Gold Hits New Highs

And Bitcoin too

Bitcoin who?

Gold just broke out to new all time highs.

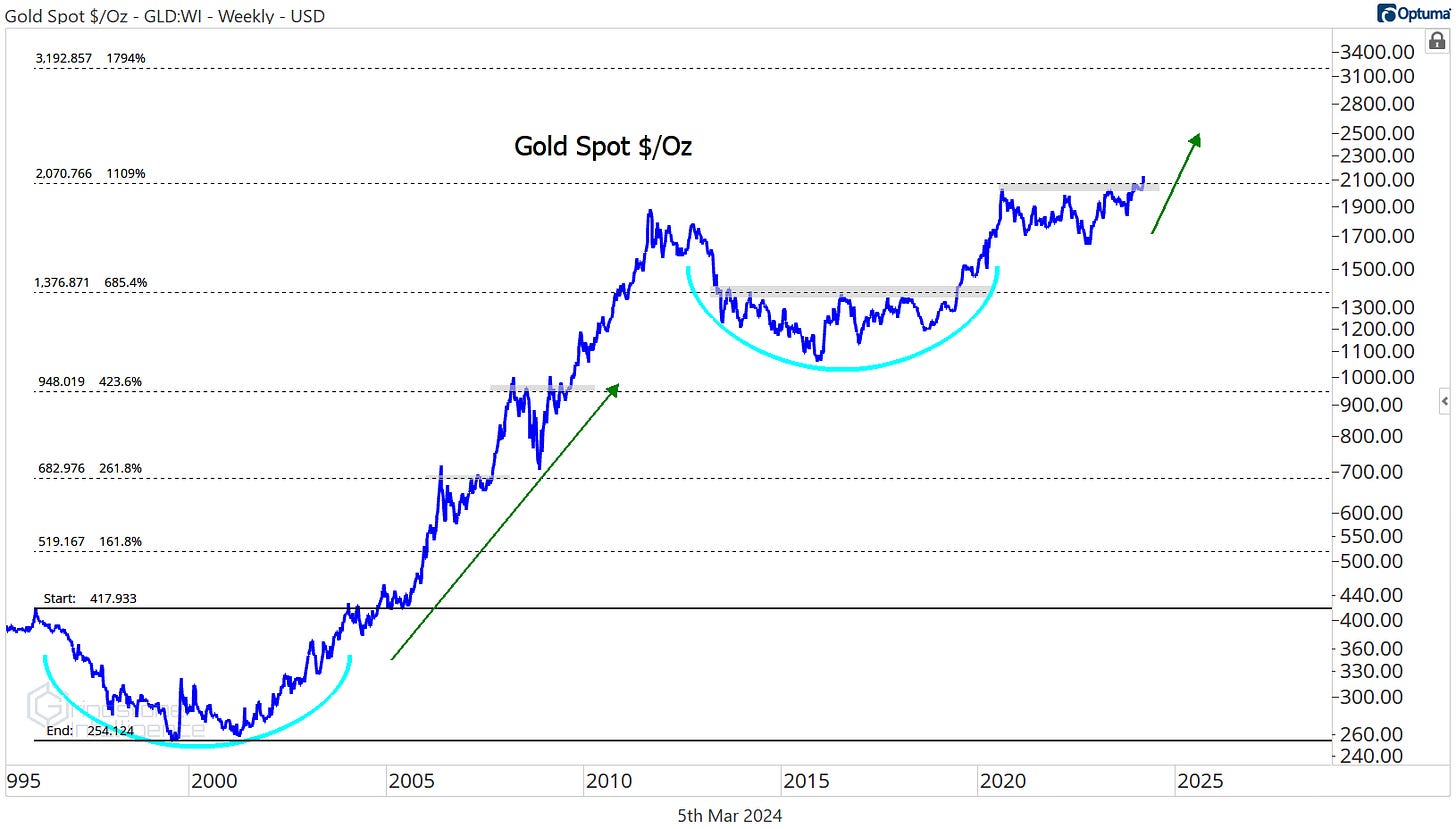

For the last three and a half years, gold prices were stuck below $2050, a level that is also the 261.8% retracement from the COVID selloff in March 2020. Between those pre-COVID highs at $1,680 and resistance at $2050, the yellow metal has bounced back and forth, digesting the gains from 2015 to 2020 and generally frustrating everyone that has been involved.

