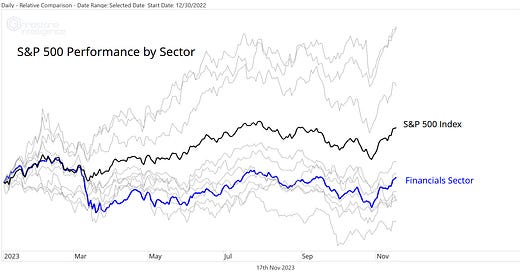

The Financials sector is in the middle of the pack this year, outperforming 5 sectors but lagging the other 5. Unfortunately, in a year where returns have been dominated by gains at the top, being in the middle of the pack doesn’t equate to ‘average’. The Financials have risen a paltry 1.5% for the year. The S&P 500 is up 17.5%.

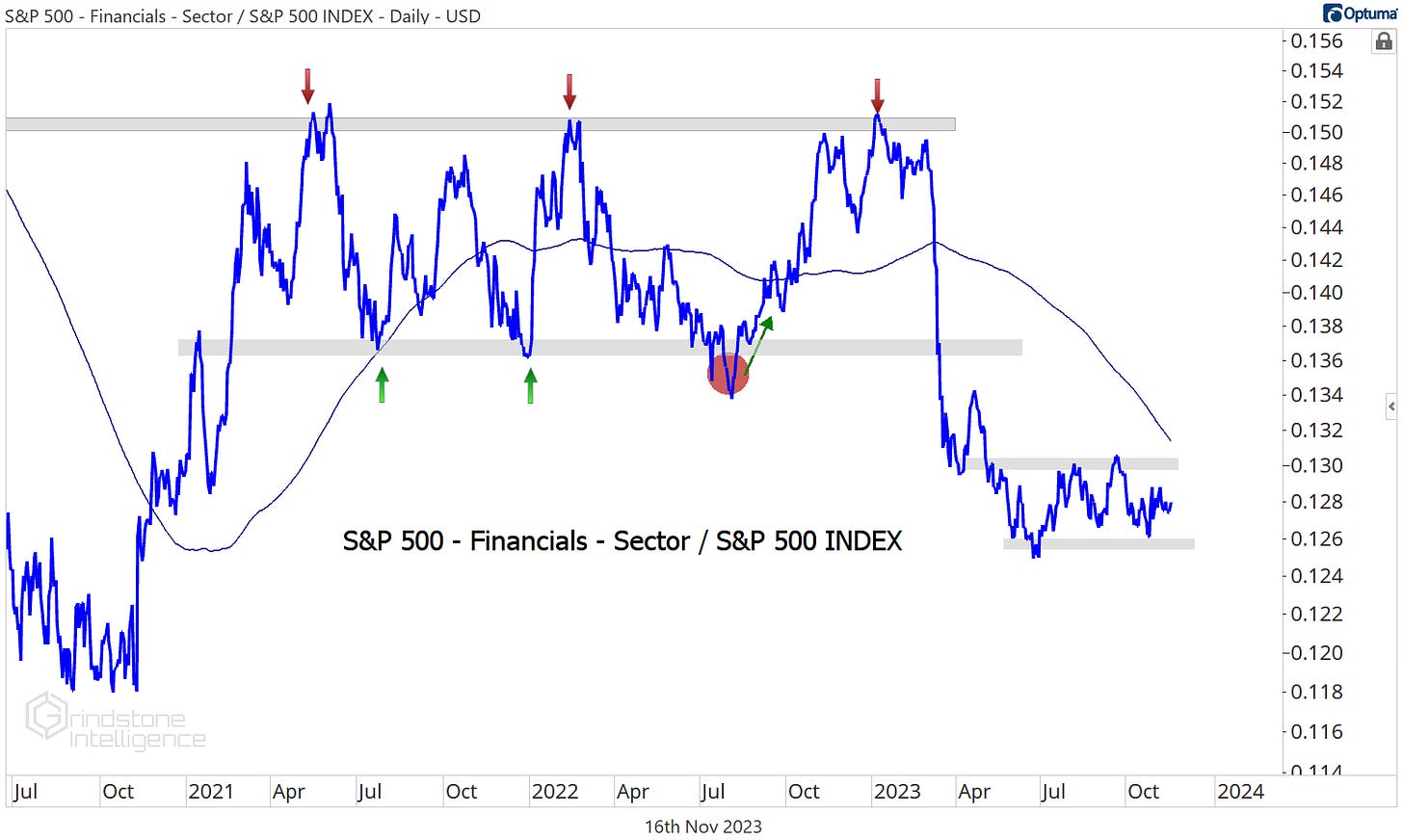

On the bright side, things haven’t gotten any worse since the immediate aftermath of the spring bank collapses. The sector has tracked the benchmark index step for step over the last 6 months. We’re wary, though, that this consolidation pattern for the Financials vs. the S&P 500 will resolve lower. Consolidations tend to result in the direction of the underlying trend.

