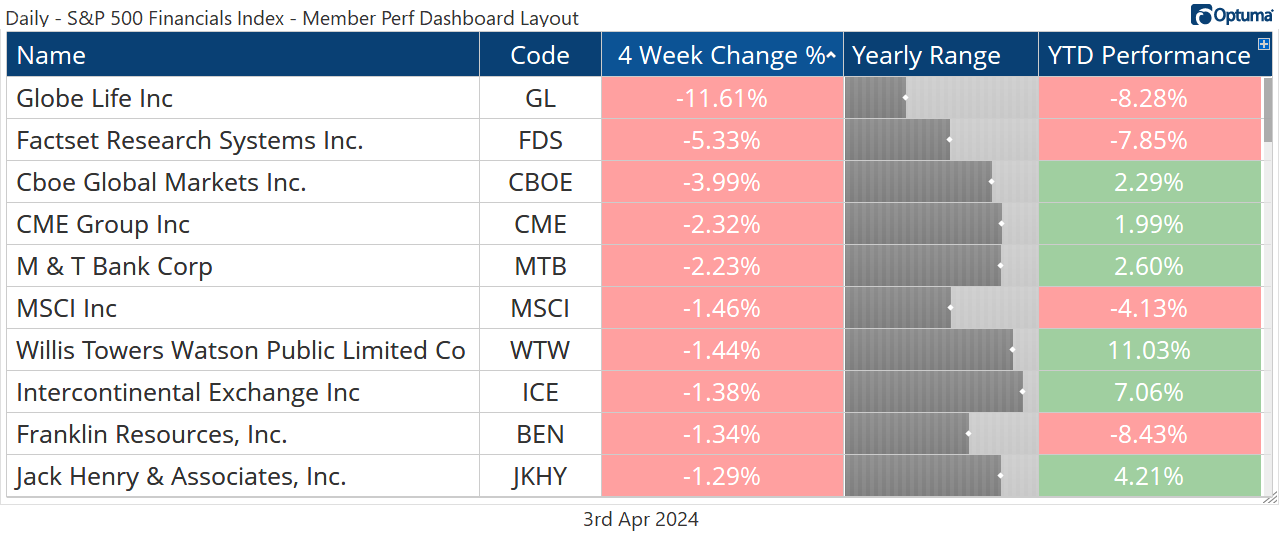

Just as important as buying relative strength is avoiding relative weakness. Losers tend to keep on losing.

