From the Ground Up

Stocks to watch from our latest scan

It’s been almost 20 years since, Joel Greenblatt introduced his ‘Magic Formula for Investing’ with The Little Book That Beats the Market. In it, he details a methodical approach that helps investors find some of the cheapest, most well-operated companies and buy them each month for a one-year holding period.

There is nothing truly “magical” about the formula, and we don’t really subscribe to the belief that any one tool guarantees investment success. What we do believe is that the majority of stock market returns over the long-term usually come from just a handful of the best-performing names, and we should use every tool available to look for them.

Though we primarily stick to a technical approach at Grindstone, how we find the winners doesn’t really matter. Remember, we’re all looking for the same stocks - the ones will end up on the fat tails of the distribution curve - and over the long-term, the best charts are going to be for stocks with the best fundamentals. Greenblatt’s results have shown that sometimes, the biggest winners come from the lowliest of beginnings.

We built our scan with that in mind, focusing first on the best companies in each sector (those that generate the highest returns) and then finding which stocks on that list are held least dear by investors.

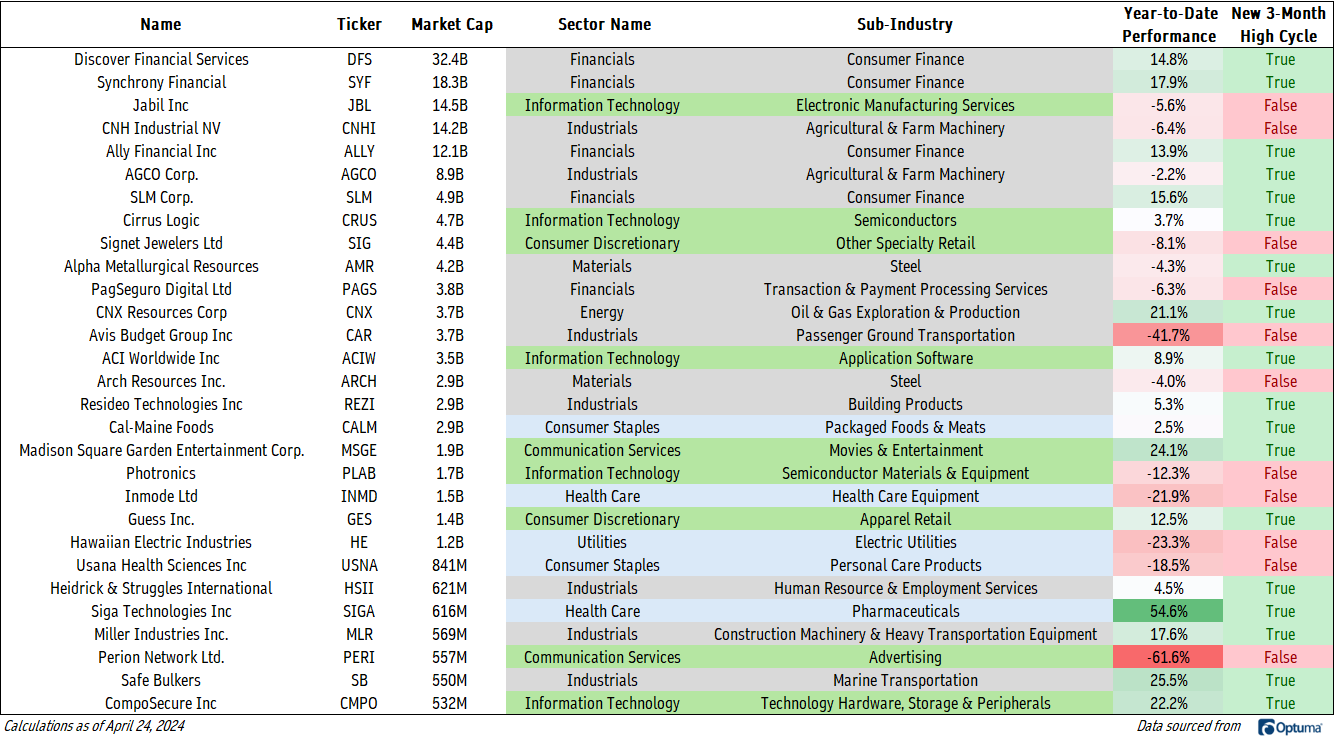

Here’s a list of the top-ranked stocks in our universe:

Our goal here isn’t to buy the whole list.

Buying good companies at good prices is a fine place to start, but that alone isn’t enough. Often, there’s a reason that seemingly good companies are trading at rock-bottom prices, and buying them blindly can have us on the wrong side of prolonged downtrends.

The intrinsic value of a stock changes over time, so even cheap stocks that are bought below their current intrinsic value can lose us money over time. There’s no rule that says a stock price has to move towards its ‘true’ value - and it definitely doesn’t have to do it quickly.

