Gold Breakout on Hold

Just a few weeks ago, it looked as though gold would finally reach new highs. Alas, the breakout was not meant to be – at least not yet. May saw gold fail once again at 2100.

In the near-term, 1950 is the most important level. That price marked reversals in the fall of 2020 and again earlier this year. The principle of polarity suggests this former resistance level should now offer support, and bulls could make another run at those highs.

And each time buyers push prices up toward that resistance, they absorb more overhead supply. At some point, there won’t be any sellers left, and this consolidation should resolve in the direction of the underlying trend. How high could the metal go on a breakout above 2100? Above 3000. That’s the 1794% Fibonacci retracement from the 1990s decline. Prices have respected these retracement levels all the way up: The hiccups in 2006 and 2008 occurred near Fib levels, the ceiling from 2013-2019 was the 684.4% retracement, and right now, were stuck below the 1109% retracement. It would make a lot of sense to go up and touch the next one. That might even be a conservative expectation – prices rallied a lot more after the 2004 breakout.

None of that can happen with prices still just below resistance from those 2020-2022 highs. And if we fail to hang above 1950, gold could be stuck in this range for much longer.

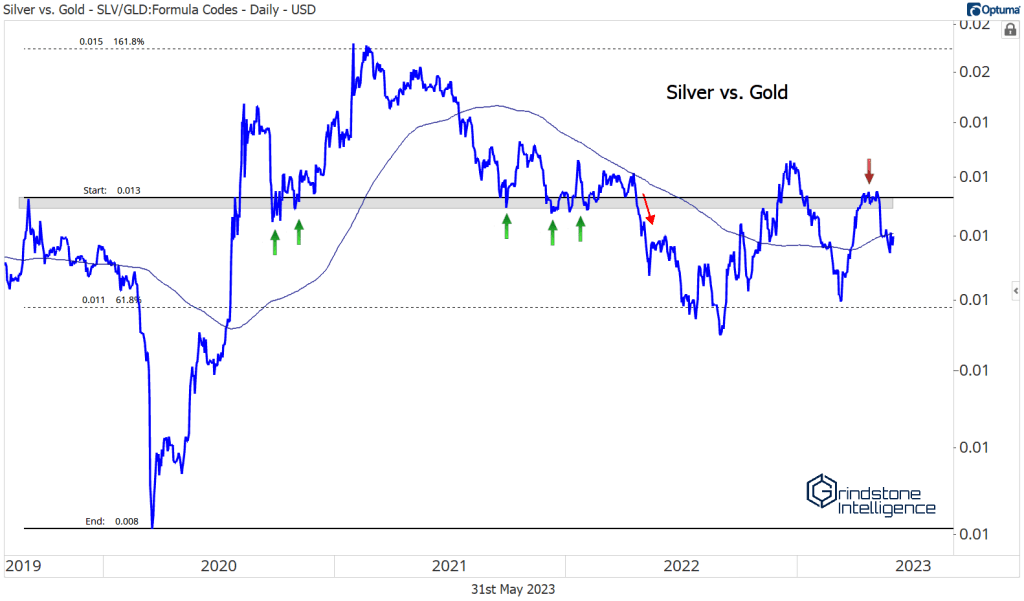

Silver is the thorn in gold’s side, dragging it lower on each rally attempt. Silver and gold tend to be highly correlated, but silver tends to move in greater magnitudes. As such, when precious metals are rising, silver should outperform. Instead, silver refuses to lead. Notice how the silver/gold ratio failed again at its 2019 highs last month at the same time gold was trying to breach 2100.

Silver’s relative weakness in January (black rectangle below) was the proximate cause of the February selloff in precious metals, too. Fortunately, this gives us a very clear technical level to work with. If silver is back above those January highs, we can approach the group from a more bullish stance, and we’ll be leaning toward new all-time highs in gold. But as long as silver is below 24, we need to stand on the sidelines.

The post Gold Breakout on Hold first appeared on Grindstone Intelligence.