From the Ground Up: Stocks to Watch from Our Latest Scan - 11/8/2023

Back in 2005, Joel Greenblatt introduced his ‘Magic Formula for Investing’ with The Little Book That Beats the Market. The book details a methodical approach that helps investors find some of the cheapest, most well-operated companies and buy them each month for a one-year holding period.

There is nothing “magical” about the formula (or our variations of it), and the use of the formula does not guarantee investment success. Obviously. But Greenblatt’s own results have shown the value of utilizing this simple approach.

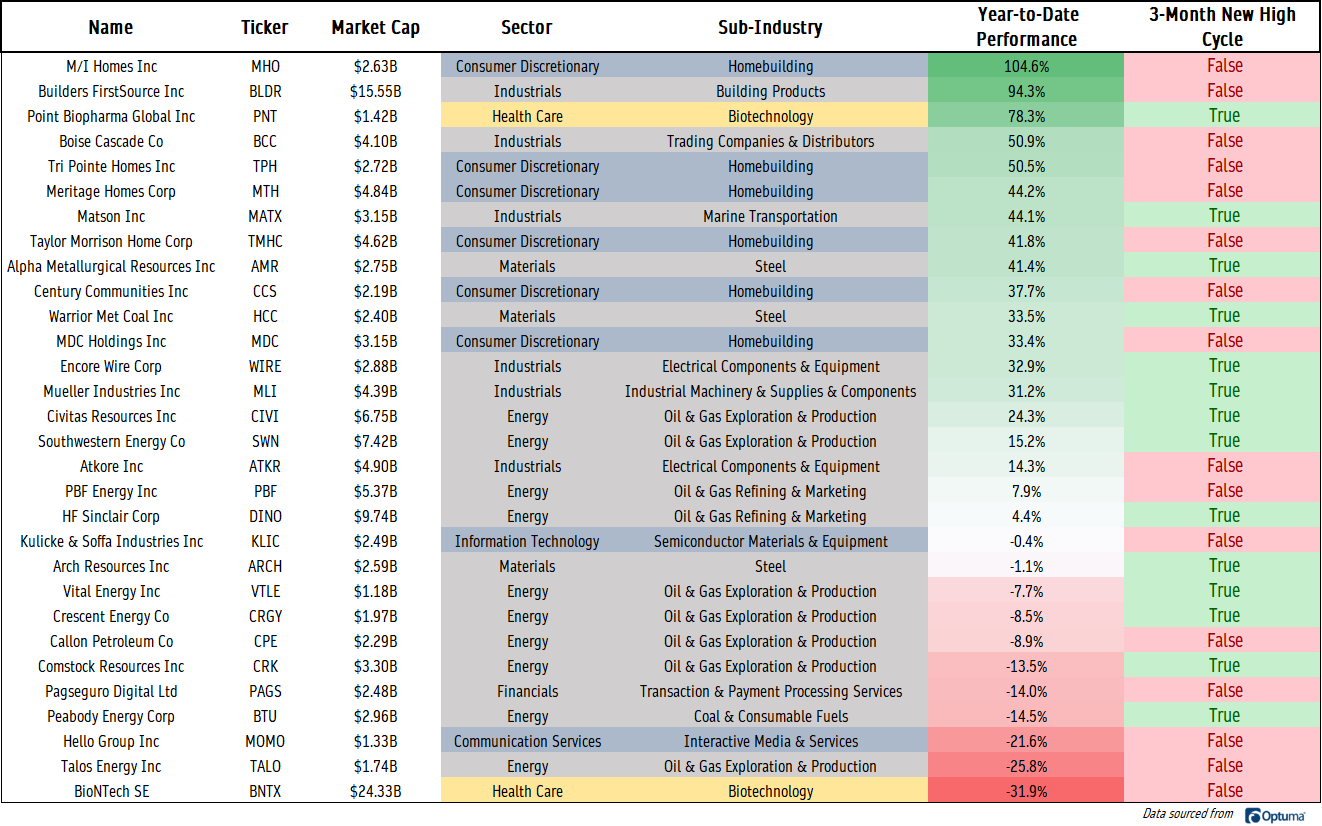

We built this scan with the Magic Formula in mind, focusing first on the best companies (those that generate the highest returns on invested capital) and then finding which stocks on that list are held least dear by investors. In our results, we’re seeing a lot of homebuilders, energy producers, and industrial suppliers. That makes sense with where sentiment is in the market today. All three of those groups have experienced strong revenue and earnings growth over the past few years, but with the impact of high interest rates coming due and recession risks on the rise, the consensus believes those fundamental performances aren’t sustainable. Here’s the full list:

Buying good companies at good prices is a fine place to start, but that alone isn’t enough. Often, there’s a reason that seemingly good companies are trading at rock-bottom prices, and buying them blindly can have us on the wrong side of sustained downtrends. That’s why we couple trend identification and relative strength along with our fundamental scans.

Below, we highlight our favorite names.

Builders Firstsource, a building products supplier in the Industrials sector, found support near a rising 200-day moving average, an area that also marked the 161.8% retracement from the 2022 selloff. We like how BLDR has managed to stay out of oversold territory since those June 2022 lows, signaling that buyers are still firmly in control.

And the stock is still firmly in an uptrend relative to its sector, too. Here it is compared to the Industrials.

Ever since breaking out of a 5-year base in 2020, the ratio has seen a pattern of higher highs and higher lows. We haven’t seen any evidence of that trend reversing. We like BLDR with a long-term target of $210.

M/I Homes is another that continues to look great. It’s doubled in 2023, but still finds itself trading at a lower valuation than most stocks. We like MHO long above $100 with a target of $140, which is the 261.8% retracement from the 2021-2022 decline.

Supporting our view is the relative strength we’re seeing vs. the rest of the market. Check out this huge, 15-year consolidation resolving higher in the ratio of MHO compared to the SPX. That’s not something we’re going to bet against.

Then there’s Mueller Industries. MLI missed the memo that there was a bear market in stocks last year. It’s been setting higher highs and higher lows since March 2020.

And it’s on the verge of a massive, 20-year relative breakout compared to the S&P 500 index. We want to be buying this industrial manufacturer with a target of $66.

Encore Wire might be the best of them all. They manufacture copper and aluminum wires and cables, and judging by their stock, business is good. WIRE has jumped from less than $40 in 2020 to almost $200 today. And consistent with the theme above, WIRE is breaking out of a massive relative base. Has the stock gone too far, too fast? I don’t know. It just spent 15 years doing nothing. Maybe we’re just getting started.

From late 2021 to late 2022, the stock went nowhere as it digested massive gains from the prior year. Then it broke out to new highs and surged until it found resistance at the 685.4% retracement from the 2019-2020 decline.

We’ve spent the last 9 months digesting those gains, reminiscent of that previous consolidation. Is it time for an encore? We think so. We like WIRE above $195 with a target of $290.

Until next time.