A downside resolution would have us looking to underweight the sector and find other places to put our money. But ‘underweight’ is different than ‘short’. This is a bull market after all, and being short in the face of broad market tailwinds isn’t something we’re particularly interested in.

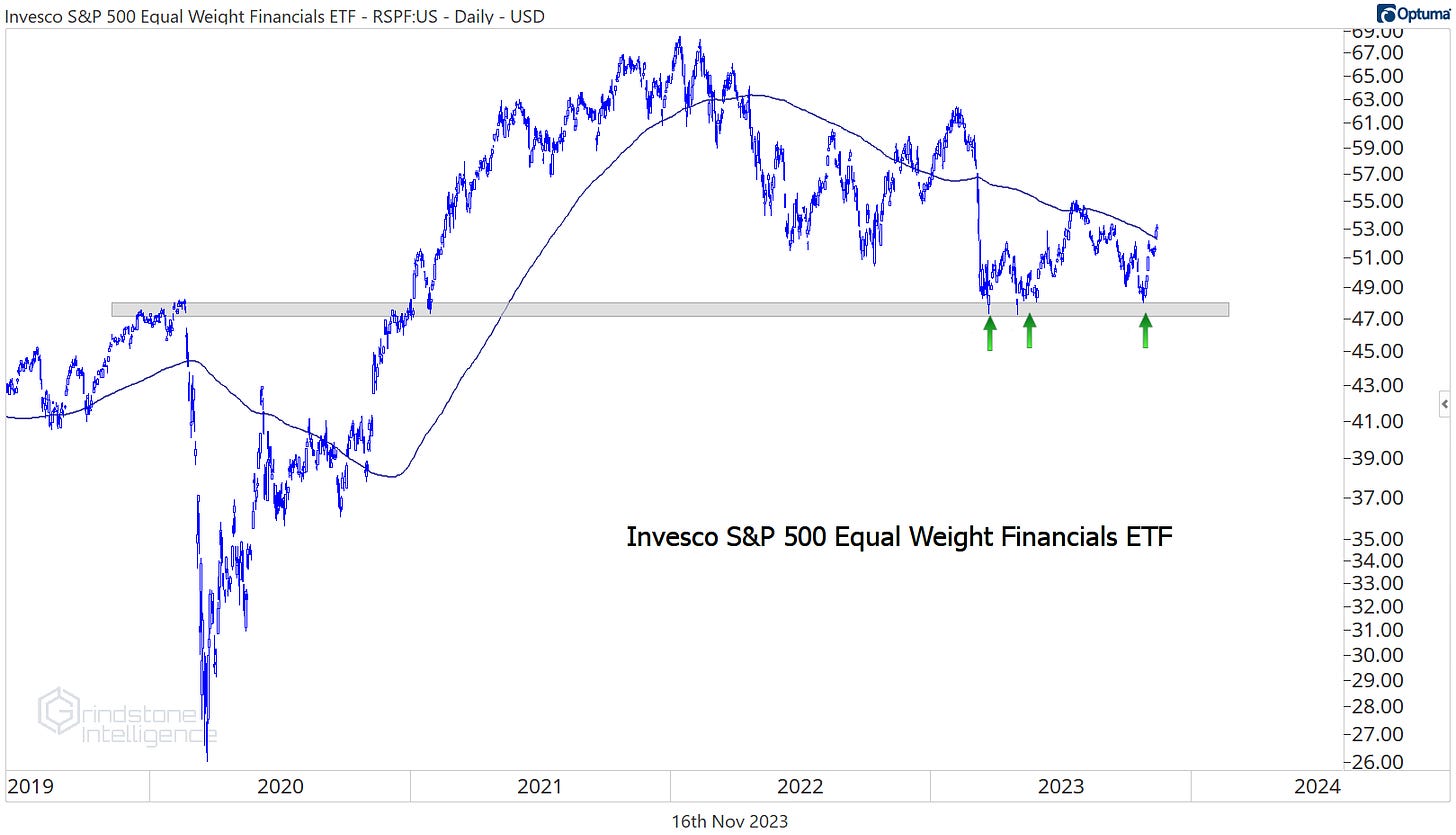

Besides, we don’t have much reason to think Financials will decline on an absolute basis. At least not while they’re consolidating above their 2007 highs. This level was our line in the sand for the back half of last year and during the banking panics of the spring. If we’re breaking down below those former highs then sure, we can start talking about ways to short the group. But as long as we’re above them, how bad can things really be?