That’s why we couple trend identification with our value scans to find the best companies with the best setups. Merging fundamental and technical analysis helps us manage risk and increases our odds of finding big winners with sustainable trends.

Here are our favorite setups from the list.

Alpha Metallurgical Resources, a $4B steel stock, just found support at the 261.8% retracement from its 2022 range. Check out the momentum profile in the lower pane. RSI has stayed out of oversold territory for the last year, even after that bearish momentum divergence towards the end of last year. Now that we’ve worked that divergence off with a mean reversion, we can approach AMR from the long side. We want to be buying it above $300 with a long-term target that’s 2x from here, at $640.

Miller Industries is one of the smallest stocks in our coverage, with a market cap of less than $600M. But there’s nothing small about this base breakout. We think Miller goes to $63 next, which is the 161.8% retracement from the 2021-2022 decline, and we can own it above the former highs of $47. Longer-term, we think it could go to $88.

SLM Corp is also breaking out of a multi-year base. It peaked in 2021 at the 261.8% retracement from the 2020 decline, and now that it’s finally surpassed those former highs, we can be buying it with a target of $30.

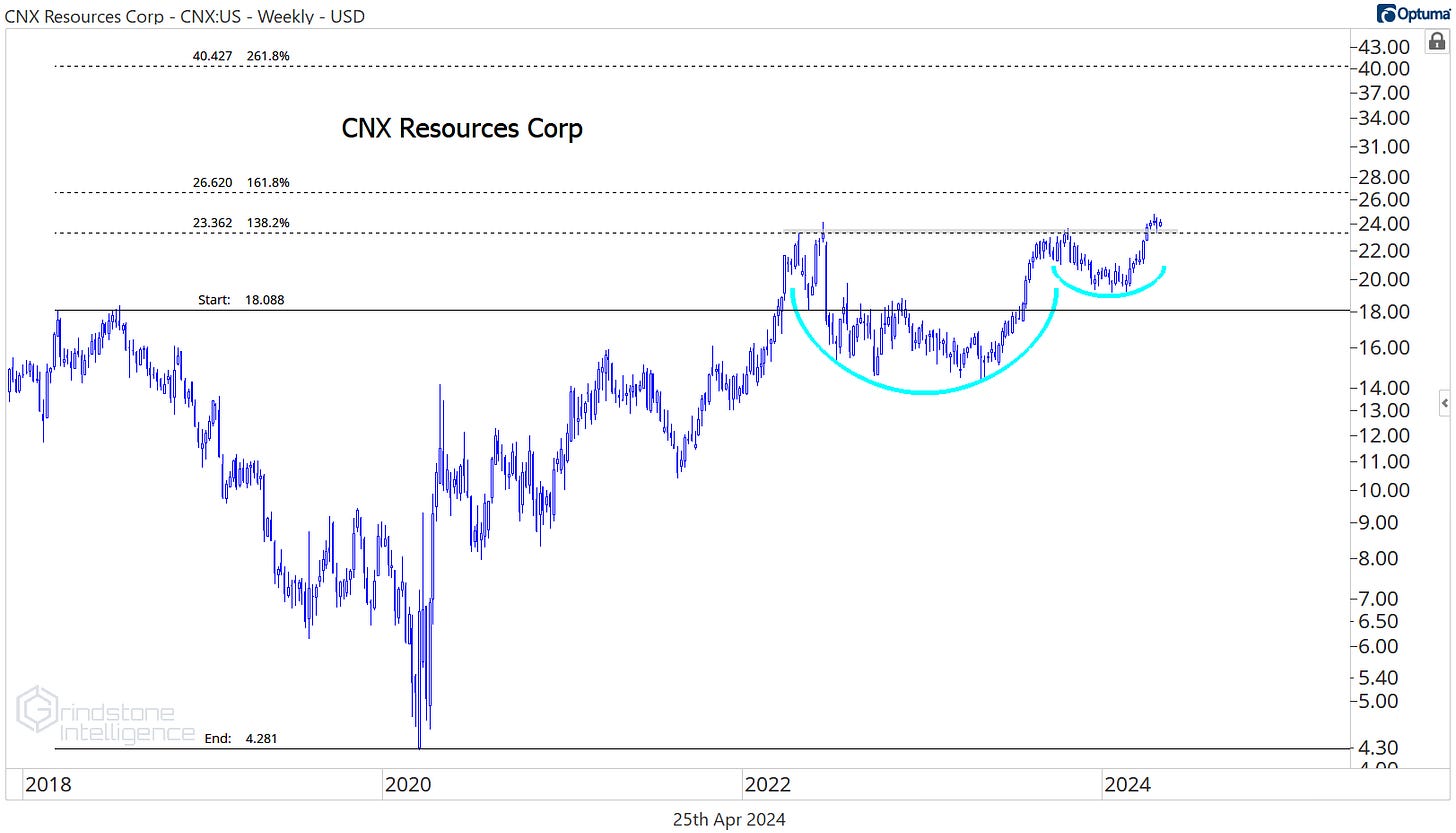

And CNX Resources, an oil and gas producer, just came out of a big base of its own. Since early 2022, CNX had been stuck below the 138.2% retracement from the 2018-2020 decline. It just completed a beautiful cup and handle continuation pattern.