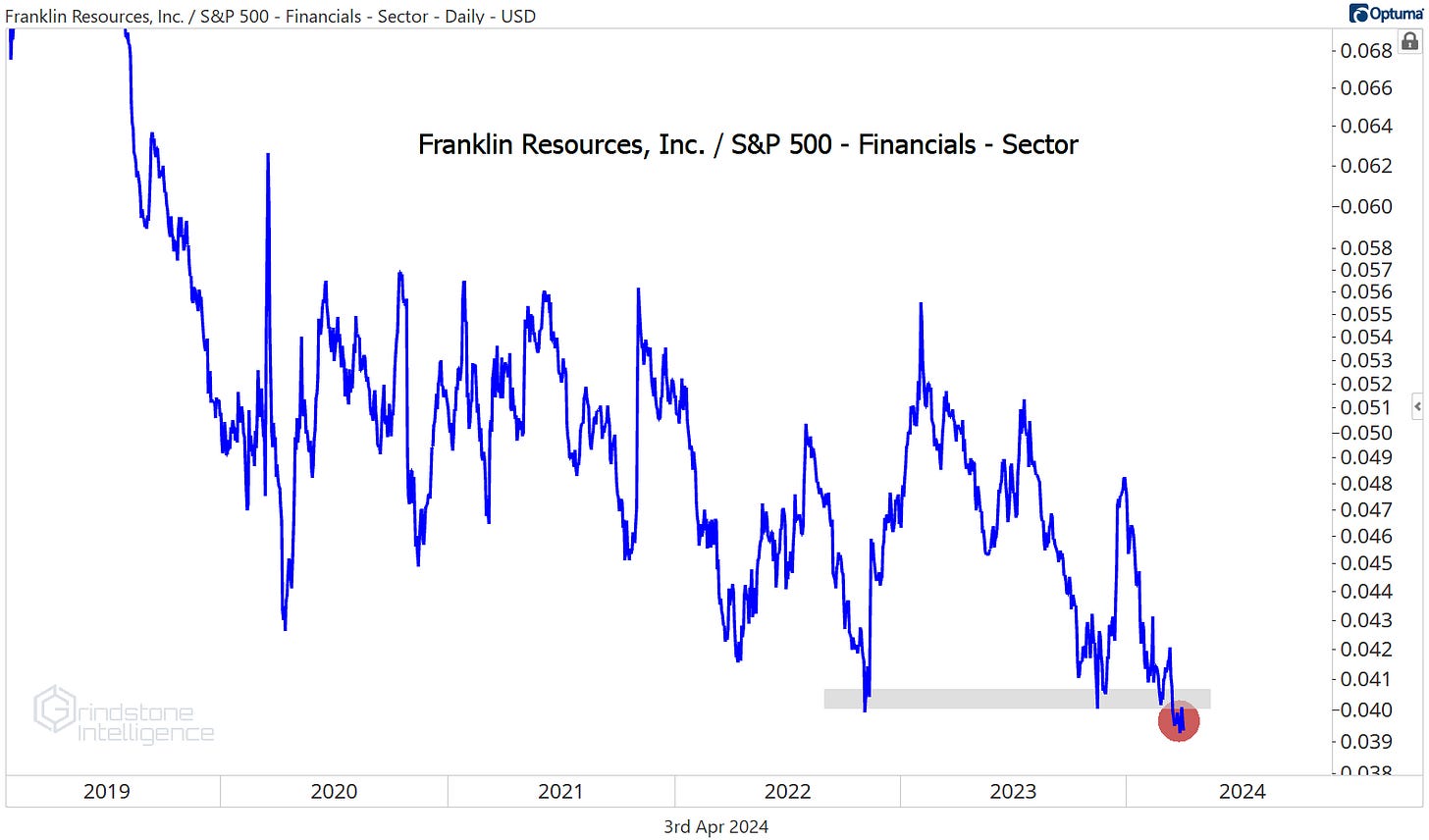

Franklin Resources has lost 80% of its value when compared to the rest of the sector over the 13 years, and it just hit new 20-year relative lows.