The same goes for Financials on an equal weight basis. Our line in the sand here is the pre-COVID highs. If we’re below that, the overall market is probably under pressure, and we’ll probably be looking for a lot of short opportunities. And in that scenario, Financials are probably leading on the downside. But that’s not the environment we’re in right now.

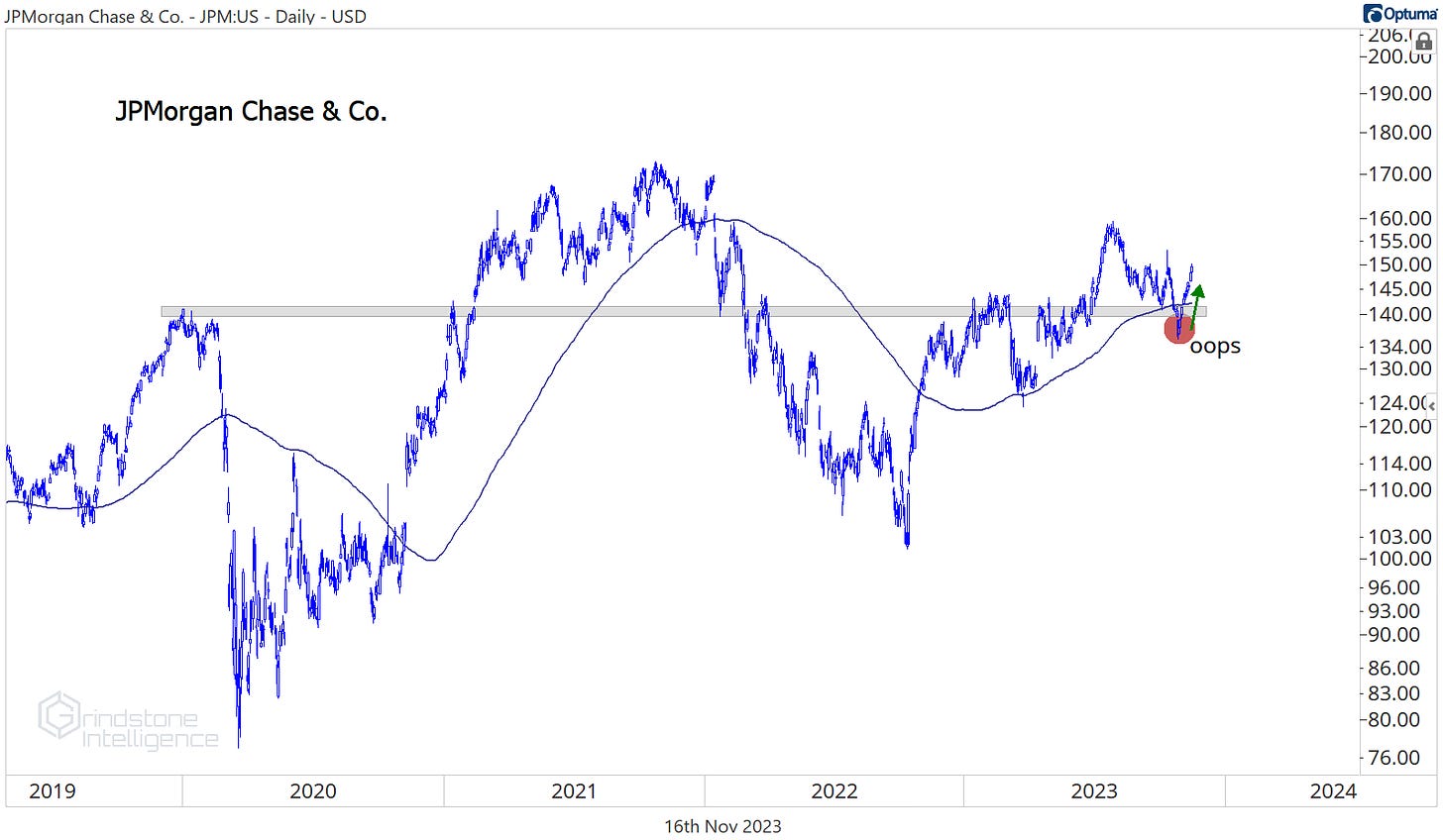

Sorry bears, but you had your chance. I can’t think of any stock in the sector that’s more important than JPMorgan - it’s one of the most important stocks in the world for that matter. And you guys had JPM on the ropes a few weeks ago. You pushed it below the pre-COVID highs and knocked it beneath the 200-day moving average for the first time all year. Then you fumbled the opportunity. JPM is back above that key level - and from failed moves comes fast moves in the opposite direction.