There’s likely some resistance at the 161.8% retracement near $26, but we think CNX eventually goes to $40. We like it long above $23.50.

The next breakout could come from Signet Jewelers. SIG has spent most of the last 6 months knocking on the door of its 2021 highs, and momentum has stayed out of oversold territory over the course of the consolidation. A bullish resolution is the higher probability outcome.

On a move above $110, we want to be buying SIG with a target of $147, which is the 161.8% retracement from the 2021-2022 decline.

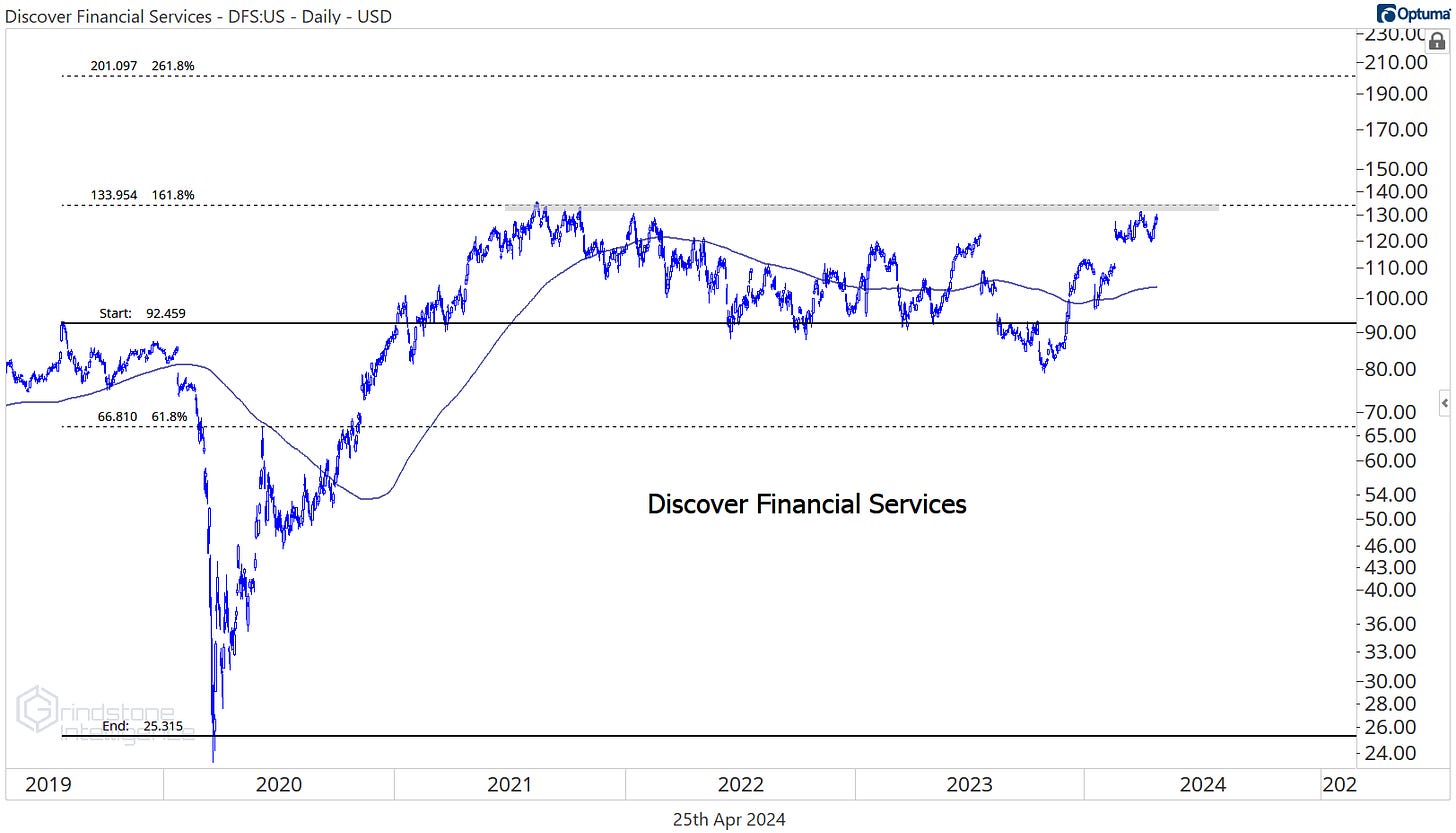

Discover Financial Services is similarly positioned. It’s been stuck below the 161.8% retracement from the COVID collapse for the last 3 years, and the stock has been knocking on the door of new highs all year. If that breakout comes, we think the next stop is $200.