More stocks to watch

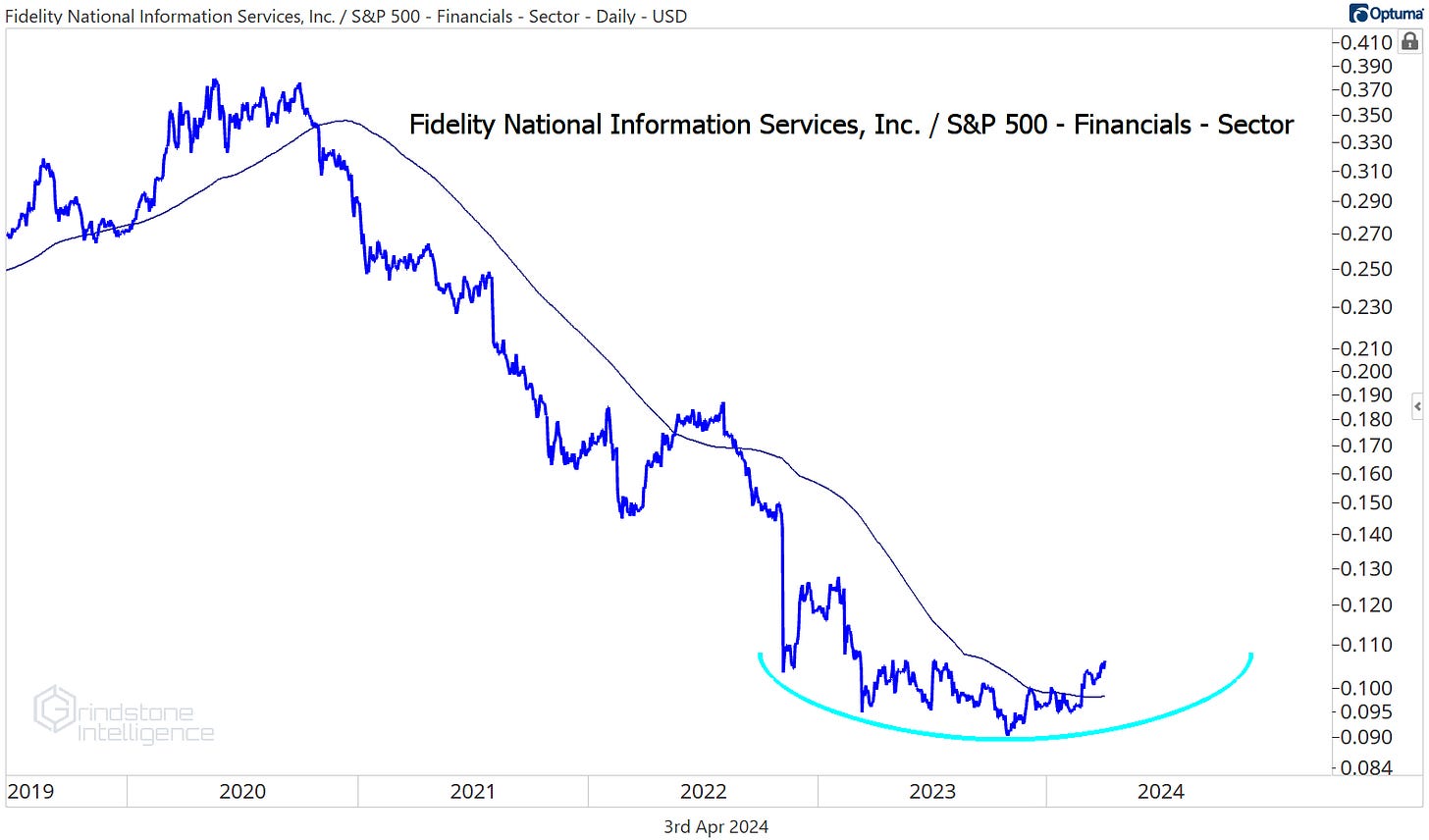

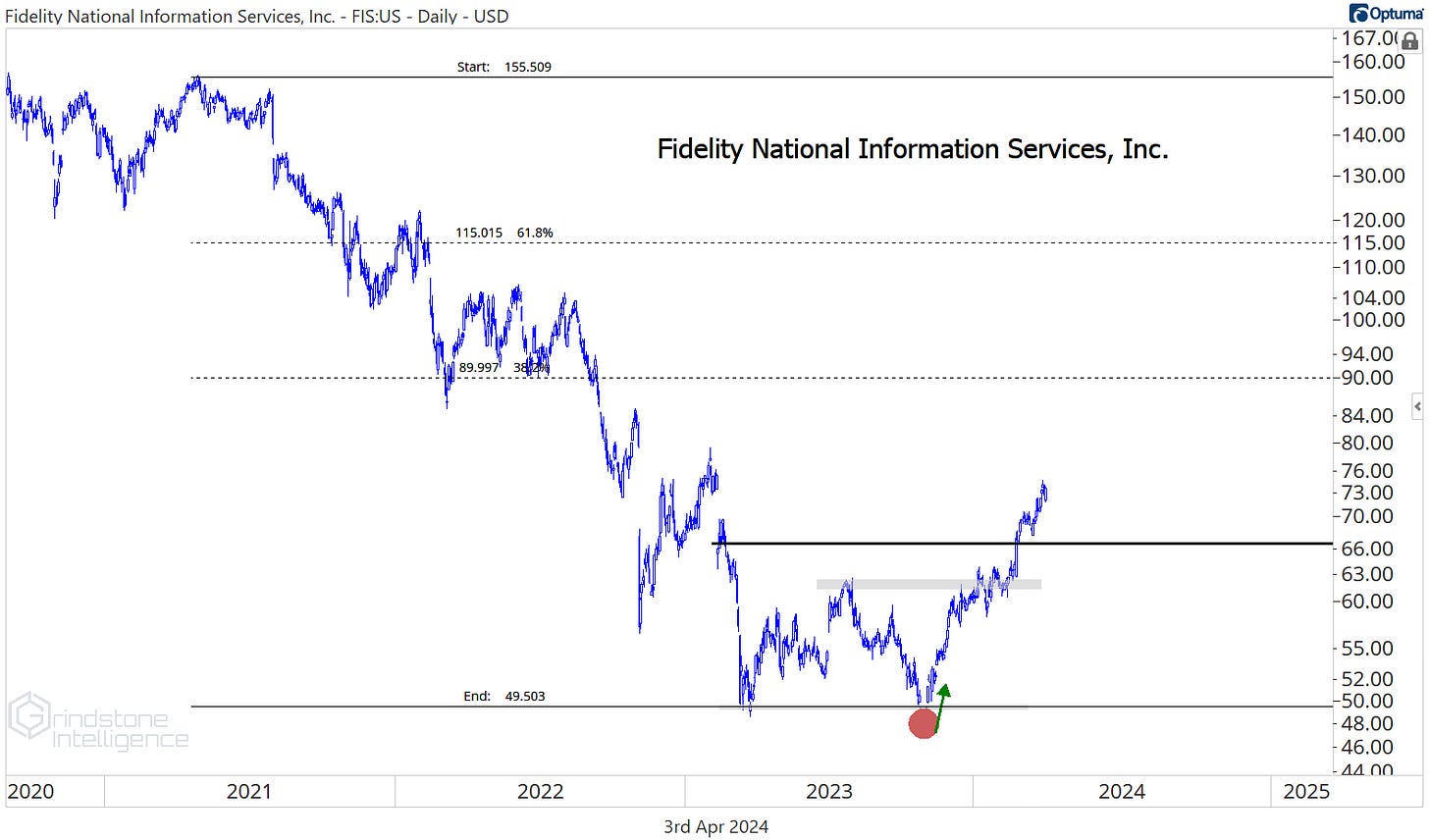

Trends are always more likely to persist than reverse. That’s why we spend most of our time focusing on stocks in uptrends and avoiding the ones in downtrends. But that doesn’t mean trends never reverse. We’re eying a potential downtrend reversal in Fidelity National.

It’s been one of the worst stocks in the world over the past few years, but compared to the S&P 500, FIS stopped going down last fall. And the FIS/SPX ratio is further above its 200-day right now than at any point since March 2020.

On an absolute basis, the downtrend reversal is even further underway. We continue to like FIS above $63 with a target of $90, which is the 38.2% retracement from the entire 3 year decline.