With the leadership of JPMorgan, perhaps we should give more weight to a bullish outcome for the sector. We’ve laid out the levels where we’d turn more bearish on Financials, but what’s the bull case? How about the rapid improvement in breadth?

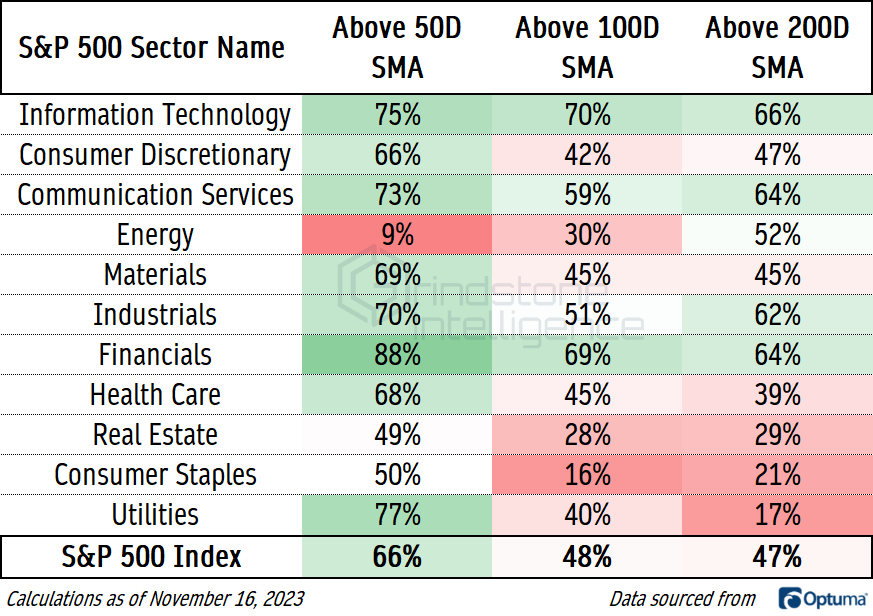

Right now, more Financials stocks are above their 50-day moving average than any other sector. The number above their 100 and 200-day moving averages is also better than the overall S&P 500. There’s a lot of long-term trend damage to repair still, but the Financials are well on their way.

Digging Deeper

The Financials sector overall is virtually flat for the year, and no sub-industry embodies that truth better than the Capital Markets. They’ve risen a whopping 0.01% for 2023.

Cboe has been much better than that, though. We’ve liked the stock since it broke out above $137, and we had a target of $175, which is the 161.8% retracement of the 2018-2020 decline. Now that our target has been hit, we want to see how it responds to this potential area of resistance.

Based on the stock’s relative strength, we’re inclined to believe that CBOE will eventually head higher. It just broke out of a 5-year base relative to the rest of the Financials. If you want to outperform, you need to own the things that are outperforming - like this. Some near-term trouble is to be expected here, but if CBOE is above $175, we can be long with a target of $235.

Leaders

We’ve got a good setup in S&P Global, which was among the best performers over the last 4 weeks and sits near the top pf the year-to-date leaderboard. For this one, we only want to be long above $385, with a target of $515, which is the 261.8% retracement from the COVID selloff.

Losers

Discover was the worst stock in the sector over the last month, but we aren’t buying the pullback. DFS is below the 2019 highs, which was a key support level all throughout 2022 and the first half of 2023. Now, that former support will act as stiff resistance on any rallies.

The stock is facing the same headwinds on a relative basis. Here it is breaking down below a 2-year support level vs. the rest of the sector. If we were looking for stocks to short, this one would be near the top of our list. Since this is a bull market and we’re not looking for things to short, this is just one to ignore.

Arch Capital Group reached our target of the 261.8% retracement from the 2020 selloff, and now we want to step aside and see how the sector’s second-best YTD performer responds.

We’ll be watching the relative chart just as closely as the absolute one. Since the broad market troughed in late October, ACGL has lagged on the rebound, pushing the ratio of ACGL vs. the Financials sector back toward the spring highs. We’re taking a wait-and-see approach on the stock for now.

Earnings Outlook

If you’re buying the Financials, it’s not because you think they’re going to grow earnings in an outsized way. Earnings in 2023 are on pace to decline about 1%, with sales down about 7%. Next year, both sales and earnings are expected to rebound at a modest mid-single digit pace before earnings growth reaches a more respectable 8% in 2025.

Projected growth over the next two years is lower than that of every other sector in the index, save Energy.

One More to Watch

We’ve been watching Fiserv as it tries to break out of a multi-year base. FI was one of the best uptrends you could find in the decade leading up to COVID, and now it’s had some time to digest all those gains. The first attempt to get going this summer resulted in a failed move, but after the false start, FI is making another challenge of the former highs. We want to be long above $123 with a near-term target above $150.