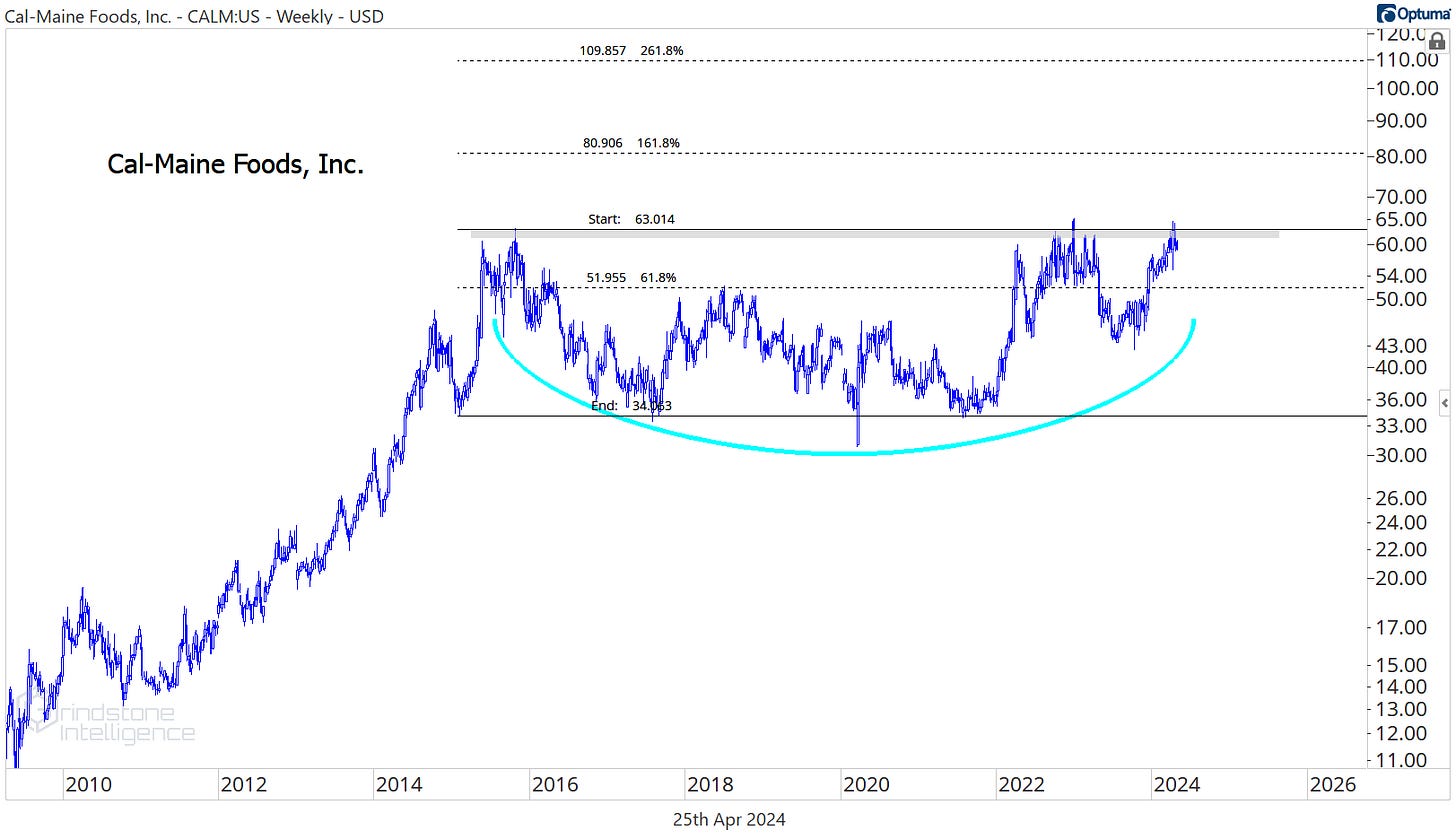

There are big bases, and then there are big bases. How about this decade-long consolidation within a long-term uptrend for Cal-Maine foods?

We saw a failed attempt to climb out of this range back in December 2022, and we got above the 2015 highs on an intraday basis just a few weeks ago. The more times a level is tested, the more likely it is to break. Eventually, there won’t be any sellers left. On a close above $63, we want to keep CALM and buy Cal-Maine with an initial target of $81. Our long-term expectation is for prices to hit $110.

That’s all for today. Until next time.