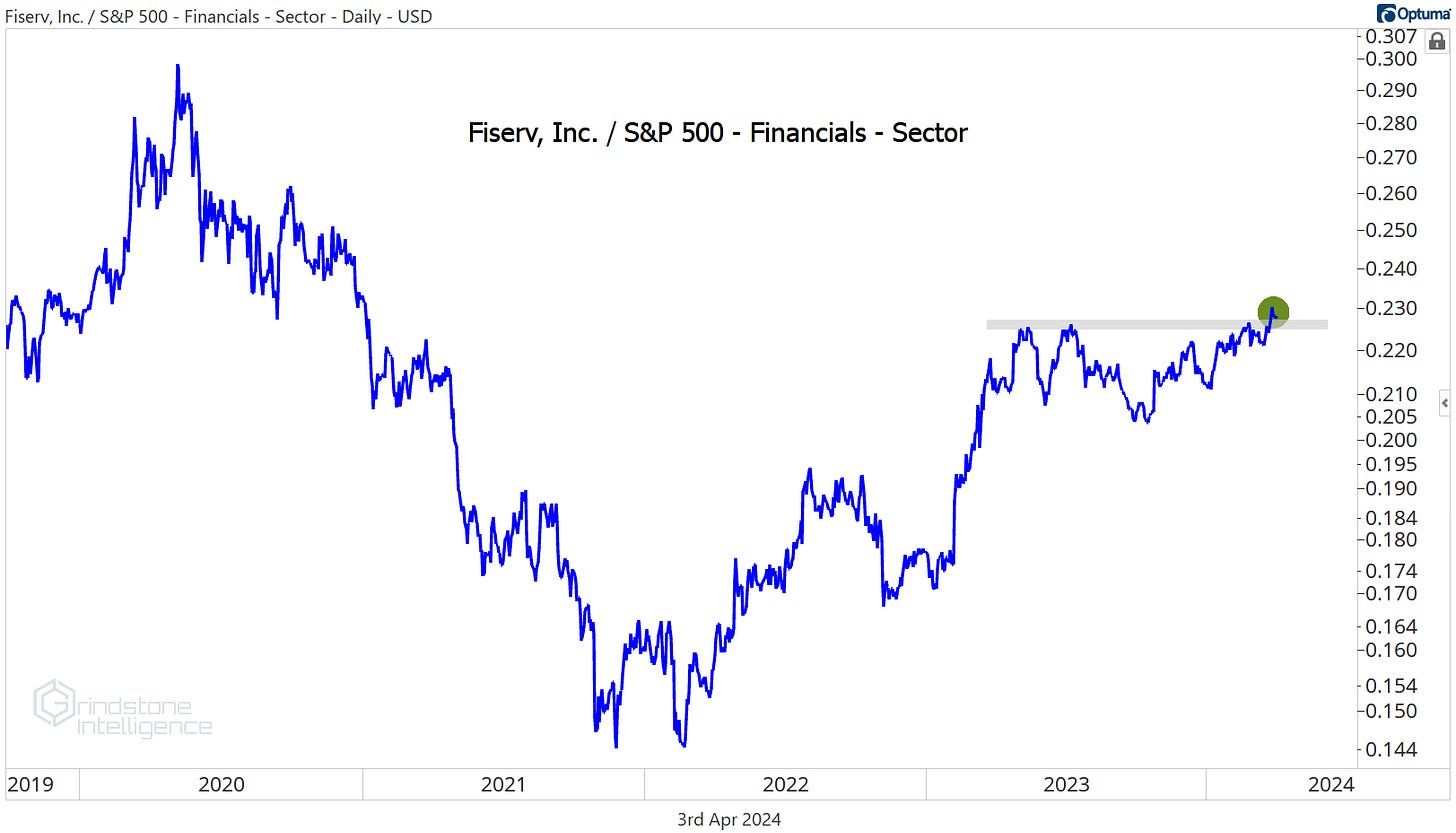

Fiserv has no downtrend to reverse. It’s climbed past our former target of $155 to reach new all time highs.

That gives us a new entry opportunity, and we can be initiating new long positions with the 161.8% from the 2020 decline to manage risk against. Our next target is $205.

As you might have guessed, FI has been on our radar because it’s showing relative strength. Compared to the rest of the sector, it just broke out of a 12-month base.

Speaking of bases, how about this multi-year breakout for JPMorgan compared to the rest of the sector? That’s not a bearish sign for what’s arguably one of the most important stocks in the entire world.

With JPM setting new highs, you’ll have a hard time convincing us that we’re in the midst of anything other than a healthy bull market. It was stuck below the 423.6% retracement from the 2007-2009 decline for the last few years, but it just broke out above that key resistance level. We want to be buying JPM above $180 with a target of $275.

That’s all for today. Until next time.