From the Ground Up

Stocks to watch from our latest scan

Back in 2005, Joel Greenblatt introduced his ‘Magic Formula for Investing’ with The Little Book That Beats the Market. The book details a methodical approach that helps investors find some of the cheapest, most well-operated companies and buy them each month for a one-year holding period.

There is nothing “magical” about the formula (or our variations of it), and the use of the formula does not guarantee investment success. Obviously. But Greenblatt’s own results have shown the value of utilizing this simple approach.

We built our scan with the Magic Formula in mind, focusing first on the best companies in each sector (those that generate the highest returns) and then finding which stocks on that list are held least dear by investors.

Here’s a list of the top-ranked stocks in our universe:

Our goal here isn’t to buy the whole list.

Buying good companies at good prices is a fine place to start, but that alone isn’t enough. Often, there’s a reason that seemingly good companies are trading at rock-bottom prices, and buying them blindly can have us on the wrong side of prolonged downtrends.

The intrinsic value of a stock changes over time, so even cheap stocks that are bought below their current intrinsic value can lose over time. There’s no rule that says a stock price has to move towards its ‘true’ value - and it definitely doesn’t have to do it quickly.

That’s why we couple trend identification and relative strength with our value scans to find the best companies with the best setups. Merging fundamental and technical analysis increases our odds of finding big winners with sustainable trends.

Below, we highlight our favorite names.

First off is Boise Cascade, a building materials company. Boise just broke out of a huge, 10-year base relative to the S&P 500 index. That sets the stage for several years of outperformance.

Near-term, BCC just ran into potential resistance at the 423.6% retracement from the 2015-2016 decline, and we want to see how it responds. After some digestion, we want to be long above $135 with a target up at that next key Fibonacci level, near $210.

The base for PulteGroup is even larger. Those 2009 relative highs were serious trouble for almost 15 years, but PHM has been off to the races ever since the 2023 breakout.

The risk/reward here on PHM isn’t great as it approaches our target of $117, but longer-term, we think it can go all the way to $185.

Hovnanian Enterprises is trying to break out of a big base, too. Check out this 8-year inverse head and shoulders patter relative to the S&P 500:

For HOV, we want to be buying any pullbacks toward $135 with a target of $210.

Are you liking all these big base breakouts vs. the rest of the market? We’ve got more. Check out Bel Fuse, an electronic component manufacturer. After a failed breakout in mid-2023, BELFA is challenging those 2014 relative highs once again. the more times a level is tested, the more likely it is to break.

The stock itself is already at all-time highs. We like it above $60 with a target of $90.

Warrior Met Coal hit our target of $71 and it’s spent the last few weeks digesting the 115% rally from May ‘23. On a resumption of the uptrend, we want to buy HCC above $71 with a target of $108.

Sticking with our theme, Warrior Met Coal is showing relative strength, too. It recently broke out of a 5-year base vs. the SPX. We want to make sure that breakout holds on this backtest.

And finally, here’s Photronics trying to set new 14-year highs against the S&P 500.

PLAB is consolidating above the 261.8% retracement from the 2020 decline, which gives us a great risk/reward setup. We want to own this one as long as it’s above $29 with a target of $42.

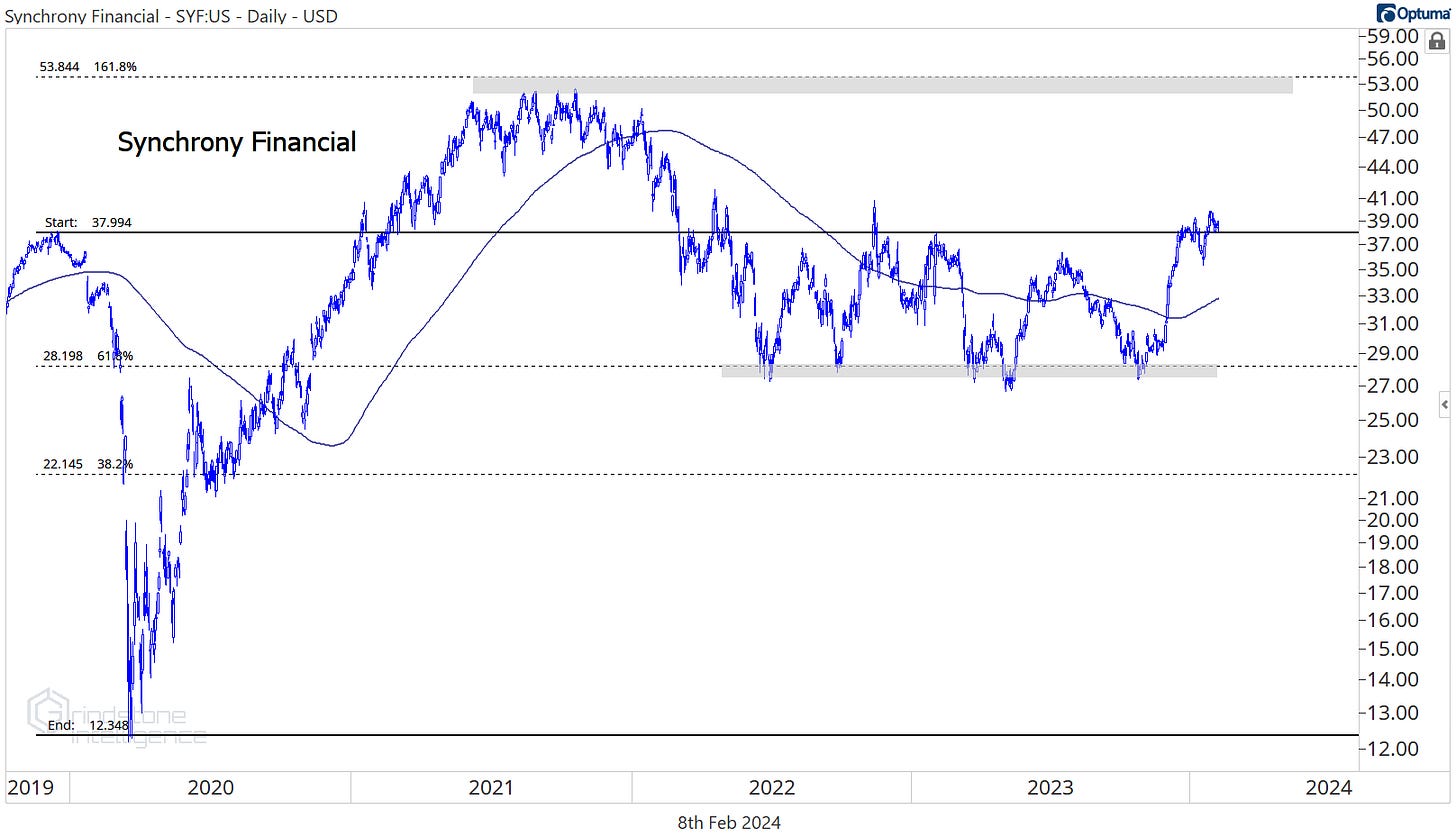

Two stocks that aren’t showing much relative strength are Synchrony Financial and Wabash National. But we still like the setup in each. For SYF, we want to be long above the pre-COVID highs at $38 with a target of $55.

For WNC, we want to buy a breakout above $28 with a target up at $36, which is the 261.8% retracement from the 2022 bear market.

That’s all for today. Until next time.