Eventually a resolution had to come, one way or the other, and this time, the bulls won out. The trade here is pretty clean: We want to own gold above the 2020-2023 highs with a target of $2400.

We wouldn’t be surprised to see some resistance in the $2200 range, since that’s the 161.8% retracement from the 2023 selloff, but $2400 is the next key retracement from last years selloff and the 423.6% retracement from the March 2020 selloff. That cluster of Fibonacci retracements should draw prices higher.

There could be more to it than that. A move to $2400 would be a huge win for the bulls, but it’s fairly conservative from a big picture point of view. We’re eying $3200 longer-term, which is the 1794% Fibonacci retracement from the 1990s decline. Prices have respected these retracement levels all the way up: The hiccups in 2006 and 2008 occurred near Fib levels, the ceiling from 2013-2019 was the 684.4% retracement, and for the last few years we were stuck below the 1109% retracement. It would make a lot of sense to go up and touch that next level. Even $3200 might be too conservative of an expectation – prices rallied a lot more after the 2004 breakout.

Even with the breakout, we have to be wary of the opportunity cost of owning gold relative to other assets. On the one hand, there’s been virtually no added benefit to holding the S&P 500 over gold since early 2021. On the other, stocks are just a few days removed from setting multi-year highs relative to rocks. We’re keeping a close eye on the backtest of this breakout level:

What would it take to turn the tide in favor of gold? More participation from silver would sure help. Prices for silver and gold tend to be highly correlated, but silver tends to move in greater magnitudes. As such, when precious metals are rising, we expect silver to outperform. That’s what we’ve typically seen during gold’s best runs.

And silver is an absolute mess. It’s not in a downtrend, but it’s not in an uptrend either.

Relative to gold, though, silver is trying to get something going here. The silver/gold ratio is holding above support from the 61.8% retracement of the the 2019-2020 decline.

If this level fails, we have a hard time believing that gold prices will be ripping higher. Especially relative to stocks.

What about the precious metals stocks?

We definitely don’t want to be shorting the miners. Check out SILJ, the Junior Silver Miners. These guys are the junkiest of the junk, but they found some support at multi-year lows. If bears can’t even keep the worst guys down, what’s that telling us?

‘Not shorting’ is not the same as ‘buying’ them, though. The group hasn’t held up nearly as well as the metals themselves. Check out GDX, the VanEck Gold Miners ETF, relative to the S&P 500. It just broke 8-year support to hit all-time lows:

If the GDX/SPX ratio is back above that former support level? Sure, then we can talk about miners to buy. But that’s not the case right now. This is a downtrend until proven otherwise.

We’ve got a similar setup in the base metals. If DBB is back above the 2022-2023 lows, then we’ve got a potential trend reversal on our hands, and we want to be looking for ways to get long. But for now, price is consolidating below resistance after a breakdown. That’s not bullish.

Here’s the interesting thing. We like what gold is doing, but we don’t like what the gold miners are doing. We don’t like what the base metals are doing, but some of the base metals stocks are doing pretty well.

Nucor just came out of a 2-year base. The setup is really clean and we like the stock above $175 with a target of $220.

We’d have more confidence if this consolidation for NUE relative to the rest of the market resolves higher, too. No matter how you slice it, this is not a relative downtrend.

The same thing goes for Reliance Steel. This looks like a textbook consolidation within an ongoing uptrend for RS compared to the SPX.

We can be buying pullbacks to $290 with a target of $420.

And did you really think we’d throw shade at Bitcoin and just walk away?

Sure, it’s fun to laugh at Bitcoin after a big, bearish reversal day, especially when Gold is ripping. I mean, who doesn’t love it when the old guy comes back from the dead and teaches the young up-and-comer a lesson? (I’m very proud of this. Maybe the finest piece of production I’ve ever done).

All jokes aside, Bitcoin is still in an uptrend. The last time we discussed it back in January, we said we only wanted to own it above 45,000, and then with a target of 70,000. It just hit that 70,000 target.

Do prices eventually go higher from here? Probably. But we set targets for a reason. Let’s see how Bitcoin responds to these former highs.

If we can move past this resistance level and hang above 70k, then we can set a new target of $112k, which is the 685.4% retracement from the 2018 selloff. Until that breakout happens, it’s somebody else’s problem. We’ll spend our time waiting and watching for other opportunities.

And maybe rewatching Happy Gilmore. What a classic.

Until next time.